New evidence suggests that receiving benefits from the Supplemental Nutrition Assistance Program facilitates work in the long run

One of today’s most heated debates around U.S. income support programs is about work requirements. From the removal of work requirements through the 2021 enhancements to the Child Tax Credit to the imposition of additional ones in the 2023 debt ceiling negotiations, work requirements are now a lightning rod in policy debates. The high stakes of these debates center around a question that is as normative as it is economically important: Should policymakers help people attain adequate living standards if it means they will be less likely to participate in the U.S. labor market?

But what if that tradeoff doesn’t exist? What if income supports themselves facilitate work?

This intriguing question is where a recent working paper by economists Jason Cook of the University of Utah and Chloe East of the University of Colorado Denver comes in. Using a rich administrative data set that matches an unidentified state’s Unemployment Insurance earnings records with its Supplemental Nutrition Assistance Program, or SNAP, files, the two researchers examine how successfully applying to the program formerly known as food stamps affects employment.

Cook and East take advantage of a natural experiment: Applicants to an unidentified state’s Supplemental Nutrition Assistance Program are randomly assigned a caseworker. Some caseworkers are more likely to facilitate successful applications for SNAP benefits than others because they provide more help with the application process than their peers. Using this random variation, the two researchers compare the labor force outcomes of similar working-aged SNAP applicants, some of whom received benefits because of the caseworker they were assigned and others who did not receive benefits because of the caseworkers they are assigned.

Their results are unlikely to be affected by work requirements because in the state they study most SNAP recipients (96 percent) have disabilities, dependents, are old or young, are already working, are in school, or have another circumstance that exempts them from work requirements.

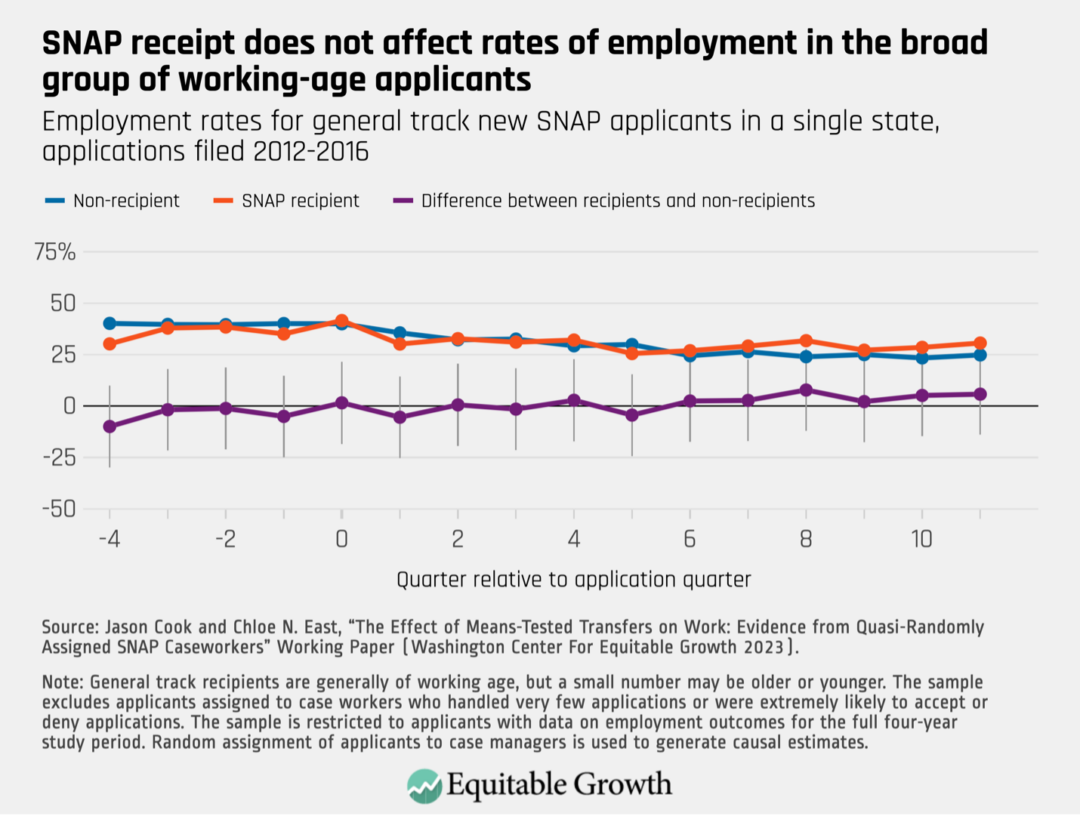

Their results are striking. Looking across the broad sample, Cook and East find no effect of receiving SNAP benefits on work. Comparing those who received SNAP benefits because of the caseworker they were assigned to those who did not receive it because of the caseworker they were assigned, they see no difference in the likelihood of working following successfully applying for SNAP. This in and of itself is notable, given that proponents of work requirements worry that receiving SNAP benefits will discourage them from working. (See Figure 1.)

Figure 1

Looking closely at the data, Cook and East noticed something important: Sixty-one percent of their sample members had not worked at all in the year prior to applying for SNAP, 25 percent had worked steadily throughout the year prior, and 14 percent had worked in some of the prior quarters but not others. Looking to the 61 percent of sample members who had not worked at all in the prior to applying for SNAP, it is likely that most of them faced serious and long-lasting barriers to work: They could have young children or family members with disabilities to care for, they themselves could have a disability that makes working challenging or impossible, or they could live in an area where the labor market makes work hard to come by.

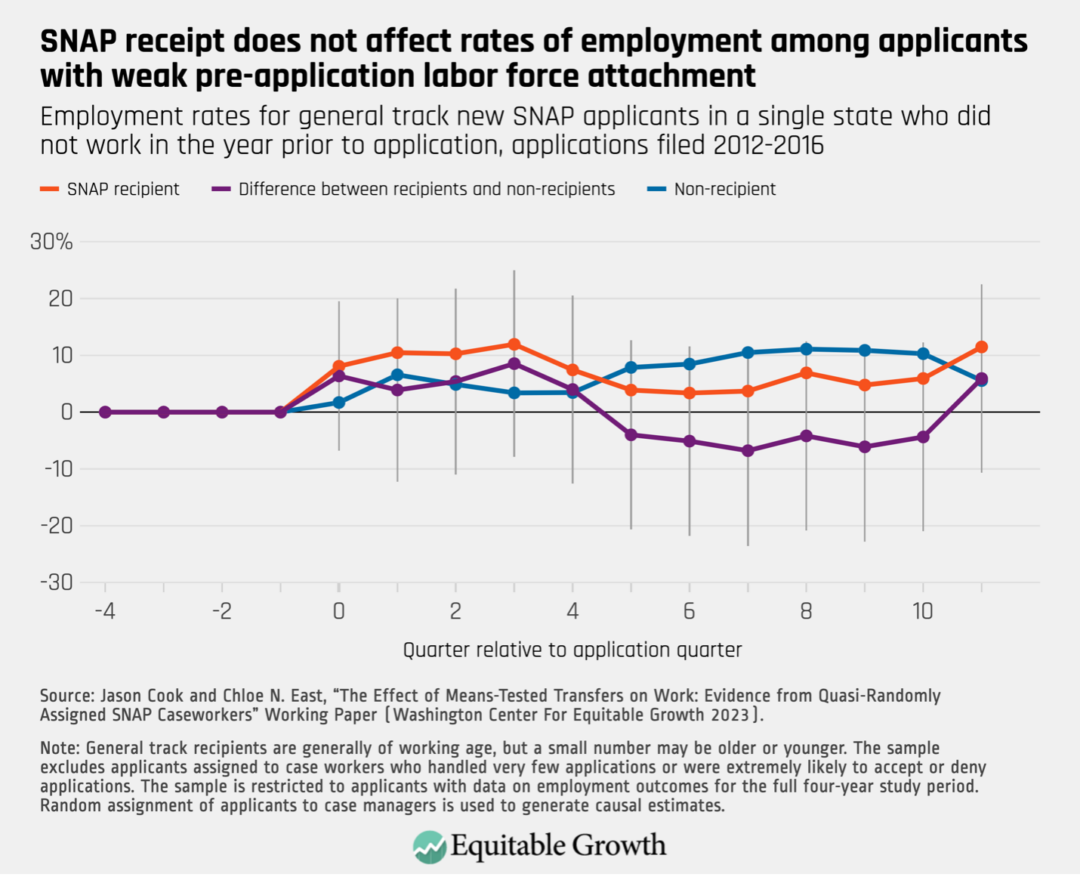

So, accordingly, the two researchers break down the sample into applicants who worked in the full year prior to applying for SNAP and applicants who did not work at all in that same year prior to application. Looking at those who had not worked, they find a similar trend to the trend in the full sample—receiving SNAP benefits does not affect one’s likelihood of working in the three years following applying to the program. (See Figure 2.)

Figure 2

This finding makes sense. Given the strong barriers to work probably experienced by this group, they are unlikely to work under any circumstances—receiving SNAP benefits does not change that fact.

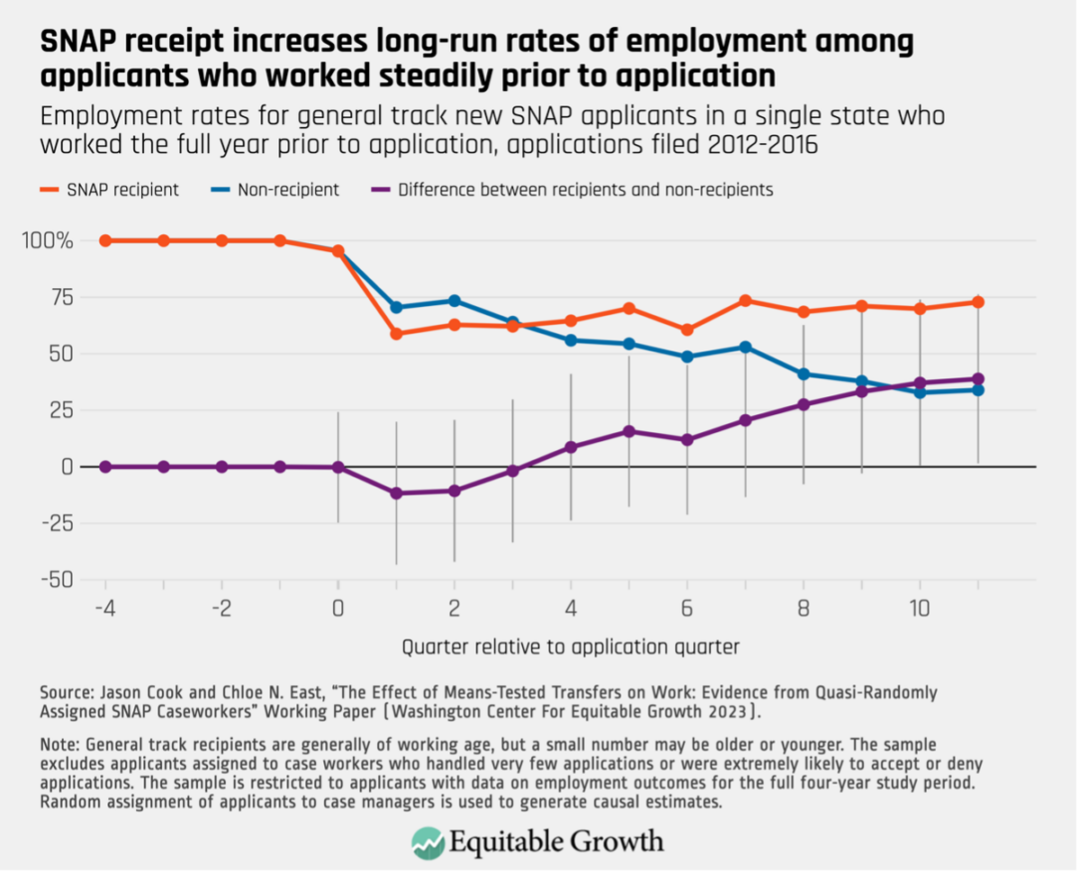

Looking to the quarter of the sample who worked the entire year prior to receiving SNAP benefits, however, we see a different story. Given their recent work history, these applicants are less likely to face the significant barriers to work that are more likely faced by the other portion of the sample. Among these applicants with a year of work history prior to application, there is a dip in their employment rates regardless of whether they received SNAP benefits. This suggests that a change (or anticipated change) in work status may have induced sample members to apply for SNAP in the first place. (See Figure 3.)

Figure 3

Looking further out in Figure 3, however, an interesting trend emerges: One year after application, if the applicants had not received SNAP because of the caseworker they were assigned, then they are actually lesslikely to work than had they instead received SNAP benefits because of the caseworker they were assigned—a trend that becomes more pronounced as time progresses. By the end of the three-year post-application observation period, SNAP recipients are a whopping 34 percentage points more likely to work than those who did not receive SNAP benefits.

What can explain this finding? It appears that SNAP applicants who had been steadily working prior to application use SNAP to cushion the blow of an employment shock, such as a layoff or a change in family or health status that affects their ability to work. When people have resources from SNAP following an employment shock, perhaps they can be more selective in their search for re-employment, leading to a better match with an employer in the long run and a longer tenure on the job. Indeed, evidence from the Unemployment Insurance program shows just this sort of dynamic.

Another possibility is that the income support from the Supplemental Nutrition Assistance Program protects people from experiencing hardships such as eviction, repossessed cars, and damaged credit that make finding and maintaining employment difficult or impossible. The results of Cook and East’s study suggest that regardless of whether income support flows from an unemployment program or a nutrition program, it can have important and beneficial long-run effects on job matching and employment status.

The finding that government expenditures on income support programs without work requirements can lead to long-run gains in employment has important implications for cost benefit analysis. Rather than assuming that the receipt of these benefits lowers employment and associated tax revenue, this research suggests that receiving them actually increases tax revenue over the long run due to increases in employment.

Indeed, the study’s co-authors write, “We find that the effect of SNAP on government revenue due only to changes in labor supply over three years is positive because the longer-run positive effects outweigh the short-term negative ones.” This finding complements a larger body of work on the long-run benefits of the Supplemental Nutrition Assistance Program, from upward intergenerational economic mobility to macroeconomic stabilization.

This paper contributes to a growing body of evidence on the way income support programs interact with work. Already, a substantial body of evidence suggests that work requirements don’t work when policymakers hope to help people attain adequate living standards through labor market participation. This paper joins a few other notable studies suggesting that the income supports themselves—without strings attached—may actually be most effective at achieving this goal.