Why the Inflation Reduction Act is key to strong, broad-based U.S. economic growth

The Inflation Reduction Act spells good news for the U.S. economy. The newly signed legislation makes historic investments to combat climate change, lower healthcare costs, and crack down on tax evasion. All three of these policy actions will help tame rising inflation by lowering the cost of energy, prescription drugs, and health insurance, and by raising the federal revenue required to both pay for these programs and reduce the federal budget deficit.

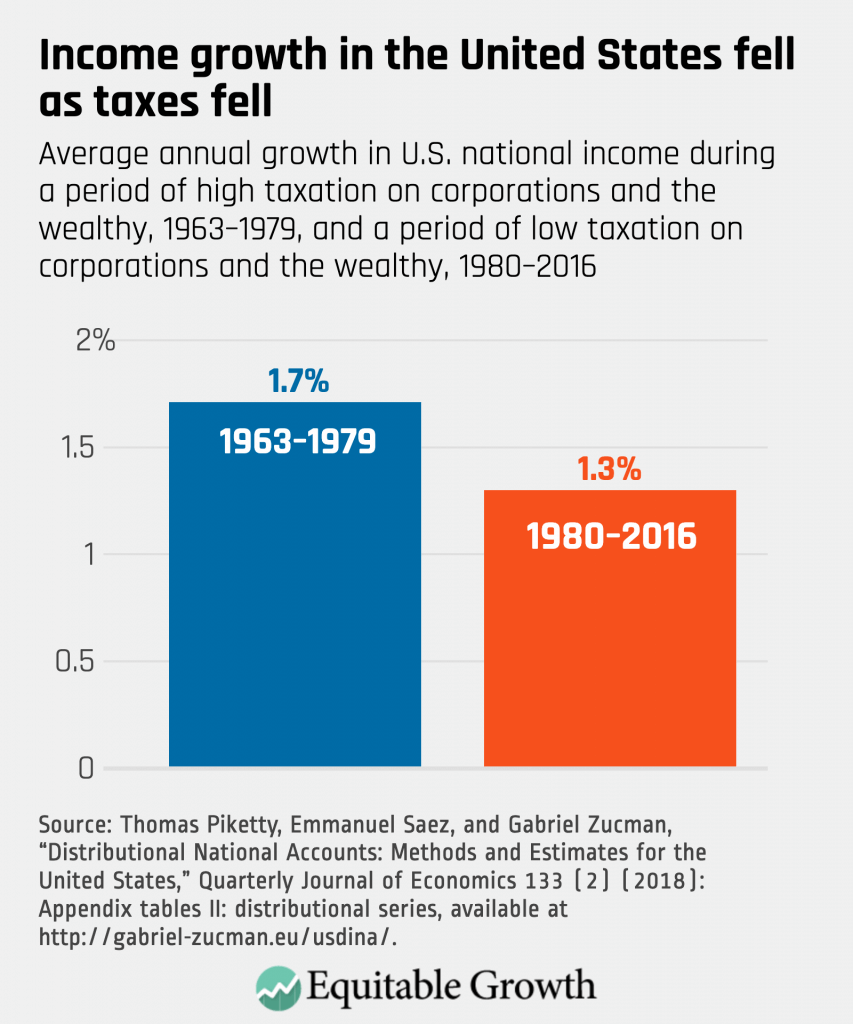

In addition to dealing with rising inflationary pressures, the Inflation Reduction Act will help combat persistent and growing economic inequality in the United States. Over the past five decades, inequality soared while growth stalled. Despite promises to the contrary, the old prescription of tax cuts for the rich and reduced public investment are not working for U.S. workers and their families. (See Figure 1.)

Figure 1

This wide and growing income divide became painfully clear amid the COVID-19 pandemic, which immediately exacerbated longstanding economic divides, especially by race and gender. The federal government’s decisive action during the pandemic, especially the enactment of the Coronavirus Aid, Relief, and Economic Security, or CARES, Act in 2020 and American Rescue Plan in 2021, helped ensure a quicker and more equitable recovery than in the past. Yet neither law thoroughly addressed the long-term economic challenges posed by economic inequality.

The Inflation Reduction Act is a critical next step. The legislation will make long-overdue investments in lowering prescription drug prices and making health insurance premiums more affordable. But the largest benefit is its actions to mitigate climate change—which, the evidence shows, will pay long-term dividends in the form of strong, stable, and broadly shared growth. Key climate provisions include:

- A tax credit for low- and middle-income Americans to buy used and new electric vehicles

- Various rebates, credits, and grants to make homes more energy efficient

- Support for the domestic manufacturing of solar panels, wind turbines, and batteries

- An overarching focus on ensuring marginalized communities benefit from the transition to a clean economy

All of these investments are fully paid for—and then some—by increased taxes on megacorporations, the wealthy, and tax evaders at the top of the income distribution. Equitable Growth grantees Daniel Reck at the London School of Economics, Max Risch at Carnegie Mellon University, and Gabriel Zucman at the University of California, Berkeley recently documented widespread tax evasion at the tippy top of the income ladder in the United States. They also estimate that more effective tax enforcement of the top 1 percent of income earners could yield an additional $175 billion in previously foregone federal tax revenue per year.

The Inflation Reduction Act enables the IRS to go after this giant unpaid tax bill of the wealthiest among us to reduce the federal budget deficit and pay for the investments needed to tame inflation and build a more equitable, and thus much stronger, economy. The nonpartisan Congressional Budget Office conservatively estimates that providing these new resources to the IRS will result in $204 billion in gross revenue over 10 years.

The strong evidence base behind both the investment and revenue components of the bill is one reason former government officials, budget experts, and academic economists—including seven Nobel laureates in economics and five John Bates Clark medalists—all endorsed the bill. And indeed, it’s clear that empirical economic evidence played a decisive role in the negotiations around the Inflation Reduction Act. It was economists who pushed back on the faulty logic that raising taxes on the wealthy and corporations or making long-term, high-return investments would exacerbate inflation—none of which is supported by the evidence.

Critics of the legislation point to the American Rescue Plan, which they mischaracterize as the sole cause of rising inflation, to argue that more investments will lead to more inflation. Yet they conveniently fail to note that the American Rescue Plan and its predecessor, the CARES Act, helped to lay the groundwork for a robust recovery from the pandemic-induced recession, with 2021 growth in Gross Domestic Product and job creation both hitting levels not experienced by the United States in decades.

To be sure, pent-up demand soared among U.S. consumers, many of whom were registering the strongest wage gains in decades just as public health measures to fight the pandemic—in the form of the new vaccines and booster shots—enabled them to spend more. But the largest root causes of the latest bout of inflation are constrained global supply chains and soaring global energy prices brought about mostly by Russian President Vladimir Putin’s invasion of Ukraine in February.

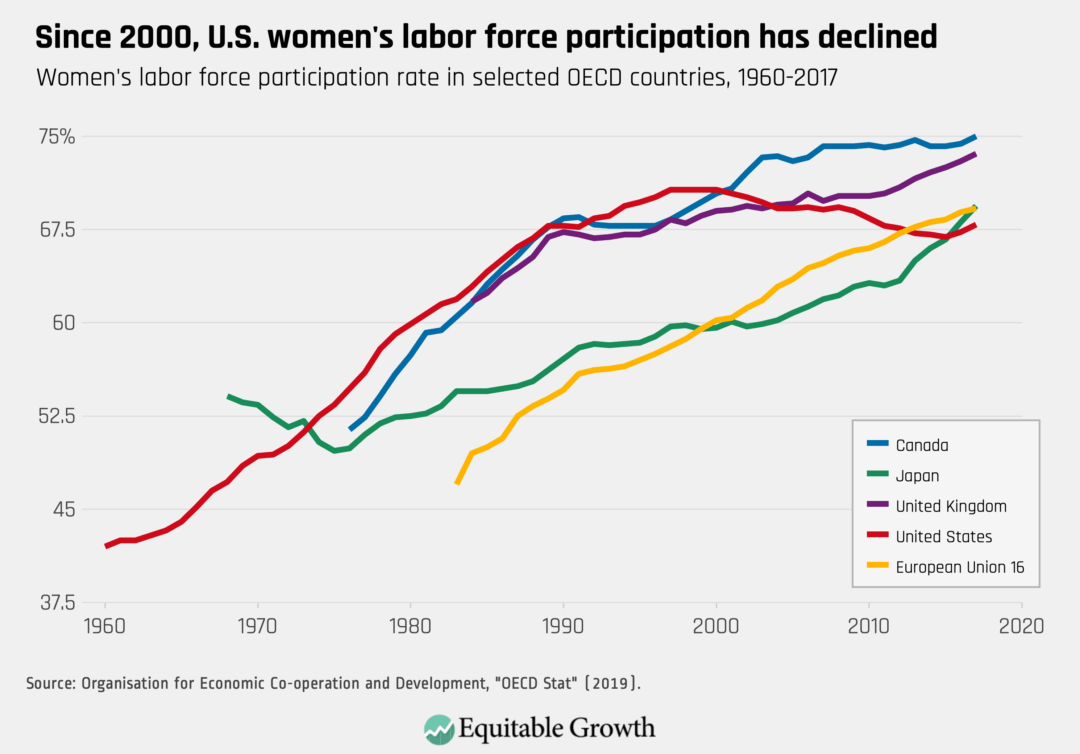

Of course, the Inflation Reduction Act is not perfect. It notably left out many evidence-based policies that would have spurred more equitable growth and helped combat current price pressures. Perhaps most disappointing is the lack of investment in critical social infrastructure, such as child care, home- and community-based services and supports for older adults and people with disabilities, paid leave, an expanded Child Tax Credit, and universal pre-Kindergarten. The United States is woefully behind the rest of the world on these policies, which is one reason female labor force participation has stalled or even regressed in recent years. (See Figure 2.)

Figure 2

Supporting families and caregivers would also increase the size of the U.S. workforce and the overall output potential of the U.S. economy, helping to address current supply constraints that are driving up prices and hampering growth.

Until policymakers in Washington enact paid family and medical leave, paid sick leave, universal pre-Kindergarten, and public child care and elder care, the United States won’t have the kind of equitable economy that powers more sustainable economic growth that U.S. workers and their families deserve.