A plan for equitable climate policy in the United States

This essay is part of Vision 2020: Evidence for a stronger economy, a compilation of 21 essays presenting innovative, evidence-based, and concrete ideas to shape the 2020 policy debate. The authors in the new book include preeminent economists, political scientists, and sociologists who use cutting-edge research methods to answer some of the thorniest economic questions facing policymakers today.

To read more about the Vision 2020 book and download the full collection of essays, click here.

Overview

One year ago, the town of Paradise, California burned to the ground, killing 85 people. Before the fire, it was a poor community with a median annual income of less than $50,000, below the national average.1 In Paradise, climate change combined with economic disadvantage to create a deadly situation.

Unfortunately, this kind of scenario will be increasingly common as the climate crisis accelerates. Across the western United States, wildfires fueled by climate change are putting rural communities at risk. Scientists estimate that climate change has increased wildfire risk by 500 percent, compared to historic risk levels in the 20th century. In addition, twice as much land area in the western United States burned between 1984 and 2015 than would have without climate change.2

Climate change also is making heatwaves hotter, hurricanes stronger, and droughts longer.3 Humankind has already warmed the planet by 1 degree Celsius (1.8 degrees Fahrenheit), or about halfway to the 2 degrees Celsius level that world leaders agreed to limit warming under the Paris Agreement on climate change. Meanwhile, the crisis is claiming American lives—in California wildfires, New Orleans and Houston flooding, and in heatwaves and storm surges across the country—with many more in danger as climate change accelerates.

This crisis will increasingly and dramatically exacerbate economic inequality in the United States. Low- and middle-income Americans have minimal safety net protections from the impact of climate change. These communities are more vulnerable to health-related risks, don’t have the financial resources to recover from climate disasters, and are more vulnerable to climate-related hazards in the first instance. And U.S. workers and communities who may face economic costs from the energy transition to a more clean economy don’t have guaranteed access to healthcare, pensions, and the necessary assistance to maintain their dignity and quality of life.

Already, insurers are declining coverage for housing against growing climate risks such as flooding and wildfires. Without equitable climate policies in place, low-income Americans will have to face a double threat. They will be more likely to die in heatwaves, struggle to recover from hurricanes and wildfires, and, without health insurance, face greater burdens from diseases pushing into new ranges as the planet warms. At the same time, they will struggle the most to pay for the costs associated with preventing even worse climate change impacts.

In this essay, we make the case that equitable climate policy is both good economic policy and good politics. We then present specific policy proposals to support the decarbonization of the U.S. economy by 2050, in line with what climate scientists tell us is necessary to limit warming. We follow with a number of economic and social policies that need to be part of equitable climate policy, such as:

- Community Benefits Agreements for clean energy projects that ensure communities and firms share the profits from wind and solar farms

- Subsidies for clean transportation targeted at low-income Americans

- Retirement with dignity or retraining for fossil fuel industry workers into good-paying clean energy jobs

These and other energy transition investments presented in this essay can be structured to support equitable growth in the United States.

Equitable climate policy is good economic policy and good politics

Unmitigated climate change will hit low- and middle-income Americans the hardest, but climate solutions also could exacerbate economic inequality. The reason is straightforward: Low- and middle-income Americans depend on cheap energy, transport, food, and consumer goods powered or produced using fossil fuels. Many of these goods are relatively inexpensive because their prices do not include the damages caused by carbon pollution. Putting a price on carbon will raise household energy costs, even while one out of every three Americans is already struggling to pay their electricity bills.4

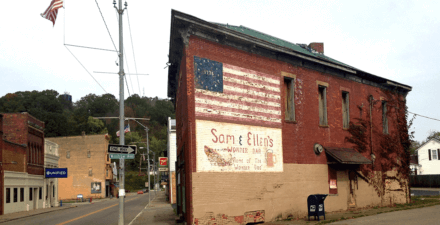

Rural residents across the country in particular must deal with higher prices for fossil fuel-related goods and services—costs that would climb still higher when a price is put on carbon pollution. This is why climate policy that does not take economic inequality into consideration could further squeeze U.S. families that are already struggling with wage stagnation.

To overcome this challenge, we need an approach to climate policy that centers on economic inequality. This is the promise of policy proposals such as the Green New Deal—a wide variety of ideas that integrate social and economic reforms into climate policymaking. According to Green New Deal advocates, climate reforms must address economic inequalities in order to create a just and sustainable future. In this section of the essay, we focus on two key components in this approach: passing a federal clean electricity standard, and investments in clean energy research and development.

But first, let us explain why equitable climate policy also is good economic policy and good politics. No matter what climate reforms are proposed, opponents of those reforms in the fossil fuel industries will frame them as harmful to low- and middle-income Americans. Yet smart climate policy can be designed to offset adverse effects on low- and moderate-income U.S. households. In our research, we show that combining climate reforms with economic and social policy expands public support—even among Republicans.5 This suggests that linking climate and social policy is likely to generate greater public support.

In the past, putting a price on carbon has been the centerpiece of climate reforms. While policymakers may still want to pursue this policy, it is essential to understand that this action alone would be insufficient. Further, any carbon price must also be designed to raise living standards for low- and middle-income households.

One option is to redistribute revenues collected by the government after putting a price on carbon directly back to the public in a progressive way. While we recognize the potential political value of that approach, we also note that any form of taxation—progressive or not—can face political roadblocks. So, it is essential that equitable climate policy makes clear that any transfer payments to U.S. households made with carbon revenues are highly visible to the recipients and clearly associated with carbon taxation in the minds of recipients.

A federal clean electricity standard

Over the past three decades, many states have passed clean energy requirements, even as the federal government has lagged behind. A majority of states now have a Renewable Portfolio Standard in place that requires a certain amount of clean electricity by a given year. Yet other states are falling behind. The United States needs a federal clean electricity standard to meet the climate crisis head on.

A nationwide clean electricity standard can ensure that contributions to climate solutions are not only equitable overall but also offer equitable protection from the local air pollution and other harms that accompany carbon-intensive power plants. This federal standard also would allow the transportation and building sectors to decarbonize much more easily, as those sectors become electrified and begin running off of clean power.

Coal-fired power plants, for instance, are disproportionately sited in communities of color, particularly in urban areas, forcing these communities to bear the negative health externalities of local air pollution.6 More generally, research shows that communities of color bear a disproportionate “pollution burden,” with more than 50 percent greater exposure to pollution relative to their consumption.7 Only a federally coordinated clean energy standard can ensure that no community or region of the country gets left behind by the transition to cleaner energy.

Investments into clean energy research and development

Compared to historic levels, federal investment in energy research and development is extremely low.8 The costs of many energy technologies have fallen over the past decade. Yet it will not be enough to simply deploy existing technologies. There are several areas where the solutions required to fully decarbonize our economy by 2050 are not yet available. That’s why sustained federal investment in research and development is essential.

One key case in point: Investments are needed in energy storage technologies, including grid-scale batteries in order to store wind and solar energy during the times of the year when energy from these sources is scarce. Climate research and development also needs to target reducing carbon pollution from industrial processes, including steel production, cement, and chemicals processing.

As climate science models overwhelmingly show, negative-emissions technologies are also necessary to ensure a stable climate.9 These carbon dioxide removal methods, such as direct air capture technologies or bioenergy production using carbon capture and sequestration technologies, are required to remove historic carbon pollution from the atmosphere and bring carbon concentrations down to safe levels.

Particular attention should be paid to investments in direct air capture technologies, which are at the threshold of commercial viability. For those unfamiliar with these technologies, they involve capturing carbon from the air and either sequestering it underground or using it to create a synthetic fuel, for example to power airplanes. These technologies do not require burning any fossil fuels and are therefore distinct from carbon capture and sequestration technologies.

Funding climate technologies equitably

Many economists believe that putting a federal price on carbon is necessary to price out fossil fuels and provide the revenues necessary for the next transformation of the U.S. energy system. We have reservations about this policy instrument because the political economy of carbon pricing is challenging. Carbon taxes focus policymaking debates on the short-term costs of actions, while masking the substantial economic and ecological benefits of climate reforms. And because carbon pricing can perpetuate economic inequalities, it allows climate policy opponents to present themselves as representing the interests of low-income communities even though, in reality, these communities are being endangered by those same polluting interests.

We believe that equitable climate policymaking instead requires massive investments in communities across the country, and that these investments should be funded from existing revenue sources. Other national and economic security threats are routinely prioritized in U.S. budgetary negotiations and are not restricted to particular earmarked sources. So too should efforts to manage the existential threat of climate change.

The clean energy transition will involve an enormous amount of investment and result in equally massive profits. How can policymakers ensure that some of these benefits are captured by communities, including low- and middle-income communities and communities of color? In addition to carbon pricing, there are a number of policy tools available to ensure equity during the energy transition, among them:

- Community Benefits Agreements

- Subsidies for electric vehicles

- Public transit funding

- Funding for clean energy adoption in underserved communities

- Policies to retire coal plants and increase equity

- Payments and retraining for workers in fossil fuel-intensive industries

- Repeal fossil fuel subsidies

Let’s briefly consider each of these recommendations in turn.

Community Benefits Agreements

Community Benefits Agreements are contracts between large energy developers and communities hosting an energy project. These agreements require that the community receive a share of the project’s benefits. In the few offshore wind developments in the United States, for example, these agreements are in place.10 Policymakers could provide extra incentives for projects that receive government subsidies or tax benefits to negotiate Community Benefits Agreements. These agreements also could require minimum wage standards, unionization or other equitable labor market arrangements.

These terms and conditions would likely increase acceptance of wind energy farms in nearby communities. As our research shows, about 1 in 10 wind energy plants currently faces local resistance, and that number is growing over time.11 Offshore wind energy has faced strong opposition, which is particularly problematic given how high quality this energy source would prove if developed. Deploying renewable energy very fast will require communities to see the benefits of hosting projects.

Subsidies for electric vehicles

To date, wealthier Americans have used most of the tax incentives available when purchasing an electric vehicle.12 While these early, wealthy adopters have brought down the cost of these technologies, it is now time for electric-vehicle policies to be more accessible to all Americans. Subsidies for electric vehicles should be at the point of sale, so that they do not require middle- and low-income buyers to carry large costs until they can claim tax credits at the end of the year. Vehicle rebates could be based on means testing or be restricted to cars whose base price falls below a preset cap. The latter approach could help target lower-end car models that lower-income Americans are more likely to afford.

Efforts to increase the cost of carbon pollution would also make the purchase of electric vehicles even more attractive, price-wise, as fossil fuel-powered vehicles become more costly to drive due to carbon taxes. Targeted investments also are necessary to build electric vehicle charging infrastructure across the country and especially in low-income and rural communities. It is critical that lower-income Americans not get left behind, paying the true costs of fossil fuels, while other Americans have the resources to transition their transportation options.

Public transit funding

Equitable climate policy needs to ensure that electrified public transportation systems are built in urban areas and that the development of affordable housing near clean transit lines is part of that development. This means policymakers need to rethink patterns of urban development to ensure that affordable housing is available in places that do not force low-income families to intensify their dependence on long, fossil-fuel-dependent commutes.

The federal government has a role to play in guaranteeing this supply of environmentally friendly affordable housing. The government should directly build and renovate affordable housing to ensure low-income Americans and renters are not left behind by the energy transition.

Funding for clean energy adoption in underserved communities

Research suggests that clean energy adoption has been unequal along racial lines, even after accounting for differences in wealth.13 Policymakers need to ensure that substantial clean energy investments are made in underserved communities. When funding for low-carbon technology projects is limited, for example, policy should prioritize projects in disadvantaged communities. Renewable energy tax credits should couple a basic credit, perhaps 20 percent, for most solar projects, with an additional tax credit of 10 percent for projects that benefit poor and low-income communities.

Overall, this kind of tax credit would deploy carbon tax revenues to leverage private-sector investment within low-income communities. Further, this policy could be designed to ensure benefits reach both homeowners and renters. If clean energy adoption projects are built in low-income housing, then the tax credit could require 50 percent of the benefits go to renters and 50 percent to the project developer and/or the building owner.

Policies to retire coal plants and increase equity

Existing federal laws and inexpensive natural gas, a fossil fuel, are causing the closure of costly and highly polluting coal-fired energy plants, yet almost one-third of the U.S. power grid is still fueled by this dirty energy source.14 For both health and climate reasons, policymakers must shut down all remaining coal plants as fast as possible.

Many of these coal plants are owned by or contracted through rural electric cooperatives, which are nonprofit utilities founded after the New Deal that operate in some states. As of 2017, 65 percent of rural electric cooperatives’ electricity mix came from fossil fuels, particularly coal. To speed up the retirement of these utilities’ dirty assets, debt relief for rural electric cooperatives may be necessary.15 The federal government could provide funding to write down these debts or restructure loans, for example through the existing Rural Utilities Service.

Another approach to retire coal plants more quickly is through the securitization of the debt held by coal-fired plants. In 2019, Colorado passed a new law that enables utilities to restructure loans on their coal plants. Using government bonds, the utility can lower its cost of capital. In return for these favorable terms, the utility retires its coal plants early.

In the Colorado case, part of the revenue the government collects through the bonds will flow into a fund to support workers and communities near these plants. Given the impact on health from coal plants, closing them has clear benefits for nearby communities, particularly communities of color.16 Of course, shutting down coal plants is also essential to addressing the climate crisis.

Payments and retraining for workers in fossil fuel-intensive industries

There needs to be compensation for workers in fossil fuel-intensive industries so that they can retire with dignity or receive training for new, good-paying jobs in their communities. One of the challenges to the clean energy transition is that communities and workers in parts of our country depend on historic, polluting industries for their livelihoods. Coal miners and other fossil fuel workers must be offered real alternative economic opportunities with a living wage.

Weak compensation programs that either force workers into retirement with minimal social safety nets or funnel them into entry-level service industries will compound economic inequities and undermine political support for the energy transition. Instead, we need robust retraining for good-paying clean energy sector jobs. If necessary, these should be subsidized by government-led clean energy deployment.

Further, many U.S. unions maintain strong ties to carbon-intensive industries, such as auto manufacturing or heavy industry. By contrast, many jobs in the clean energy sector—from clean energy deployment to electric vehicle manufacturing—remain nonunionized. In part, this reflects secular decline in union participation across new U.S. economic sectors. To ensure political support for the energy transition among labor communities coping with decarbonization, government funding for clean energy projects should prioritize unionized workers.

Repeal fossil fuel subsidies

For more than a century now, the federal government has provided valuable tax breaks to the oil and gas industry. Even conservative estimates value this funding at around $20 billion every year.17 U.S. taxpayers should not be paying companies to destabilize the climate. Congress should reform the tax code to eliminate fossil fuel subsidies, including the Intangible Drilling Costs Deduction and the Percentage Depletion Deduction.

Carbon tax revenues

Carbon pricing is a tool that still enjoys support among many policymakers, but we have reservations about its political viability. To the degree that a carbon price is included in a package, we emphasize the importance of using revenues to manage the inequities associated with decarbonization. A variety of revenue options are available. They can be invested in clean energy innovation and deployment or be returned back to Americans. If revenues are given back to the public, then they must be highly visible. They should not be implemented through the tax code, but through visible checks or electronic payments. Citizens need to understand that their dividend payments are specifically linked to new climate change reforms.

In addition, policymakers could allocate a portion of carbon-price revenues to municipal or county-level governments to spend on local projects to reduce greenhouse gas emissions, following the example of California’s cap-and-trade program. In one project funded by this Transformative Climate Communities program, carbon-pricing revenues have been awarded to the city of Fresno for transit-connected affordable housing, weatherization and renewable energy investments in low-income neighborhoods, and urban greening projects.18

The revenues from carbon taxation also could be used to deploy clean-energy and energy-efficiency technologies in low- and middle-income Americans’ communities, helping to distribute the benefits of the energy transition more equally. Policies could be enacted to retrofit low-income housing, for example, improving efficiency and indoor health simultaneously. These carbon-tax revenues also could be used to offset energy bills directly in low- and middle-income households. These diverse benefits should be included in any climate reform package so there is no reason why they must be tied to carbon pricing revenues specifically.

Download FileA plan for equitable climate policy in the United States

Conclusion

Policymakers and the general public must recognize that government funding for low-carbon technologies can be a powerful social policy. Such subsidies are more than a way to reduce the risks of climate change. They also boast the potential to equalize access to new technologies and reduce economic inequality.

For that reason, the federal government must ensure that economically disadvantaged Americans gain the same access to new green technologies as all others and are not left behind in the emerging low-carbon economy. Our government must stop abdicating its responsibility to address the climate crisis.

Government intervention has been necessary in every U.S. energy transition since the 19th century. This time, equitable climate policy must fund significant government incentives to deploy low-carbon technologies, especially in disadvantaged communities, and must fund aggressive investments in clean energy research and development so that clean energy becomes cheap and ubiquitous for all U.S. households.

—Leah Stokes and Matto Mildenberger are both assistant professors in the Department of Political Science and affiliated with the Bren School of Environmental Science & Management and the Environmental Studies Department at the University of California, Santa Barbara.

End Notes

1. United States Census Bureau, “U.S. Census Bureau QuickFacts: Paradise Town, California” (2017), available at www.census.gov/quickfacts/paradisetowncalifornia.

2. John T. Abatzoglou and A. Park Williams, “Impact of Anthropogenic Climate Change on Wildfire across Western US Forests,” Proceedings of the National Academy of Sciences 113 (42) (2016): 11770–11775; Simon F. B. Tett and others, “Anthropogenic Forcings and Associated Changes in Fire Risk in Western North America and Australia During 2015/16,” Bulletin of the American Meteorological Society 99 (1) (2018).

3. Daniel Mitchell and others, “Attributing Human Mortality during Extreme Heat Waves to Anthropogenic Climate Change,” Environmental Research Letters 11 (7) (2016): 074006; Mu Xiao and others, “On the Causes of Declining Colorado River Streamflows,” Water Resources Research 54 (9) (2018): 6739–6756.

4. Chip Berry and others, “One in Three U.S. Households Faces a Challenge in Meeting Energy Needs,” Today in Energy blog, September 19, 2018, available at www.eia.gov/todayinenergy/detail.php?id=37072.

5. P. Bergquist, M. Mildenberger, and L.C. Stokes, “Combining Climate, Economic, and Social Policy Builds Political Support for Climate Action in the US.” Working Paper (SSRN, 2019), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3477525.

6. Adrian Wilson, Coal Blooded: Putting Profits before People (Baltimore, MD: National Association for the Advancement of Colored People, 2016), available at www.naacp.org/wp-content/uploads/2016/04/CoalBlooded.pdf.

7. Christopher W. Tessum and others, “Inequity in Consumption of Goods and Services Adds to Racial–Ethnic Disparities in Air Pollution Exposure,” Proceedings of the National Academy of Sciences 116 (13) (2019): 6001–6006.

8. G. F. Nemet and D. M.Kammen, “U.S. energy research and development: Declining investment, increasing need, and the feasibility of expansion,” Energy Policy 35 (1) (2007): 746–55.

9. Intergovernmental Panel on Climate Change, “Global warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty” (2018).

10. Sarah C. Klain and others, “Will Communities ‘Open-up’ to Offshore Wind? Lessons Learned from New England Islands in the United States,” Energy Research & Social Science 34 (2017): 13–26.

11. C. Miljanich and L.C. Stokes, “Prevalence and Predictors of Wind Energy Protests in the United States.” Working Paper (2019).

12. Severin Borenstein and Lucas W. Davis, “The Distributional Effects of US Clean Energy Tax Credits,” Tax Policy and the Economy 30 (1) (2016): 191–234.

13. Deborah Sunter and others, “Disparities in rooftop photovoltaics deployment in the United States by race and ethnicity,” Nature Sustainability 2 (2019): 71–76, available at https://www.nature.com/articles/s41893-018-0204-z.

14. “FAQ: What Is U.S. Electricity Generation by Energy Source?,” available at www.eia.gov/tools/faqs/faq.php?id=427&t=3 (last accessed December 9, 2019).

15. Joe Smyth, “Rural America Could Power a Renewable Economy – but First We Need to Solve Coal Debt,” Clean Cooperative, July 2, 2019, available at www.cleancooperative.com/news/rural-america-could-power-a-renewable-economy-but-first-we-need-to-solve-coal-debt.

16. Wilson, Coal Blooded: Putting Profits before People.

17. Environmental and Energy Study Institute, “Fact Sheet: Fossil Fuel Subsidies: A Closer Look at Tax Breaks and Societal Costs” (n.d.), available at https://www.eesi.org/papers/view/fact-sheet-fossil-fuel-subsidies-a-closer-look-at-tax-breaks-and-societal-costs.

18. “Fresno Transformative Climate Communities Collaborative,” available at www.transformfresno.com/ (last accessed December 9, 2019).