Restoring the federal estate tax is a proven way to raise revenue and address wealth inequality

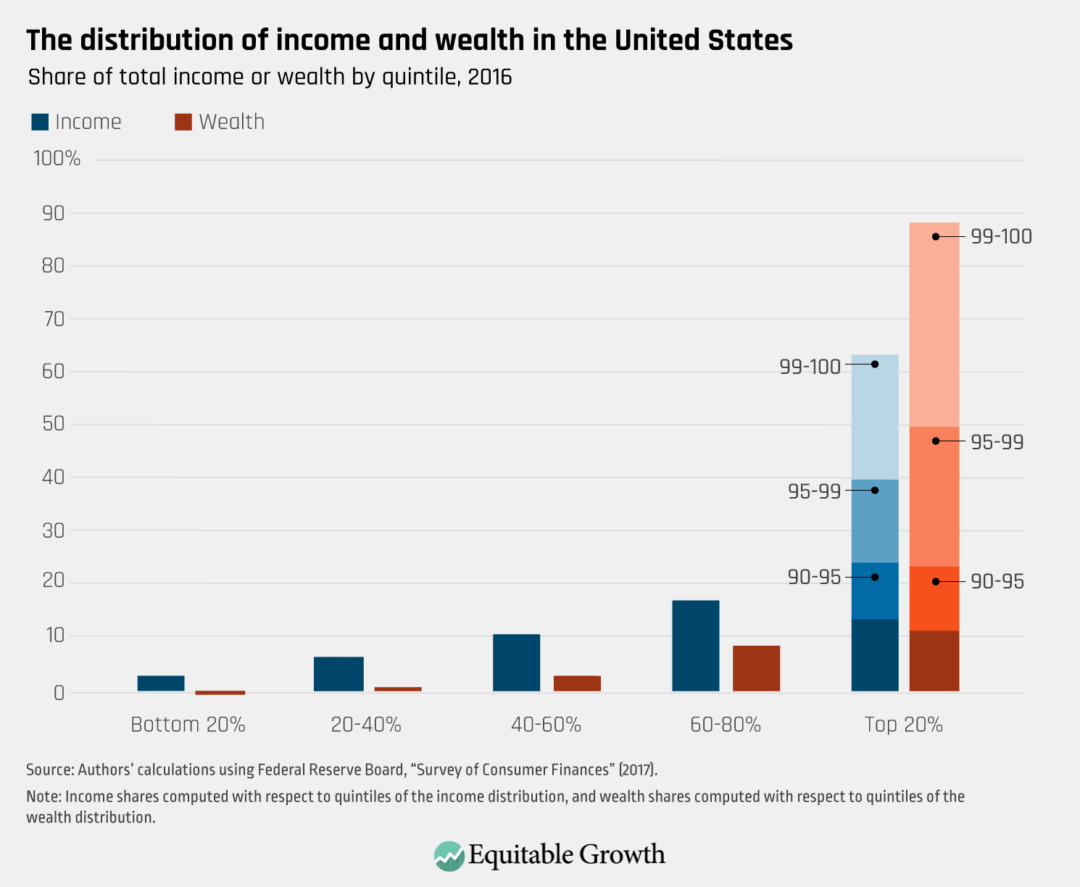

Wealth inequality in the United States is rising more steeply to the already very rich, even more than the well-known rise in income inequality. The wealthiest 1 percent of families in the United States hold about 40 percent of all wealth and the bottom 90 percent of families hold less than one-quarter of all wealth. (See Figure 1.)

Figure 1

This gaping wealth divide has sparked proposals for sharply higher taxes on wealth. Taxing wealth is a promising way to raise revenues and deal with the deep historical skeins of economic inequality and structural racism exposed by the coronavirus and COVID-19, the disease it causes. There are many ways taxes on wealth could be reformed and expanded, including adoption of a wealth tax, switching to mark-to-market taxation of investment income, incremental reforms to the existing income tax, and adopting an inheritance tax. Recently, I and my co-authors William Gale, Christopher Pulliam, and Isabel Sawhill at The Brookings Institution proposed another approach—expanding the federal estate tax.

There are four principal reasons why expanding the estate tax could well be the most effective and efficient way to close the wealth divide and provide the federal government with the fiscal means to ensure the economic recovery from the coronavirus recession is both equitable and designed to deliver long-term structural change. First, policymakers have repeatedly cut the estate tax over the past 20 years, without regard for the true economic and distributional consequences. The result: The top estate tax rate has fallen from 77 percent in 1976 to 40 percent currently, and dramatic increases in the exemption mean that many fewer estates have to pay anything.

Second, although critics like to characterize the estate tax as penalizing a lifetime of hard work and savings, the estate tax, in practice, is better described as an effective backstop to the federal income tax. The estate tax is not a tax on death; it is a way of collecting taxes that the deceased avoided over their lifetimes by using income tax loopholes. Academic research shows that an effective estate tax and forced realization of untaxed capital gains at death are similar in many ways, in terms of revenue and distributional effects.

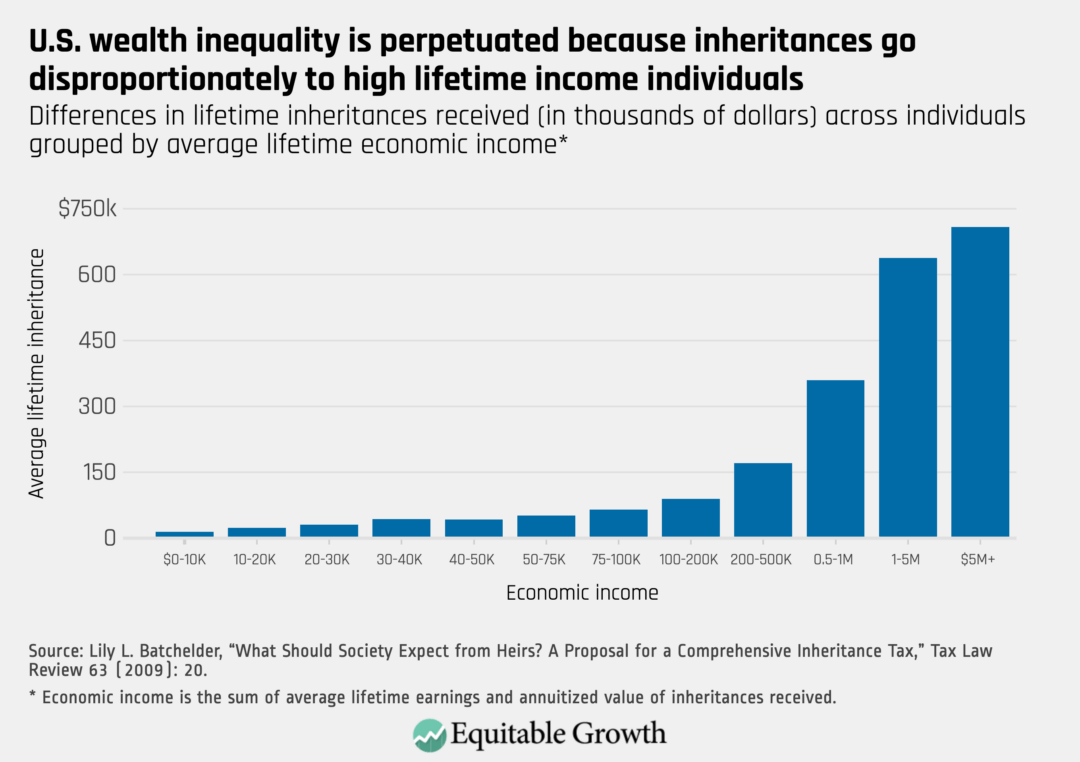

Third, the very failure to collect taxes on the true incomes of the very wealthy increases wealth inequality within generations and amplifies the inequality due to intergenerational wealth transfers. Law professor Lily Batchelder at New York University finds that “wealth transfers increase within-generation inequality on an absolute basis because of what economists call regression to the mean.” She explains that “someone who earns $100 million per year, for example, is likely to have a child whose income is slightly lower, even including the child’s inheritance [but] someone who earns $10,000 per year is likely to have a child whose income is slightly higher than her own.” (See Figure 2.)

Figure 2

These deeply skewed inheritances—due to no effort on the part of the children, grandchildren, and great-grandchildren of the wealthy—robs the United States of the promise of equal opportunity and leaves the federal government with less revenue to address the baleful long-term economic consequences of wealth inequality.

Which brings me to the fourth reason to revive the estate tax—doing so would greatly improve the overall fiscal outlook of the federal government, and in a highly progressive way. Simply restoring the estate tax to the 2001 law, adjusted for inflation, would have generated $145 billion in 2020, which is almost 25 percent of all nondefense discretionary spending in that year. This is more than eight times what the IRS is collecting today under the existing estate tax.

Gale, Pulliam, Sawhill, and I provide a range of calculations of how reviving the estate tax could result in significantly more revenue for the federal government. Our estate tax calculator is one way policymakers in Congress can decide how to expand the estate tax. As we say in the conclusion of our Brookings issue brief, “The long-term threats of unsustainable federal debt, rising inequality, and the need for government investments should compel policymakers to seek new ways to raise substantial revenue from the well-to-do. An expanded estate tax would raise large amounts of revenue, be highly progressive, and directly target a major source of wealth inequality.”