Factsheet: What the research says about the economics of the 2021 enhanced Child Tax Credit

The Child Tax Credit has historically provided income support to middle- and high-income taxpayers with children. In 2021, however, the U.S. Congress enacted a temporary enhanced Child Tax Credit with three key changes:

- Eligibility was expanded to lower-earning taxpayers because the credit was made fully refundable, and the earnings requirement was dropped.

- The maximum amount was raised to $3,000 per child ages 6 to 17 and $3,600 per child younger than 6 years old, from $2,000 per child younger than 17.

- Families could receive six monthly payments of between $250 and $300 per child during the second half of 2021, with the remainder paid after filing 2021 taxes in 2022.

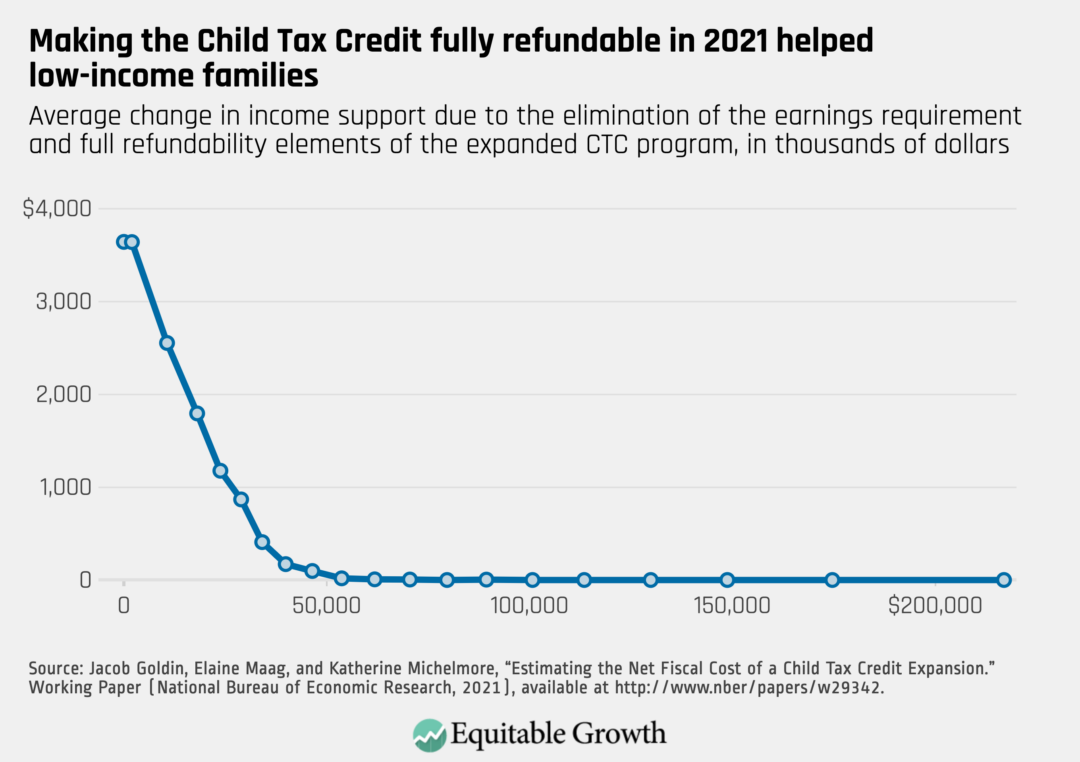

The temporary expansion of the Child Tax Credit increased benefit levels the most for low-income households, as shown below. (See Figure 1.) All of these changes have since expired.

Figure 1

This factsheet summarizes the current research on the effects of the enhanced Child Tax Credit. Early evaluations of its temporary expansion generally find that it increased economic well-being with limited or no detriment to the U.S. labor supply. A well-established body of research suggests that the improved well-being of these children will boost U.S. productivity and growth when they reach adulthood.

Research finds that the 2021 enhanced Child Tax Credit improved the well-being of U.S. children and their families

- Recent research by economist Zachary Parolin and his co-authors at Columbia University estimates that the CTC expansion reduced child poverty by 40 percent.1

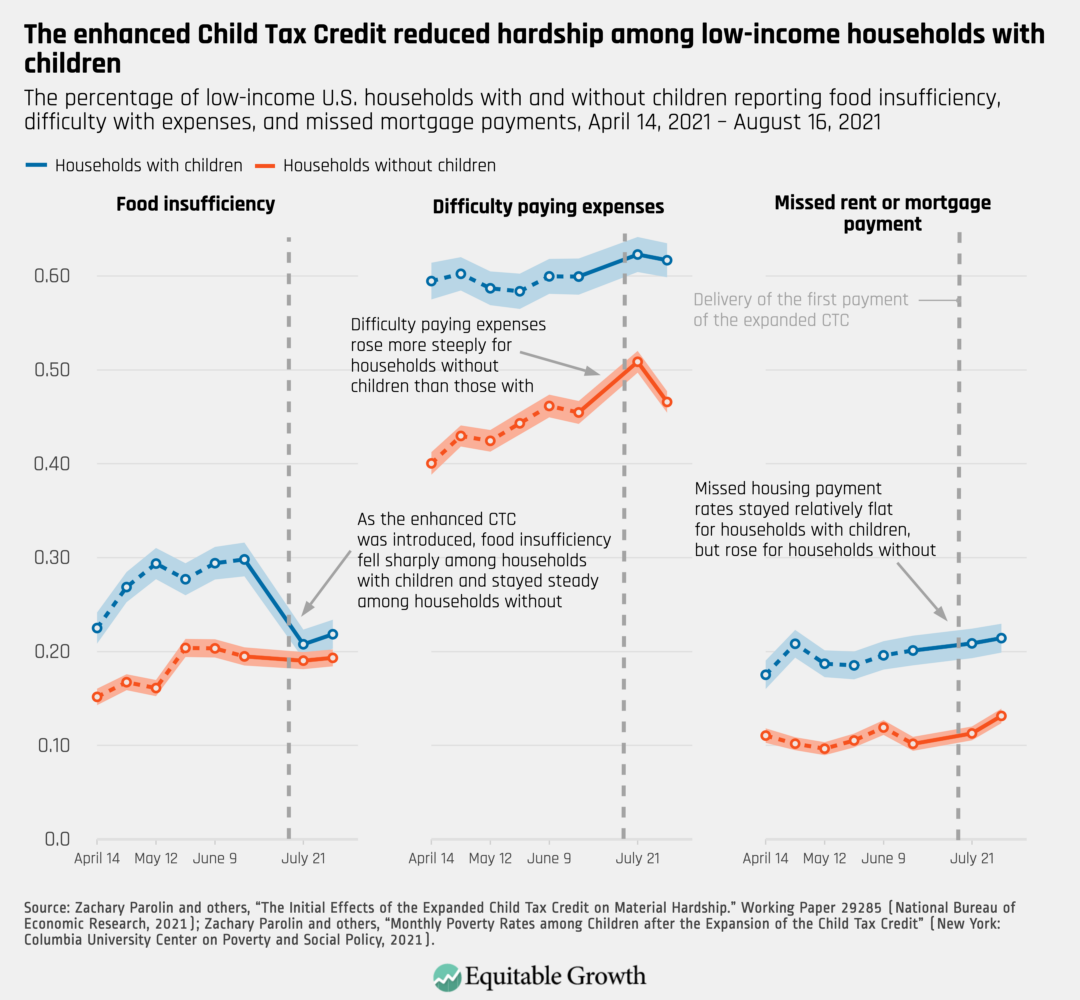

- The enhanced Child Tax Credit also supported families with children by reducing food insecurity, lowering reported difficulties affording expenses, and cutting the rate of missing housing payments. (See Figure 2.)

Figure 2

- Recent research by Natasha Pilkauskas and her colleagues at the University of Michigan finds that the enhanced Child Tax Credit reduced the number of food hardships by nearly a third for the average low-income family receiving the credit.2

- Pilkauskas and her co-authors also find that the expansion significantly reduced the experience of medical hardship among low-income families.3

- A large body of literature on financial transfers similar to the Child Tax Credit finds beneficial effects in the areas of health, education, and adulthood earnings.4

Research finds that the 2021 enhanced Child Tax Credit did not affect parental work effort

- More research by Parolin and his co-authors compares changes in U.S. labor supply for households with children versus those without, finding no consistent differences in the monthly employment outcomes of these two groups around the time of the CTC expansion.5

- More research by Natasha Pilkauskas and her co-authors does not find a statistically significant relationship between employment and the CTC expansion among families in their sample, suggesting that the expansion did not deter work.6

- Simulations, which use estimates from existing research to predict the effects of the enhanced Child Tax Credit in the future rather than measuring actual effects from the 2021 expansion, find mixed results that are contingent on their assumptions. Of the three most prominent simulations of a permanent CTC expansion, two suggest that labor supply effects would be small.7 One suggests that they would be substantial.8

The design of the enhanced 2021 Child Tax Credit improved racial and socioeconomic equity in the program

- Columbia University researchers find that prior to the temporary expansion, about one-third of children lived in families that earned too little to receive the Child Tax Credit, and that children of color, rural children, and young children are overrepresented in this group.9

- The design of the enhanced 2021 Child Tax Credit removed structural barriers, such as earnings requirements, and research suggests that many families with children who had previously been carved out of this income support received it. Specifically:

- Early survey evidence reported by Katherine Michelmore and her University of Michigan colleague Pilkauskas suggests that approximately two-thirds of very low-income families received monthly CTC payments.10

- Yet research suggests that some barriers remained.

- Questions still surround why roughly 1 in 5 low-income families did not receive payments.11

- Some low-income families did not receive the monthly payments because they opted for one lump sum in 2022.12

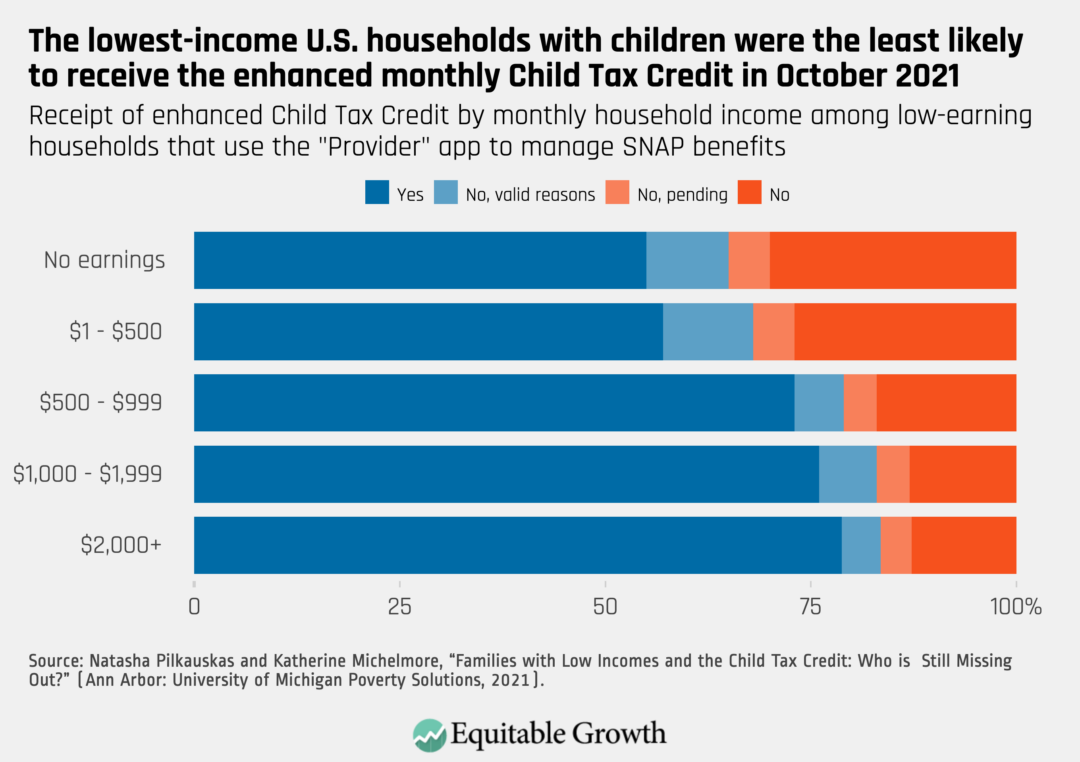

- A remaining barrier may be that families who wouldn’t ordinarily file taxes may not have known about their newfound eligibility. Indeed, families with little or no earnings had substantially lower rates of receiving the expanded Child Tax Credit in the first several months of the expansion.13 (See Figure 3.)

Figure 3

- Language barriers also may have affected access. Pilkauskas and Michelmore find lower rates of receipt among respondents who took the survey in Spanish, despite high rates of tax filing.14

Policy implications

Research broadly supports a permanent expansion of the Child Tax Credit. There seems to be a consensus that such a policy would improve well-being. The trial expansion of the enhanced Child Tax Credit in 2021 did not seem to cause parents to work less. Most simulations of a permanent expansion of this income support suggest that labor disincentives would be small.

Indeed, the primary argument for not expanding the Child Tax Credit is that it would allow low-income parents to work less, which would work against the program’s goal of reducing child poverty. Yet a large body of evidence on income support for children makes a strong case that these policies tend to improve children’s well-being, as well as their socioeconomic outcomes in adulthood, thus boosting U.S. economic productivity and growth over the long term.

End Notes

1. Zachary Parolin and others, “The Initial Effects of the Expanded Child Tax Credit on Material Hardship.” Working Paper 29285 (National Bureau of Economic Research, 2021), available at https://www.nber.org/papers/w29285; Zachary Parolin and others, “Monthly Poverty Rates among Children after the Expansion of the Child Tax Credit” (New York: Columbia University Center on Poverty and Social Policy, 2021), available at https://www.povertycenter.columbia.edu/publication/monthly-poverty-july-2021

2. Natasha Pilkauskas and others, “The Effects of Income on the Economic Wellbeing of Families with Low Incomes: Evidence from the 2021 Expanded Child Tax Credit.” Working Paper No. w30533 (National Bureau of Economic Research, 2022), available at https://www.nber.org/papers/w30533.

3. Ibid.

4. National Academies of Sciences, Engineering, and Medicine, “A Roadmap to Reducing Child Poverty” (2019), available at https://nap.nationalacademies.org/child-poverty; Anna Aizer, Hilary Hoynes, and Adriana Lleras-Muney, “Children and the US Social Safety Net: Balancing Disincentives for Adults and Benefits for Children,” Journal of Economic Perspectives 36 (2) (2022): 149–74, available at https://www.aeaweb.org/articles?id=10.1257/jep.36.2.149.

5. Elizabeth Ananat and others, “Effects of the Expanded Child Tax Credit on Employment Outcomes: Evidence from Real-World Data from April to December 2021.” Working Paper 29823 (National Bureau of Economic Research, 2022), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4051257.

6. Pilkauskas and others, “The Effects of Income on the Economic Wellbeing of Families with Low Incomes: Evidence from the 2021 Expanded Child Tax Credit.”

7. Jacob Goldin, Elaine Maag, and Katherine Michelmore, “Estimating the Net Fiscal Cost of a Child Tax Credit Expansion.” Working Paper 29342 (National Bureau of Economic Research, 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3940028; Irwin Garfinkel and others, “The Benefits and Costs of a U.S. Child Allowance.” Working Paper 29854 (National Bureau of Economic Research, 2022), available at https://www.nber.org/papers/w29854.

8. Kevin Corinth and others, “The Anti-Poverty, Targeting, and Labor Supply Effects of Replacing a Child Tax Credit with a Child Allowance.” Working Paper 29366 (National Bureau of Economic Research, 2021), available at https://www.nber.org/papers/w29366.

9. Sophie Collyer, David Harris, and Christopher Wimer, “Left behind: The one-third of children in families who earn too little to get the full child tax credit,” Poverty & Social Policy Brief 3 (6) (2019).

10. Natasha Pilkauskas and Katherine Michelmore, “Families with Low Incomes and the Child Tax Credit: Who is Still Missing Out?” (Ann Arbor: University of Michigan Poverty Solutions, 2021).

11. Ibid.

12. Ibid.

13. Ibid.

14. Ibid.