Weekend reading: Bolstering U.S. social infrastructure and the care economy through public investments edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

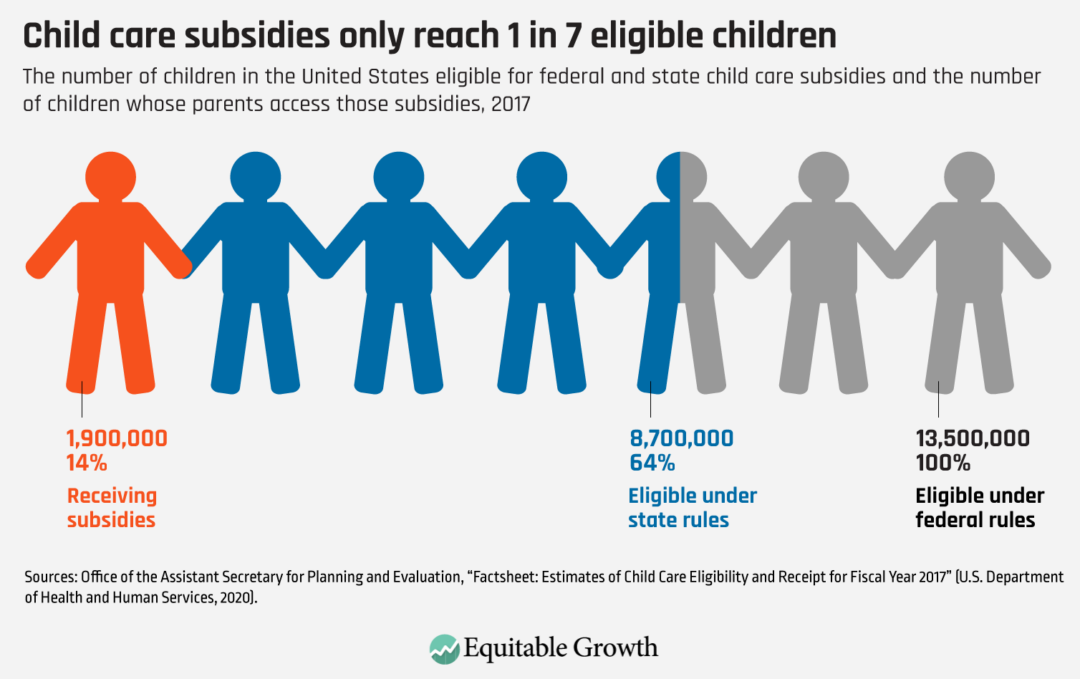

Despite the essential role that child care plays in the lives of U.S. workers and their families, the current child care market in the United States is not meeting families’ needs. This not only impacts families themselves, but also the overall economy, as high-quality care has far-ranging impacts on economic activity and growth. Sam Abbott explains why public investments are needed in early care and education to support immediate and long-term economic growth, as well as bolster human capital development in the next generation of workers. He then details how public investments in particular can offset deficiencies in the private child care market and support child care workers, who play a vital role in the U.S. economy. These investments, he concludes, are some of the best bets policymakers can make, with research showing that every dollar in spending on early care and education generates more than $8 in economic activity. Accompanying Abbott’s report is a factsheet laying out what the economic research has found about the impacts of child care and early childhood education on the U.S. economy.

Policymakers should also seize the opportunity in the current 2022 budget reconciliation negotiations to invest in U.S. social infrastructure, Abbott and Alix Gould-Werth write. Much like investments in early care and education, they explain, increasing spending on other social infrastructure and income support programs would give a much-needed boost to the overall economy in addition to supporting those workers and families most in need. The co-authors detail recent economic findings about the role of care infrastructure, paid family and medical leave, early care and education, and income supports in ensuring strong, stable and broadly shared economic growth. As the United States emerges from the greatest health, economic, and caregiving crises in decades, they conclude, Congress should boost public investments in these critical programs to correct years of neglect and underinvestment.

Though some policymakers are fearful of making these investments due to overblown fears of increasing the national debt, University of California, Berkeley’s Barry Eichengreen urges them to ignore the deficit fearmongering on Capitol Hill. Detailing arguments from his new co-authored book, In Defense of Public Debt, he shows how governments throughout the years have issued public debt to address emergencies and pressing social needs, and makes the case that our current conditions demand similar action. Not only is our current physical infrastructure crumbling due to decades of underinvestment and the heightened threat of climate change, but social infrastructure programs are also far behind where they should be. Eichengreen effectively rebuffs the critiques of President Joe Biden’s Build Back Better agenda and encourages policymakers to pass it while they have the chance.

Equitable Growth is hosting its biennial policy conference on Monday and Tuesday. The virtual event, “Equitable Growth 2021: Evidence for a Stronger Economic Future,” will gather policymakers, academics, activists, and thought leaders to discuss pressing economic issues and policy solutions. (Click here to register.) The first day of sessions will feature a keynote address from U.S. Secretary of Labor Marty Walsh and a conversation between Equitable Growth President and CEO Michelle Holder and Michigan State University’s Lisa Cook. Maryam Janani-Flores, Kate Bahn, and Carmen Sanchez Cumming detail the sessions on day 2, and highlight speakers who will participate in panel sessions on topics such as envisioning a new economic future, rebalancing Big Tech’s grip on the economy, boosting aggregate demand and managing debt burdens, and social infrastructure as an engine for economy growth. The September edition of Expert Focus—Equitable Growth’s monthly series highlighting scholars at the forefront of economic and social science research—also showcases featured speakers from this year’s policy conference.

New research examines the value of racial and gender diversity at the Federal Reserve. As the Federal Open Market Committee meets next week, the 12-member body should consider the findings of a working paper published this week by Francesco D’Acunto at Boston College’s Carroll School of Management, Andreas Fuster at the Swiss Finance Institute, and Michael Weber at the University of Chicago’s Booth School of Business. The co-authors study the influence that the race and gender of FOMC members has on public perception and trust of their opinions on inflation and Unemployment Insurance. They find that Black men and women, as well as White women, are more likely to align their economic expectations with those of FOMC members from diverse backgrounds, while White men and Hispanic respondents trusted FOMC members regardless of race or gender. The research highlights the importance and salience of diversity and representation at the highest levels of policymaking and decision-making—as well as the current and historical lack of non-White male economists at the Fed and within the field more broadly.

Links from around the web

A new U.S. Treasury Department report says that the nation’s child care system is failing families, reports CNBC’s Ylan Mui, finding that market failures keep high-quality and affordable care out of reach for many families. Similar to the Equitable Growth report released this week, the Treasury report details the challenges many families face in finding affordable, accessible, and quality care options for their children and examines the often poor working conditions that many child care workers experience, from low pay to high stress. The Treasury report also recommends policymakers pass President Biden’s Build Back Better agenda. Mui runs through the details of the Treasury report, interviewing several policymakers and previewing the next steps in Congress.

Unions can play a major role in wealth building and bridging the wealth divide between families of color and their White counterparts, write Aurelia Glass and David Madland in an op-ed published in The Hill. They detail the findings of a recent analysis they and a co-author, Christian Weller, performed on Federal Reserve data from the Survey of Consumer Finances. While unions alone are not a silver bullet, they allow families to make significant gains in growing wealth and establishing more financial security. Their study finds that “the median union family has over double the wealth of the median nonunion family” and that “the wealth gap between white families and Black and Hispanic families was significantly smaller for union households compared to nonunion households.” This, they explain, has significant implications for President Biden’s plan to rebuild the middle class, which is currently shrinking and out of reach for many U.S. households.

The coronavirus pandemic has disrupted the trajectories of millions of college students in the United States. Men make up the majority of drop-outs, according to some estimates—but, Kevin Carey writes in The New York Times’ The Upshot, women are still playing catch up in the U.S. economy. The college gender imbalance is not a new phenomenon, as women have outnumbered men on campuses for decades. Carey details the data on gender disparities in college and beyond, noting that despite higher female enrollment at universities, the gender pay gap is still pervasive across the U.S. labor force.

Inflation is on everyone’s mind. NPR’s Scott Horsley reports that high meat prices are contributing to inflation and that concentration in agriculture and meatpacking could be to blame. Horsley details the Biden administration’s efforts to target what they call “Big Meat,” in their campaign against anticompetitive behavior and market dominance. The administration’s goal, he writes, is to restore competition in the U.S. meatpacking and processing industry—in which more than 80 percent of beef is slaughtered and processed by just four companies—which would work in consumers’ favor by lowering prices.

Friday figure

Figure is from Equitable Growth’s “The child care economy,” by Sam Abbott.