New U.S. antitrust legislation before Congress must mandate an anticompetitive presumption for acquisitions of nascent potential competitors by dominant firms

Antitrust and competition issues are receiving renewed interest, and for good reason. So far, the discussion has occurred at a high level of generality. To address important specific antitrust enforcement and competition issues, the Washington Center for Equitable Growth has launched this blog, which we call “Competitive Edge.” This series features leading experts in antitrust enforcement on a broad range of topics: potential areas for antitrust enforcement, concerns about existing doctrine, practical realities enforcers face, proposals for reform, and broader policies to promote competition. Steven Salop has authored this contribution.

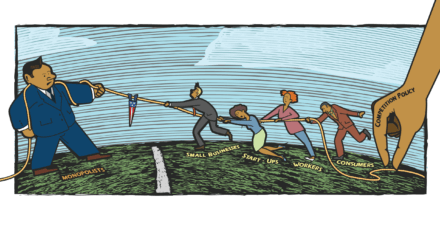

The octopus image, above, updates an iconic editorial cartoon first published in 1904 in the magazine Puck to portray the Standard Oil monopoly. Please note the harpoon. Our goal for Competitive Edge is to promote the development of sharp and effective tools to increase competition in the United States economy.

The current U.S. economy is increasingly characterized by dominant firms controlling digital platforms. One way that dominant networks maintain or even increase their power is by acquiring nascent or potential competitors that otherwise might become significant competitors by themselves or by joining with other rivals. Now, there is legislation before Congress to correct past anticompetitive presumptions by dominant firms. Reining in acquisitions by these burgeoning monopolies in the digital arena is important to U.S. economic competitiveness and innovation.

Most of the discussion about digital monopolies focus on Alphabet Inc.’s Google unit, Facebook Inc., Apple Inc., and Amazon.com Inc., but there are other digital platforms with substantial market power. In air travel, Sabre Corp. is the dominant platform that connects airlines and travel agents. In auto repair, CCC Intelligent Solutions Holdings Inc. is the dominant platform that connects the auto industry’s original equipment manufacturers and other parts suppliers and repair shops. There are many credit-card-issuing banks, but only three major credit card networks (Visa, MasterCard, and American Express), and the networks’ rules make it impossible for merchants to negotiate lower fees with the card-issuing banks or each other.

Viewpoints on these anticompetitive market conditions largely support greater antitrust scrutiny. Various commentators—including the University of Chicago Booth School of Business’ Stigler Report, Carl Shapiro at the University of California, Berkeley’s Hass School of Business, and me—recommend that there be increased enforcement in this area. Koren Wong-Ervin, an antitrust partner at Axinn, Veltrop, & Harkrider LLP, takes a more skeptical approach.

Yet U.S. antitrust law makes it very difficult for the enforcement agencies to bring successful actions to prevent these kinds of acquisitions and, at least until recently, enforcement has been very lax. There have been a number of notable examples of missed enforcement opportunities. The Federal Trade Commission and the United Kingdom’s Competition and Markets Authority, for example, failed to attempt to stop the Facebook acquisition of Instagram in 2012, despite emails by Facebook’s CEO Mark Zuckerberg that clearly indicated a desire to acquire Instagram in order to prevent it from competing with Facebook.

Similarly, the Federal Trade Commission permitted Google to acquire AdMob in 2009 and Doubleclick in 2007. These two acquisitions helped set the stage for Google to obtain its monopoly over display advertising networks—a situation that resulted in a monopolization case brought by a group of state attorneys general led by the state of Texas.

Now, the two U.S. antitrust agencies are stepping up. The Federal Trade Commission has brought a monopolization case to unwind the Facebook mergers, and the U.S. Department of Justice’s Antitrust Division sued to block the Visa/Plaid merger. But the legal barriers are overly high. In order to correct this enforcement gap, the law should mandate a strong anticompetitive presumption for acquisitions of nascent or potential competitors by dominant platforms and other firms with substantial market power.

That presumption should be coupled with a high rebuttal burden placed on dominant firms. This rebuttal burden means that the merging firms will have to show that the transaction will not harm competition. The high burden would require them to show this result with clear evidence, not simply showing by a preponderance of the evidence that a merger is unlikely to cause anticompetitive effects.

The rationale for this strong presumption has two parts. First, reliable case-specific evidence is often necessarily limited, so there is a need to rely more on a presumption, whether it is procompetitive or anticompetitive. Second, underdeterrence and failing to stop anticompetitive transactions is far more worrisome than overdeterrence and erroneously stopping procompetitive ones. Thus, the choice of an anticompetitive presumption with a high rebuttal burden makes more sense.

This is where I disagree with conservatives. The conservative position might be paraphrased as “unless you are confident, do nothing.” My view is that we face a policy choice in digital markets between accepting “monopoly capitalism” and ensuring the potential for competition and deconcentration. The latter approach is more appropriate.

I will now drill down on the issue of evidence. In evaluating acquisitions and other conduct involving potential or nascent competitors, probative case-specific information often is limited because the potential or nascent rival may have little or no track record, and the competitive harms may be in future markets. Thus, the antitrust agencies and courts have no choice but to rely more heavily on categorical predictions—that is, presumptions. This approach is not speculation. It is an application of rigorous decision theory: the famous Bayes Law.

Decision theory involves efficiently combining prior information about the category of conduct, or “presumptions,” and case-specific evidence. The relative weights placed on these two sources of information depend on the strength of the presumption and the reliability of the case-specific evidence. If the case-specific evidence is limited or less reliable in making a good prediction, then more weight should be placed on the presumption. If reliable evidence is limited, then the presumption often will decide the case.

Of course, there is a choice between an anticompetitive presumption or a procompetitive presumption. In my view, the appropriate approach is an anticompetitive presumption. This is because underdeterrence is a more serious concern than overdeterrence when the acquiring firm is dominant or has substantial market power.

Market forces lead to large underdeterrence concerns

First, in markets with large network effects, scale economies, and switching costs—all of which are subject to tipping toward monopoly—competition in the market often comes from disruptive new entrants. When such competition does occur, the benefits are substantial. The danger of the acquisitions of potential competitors is that they will prevent that disruptive competition from occurring.

Second, for this reason, dominant firms have powerful incentives to eliminate or neutralize nascent or potential competition. The dominant firm also has the resources to do so by sharing the monopoly profits. There is a simple reason for this: Monopoly profits typically exceed more competitive, duopoly profits. This is because competition on price and quality typically deliver increased consumer welfare while reducing industry profits. Consumers gain at the expense of firms when there is competition. By outbidding rivals to buy out the entrant, the dominant firm can preserve its monopoly power and profits.

Third, to state the obvious, there can be no “market self-correction” away from a condition of dominance to competition if the dominant firm is permitted to acquire, destroy, or neutralize nascent competitors or entrants that would lead to more competition and market self-correction.

Fourth, the dominant firm has more market information than do the two U.S. antitrust agencies and their counterparts abroad. So, dominant firms can perceive higher-level threats before they become apparent to the agencies. This might have been the case with Google’s acquisitions of DoubleClick and AdMob, or Facebook’s acquisitions of Instagram and WhatsApp.

Fifth, a dominant firm’s higher bids to acquire a nascent competitor or potential entrant by no means implies that the acquisition is more efficient or will be more likely to benefit consumers than would the acquisition by another firm. It can simply be the fact that the dominant firm is willing and able to pay more to protect its monopoly profits.

Overdeterrence is a lesser concern

First, dominant firms typically can achieve most, if not all, of the legitimate benefits from these acquisitions or agreements on their own, albeit perhaps with some delay, or through nonexclusive agreements.

Second, if dominant firms are not permitted to acquire potential competitors, then the courts and antirust agencies should not assume that the efficiencies will be lost. They typically will be obtained by alternative purchasers or partners.

Third, it is not the case that preventing dominant firms from making these acquisitions will lead to fewer start-ups or less innovation by nascent competitors. Even with constraints on dominant firms, the start-ups will still be able to pursue an “invest and exit” strategy of selling to larger firms. They just will not be able to sell to the dominant firm.

The evidence indicates greater competitive concerns from underdeterrence, not overdeterrence

Koren Wong-Ervin suggests that there is insufficient credible evidence of a competitive problem that needs to be fixed. I disagree.

First, there are some compelling anecdotes suggesting that the agencies believed they were unlikely to successfully enjoin some significant problematical acquisitions. These include Google’s acquisitions of AdMob and DoubleClick and Facebook’s acquisition of Instagram, as mentioned above. Sabre’s acquisition of Farelogix was a notable judicial error.

Two recent studies also reinforce these concerns. One important study focused on pharmaceutical transactions. The study finds that drug projects acquired in mergers were less likely to be developed when they overlapped with the acquirer’s existing product portfolio, especially when the acquirer’s market power was large due to weak competition or distant patent expiration. The authors find that 5 percent to 7 percent of the deals qualified as what they termed “killer acquisitions.” They also find that the deals were disproportionately not reportable in the United States.

Another study of acquisitions by Google, Amazon, Facebook, and Apple finds that among the deals where they had sufficient data, 10 percent to 15 percent of the deals were competitively problematical. This amounted to one to two significant deals per year. Moreover, the study limited the identification of potentially problematical transactions in several ways. Their list does not include transactions where the acquired firm was in a vertically adjacent market. The study simply assumes that these firms would not become entrants into the dominant firm’s “core market.”

This second study also did not account for the possibility that these acquired firms may have had important assets that would have been valuable to rivals or where the dominant platform was able to use the acquisition to increase the spread of its monopoly. Google’s acquisition of Nest, for example, was not included because Nest was not an entrant into search. But Nest likely will be an important search access point as voice assistance becomes more common. If Nest is owned by Google, then it likely will not support interoperability among competing voice assistants.

Finally, there were many other deals that might have raised concerns, but a combination of narrow “filters” that the second study used to identify concerns and the authors’ lack of access to sufficient public information reduced the number of transactions evaluated in the second study. One case in point: The authors of the second study identified 79 Facebook deals, of which 19 were in the messaging or social media segments. Yet apparently only eight of those 19 deals were evaluated.

Conclusion

For all these reasons, the law should mandate a strong anticompetitive presumption for acquisitions of nascent or potential competitors by firms that are dominant or have substantial market power, with a high rebuttal burden placed on the acquiring firm. This type of presumption can lead to increased enforcement and greater competition as the modern economy develops.

In this regard, three legislative proposals have been made. Recently introduced legislation offered by Sen. Amy Klobuchar (D-MN) offers two approaches. First, the bill creates an anticompetitive presumption based on market share (50 percent) that applies to acquisitions of companies “that have a reasonable probability of competing with the acquiring person in the same market.” In this situation, it would not be necessary for an antitrust agency to prove that a potential competitor is more likely to enter or that it is more likely to have a substantial impact. Second, a separate-size-of-transaction presumption would require, at least for the largest transactions and companies, that the acquirer prove that the acquisition does not create even an appreciable risk of materially lessening competition.

More recently, the Platform Competition and Opportunity Act of 2021 sponsored by Rep. Hakeem Jeffries (D-NY) and co-sponsored by Rep. Ken Buck (R-CO) addresses mergers for large tech platforms. This bill presumes that any merger by a covered platform is illegal unless the defendant can show by clear and convincing evidence that the acquired firm is not a competitive threat and that the transaction would not “enhance or increase the covered platform’s market position.”

Sens. Charles Grassley (R-IA) and Mike Lee (R-UT) also have introduced a bill that includes provisions that create anticompetitive presumptions against acquisitions of potential or nascent competitors by firms with market shares exceeding 33 percent. For firms with market shares exceeding 66 percent, the presumption is made even stronger because there is only a very limited exception.

In light of this bipartisan support, Congress may well follow through and legislate a strong anticompetitive presumption. It should.

—Steven C. Salop is professor of economics and law at the Georgetown University Law Center and a senior consultant at Charles River Associates. He regularly consults to private companies and government agencies. The opinions expressed here are his own and do not necessarily represent the views of colleagues or consulting clients.