Competitive Edge: Principles and presumptions for U.S. vertical merger enforcement policy

Antitrust and competition issues are receiving renewed interest, and for good reason. So far, the discussion has occurred at a high level of generality. To address important specific antitrust enforcement and competition issues, the Washington Center for Equitable Growth has launched this blog, which we call “Competitive Edge.” This series features leading experts in antitrust enforcement on a broad range of topics: potential areas for antitrust enforcement, concerns about existing doctrine, practical realities enforcers face, proposals for reform, and broader policies to promote competition. Jonathan B. Baker, Nancy L. Rose, Steven C. Salop, and Fiona Scott Morton have authored this month’s contribution.

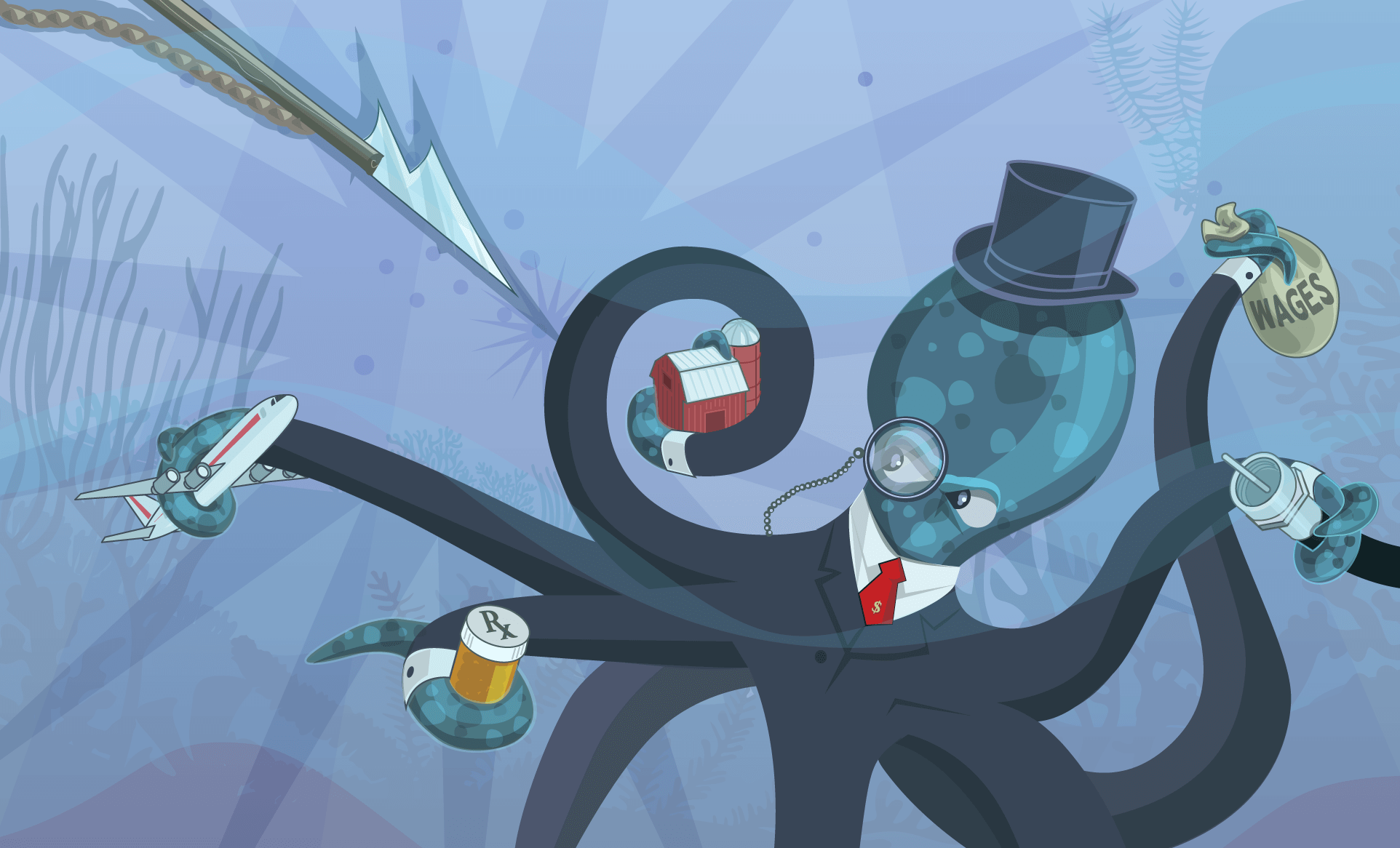

The octopus image, above, updates an iconic editorial cartoon first published in 1904 in the magazine Puck to portray the Standard Oil monopoly. Please note the harpoon. Our goal for Competitive Edge is to promote the development of sharp and effective tools to increase competition in the United States economy.

Most discussions of U.S. merger policy focus on horizontal mergers. These are transactions that combine firms at the same level of production, such as would have occurred in the wireless phone telecommunications sector when AT&T Inc. attempted to acquire T-Mobile US, Inc. By contrast, vertical mergers combine firms at different levels of production, such as when AT&T acquired Time Warner in 2018. Vertical merger analysis also applies to the combination of firms producing complementary products, such as when Ticketmaster Entertainment LLC acquired the live events promotion company LiveNation.

U.S. antitrust laws cover vertical mergers, and the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice investigate them. Until the recent AT&T/Time Warner case, however, the agencies had not litigated a vertical merger in court for 40 years. There are only about two vertical merger enforcement actions per year across the two agencies. These are seldom resolved with divestitures or merger abandonments, but rather are routinely settled with consent decrees that regulate behavior.

There seems to be consensus that the DOJ’s 1984 Vertical Merger Guidelines, now 35 years old, reflect neither modern theoretical and empirical economic analysis nor current agency enforcement policy. There also is little dispute that antitrust enforcement should be based on rigorous economic analysis. Yet widely divergent views of preferred enforcement policies were expressed by the FTC’s commissioners when resolving office supply company Staples, Inc.’s acquisition of Essendant and Fresenius Medical Care AG’s acquisition of NxStage, by the various amicus briefs filed in connection with the appellate review of the Justice Department’s unsuccessful challenge to AT&T’s acquisition of Time Warner (here, here, and here), by Assistant Attorney General Makan Delrahim, by the participants the FTC’s competition policy hearing on vertical mergers, and by two of us (here, here, and here).

This broad range of views suggests the difficulty that the two federal antitrust enforcement agencies will face in formulating new vertical merger guidelines. The D.C. Circuit’s decision in United States v. AT&T offered some guidance by applying the same legal standards for vertical mergers as are applied to horizontal mergers, but the court left substantial gaps that the agencies will need to fill.

Based on our review of the economic literature on vertical integration and our experience analyzing vertical mergers, we are concerned that there is too little vertical merger enforcement. Recent empirical studies have identified a number of cases in which vertical mergers have led to higher prices. And a recent private antitrust case successfully attacked a merger that was both vertical and horizontal and had been cleared by the Justice Department in 2012 with no remedy.

We recommend an approach to reduce false negatives, which erroneously allow mergers that harm competition, while keeping low the risk of false positives, which erroneously condemn mergers that are pro-competitive. Our analysis focuses on oligopoly markets where vertical mergers are most likely to raise concerns and most likely to be subject to agency investigation and enforcement. Oligopoly markets are those with a small number of competitors and barriers to entry, where the firms take rivals’ responses into account when making market decisions. These include digital markets where production economies of scale and network effects can create oligopoly structures and entry barriers, leading to the exercise of market power and raising competitive concerns with vertical mergers.

We recommend that the two antitrust agencies adopt the following five principles to guide vertical merger enforcement, which we discuss in more detail in our longer article.

- The agencies should consider and investigate the full range of potential anti-competitive harms when evaluating vertical mergers.

- The agencies should decline to presume that vertical mergers benefit competition on balance in the oligopoly markets that typically prompt agency review, and not set a higher evidentiary standard based on such a presumption.

- The agencies should evaluate claimed efficiencies resulting from vertical mergers as carefully and critically as they evaluate claimed efficiencies resulting from horizontal mergers, and should require the merging parties to show that the efficiencies are verifiable, merger-specific, and sufficient to reverse the potential anti-competitive effects.

- The agencies should decline to adopt a safe harbor for vertical mergers, even if rebuttable, except perhaps when both firms compete in unconcentrated markets.

- The agencies also should consider adopting presumptions (rebuttable) that a vertical merger harms competition when certain factual predicates are satisfied.

We set out several possible presumptions here that could be invoked when at least one of the markets is concentrated. These identify conditions under which economic analysis suggests that the merger creates the greatest likelihood of anti-competitive effects. By successfully establishing a presumption, the plaintiff would satisfy its prima facie case, thereby shifting the burden of production to the merging firms. These presumptions are:

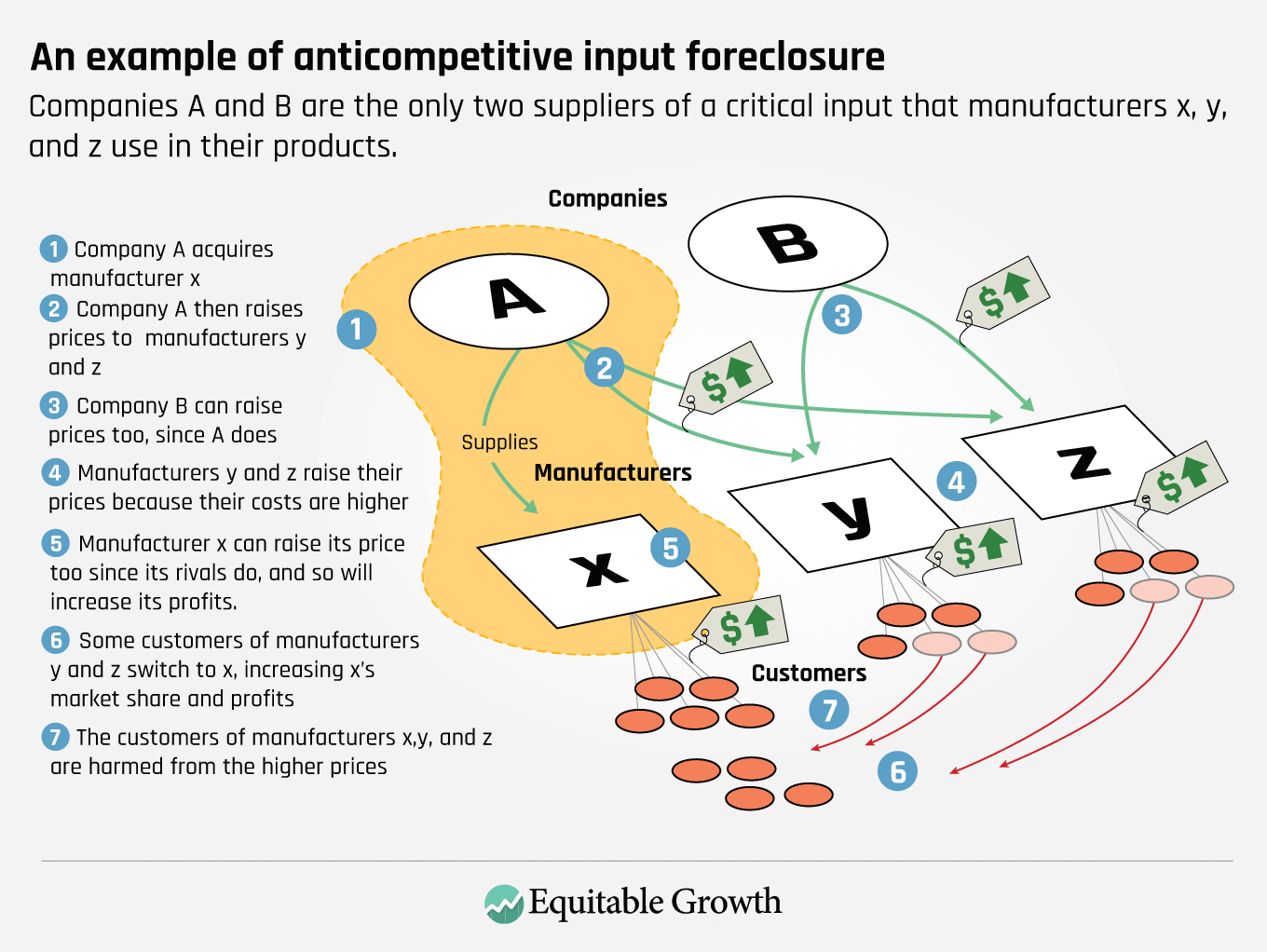

- Input foreclosure presumption. One concern is that a vertical merger will harm competition in the downstream market if the upstream merging firm in a concentrated market is a substantial supplier of a critical input to the competitors of the other merging firm, and a hypothetical decision to stop dealing with those downstream competitors would lead to substantial diversion of business to the downstream merging firm. This diversion might be increased if other upstream suppliers raise their prices in response. In this situation, a vertical merger can raise the costs of the unintegrated rivals and permit the merged firm to exercise market power in the downstream market.

- Customer foreclosure presumption. A mirror effect can occur that harms competition in the upstream market if the downstream merging firm is a substantial purchaser of the input produced in a concentrated upstream market, and a decision to stop dealing with the competitors of the upstream merging firms would lead to the exit, marginalization, or significantly higher variable costs of one or more of those competitors by diverting a substantial amount of business away from them. In this situation, a vertical merger can reduce competition in the upstream market and permit the merged firm to exercise market power. It also can lead to an increased likelihood of input foreclosure.

- Elimination of potential entry presumption. Competition also may be harmed if either or both of the merging firms has a substantial probability of entering into the other firm’s concentrated market absent the merger. In this situation, the merger would eliminate the possibility that entry—or the fear of that entry, if the incumbent firm charges excessive prices—would make the market more competitive.

- Disruptive or maverick seller presumption. One seller can constrain coordination in its concentrated market if it has different pricing incentives from the other firms. A vertical merger that eliminates a downstream firm that has prevented or substantially constrained coordination in the upstream market can harm competition if the upstream market is concentrated and the upstream firm supplies the maverick’s competitors. In this situation, the constraining influence of the disruptive or maverick firm could be eliminated, leading to higher market prices.

- Disruptive or maverick buyer presumption. This presumption would be invoked if the downstream merging firm purchases the product sold by the other merging firm or its competitors—and, by its conduct, that firm has prevented or substantially constrained coordination in the sale of that product by the other merging firm and its competitors in a concentrated input market. In this situation, the constraining influence of the disruptive or maverick firm could be eliminated, leading to higher market prices.

- Evasion of regulation presumption. If the downstream firm’s maximum price is regulated, competition nonetheless may be harmed from a vertical merger. This can occur, for example, if the regulation permits the downstream firm to raise its price in response to cost increases. The regulated downstream firm could raise the price of the input supplied to it by its upstream merger partner, increasing upstream profits and downstream prices. Evasion of regulation could also occur if the merger involves firms that sell complementary products. The newly merged firm could raise the price of the bundle and attribute the price increase to the unregulated product.

- Dominant platform presumption. Competition may be harmed if a dominant platform company acquires a firm with a substantial probability of entering in competition with it absent the merger, or if that dominant platform company acquires a competitor in an adjacent market. Rivals in vertically adjacent or complementary product markets are often potential entrants, so this presumption reaches nascent threats to competition created by eliminating the potential entrants through the merger. This presumption can be understood as an application of the elimination of potential entry presumption and an input or customer foreclosure presumption in a setting where network effects and economies of scale would be expected to raise barriers to entry, and thus endow a dominant platform with substantial market power.

If the two antitrust enforcement agencies adopt any or all of the presumptions, then they should allow them to be rebutted by evidence showing that anti-competitive effects are unlikely. Hence none of the presumptions would create a per se prohibition of vertical mergers. The agencies also should continue to investigate vertical mergers that raise competitive concerns even if these presumptions are not applied. These presumptions set out conditions where concerns are greatest. These are not the only conditions where there are potential concerns.

Vertical mergers can substantially harm competition. Adopting these five principles will anchor effective vertical merger enforcement by reducing false negatives while keeping false positives low. We hope the agencies will follow our recommendations. These recommendations also could be useful to the courts, or if the Congress decides to amend Section 7 of the Clayton Antitrust Act.

The authors are: Jonathan Baker (research professor of law, American University Washington College of Law; chief economist, Federal Communications Commission, 2009–2011; director, Bureau of Economics, Federal Trade Commission, 1995–1998); Nancy L. Rose (Charles P. Kindleberger Professor of applied economics and department head, Massachusetts Institute of Technology; deputy assistant attorney general for Economic Analysis, U.S. Department of Justice, 2014–2016); Steven C. Salop (professor of economics and law, Georgetown University Law Center); and Fiona Scott Morton (Theodore Nierenberg Professor of economics at the Yale School of Management; deputy assistant attorney general for Economic Analysis, U.S. Department of Justice, 2011–2012). The issues discussed in this column are examined in more detail in the authors’ longer article that will be published this summer in Antitrust magazine.