Equitable Growth hosts event featuring Sen. Elizabeth Warren on pro-growth tax reform in 2025

Several provisions of former President Donald Trump’s 2017 tax cuts are set to expire next year, providing an opportunity to reimagine how federal taxes can both raise additional revenue for critical public investments and ensure the U.S. economy is working for all—not just the privileged few. Replacing the failed “trickle down” tax policies of the past will require both robust evidence and creative vision.

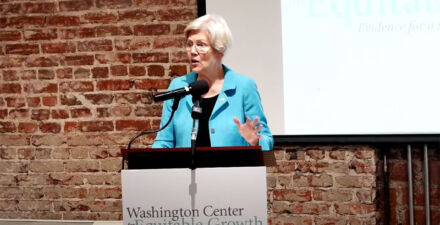

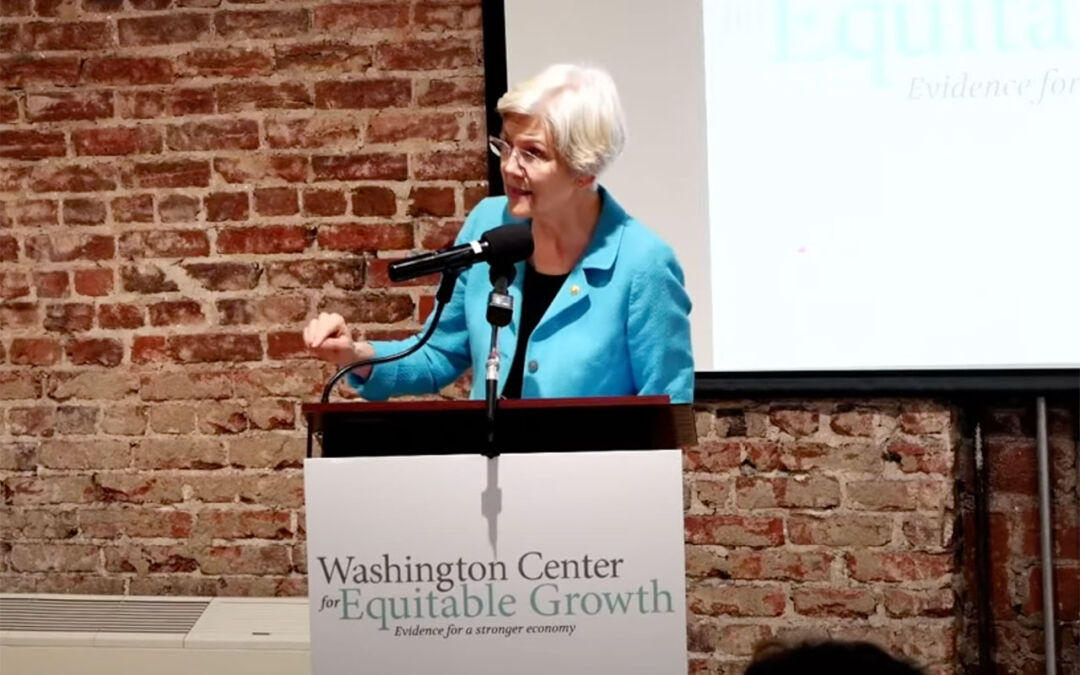

On June 17, the Washington Center for Equitable Growth hosted an event titled “The Promise of Equitable and Pro-Growth Tax Reform,” gathering academics and policymakers, as well as journalists and tax experts, to discuss potential changes to the tax code in 2025 and to showcase the best research on how to achieve equitable, pro-growth tax reform. The event, held at the National Union Building in Washington, DC, featured a keynote address by Sen. Elizabeth Warren (D-MA), followed by a panel of tax policy experts and closing remarks from Daniel Hornung, deputy director of the White House National Economic Council.

After opening remarks from Equitable Growth Senior Fellow David Mitchell, Sen. Warren kicked things off with her call to be prepared to fight for tax reform. She focused on how the tax code is a reflection of a country’s values—and how the current federal tax code reflects the values of the very wealthy and big corporations. She cited the upcoming presidential election as a key factor in the policy negotiations around the expiring provisions of the Tax Cuts and Jobs Act of 2017, and urged policymakers to prioritize making the tax code more equitable for middle class families by getting billionaires and corporations to pay their fair share in taxes.

Sen. Warren also highlighted the importance of funding the IRS to go after tax cheats and the widespread tax evasion that is common among the top 1 percent of income earners. The loopholes in the U.S. tax code that enable this tax evasion also ensure that the rich become richer and continue to accumulate both wealth and political power.

Equitable Growth Senior Policy Fellow Michael Linden then introduced the panel of tax policy experts: UCLA School of Law’s Kim Clausing, University of Maryland’s Daniel Reck, Yale Law School’s Zachary Liscow and Natasha Sarin, and Nadiya Beckwith-Stanley of Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates. The panelists covered three broad topics—business taxation, taxing wealth, and tax law enforcement—before turning to an audience question-and-answer session.

Linden first turned the panel’s attention to wealth taxation, diving into why taxing capital is so important to making the tax code more equitable. Beckwith-Stanley explained how harmful it is that the U.S. government taxes capital differently than it taxes labor income, and highlighted a few policy areas for improvement: different rates of taxation and when capital is taxed.

Liscow discussed his proposal to close the billionaire borrowing loophole, or taxing the very wealthy who use their financial assets as collateral to borrow money and then pay little—or no—taxes on the cash they use to finance their lifestyles. His research shows that closing this loophole would raise about $100 billion over 10 years. Sarin then hit upon the inefficient nature of the way capital is currently taxed, urging policymakers to think about this problem, as well as the arguments for raising revenue.

On taxing businesses, Linden focused on provisions of the Tax Cuts and Jobs Act that benefitted corporations without improving worker well-being, particularly cuts for pass-through businesses that exacerbated inequality. Clausing discussed how the Trump-era tax cuts did not have a large-scale effect on wages, economic growth, or investment, but did disproportionately benefit the wealthy and big corporations. She highlighted that the U.S. corporate tax base is very concentrated, meaning that adjusting the corporate tax rate would have a big impact on revenue without affecting the vast majority of taxpayers.

Linden then asked Reck to explain how his research on tax evasion by the wealthy shows how rich people often use specific business structures to shield their wealth from taxation, taking advantage of loopholes in the tax code to create more loopholes that allow them to continue to avoid taxes. Reck echoed Sen. Warren’s calls for Congress to continue funding the IRS, saying that this funding is essential to catching these tax evasion schemes and ensuring the wealthy pay what they should.

The panelists then discussed the importance of enforcing tax law and why further IRS cuts would undermine the government’s ability to restore fairness in the U.S. tax code. Sarin detailed the decades-long draining of IRS resources that hindered its ability to enforce the law, and how that reduced the audit rate of pass-through businesses to zero percent, incentivizing companies to continue to exploit loopholes in the law.

Beckwith-Stanley also raised the issue of racial disparities in IRS audits, and highlighted the nuance of this issue of IRS funding. Sarin then also talked about how many low-income communities are wary of accessing all of the income support programs to which they are entitled out of fear that the IRS—a law enforcement agency—would come after them in an audit.

Panelists then each listed one policy proposal they would like to see enacted. Liscow raised his proposal to tax the billionaires borrowing loophole, while Clausing pushed for taxing corporations at the entity level. Sarin mentioned a permanent expansion of the Child Tax Credit to lift millions of U.S. children out of poverty. Beckwith-Stanley highlighted the importance of making any change to the tax code permanent rather than continuing to pass short-term changes that have to be renegotiated after a few years.

After wrapping up a lively Q&A section that covered tax rates as a share of Gross Domestic Product, research on partnerships and pass-through income, using the tax code to shape corporate behavior, and key principles to follow going into tax policy negotiations in 2025, the National Economic Council’s Hornung delivered closing remarks. He laid out various problems with the Trump-era tax cuts, particularly their contributions to the federal deficit and economic inequality.

Hornung then highlighted the importance of reorienting the tax system to promote shared growth and economic opportunity. He said policymakers need to address structural issues in the tax code alongside demographic shifts that require them to raise more revenue to ensure the federal government can sustainably invest in social programs. He reiterated how centering these goals would not only address the failures of the Trump-era tax cuts but also make the U.S. tax code work better for the middle class and fairer overall.

Did you find this content informative and engaging?

Get updates and stay in tune with U.S. economic inequality and growth!