Weekend reading: Raise the minimum wage edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

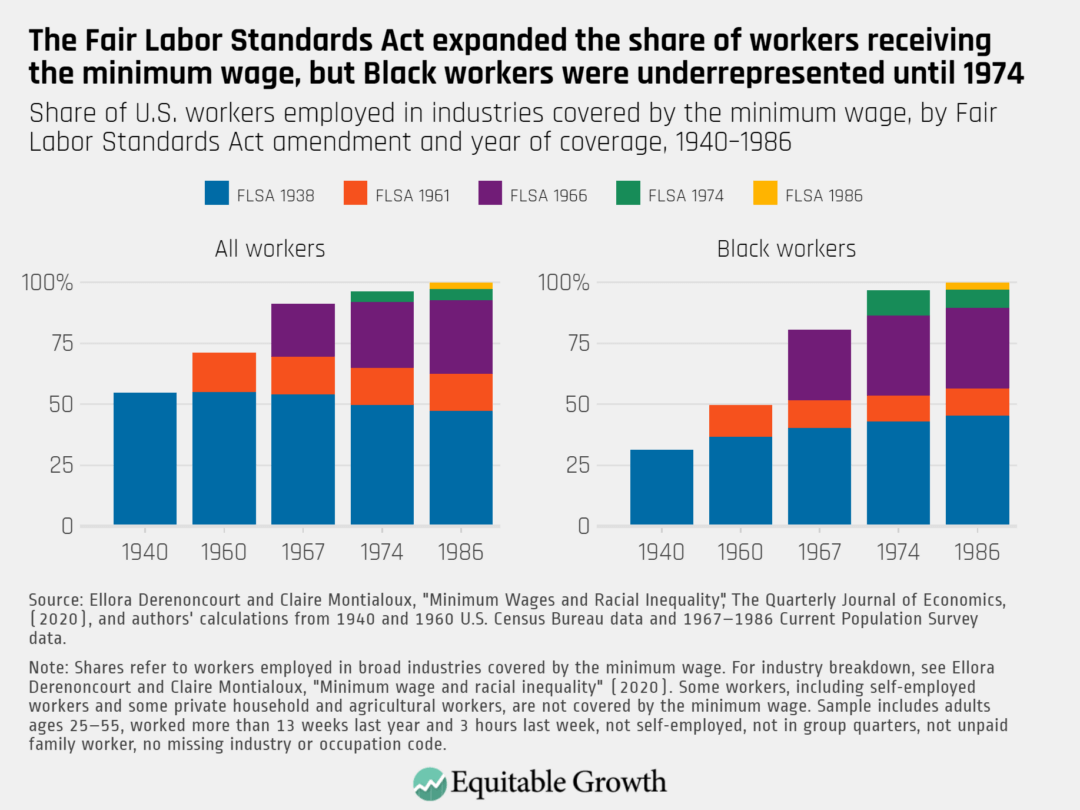

The minimum wage is one of the primary tools to raise the earnings of low-income workers in the United States. From the time it was first enacted in some states in the early 20th century to the times it was expanded and applied to new industries and grew to include more workers, the clear, widespread positive benefits of the minimum wage are manifest. Ellora Derenoncourt, Claire Montialoux, and Kate Bahn detail the various reforms to the federal minimum wage and its effect on earnings—specifically, its role in narrowing the racial income divide in the 1960s and 1970s, as well as its role in perpetuating that divide in recent decades as the minimum wage has not kept pace with inflation and economic growth. The co-authors explain why increasing the federal minimum wage may be critical to ensure a booming economic recovery and broad-based prosperity for all Americans following the coronavirus recession, which is currently exacerbating racial disparities in the economic security of U.S. households.

Derenoncourt and Montialoux also wrote an op-ed in The New York Times this week, on the vital role the minimum wage plays in reducing racial inequality in the United States. Their research, cited in both the issue brief on our website and in the Times op-ed, shows that raising the minimum wage would have a significant impact on the persistent earnings divide between White workers and their Black, Hispanic, and Native American colleagues. Raising the minimum wage and expanding its application to new sectors currently not covered would be an extremely effective tool in the fight for racial justice, they write, without significantly reducing the number of low-wage jobs available to workers in the U.S. economy.

The extreme inequality that has marked the U.S. economy over the past 40 years made the country more vulnerable to the worst effects of the pandemic and its recession, writes Heather Boushey on Medium. Not only does the United States have one of the world’s highest rates of death from COVID-19, the disease caused by the coronavirus, and the most cases and deaths overall, but the U.S. economy also seems likely to recover much more slowly than that of our competitors. Boushey revisits five predictions she made earlier in the pandemic about the course of the health and economic crises, and then details how policymakers can get the country back on the path to an equitable and robust recovery.

A new study confirms that access to paid sick leave reduced U.S. coronavirus infections by as much as 400 cases per day in states where workers gained access to an emergency paid leave guarantee enacted by Congress in March. Equitable Growth put together a factsheet detailing the key takeaways from the study and the policy implications for the United States—one of only three high-income nations in the world that does not already have a universal paid sick leave program in place.

Public investments in education are a vital element of broad-based, equitable economic growth that will benefit middle-class and low-income families in the United States. Not only are these investments essential for our future workforce—and some even pay for themselves in terms of long-term economic growth, tax revenues, and reduced public spending—but they also can provide a macroeconomic stimulus in the short term that will help jump-start our economy as it struggles to get out of recession. Robert Lynch summarizes several types of public investments in education, specifically investments in school facilities and in pre-Kindergarten and Kindergarten-through-12th grade services, and how they would contribute to economic growth in the coming years and decades. Lynch analyzes the current policy considerations of these investments and explains why the current low-interest rate environment provides an opportunity to finance these investments with debt, which he argues would be better than financing via tax increases or savings from reductions in other public spending.

Equitable Growth staff submitted to two letters this week to federal government agencies seeking public comments. One comment letter, to the U.S. Department of Labor, expressed our labor market experts’ concerns about a proposed change to the standards for classifying workers as independent contractors or employees under the Fair Labor Standards Act. The change would remove important protections given to employees under the law, including the minimum wage and overtime protections, along with stripping workers of the many benefits of full-time employment, such as healthcare and retirement benefits. The other comment letter, co-signed by Policy Director Amanda Fischer, was sent to the U.S. Department of Justice’s Antitrust Division regarding its Bank Merger Review Guidelines. Fischer and her co-signatories urge the Antitrust Division to reverse the trend of deregulation and consolidation in the banking industry, and in so doing promote much-needed financial stability for U.S. households amid the current economic downturn.

This week, Equitable Growth announced changes to our Steering Committee, with the addition of Lisa Cook of Michigan State University, Hilary Hoynes of the University of California, Berkeley, and Atif Mian of Princeton University. We are looking forward to their contributions to our academic grants program and their support for the next generation of scholars studying the effects of economic inequality on growth and stability. Find out more about their research backgrounds and our Steering Committee.

Links from around the web

Even as reports abound signaling a growing U.S. economy and less unemployment, many Americans, especially Black Americans, are still struggling to find work and pay their basic expenses. The unemployment rate for Black workers remains in the double-digits, high above the rate for White workers. And Black Americans still face disproportionate risk in catching the coronavirus and dying from COVID-19. Dartunorro Clark writes for NBC News that in addition to policies aimed at lowering the Black unemployment rate, more sweeping federal action will be needed in order to address the historic levels of structural inequality in the labor market. Clark details the deep-seated inequalities that persist and the various ways they affect Black workers, particularly now, in the midst of the coronavirus recession. He also discusses the impact (or lack thereof) of the diversity and inclusion pledges many large corporations made earlier this year, alongside large donations to racial justice organizations, on racial inequality—and on the lives of Black employees.

Changes in aggregate Gross Domestic Product do not provide an accurate account of what is really happening across the U.S. economy. Neil Irwin of The New York Times’ The Upshot blog uses the apt metaphor of taking a 3-month average of a person’s health indicators before and after that person is hit by a bus to show why this week’s GDP release is not telling the full story of what’s happening to the U.S. economy. Even though the reports show a record-breaking 7.4 percent rise in GDP over the past 3 months, the data also exposes an economy in a deep recession (albeit not a complete collapse). Irwin points out that the details of the data, when broken down, reveal the areas of the economy that are beginning to recover alongside those that are still reeling from the coronavirus pandemic and recession. He highlights the importance of looking past the headline GDP numbers and diving in more depth into the data to get a better idea of where the economy is and where it might be heading.

Centuries of discrimination and injustices in the United States have robbed Black people from access to opportunities to build wealth and have crippled generations of families, contributing to the vast racial wealth, income, and mobility divides seen today between Black and White Americans, among other disparities in areas such as health, housing, and education. The Washington Post’s Michelle Singletary makes the case for a reparations program in the United States to begin healing the wounds caused by these atrocities—wounds which have repeatedly been scratched open by various actions (or inaction) and policies by the U.S. government. Rebutting several arguments put forth by opponents of reparations, Singletary shows why actions must be taken to acknowledge, redress, and provide closure for descendants of enslaved Americans and how such actions would address the structural racism that pervades every area of our economy and society.

The U.S. economy will not fully recover from the coronavirus recession without universal paid sick leave and child care. Erika L. Moritsugu and Avenel Joseph detail the importance of these two programs for workers in The Hill, explaining the impossible choice many workers have faced during the pandemic between missing a paycheck—or worse, losing their job—or keeping themselves and their loved ones safe from the virus. A paid leave program would relieve them of this burden and surely reduce the spread of the virus, facilitating an equitable recovery for all Americans. Likewise, Moritsugu and Joseph continue, providing accessible and quality child care would enable working parents—and especially working mothers—to continue to provide for their families with the peace of mind that their children are safe. While emergency sick leave provided to some workers in March did help, that program is set to expire at the end of this year. But this pandemic is not temporary, and even if it were, future crises are likely to place these issues back in the spotlight again. We need permanent solutions that provide guaranteed paid sick leave for all workers and affordable child care for all families.

Friday figure

Figure is from Equitable Growth’s “Why minimum wages are a critical tool for achieving racial justice in the U.S. labor market,” by Ellora Derenoncourt, Claire Montialoux, and Kate Bahn.