The curious case of the federal prosecutor who sided with defendants

Antitrust policy has been front and center in U.S. public policy debates over the past few years. The House Judiciary Committee recently completed its investigation into digital markets. Senate Democrats introduced multiple bills to reform antitrust laws. Even the comedian Jon Oliver devoted an episode of his show to concentration and market power.

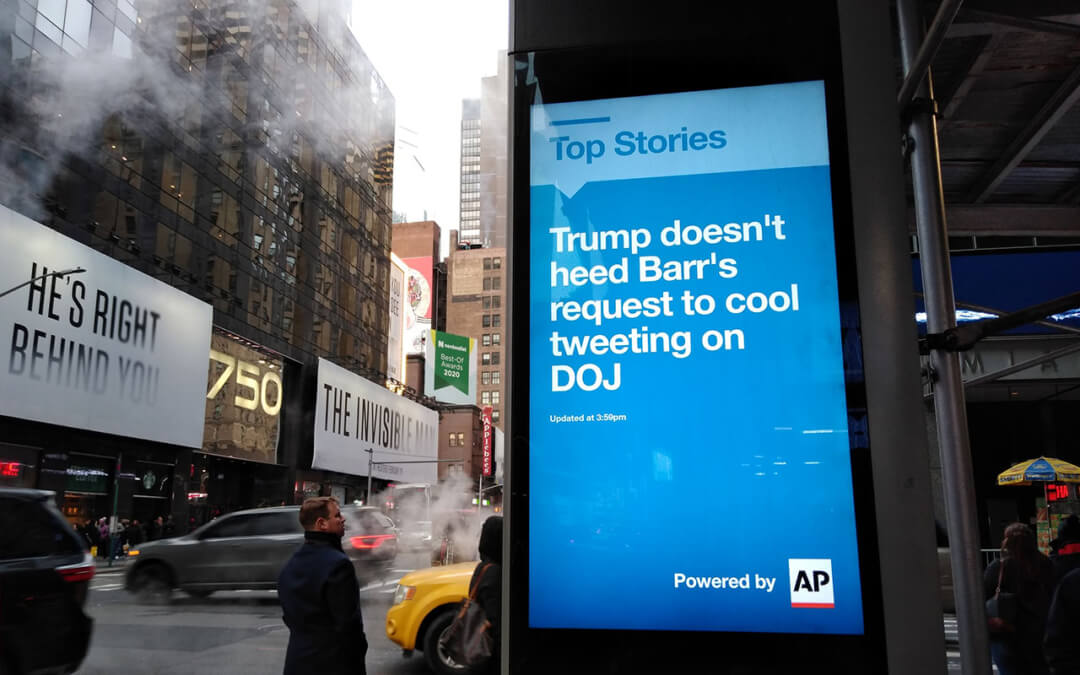

The leadership at the Antitrust Division of the U.S. Department of Justice and U.S. Attorney General William Barr missed the memo. Antitrust enforcement by the Department of Justice is at historic lows, yet the Department of Justice is breaking new ground in one area—siding with defendants in antitrust actions brought by other enforcers, the Federal Trade Commission and state attorneys general.

Let’s look at three cases that are emblematic of this antitrust tilt toward defendants in antitrust cases brought by other antitrust agencies. As Equitable Growth recently reiterated, the United States has a monopoly power problem. During this critical moment, however, the Trump administration’s antitrust legacy at the Department Justice may be to limit the ability of the antitrust laws to combat that problem. Rather than criticizing other agencies for bringing cases, the leadership at the Department of Justice and its Antitrust Division would better serve the country by enforcing the law.

Peabody-Arch Coal: The most recent intervention

Let’s start with the most recent action. Back in February 2020, in a 4-1 vote, the Federal Trade Commission sought to block a joint venture (a form of coordination that is less than a full merger but still subject to the antitrust laws) between Peabody Energy Corporation and Arch Coal, Inc. According to the complaint, the two companies are combining their coal mines located in the Southern Powder River Basin in Wyoming. They are the two largest coal mines in the Southern Powder River Basin and fierce, direct competitors.

According to the Commission’s complaint, coal from this region is different than other coal. It is cheaper to mine, being close to the surface. It is cleaner to burn. And it boasts a higher heat content. This is why the Federal Trade Commission argues that the proposed post-merger joint venture would be able to increase the price of its coal—it won’t be profitable for utilities to shift to other types of coal or other types of energy. Currently, the agency is seeking a preliminary judgement in federal court to prevent the joint venture.

If granted, that injunction would block the deal until the FTC’s litigation on the full merits is concluded, which is an administrative trial. The federal court held a 9-day hearing on the request for a preliminary injunction, with the parties now awaiting the court’s judgment. The administrative trial is scheduled to start on December 1, 2020, before the FTC’s administrative law judge.

So far, this is a pretty standard antitrust complaint. It includes high market shares, direct competitors, and limited alternatives. Could the Federal Trade Commission be wrong? Maybe, which is why the agency has to go to court and convince a judge that the evidence supports its case.

Here is what is not so standard. After meeting with Wyoming Gov. Mark Gordon (R), who supports the merger, Attorney General Barr announced he was going to review the FTC’s case: “If I reach a conclusion in which I feel like the merger would benefit competition,” he explained, “then I will try to use whatever authority I have to rectify the situation.”

A judge will decide the merits of the Peabody-Arch Coal case, so let’s focus on Government 101. The Federal Trade Commission is an independent agency. It was created to be separate from the U.S. Department of Justice. Neither the Department of Justice nor Attorney General Barr have any formal authority over the FTC’s decision to bring an antitrust case. But the Department of Justice can interfere. It can file statements of interest in the case or intervene in an ongoing litigation.

The parties will almost certainly quote as often as possible Attorney General Barr’s statement: “It sounds to me like the whole picture wasn’t looked at here.” Why interfere in this case? It is not as though the agency has a reputation for being overly aggressive. It currently has three Republican commissioners, two of whom—Chairman Joe Simmons and Commissioner Noah Phillips—supported the action. Both a majority of the Commission and a majority of the majority party at the agency supported blocking the joint venture.

Qualcomm: Opposing monopolization cases

Next up is the semiconductor monopoly case involving Qualcomm Inc. In 2017, the Federal Trade Commission alleged that Qualcomm used licensing and supply terms to maintain its monopoly on semiconductors necessary for cell phones to work. After the trial and before the judge issued her decision, the Antitrust Division of the Department of Justice filed a statement of interest, requesting that the judge hold additional hearings on remedy if she were to rule for the FTC.

When the judge did rule in the FTC’s favor and rejected the need for more hearings, the Division sided with Qualcomm in seeking a stay of the order and asking the federal Ninth Circuit Court of Appeals to vacate the lower court’s decision. The Ninth Circuit granted the stay and recently ruled in favor of Qualcomm.

The current administration’s Antitrust Division has not brought a single monopolization case (to be fair, the Division has brought only one monopolization case this century). But it opposes this monopolization case against Qualcomm brought by the Federal Trade Commission.

Although the Justice Department (along with the Departments of Defense and Energy) raised legal issues with the district court’s decision, it also mentioned national security 17 times in one brief, an argument the Justice Department itself had to refute when it sought to break up AT&T almost 40 years ago.

T-Mobile Sprint: Defending consolidation

Then, there is the case challenging T-Mobile US Inc.’s acquisition of Sprint Corporation. In November of last year, a group of state attorneys general sued to block the deal that would reduce the number of mobile phone carriers in the United States from four to three. The Antitrust Division had entered a settlement with the two companies, agreeing not to challenge the transaction in exchange for a remedy that the Division believed would resolve any competitive concerns.

The Antitrust Division filed a Statement of Interest in the states’ case defending the merger. In its view, “The Litigating States’ strong interest in this merger does not justify their attempt to substitute their judgment for the nationwide perspective of the United States.” The Assistant Attorney General Makan Delrahim even went so far as to encourage Dish Network Corporation, which would benefit from the settlement as a buyer of some of the merging parties’ assets, to lobby lawmakers to the settlement.

In short, the Antitrust Division was asking for the very deference it had failed to show the Federal Trade Commission in the first two cases detailed above. The district court ruled against the states.

The New York Times published an editorial titled “Why is the Justice Department Treating T-Mobile Like a Client?” More recently, the Department of Justice took the extraordinary step of issuing a press release congratulating T-Mobile and Dish for completing their divestiture. As professor Chris Sagers has pointed out, the same Department of Justice the very next day told the court that the “remedial divestitures the agency required for the deal to go through would not be fully carried out.”

The troubling history of interference in antitrust actions

Based on these three cases in just more than a year, one might think it is common for the Department of Justice to sit in judgment of the Federal Trade Commission’s and state attorneys’ general antitrust enforcement actions. Yet these are extraordinarily unprecedented interventions. Before the Trump administration, even when there were open disagreements among antitrust enforcers, the Department of Justice did not join any ongoing litigation to side with the defendants.

The closest example to this type of interference occurred in 2006 and cost consumers billions of dollars. The Justice Department opposed the Federal Trade Commission’s request that the Supreme Court hear its appeal in Federal Trade Commission v. Schering-Plough Corp., a case involving a patent settlement in which the branded pharmaceutical company allegedly paid its potential generic competitor to stay off the market (pay-for-delay agreements). Unlike the current examples, the Justice Department intervened only after specifically requested by the Supreme Court and did not comment on the ultimate merits. The Supreme Court rejected the FTC’s request.

Pay-for-delays then became ubiquitous. Roughly 8 years later, the Supreme Court finally took up the issue of pharmaceutical patent settlements and roughly adopted the same position that the Federal Trade Commission had advocated in the earlier Schering case. In the interim, pay-for-delay deals increased prescription drug costs by more than $60 billion. Had the Justice Department sided with the FTC back in 2006, those extra costs could have been avoided.

Implications

The value of the Antitrust Division sitting in judgment of other enforcers is questionable. True, in both the Qualcomm case and the T-Mobile-Sprint litigation, the courts sided with the Division, although the Federal Trade Commission could still appeal in the Qualcomm case. Of course, it is much easier for the defendant to win when the Department of Justice is urging the court to reject the case. And, as the pay-for-delay example shows, there is no guarantee that the Department of Justice is correct.

The current Justice Department’s antitrust enforcement is not a record to be envied. Although there are rumors that the Antitrust Division may sue Alphabet Inc.’s Google unit, the Trump administration’s anger at Google’s supposed discrimination against conservative viewpoints—rather than the merits of any antitrust case—may be driving the interest of the leadership at the Justice Department. On Friday, Leah Nylan at Politico broke that story that President Donald Trump was pressuring an independent agency, the Federal Trade Commission, and its chairman Joseph Simons, to sue Google for is supposed censorship of conservative viewpoints. More generally under the Trump administration, criminal antitrust enforcement and civil nonmerger enforcement actions are at historical lows. And despite the merger wave prior to the coronavirus pandemic and resulting recession, merger enforcement was flat.

Regardless of the merits in these underlying cases, acting like a scolding nanny is not the role of the U.S. Justice Department. From a practical matter, this is a poor use of limited resources. As Equitable Growth has documented, federal antitrust enforcers have been starved of resources since 2010. As of 2018, in real terms, appropriations are 18 percent lower (after accounting for inflation) than in 2010.

Many policymakers, including me, today advocate for increasing appropriations, but it makes little sense to increase an enforcement agency’s budget if it is focused on preventing enforcement actions. To ensure that the U.S. Department of Justice uses its appropriations correctly, it may be time for Congress to consider requiring it to receive consent from the other government antitrust enforcers before it can intervene in an antitrust action initiated by the Federal Trade Commission or a state attorney general.