Place-conscious federal policies to reduce regional economic disparities in the United States

This essay is part of Boosting Wages for U.S. Workers in the New Economy, a compilation of 10 essays from leading economic thinkers who explore alternative policies for boosting wages and living standards, rooted in different structures that contribute to stagnant and unequal wages. The authors in the new book demonstrate that efforts to improve workers’ access to good jobs do not need to be limited to traditional labor policy. Policies relating to macroeconomics, to social services, and to market concentration also have direct relevance to wage levels and inequality, and can be useful tools for addressing them.

To read more about Boosting Wages for U.S. Workers in the New Economy 20 and download the full collection of essays, click here.

Overview

Over the past four decades, geographic inequality between regions of the United States has grown dramatically. A handful of metropolitan areas, largely along the coasts, have become some of the richest economic regions—cohesive groups of counties linked by strong economic ties, such as those between a city and its suburbs—in world history. At the same time, large swaths of the country have been trapped in economic decline, struggling with deindustrialization, stagnant incomes, and rising unemployment.

These economic challenges have contributed to a host of social and political problems, among them public health crises,1 declining social mobility,2 racial inequality,3 and political polarization.4 They also reduce national economic growth by reducing investment in local public goods, limiting aggregate demand, and lessening the effectiveness of federal economic policy. Absent an innovative and muscular policy response, the coronavirus pandemic and its accompanying economic collapse are likely to only worsen the outlook for struggling economic regions.5

After decades in which regional economic challenges were largely considered a problem for state and local civic leaders alone, today, there is an increasing appetite for federal policy action to reduce this form of geographic inequality—distinct from the different challenge of economic inequality within regions. Most recent proposals for reducing interregional inequality have tended to take the form of “place-based policies” that target government investment or subsidies to economically struggling cities or neighborhoods.6

This essay argues that to successfully boost wages and employment levels in struggling areas, policymakers must instead adopt a “place-conscious” approach that treats reducing interregional inequality as a priority throughout federal policymaking rather than something to be remedied after the fact. Recent research shows that the growth in geographic inequality since 1980 stems in large part from changes made to federal policy that seem, at first glance, to be geographically neutral, such as the relaxation of antitrust enforcement,7 the lowering of trade barriers,8 and the deregulation of the transportation and communications industries.9 Although these policies were the same everywhere, they interacted with the existing spatial patterns in the economy in ways that systematically advantaged some places while harming others.10

Beyond place-based: Reducing regional inequality with place-conscious policies

June 30, 2021 2:00PM – 3:30PM

Meaningful and sustained reductions to interregional inequality will require structural changes to the U.S. economy made through federal action. Almost every domain of federal policy, from food policy to military spending to public finance, has a spatial footprint. Policies that take the geographic consequences of federal action seriously—that seek to alter the economic structures that create disparities to begin with—are much more likely to succeed than policies that seek to ameliorate geographic income disparities after the fact while leaving the underlying structures that generate them intact.

To illustrate how place-conscious federal policies can reduce interregional inequality, I consider four examples of such policies:

- Universal anti-poverty programs

- Restored regulation of key sectors, notably transportation and communications

- State and local finance reform

- Direct investment to meet national priorities, such as climate resilience

Each of these policies would have the effect of reducing interregional inequality, without explicitly targeting struggling regions for subsidies or investment. Taken together, they represent a revival of the federal government as a proactive force for uniting disparate regions into one national economy—a role it has repeatedly played throughout U.S. history, from the development of the U.S. Postal Service to the building of the interstate highway system.

The problem: Rising interregional inequality and its consequences

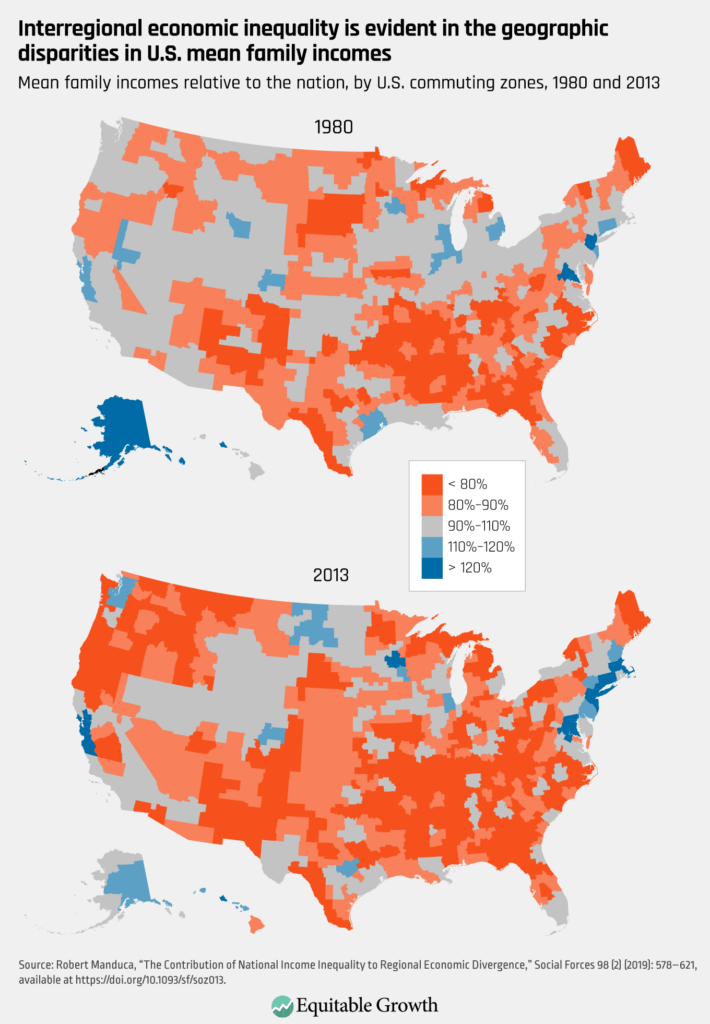

Over the past four decades, regions of the United States have diverged economically from one another. In 1980, most U.S. commuting zones had mean family incomes roughly in line with the national average.11 While there was certainly inequality within these areas, average incomes were roughly the same across most of the country—with important exceptions in the rural South, the Rio Grande Valley, and other long-identified areas of persistent rural poverty.12 By 2013, there were far more places with mean incomes that were either much higher or much lower than the nation as a whole.

Overall, the income gap between the richest 10 percent of U.S. commuting zones and the poorest 10 percent grew by almost 50 percent during this period. The fraction of the U.S. population living in areas more than 20 percent richer or poorer than the national mean almost tripled, from 12 percent to 31 percent.13 (See Figure 1.)

Figure 1

Growing interregional economic inequality, and the local economic dislocations that contribute to it, are major contributors to many of the most pressing social, economic, and political challenges facing the United States today. Public health crises—from the opioid epidemic14 to exposure to environmental toxins15—are disproportionately concentrated in economically struggling areas. Deindustrialization has contributed to a host of other social problems, from family instability to declining upward mobility.16 Regional divergence also contributes to political disfunction, both by altering the material conditions in different places such that their material interests diverge, making compromise more difficult, and by contributing to growing anger, political extremism, and polarization.17

Regional disparities are both a driver and a consequence of racial inequality. Black Americans in particular disproportionately live in the large, multistate regions—especially the Midwest and the South—that have higher-than-average poverty rates and that were hit hardest by the economic shocks of the past several decades.18 The effects of these economic dislocations were felt earliest and most strongly in communities of color, although they have now spread to many White communities as well.19

That said, some regional economic challenges can be traced directly to racist policies at all levels of government. Local and state governments in parts of the country with large Black populations—historically in the South, but also in Northern cities that received large numbers of Black migrants during the Great Migration of the 20th century—historically spent less on public goods such as education and infrastructure that contribute to regional prosperity.20 After the passage of the Voting Rights Act of 1965, state and local governments in the South began making such investments at greater rates in response to electoral pressure from African American voters, which had the effect of boosting the economy of the entire region.21

At the federal level, early examples of place-conscious policies, such as the Social Security Act of 1935 and the Fair Labor Standards Act of 1938, were originally designed to exclude African Americans, reducing their impact on regional disparities while entrenching racial inequality.22

Regional economic struggles undercut national economic performance

The economic consequences of interregional inequality are not limited to struggling regions, but are felt nationally through slower overall growth and greater macroeconomic volatility. Within regions, local economic multipliers mean that when workers lose their jobs, those job losses build on themselves: Each job lost in an initial shock from, say, a tariff reduction or a factory closing reduces demand for local services, creating further job losses that can persist for decades.23

These shocks are exacerbated by our current system of fiscal federalism, which precludes deficit spending by state and local governments and thus requires them to implement pro-cyclical fiscal policy—strengthening booms and worsening recessions.24 During the first few months of the coronavirus recession, for instance, state and local governments collectively laid off or furloughed 1.5 million workers, and layoffs are expected to continue in the absence of new federal fiscal aid.25 Cutting government spending in the middle of a recession is the definition of macroeconomic malpractice, yet it is consistently done in the United States because of how our cities and states are funded.

At the federal level, geographic inequality makes macroeconomic policymaking more challenging because the same set of federal policies must meet the needs of regions with very different economic circumstances. Interest rates have strong regional economic impacts, for example,26 and the interest rate that best serves high-cost areas such as San Francisco and New York is likely to be very different from that which meets the needs of areas struggling with unemployment. But because our country is a monetary union, we must set just one interest rate for our shared currency.27

Current place-based policies are welcome, but are limited and fragile

For decades, regional economic challenges were largely considered a problem for local civic leaders alone. But today, there is an increasing appetite for federal policy action to reduce geographic inequality. Initial proposals have largely taken the form of “place-based policies” that target struggling neighborhoods, cities, or regions for investment or subsidies with the goal of increasing incomes and employment.28 Recent proposals for place-based policies include geographically targeted tax breaks tied to job creation29 and direct federal investment in research and development located in struggling regions.30

Place-based policies have historically been the subject of skepticism on several grounds. First of all, deciding which places deserve to be targeted with extra subsidies is both technically challenging and politically fraught. Secondly, there is no guarantee that residents of a targeted place will be the final beneficiaries of these investments, since newly created jobs are often filled by in-migrants rather than current residents. Finally, such policies often appear to have the effect of simply moving economic activity from one place to another rather than increasing the total amount.31

Recent interest in place-based policies is welcome because it indicates support for federal action to reduce interregional inequality. But long-identified weaknesses remain major challenges. On the technical front, effective place-based policies require constantly identifying and judging which places are truly in need and merit federal investment. This is genuinely difficult and can lead to perceptions of corruption or that the government is “picking winners.” Any missteps cast doubt on the entire project.

This concern is prominent in critiques of the Opportunity Zones tax credit program, created in the 2017 tax bill, which has come under fire from both the left and the right for directing federal subsidies to people and areas argued not to need the help.32 Further, given the sheer magnitude of geographic inequality, the amount of subsidies required to meaningfully reduce interregional income disparities—as opposed to merely offering some relief to struggling regions—is likely to be enormous.

The solution: Universal, place-conscious policies

The key fact about regional economic divergence is that while it appears to be the result of many different local trends, it is fundamentally a national process driven in large part by national economic trends and federal policies. As recent research shows, much of the increase in interregional inequality since the 1970s is attributable to federal policy changes that seem geographically neutral at first glance.33 These include:

- Lowering of trade barriers34

- Relaxation of antitrust enforcement35

- Deregulation of the transportation and communications industries36

Though implemented nationally, these policies interacted with existing spatial patterns in the economy in ways that systematically helped some places while disadvantaging others.37

Addressing interregional inequality, then, will be most effectively accomplished at the federal level through what might be termed “place-conscious policies.” Unlike place-based policies, place-conscious policies are implemented everywhere but are designed in such a way that their benefits disproportionately fall on those places that need the most help. In this, they are the spatial analogue of the “targeting within universalism” that has long been one of the most successful ways to sustain support for programs that benefit disadvantaged individuals.38

Rather than attempting to identify and compensate regions that are “losing” the economic competition after the fact, as place-based policies do, place-conscious policies seek to even the economic playing field and lower the stakes of interregional competition to begin with. This will make them easier to administer, less susceptible to critiques for being unfair or corrupt, and ultimately more effective.

A place-conscious approach can be applied in almost every area of federal policy, from trade to taxes to military spending. Here, I briefly consider four types of place-conscious policy:

- Universal anti-poverty programs

- Re-regulation of key industries

- State and municipal finance reform

- Direct investment

Let’s look at each of them in turn.

Universal anti-poverty programs

The growing economic disparities between regions of the United States are fundamentally intertwined with the growth of economic inequality more generally. In fact, more than 50 percent of the cross-regional divergence in mean family incomes since 1980 is strictly attributable to rising overall economic inequality rather than any spatial reallocation in who lives where.39

Any federal program that benefits lower-income Americans, then, will have the effect—without explicit spatial targeting—of reducing interregional income disparities. This applies to existing transfer programs such as Social Security, disability insurance,40 and the Earned Income Tax Credit; but it would also apply to new or expanded programs such as child allowances or an expanded Child Tax Credit—proposals that have received bipartisan support41—or even a full-fledged Universal Basic Income.42

The geographic impacts of such universal antipoverty programs can be substantial. One recent study found that in Brazil, the Bolsa Família and Benefícios de Prestação Continuada programs of conditional cash transfers to families in poverty were responsible for a full 24 percent of the reduction in cross-state inequality from 1995 to 2006, despite comprising just 1.7 percent of disposable household income.43 An earlier study in the Netherlands found that social insurance programs, taken together, reduced regional inequality by 40 percent.44

Antitrust and regulated industries

Governments set the rules and determine the playing field in which markets operate. Through much of U.S. history, the federal government used its power to create a playing field that would disperse economic activity and integrate geographically isolated regions into the national economy. These efforts began with the creation of the U.S. Postal System in 1775,45 and continued through the regulation of railroads with the Interstate Commerce Commission in the late 19th century,46 rural electrification in the 1930s,47 and the first 70 years of air travel.48

Proximity to natural resources, trade routes, and other economic advantages has always mattered for regional economic performance, but these federal efforts had the aim and consequence of making geography less determinative of economic success, reducing the advantages that large urban centers or centrally located towns would otherwise receive due to their location alone.49 The strong American tradition of antitrust enforcement and skepticism of “bigness” similarly sought to reduce economic concentration in general, often with the effect of spatially distributing economic activity.50

Since the 1970s, deregulation—particularly of the transportation and communications industries—and weakening antitrust enforcement have shifted the economic playing field in favor of large corporations and large, well-connected urban centers. That is, market concentration has contributed to the geographic concentration of prosperity and, conversely, disadvantage. The airline industry offers a useful illustration. Under the old regulatory regime, price and firm entry regulations created a system in which profits from well-traveled routes cross-subsidized service on less-profitable routes, consistent with the policy goal of providing similar levels of service to similarly sized cities.51 Following deregulation in the 1970s, airlines shifted their focus to the cities and routes with the highest traffic, cutting service to small and mid-size cities.52

With lax antitrust enforcement, airlines also consolidated, reducing competition and the number of hub airports that offer large numbers of direct flights.53 This change to transportation geography, driven primarily by changes to federal regulation, triggered a reshuffling of corporate headquarters. Companies have moved from cities that lost service, such as Cincinnati or St. Louis, to cities currently blessed with extensive air connections, such as Charlotte or Atlanta.54

A place-conscious approach to regulation would return the federal government to its historic goal of binding the disparate parts of the country into one national economy and society.55 This would primarily involve once again requiring that the key industries that connect people and places—telecommunications and transportation in particular—do so on an equal footing. Reinvigorated antitrust enforcement, meanwhile, would also reduce the stakes of geographic competition: When more firms exist in an industry, small cities have more opportunities to land a headquarters or foster a successful entrant.

State and municipal finance reform

The current U.S. system of fiscal federalism is inefficient, unequitable, and almost unique among high-income countries.56 In the United States, states and localities are the primary providers of many standard government services, yet they are denied access to many of the most important tools of governance—running deficits, controlling the entry and exit of capital and labor, and printing money.57 This harms individuals, economically struggling regions, and the country as a whole.

For individuals, it makes access to basic government services contingent on the wealth of one’s community, entrenching inequality.58 It also creates economic distortions by artificially bundling choices about fiscal policy with the decision of where to live.59 For regions, it advantages already-wealthy areas by allowing them to provide more public services at lower tax rates.60 This, in turn, encourages race-to-the-bottom tax and incentive competitions.61

For the country as a whole, the current system of fiscal federalism makes recessions worse, because most state and local governments are legally prohibited from deficit spending.62 This frequently requires that cities and states, which employed about 20 million Americans prior to the coronavirus pandemic,63 cut spending and lay off workers in the middle of recessions—a highly costly emergency measure that creates further job losses through multiplier effects, worsening economic volatility.

There are ways to fix the problems baked into fiscal federalism. As recently as the 1980s, municipal governments in the United States received more than 15 percent of their revenue from federal grants. Today, that share has fallen to less than 5 percent.64 New proposals to increase federal grants to state and local governments—especially ones that disproportionately help lower-income parts of the country—enjoy support across the ideological spectrum and would provide a large and immediate boost to national economic activity—one that is greatly needed to combat the coronavirus recession.65

Direct investments and employment

A final example of federal policy to reduce interregional economic inequality is straightforward public investment. When the federal government makes investments around the country to meet national policy priorities, it contributes employment and spending to local economies. Unless these investments deliberately target only prosperous areas, the net effect will be to reduce interregional inequality.

Historically, the largest such investment has been military spending, which dramatically reshaped the economic geography of the postwar United States and continues to provide the economic base for many communities around the country.66 Federal infrastructure investments in the 1940s and 1950s were likewise a key driver of regional convergence in that era, particularly the growth of the South.67 In the future, investments in climate resilience and clean energy offer a similar opportunity to reboot lagging regional economies while meeting an overriding national goal. More broadly, federal agencies can consider spatial implications whenever they make investment or staffing decisions.68

Conclusion: National action for a national problem

Place-conscious structural fixes along the lines of what I have described—from reinvigorated antitrust, transportation, and communications regulation to fiscal federalism reform to universal anti-poverty programs—are likely to be both more effective at reducing interregional inequality and more durable than explicitly targeted place-based policies. Because they are implemented everywhere simultaneously, place-conscious policies do not require politically fraught decisions about which places qualify for help.

This universality also makes them more agile, able to respond instantly to future changes in economic geography. And because place-conscious policies would produce clear benefits to residents of all parts of the country, they offer the potential for broad-based political coalitions.

A common concern about universal programs is that they are too costly. This concern is misguided when it comes to place-conscious policies for regional development. First of all, several of the programs I outline involve changes to regulation, which would entail minimal costs to the federal government. More importantly, though, the ongoing economic and budgetary costs of local economic struggles around the country are enormous. Each person who is unemployed against their will represents tens of thousands of dollars of lost economic output each year. Investments in reviving the economies of struggling areas, then, offer an enormous economic upside for the national economy and the federal budget.

The four policy areas I explore in this essay are only the beginning of what is possible. A place-conscious approach to policymaking can and should be adopted throughout the federal government. Every policy has a spatial footprint, and while spatial considerations will rarely be the primary or sole consideration in policymaking, they deserve to be articulated and considered.

There have been multiple recent proposals to formalize this consideration of spatial equity in federal policymaking. One such proposal would implement an executive order requiring that agencies consider the geographic impact of the regulatory choices they make, much as they are currently required to consider the impact on federalism.69 Another recent proposal would subject major federal discretionary spending decisions to a place-conscious equity review,70 building on past efforts to consider geographic equity throughout the federal budget.71

At the broadest level, addressing interregional inequality requires embracing two fundamental truths. First, the United States is one country and will ultimately prosper or perish as a unit. Second, very little in economics is inevitable, and Americans have the collective power, through the federal government, to make the economy serve the needs of all parts of the country.

—Robert Manduca is an assistant professor of sociology at the University of Michigan.

Acknowledgments

End Notes

1. Anne Case and Angus Deaton, Deaths of Despair and the Future of Capitalism (Princeton, NJ: Princeton University Press, 2020), available at https://press.princeton.edu/books/hardcover/9780691190785/deaths-of-despair-and-the-future-of-capitalism.

2. Nathan Seltzer, “Cohort-Specific Experiences of Industrial Decline and Intergenerational Income Mobility,” SocArXiv (2020), available at https://doi.org/10.31235/osf.io/ve9bd.

3. Bradley L. Hardy, Trevon D. Logan, and John Parman, “The Historical Role of Race and Policy for Regional Inequality.” In Jay Shambaugh and Ryan Nunn, eds., Place-Based Policies for Shared Economic Growth (Washington: The Hamilton Project, 2018), available at https://www.hamiltonproject.org/papers/place_based_policies_for_shared_economic_growth.

4. Josh Pacewicz, Partisans and Partners: The Politics of the Post-Keynesian Society (Chicago: University of Chicago Press, 2016), available at https://press.uchicago.edu/ucp/books/book/chicago/P/bo24663027.html; David H. Autor and others, “Importing Political Polarization? The Electoral Consequences of Rising Trade Exposure.” Working Paper 22637 (National Bureau of Economic Research, 2016), available at https://doi.org/10.3386/w22637.

5. Timothy J. Bartik, “Helping America’s Distressed Communities Recover from the COVID-19 Recession and Achieve Long-Term Prosperity,” Brookings blog, September 22, 2020, available at https://www.brookings.edu/research/helping-americas-distressed-communities-recover-from-the-covid-19-recession-and-achieve-long-term-prosperity/; Lavea Brachman, “The Perils and Promise of America’s Legacy Cities in the Pandemic Era,” Brookings blog, August 12, 2020, available at https://www.brookings.edu/research/the-perils-and-promise-of-americas-legacy-cities-in-the-pandemic-era/.

6. Robert D Atkinson, Mark Muro, and Jacob Whiton, “The Case for Growth Centers” (Washington: Brookings Institution, 2019), available at https://www.brookings.edu/research/growth-centers-how-to-spread-tech-innovation-across-america/; Benjamin Austin, Edward Glaeser, and Lawrence H. Summers, “Saving the Heartland: Place-Based Policies in 21st Century America.” In Janice Eberly and James Stock, eds., Brookings Papers on Economic Activity (Washington: Brookings Institution Press, 2018), pp. 151–232, available at https://www.brookings.edu/bpea-articles/saving-the-heartland-place-based-policies-in-21st-century-america/; Timothy J. Bartik, “Using Place-Based Jobs Policies to Help Distressed Communities,” Journal of Economic Perspectives 34 (3) (2020): 99–127, available at https://doi.org/10.1257/jep.34.3.99.

7. Phillip Longman, “Bloom and Bust,” Washington Monthly, November 28, 2015, available at http://washingtonmonthly.com/magazine/novdec-2015/bloom-and-bust/; Robert Manduca, “Antitrust Enforcement as Federal Policy to Reduce Regional Economic Disparities,” The ANNALS of the American Academy of Political and Social Science 685 (1) (2019): 156–71, available at https://doi.org/10.1177/0002716219868141.

8. David H. Autor, David Dorn, and Gordon H. Hanson, “The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade,” Annual Review of Economics 8 (1) (2016): 205–40, available at https://doi.org/10.1146/annurev-economics-080315-015041.

9. Ganesh Sitaraman, Morgan Ricks, and Christopher Serkin, “Regulation and the Geography of Inequality,” Duke Law Review (forthcoming), available at https://doi.org/10.2139/ssrn.3527055.

10. Robert Manduca, “The Contribution of National Income Inequality to Regional Economic Divergence,” Social Forces 98 (2) (2019): 578–621, available at https://doi.org/10.1093/sf/soz013.

11. Commuting zones are a common method of delineating economic regions. They are defined as groups of counties linked by commuting flows. See Charles M. Tolbert and Molly Sizer, “U.S. Commuting Zones and Labor Market Areas: A 1990 Update” (Washington: Economic Research Service, 1996), available at https://trid.trb.org/view.aspx?id=471923.

12. Bruce A. Weber and Kathleen Miller, “Poverty in Rural America Then and Now.” In Ann R. Tickamyer, Jennifer Sherman, and Jennifer Warlick, eds., Rural Poverty in the United States (New York: Columbia University Press, 2017), available at http://cup.columbia.edu/book/rural-poverty-in-the-united-states/9780231172233; USDA Economic Research Service, “Rural America at a Glance – 2017 Edition,” Economic Information Bulletin (2017), available at https://www.ers.usda.gov/publications/pub-details/?pubid=85739.

13. Manduca, “The Contribution of National Income Inequality to Regional Economic Divergence.”

14. Case and Deaton, Deaths of Despair and the Future of Capitalism; Nathan Seltzer, “The Economic Underpinnings of the Drug Epidemic,” SocArXiv (2019), available at https://doi.org/10.31235/osf.io/cdwap; Atheendar S. Venkataramani and others, “Association between Automotive Assembly Plant Closures and Opioid Overdose Mortality in the United States: A Difference-in-Differences Analysis,” JAMA Internal Medicine 180 (2) (2020): 254–262, available at https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2757788; Janet Currie, Jonas Jin, and Molly Schnell, “US Employment and Opioids: Is There a Connection?,” Research in Labor Economics – Health and Labor Markets 47 (2019), available at https://www.emerald.com/insight/content/doi/10.1108/S0147-912120190000047009/full/html; Alan B. Krueger, “Where Have All the Workers Gone? An Inquiry into the Decline of the US Labor Force Participation Rate,” Brookings Papers on Economic Activity 2017 (2) (2017): 1, available at https://www.brookings.edu/bpea-articles/where-have-all-the-workers-gone-an-inquiry-into-the-decline-of-the-u-s-labor-force-participation-rate/ on the possibility of reverse causality.

15. Robert J. Sampson and Alix S. Winter, “The Racial Ecology of Lead Poisoning: Toxic Inequality in Chicago Neighborhoods, 1995-2013,” Du Bois Review: Social Science Research on Race 13 (2) (2016): 261–83, available at https://doi.org/10.1017/S1742058X16000151; Christopher Muller, Robert J. Sampson, and Alix S. Winter, “Environmental Inequality: The Social Causes and Consequences of Lead Exposure,” Annual Review of Sociology 44 (1) (2018): 263–82, available at https://doi.org/10.1146/annurev-soc-073117-041222; J. Tom Boer and others, “Is There Environmental Racism? The Demographics of Hazardous Waste in Los Angeles County,” Social Science Quarterly 78 (4) (1997): 793–810, available at https://www.jstor.org/stable/42863732.

16. William Julius Wilson, When Work Disappears: The World of the New Urban Poor (New York: Vintage, 1996), available at https://www.penguinrandomhouse.com/books/192111/when-work-disappears-by-william-julius-wilson/; David Autor, David Dorn, and Gordon Hanson, “When Work Disappears: Manufacturing Decline and the Falling Marriage Market Value of Young Men,” American Economic Review: Insights 1 (2) (2019): 161–78, available at https://doi.org/10.1257/aeri.20180010; Seltzer, “Cohort-Specific Experiences of Industrial Decline and Intergenerational Income Mobility.”

17. Jennifer M. Silva, We’re Still Here: Pain and Politics in the Heart of America (Oxford, UK: Oxford University Press, 2019), available at https://global.oup.com/academic/product/were-still-here-9780190888046?cc=us&lang=en&; Robert Wuthnow, The Left Behind: Decline and Rage in Small-Town America (Princeton, NJ: Princeton University Press, 2019), available at https://press.princeton.edu/books/hardcover/9780691177663/the-left-behind; Autor and others, “Importing Political Polarization?”; Pacewicz, Partisans and Partners.

18. Hardy, Logan, and Parman, “The Historical Role of Race and Policy for Regional Inequality.”

19. William Julius Wilson, The Truly Disadvantaged: The Inner City, the Underclass, and Public Policy (Chicago: University of Chicago Press, 1987), available at https://press.uchicago.edu/ucp/books/book/chicago/T/bo13375722.html; Case and Deaton, Deaths of Despair and the Future of Capitalism.

20. Hardy, Logan, and Parman, “The Historical Role of Race and Policy for Regional Inequality”; Ellora Derenoncourt, “Can You Move to Opportunity? Evidence from the Great Migration” (2019), p. 123, available at https://www.dropbox.com/s/l34h2avpjomylrb/derenoncourt_2019.pdf?dl=0.

21. Gavin Wright, Sharing the Prize: The Economics of the Civil Rights Revolution in the American South (Cambridge, MA: Belknap Press: An Imprint of Harvard University Press, 2013), available at https://www.hup.harvard.edu/catalog.php?isbn=9780674980402.

22. Ira Katznelson, When Affirmative Action Was White: An Untold History of Racial Inequality in Twentieth-Century America (New York: W. W. Norton and Company, 2005), available at https://wwnorton.com/books/When-Affirmative-Action-Was-White/.

23. Timothy J. Bartik, “Should Place-Based Jobs Policies Be Used to Help Distressed Communities?” (Kalamazoo, MI: W.E. Upjohn Institute, 2019), available at https://doi.org/10.17848/wp19-308; Michael Greenstone and Adam Looney, “An Economic Strategy to Renew American Communities” (Washington: The Hamilton Project, 2010), available at https://www.brookings.edu/research/an-economic-strategy-to-renew-american-communities/; Brad Hershbein and Bryan A. Stuart, “Recessions and Local Labor Market Hysteresis” (2020), p.85, available at http://bryan-stuart.com/files/HershbeinStuart_5Aug2020.pdf.

24. Alex Williams, “Intragovernmental Autonomous Stabilizers” (Annandale-on-Hudson, NY: Bard College, 2020), available at https://digitalcommons.bard.edu/levy_ms/26/.

25. Carla Flink, “Coronavirus’s Painful Side Effect Is Deep Budget Cuts for State and Local Government Services,” The Conversation, July 10, 2020, available at http://theconversation.com/coronaviruss-painful-side-effect-is-deep-budget-cuts-for-state-and-local-government-services-141105; Alan Auerbach and others, “Fiscal Effects of COVID-19.” In Janice Eberly and James Stock, eds., Brookings Papers on Economic Activity (Washington: Brookings Institution Press, 2020), available at https://www.brookings.edu/bpea-articles/fiscal-effects-of-covid-19/; Nancy Cleeland, “Local Governments Have Cut 900K Jobs, More to Come,” SHRM blog, September 18, 2020, available at https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/local-government-covid-cuts.aspx.

26. Marco Di Maggio and others, “Interest Rate Pass-through: Mortgage Rates, Household Consumption, and Voluntary Deleveraging,” American Economic Review 107 (11) (2017): 3550–88, available at https://www.aeaweb.org/articles?id=10.1257/aer.20141313.

27. Jane Jacobs, Cities and the Wealth of Nations: Principles of Economic Life (New York: Vintage, 1985), available at https://www.penguinrandomhouse.com/books/86051/cities-and-the-wealth-of-nations-by-jane-jacobs/; David Schleicher, “Stuck! The Law and Economics of Residential Stagnation,” Yale Law Journal 127 (1) (2017): 78–154, available at https://www.yalelawjournal.org/article/stuck-the-law-and-economics-of-residential-stagnation.

28. David Neumark and Helen Simpson, “Place-Based Policies.” In Gilles Duranton, J. Vernon Henderson, and William C. Strange, eds., Handbook of Regional and Urban Economics, vol. 5 (Amsterdam: Elsevier, 2015), 1197–1287, available at https://www.sciencedirect.com/science/article/pii/B9780444595317000181.

29. Austin, Glaeser, and Summers, “Saving the Heartland.”

30. Atkinson, Muro, and Whiton, “The Case for Growth Centers”; Jonathan Gruber and Simon Johnson, Jump-Starting America: How Breakthrough Science Can Revive Economic Growth and the American Dream (New York: PublicAffairs, 2019), available at https://www.publicaffairsbooks.com/titles/jonathan-gruber/jump-starting-america/9781541762503/.

31. Edward L. Glaeser and Joshua D. Gottlieb, “The Economics of Place-Making Policies.” Working Paper 14373 (National Bureau of Economic Research, 2008), available at https://www.nber.org/papers/w14373; Enrico Moretti, “Local Labor Markets.” Working Paper 15947 (National Bureau of Economic Research, 2010), available at https://www.nber.org/papers/w15947.

32. Chris Edwards, “Opportunity Zones Fuel Corruption,” Cato At Liberty blog, August 6, 2018, available at https://www.cato.org/blog/opportunity-zones-fuel-corruption; Justin Elliott, Jeff Ernsthausen, and Kyle Edwards, “A Trump Tax Break To Help The Poor Went To a Rich GOP Donor’s Superyacht Marina,” ProPublica, November 14, 2019, available at https://www.propublica.org/article/superyacht-marina-west-palm-beach-opportunity-zone-trump-tax-break-to-help-the-poor-went-to-a-rich-gop-donor?token=XgFT9qOh9SrXdoACbzMzWe_PuorElToO (but see also: Economic Innovation Group, “OZ Due Diligence: A Closer Look at ProPublica’s West Palm Beach Story,” November 21, 2019, available at https://eig.org/news/oz-due-diligence-west-palm-beach-story).

33. Global processes—most notably technological change—also play an important role in shaping regional economies. See Thomas Kemeny and Michael Storper, “Superstar Cities and Left-behind Places: Disruptive Innovation, Labor Demand, and Interregional Inequality” (London: London School of Economics, 2020), available at http://eprints.lse.ac.uk/103312/; Simona Iammarino, Andrés Rodriguez-Pose, and Michael Storper, “Regional Inequality in Europe: Evidence, Theory and Policy Implications,” Journal of Economic Geography (2018), available at https://doi.org/10.1093/jeg/lby021. However, while technology profoundly shapes regional economies, the effects of technological change on employment and wages in particular are largely determined by the local institutional context, particularly the density of labor union coverage. See Zachary Parolin, “Automation, Occupational Earnings Trends, and the Moderating Role of Organized Labor,” Social Forces (2020), available at https://academic.oup.com/sf/advance-article-abstract/doi/10.1093/sf/soaa032/5835499?redirectedFrom=fulltext; Roberto M. Fernandez, “Skill-Biased Technological Change and Wage Inequality: Evidence from a Plant Retooling,” American Journal of Sociology 107 (2) (2001): 273–320, available at http://www.jstor.org.ezp-prod1.hul.harvard.edu/stable/10.1086/324009. For this reason, I focus on institutional and policy changes in this essay.

34. Autor, Dorn, and Hanson, “The China Shock.”

35. Longman, “Bloom and Bust”; Manduca, “Antitrust Enforcement as Federal Policy to Reduce Regional Economic Disparities.”

36. Sitaraman, Ricks, and Serkin, “Regulation and the Geography of Inequality.”

37. Manduca, “The Contribution of National Income Inequality to Regional Economic Divergence.”

38. Theda Skocpol, “Targeting within Universalism: Politically Viable Policies to Combat Poverty in the United States.” In Christopher Jencks and Paul E. Peterson, eds., The Urban Underclass (Washington: Brookings Institution Press, 1991), pp. 437–59, available at https://www.brookings.edu/book/the-urban-underclass/; John A. Powell, Stephen Menendian, and Wendy Ake, “Targeted Universalism: Policy and Practice” (Berkeley, CA: Haas Institute for a Fair and Inclusive Society, 2019), available at https://belonging.berkeley.edu/targeteduniversalism

39. Manduca, “The Contribution of National Income Inequality to Regional Economic Divergence.”

40. Kathy A. Ruffing, “Geographic Pattern of Disability Receipt Largely Reflects Economic and Demographic Factors” (Washington: Center on Budget and Policy Priorities, 2015), available at https://www.cbpp.org/research/geographic-pattern-of-disability-receipt-largely-reflects-economic-and-demographic-factors.

41. Matt Bruenig, “The Family Fun Pack” (Washington: People’s Policy Project, 2019), available at https://www.peoplespolicyproject.org/projects/family-fun-pack/; Josh McCabe, “A Pro-Family Child Tax Credit for the U.S.” (Charlottesville, VA: Institute for Family Studies, 2015), available at https://ifstudies.org/blog/a-pro-family-child-tax-credit-for-the-u-s; Dylan Matthews, “Democrats Have United around a Plan to Dramatically Cut Child Poverty,” Vox, March 6, 2019, available at https://www.vox.com/future-perfect/2019/3/6/18249290/child-poverty-american-family-act-sherrod-brown-michael-bennet.

42. Steve Randy Waldman, “The Economic Geography of a Universal Basic Income,” Interfluidity blog, November 30, 2016, available at https://www.interfluidity.com/v2/6674.html.

43. Raul M. Silveira-Neto and Carlos R. Azzoni, “Social Policy As Regional Policy: Market and Nonmarket Factors Determining Regional Inequality,” Journal of Regional Science 52 (3) (2012): 433–50, available at https://doi.org/10.1111/j.1467-9787.2011.00747.x; Raul Da M. Silveira Neto and Carlos R. Azzoni, “Non-Spatial Government Policies and Regional Income Inequality in Brazil,” Regional Studies 45 (4) (2011): 453–61, available at https://doi.org/10.1080/00343400903241485.

44. Ronald J. Stoffelsma and Jan Oosterhaven, “Social Security Benefits and Interregional Income Inequalities: The Case of the Netherlands,” The Annals of Regional Science 23 (3) (1989): 223–40, available at https://doi.org/10.1007/BF01581937.

45. Winifred Gallagher, How the Post Office Created America: A History (New York: Penguin, 2016), available at https://www.penguinrandomhouse.com/books/311582/how-the-post-office-created-america-by-winifred-gallagher/.

46. Paul Stephen Dempsey, The Social and Economic Consequences of Deregulation: The Transportation Industry in Transition (New York: Quorum Books, 1989), available at https://www.worldcat.org/title/social-and-economic-consequences-of-deregulation-the-transportation-industry-in-transition/oclc/19351756.

47. John M. Carmody, “Rural Electrification in the United States,” The ANNALS of the American Academy of Political and Social Science 201 (1) (1939): 82–88, available at https://doi.org/10.1177/000271623920100110; Harold D. Jr. Wallace, “Power from the People: Rural Electrification Brought More than Lights,” National Museum of American History blog, February 11, 2016, available at https://americanhistory.si.edu/blog/rural-electrification.

48. New America Foundation, “Hard Landing: The Breakdown of America’s Air Transport System and the Role of Deregulation” (2012), available at https://na-production.s3.amazonaws.com/documents/Hard_Landing.pdf.

49. Sitaraman, Ricks, and Serkin, “Regulation and the Geography of Inequality.”

50. Longman, “Bloom and Bust”; Manduca, “Antitrust Enforcement as Federal Policy to Reduce Regional Economic Disparities”; Tim Wu, The Curse of Bigness: Antitrust in the New Gilded Age (New York: Columbia University Press, 2018), available at https://globalreports.columbia.edu/books/the-curse-of-bigness/.

51. New America Foundation, “Hard Landing: The Breakdown of America’s Air Transport System and the Role of Deregulation.”

52. Andrew R. Goetz and Timothy M. Vowles, “The Good, the Bad, and the Ugly: 30 Years of US Airline Deregulation,” Journal of Transport Geography 17 (4) (2009): 251–263, available at https://www.sciencedirect.com/science/article/abs/pii/S0966692309000386; Michael D. Wittman and William S. Swelbar, “Capacity Discipline and the Consolidation of Airport Connectivity in the United States,” Transportation Research Record 2449 (1) (2014): 72–78, available at https://doi.org/10.3141/2449-08.

53. Matt Stoller, “Towards Democratic Regulation of the Airline Industry,” Medium, April 13, 2017, available at https://medium.com/@matthewstoller/towards-democratic-regulation-of-the-airline-industry-486647bd652f; Steve Randy Waldman, “Quick Thoughts about Airline Economics,” Interfluidity blog, April 14, 2017, available at https://www.interfluidity.com/v2/6846.html.

54. Brian Kelly, “Centene CEO Says Charlotte Is a HQ Option, If St. Louis Doesn’t Improve,” KMOX-AM, July 2, 2020, available at https://kmox.radio.com/articles/news/centene-ceo-charlotte-a-hq-option-if-stl-doesnt-improve; Phillip Longman and Lina Khan, “Terminal Sickness,” Washington Monthly, March/April 2012, available at https://washingtonmonthly.com/magazine/marchapril-2012/terminal-sickness/.

55. Sitaraman, Ricks, and Serkin, “Regulation and the Geography of Inequality.”

56. Robert A. Schapiro, “States of Inequality: Fiscal Federalism, Unequal States, and Unequal People,” CALIFORNIA LAW REVIEW 108 (2020): 66, available at https://www.californialawreview.org/print/fiscal-federalism-unequal-states/.

57. Williams, “Intragovernmental Autonomous Stabilizers”; Alex Williams, “Structuring Federal Aid To States As An Automatic (and Autonomous) Stabilizer” (Washington: Employ America, 2020), available at https://employamerica.org/structuring-federal-aid-to-states-as-an-automatic-and-autonomous-stabilizer/.

58. Brian Highsmith, “The Implications of Inequality for Fiscal Federalism (or Why the Federal Government Should Pay for Local Public Schools),” Buffalo Law Review 67 (2019): 45, available at https://digitalcommons.law.buffalo.edu/buffalolawreview/vol67/iss2/5/.

59. Zachary Liscow, “The Efficiency of Equity in Local Government Finance,” SSRN Scholarly Paper (Social Science Research Network, 2017), available at https://papers.ssrn.com/abstract=2551082.

60. Joshua T. McCabe, “The Case For Reforming Federal Grants” (Washington: Niskanen Center, 2019), available at https://www.niskanencenter.org/rich-state-poor-state/.

61. Evan Mast, “Race to the Bottom? Local Tax Break Competition and Business Location,” American Economic Journal: Applied Economics 12 (1) (2020): 288–317, available at https://doi.org/10.1257/app.20170511; Stephan J. Goetz and others, “Sharing the Gains of Local Economic Growth: Race-to-the-Top versus Race-to-the-Bottom Economic Development,” Environment and Planning C: Government and Policy 29 (3) (2011): 428–56, available at https://doi.org/10.1068/c1077r.

62. Williams, “Structuring Federal Aid To States As An Automatic (and Autonomous) Stabilizer”; Williams, “Intragovernmental Autonomous Stabilizers.”

63. U.S. Bureau of Labor Statistics, “Table B-1. Employees on Nonfarm Payrolls by Industry Sector and Selected Industry Detail” (2020), available at https://www.bls.gov/news.release/empsit.t17.htm.

64. Bruce Wallin, From Revenue Sharing to Deficit Sharing: General Revenue Sharing and Cities (Washington: Georgetown University Press, 1998), available at http://press.georgetown.edu/book/georgetown/revenue-sharing-deficit-sharing; Pacewicz, Partisans and Partners, p. 53.

65. McCabe, “The Case For Reforming Federal Grants”; Bartik, “Helping America’s Distressed Communities Recover from the COVID-19 Recession and Achieve Long-Term Prosperity”; Williams, “Structuring Federal Aid To States As An Automatic (and Autonomous) Stabilizer.”

66. Ann R. Markusen and others, The Rise of the Gunbelt: The Military Remapping of Industrial America (Oxford, UK: Oxford University Press, 1991), available at https://global.oup.com/academic/product/the-rise-of-the-gunbelt-9780195066487?cc=us&lang=en&#; Andy Garin, “Public Investment and the Spread of ‘Good-Paying’ Manufacturing Jobs: Evidence from World War II’s Big Plants” (2019), available at https://drive.google.com/file/d/1B-5V02IEARt4di13ANm602nBK-sGk3Oe/view.

67. Gavin Wright, Old South, New South: Revolutions in the Southern Economy since the Civil War (New York: Basic Books, 1986), available at http://archive.org/details/oldsouthnewsouth00gavi_0; Bruce J. Schulman, From Cotton Belt to Sunbelt: Federal Policy, Economic Development, and the Transformation of the South, 1938-1980 (Durham, NC: Duke University Press, 1994), available at https://www.dukeupress.edu/From-Cotton-Belt-to-Sunbelt/.

68. Margery Austin Turner and others, “Federal Tools to Create Places of Opportunity for All” (Washington: Urban Institute, 2020), available at https://www.urban.org/research/publication/federal-tools-create-places-opportunity-all.

69. Sitaraman, Ricks, and Serkin, “Regulation and the Geography of Inequality.”

70. Turner and others, “Federal Tools to Create Places of Opportunity for All.”

71. Peter R. Orszag and others, “Developing Effective Place-Based Policies for the FY 2011 Budget” (Washington: Office of Management and Budget, 2009), available at https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/memoranda/2009/m09-28.pdf; Peter R. Orszag and others, “Developing Effective Place-Based Policies for the FY 2012 Budget” (Washington: Office of Management and Budget, 2010), available at https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/memoranda/2010/m10-21.pdf.