Business taxes are among the most progressive taxes in the U.S. tax system. They raise revenues that pay for government services and do so in a progressive fashion, reducing inequality. Equitable Growth aims to foster a robust discussion of the impact of changes in business tax policy on the well-being of families across the income distribution.

Featured work

A review of federal lending to small business owners of color during the COVID-19 pandemic

December 13, 2022

December 13, 2022

Targeting business tax incentives to realize U.S. wage growth

January 14, 2021

January 14, 2021

A Price-Based Approach to Distributing Taxes on Business Income

December 21, 2020

December 21, 2020

The relationship between taxation and U.S. economic growth

June 30, 2021

June 30, 2021

Explore Content in Business Taxation138

Understanding the economic effects of federal tax changes

December 20, 2019

December 20, 2019

Use It or Lose It: Efficiency Gains from Wealth Taxation

October 10, 2019

October 10, 2019

How does capital investment affect workers? Evidence from bonus depreciation and matched employer-employee data

August 23, 2019

August 23, 2019

Equitable Growth releases 2019 Request for Proposals

November 8, 2018

November 8, 2018

Slide presentation: How should Treasury and the IRS conduct cost-benefit analysis of tax regulations?

September 20, 2018

September 20, 2018

Slide presentation: Cost benefit analysis of tax regulations

August 8, 2018

August 8, 2018

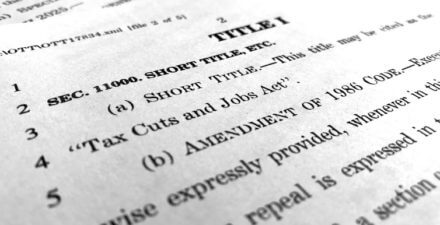

Assessing the economic effects of the Tax Cuts and Jobs Act

April 17, 2018

April 17, 2018

The Tax Foundation’s treatment of the estate tax in its macroeconomic model

December 4, 2017

December 4, 2017

U.S. corporate tax cuts and wage growth

November 30, 2017

November 30, 2017

The Tax Foundation’s score of the Tax Cuts and Jobs Act

November 9, 2017

November 9, 2017

Explore the Equitable Growth network of experts around the country and get answers to today's most pressing questions!