Ahead of President Biden’s State of the Union address, the U.S. economy is strong

On March 7, President Joe Biden will deliver the 2024 State of the Union address to the U.S. Congress and the American public, in which he will tout his economic and other policy achievements. This charticle preemptively assesses the state of the U.S. economy by looking at some of the key indicators of aggregate economic health. Overall, the data suggest that the U.S. economy is strong and poised to continue growing.

First, let’s look at scarring, or the permanent damage to the economy caused by recessions. The economic recovery from the COVID-19 pandemic has been rocky at times, but 3.5 years after the official end of the recession, the U.S. economy accomplished a remarkable feat: It completely avoided scarring (which economists also call hysteresis).

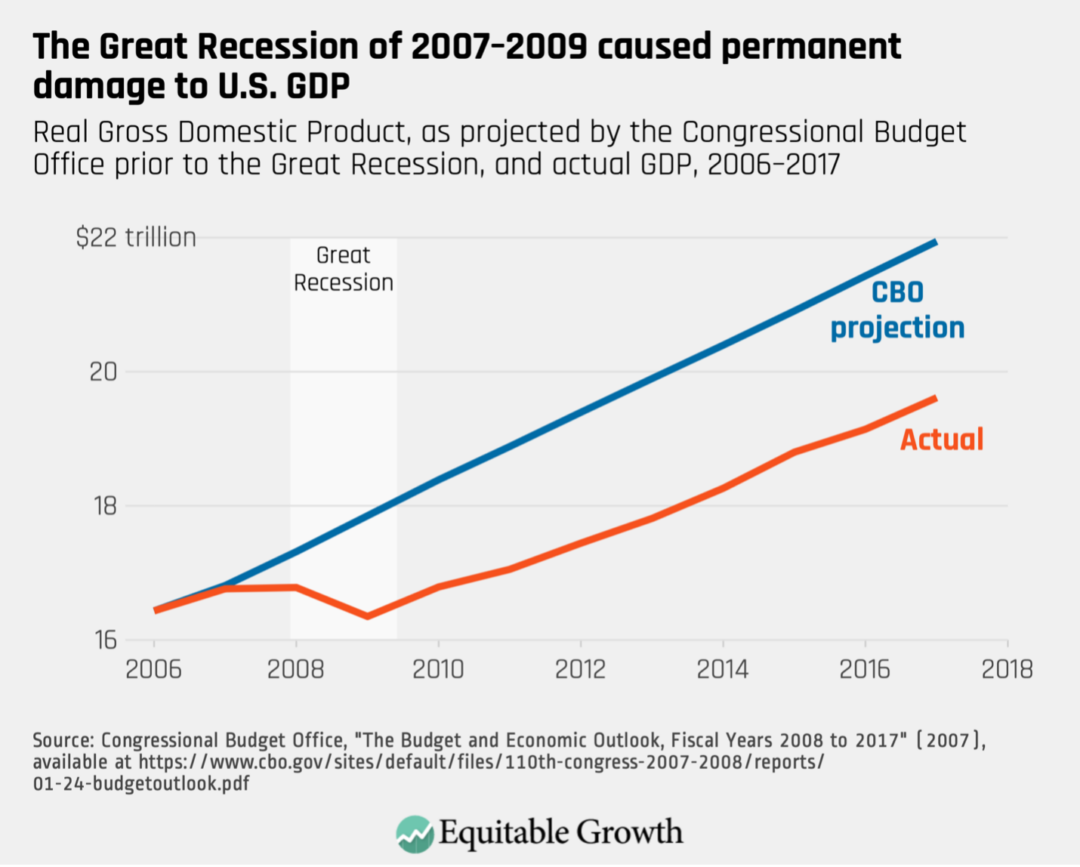

By contrast, the Great Recession of 2007–2009 caused lasting damage to the U.S. economy. Figure 1 shows how the U.S. economy contracted to well below levels forecasted by the Congressional Budget Office before the recession and stayed depressed for the length of the recovery. (See Figure 1.)

Figure 1

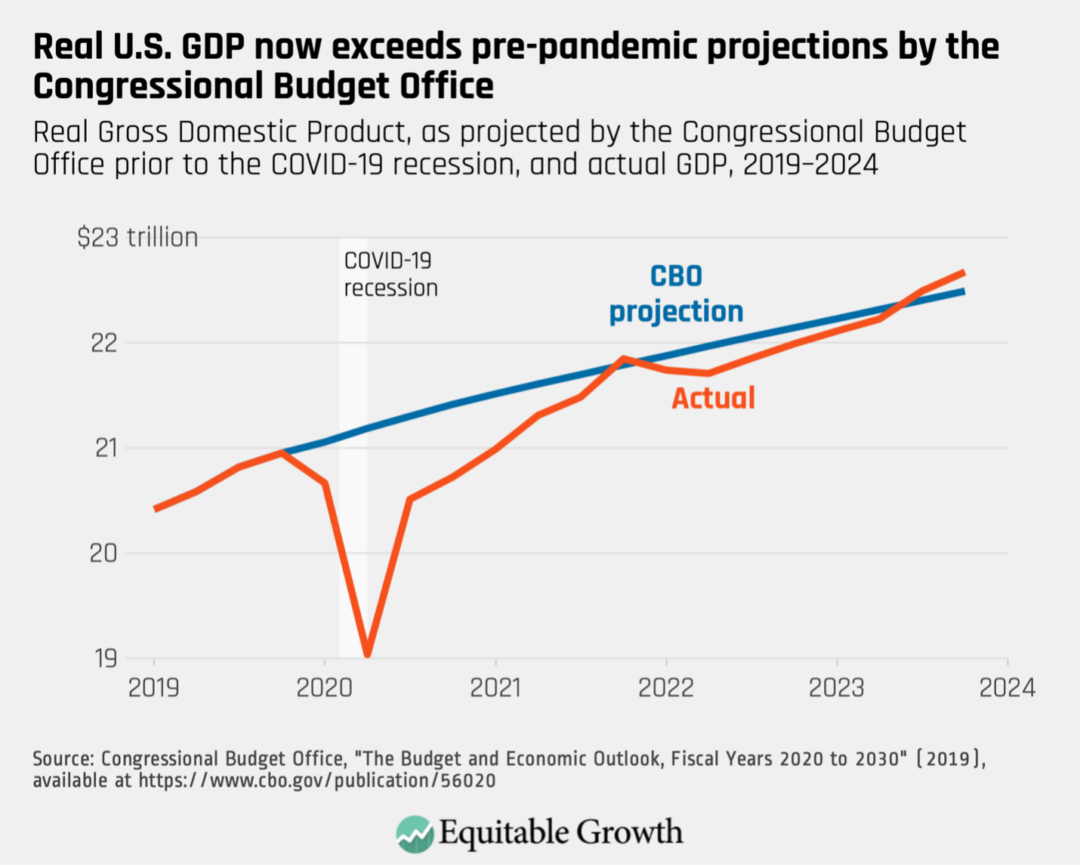

Meanwhile, the post-pandemic U.S. economy has now caught up to—and exceeded—CBO projections of Gross Domestic Product from before the COVID-19 recession. (See Figure 2.)

Figure 2

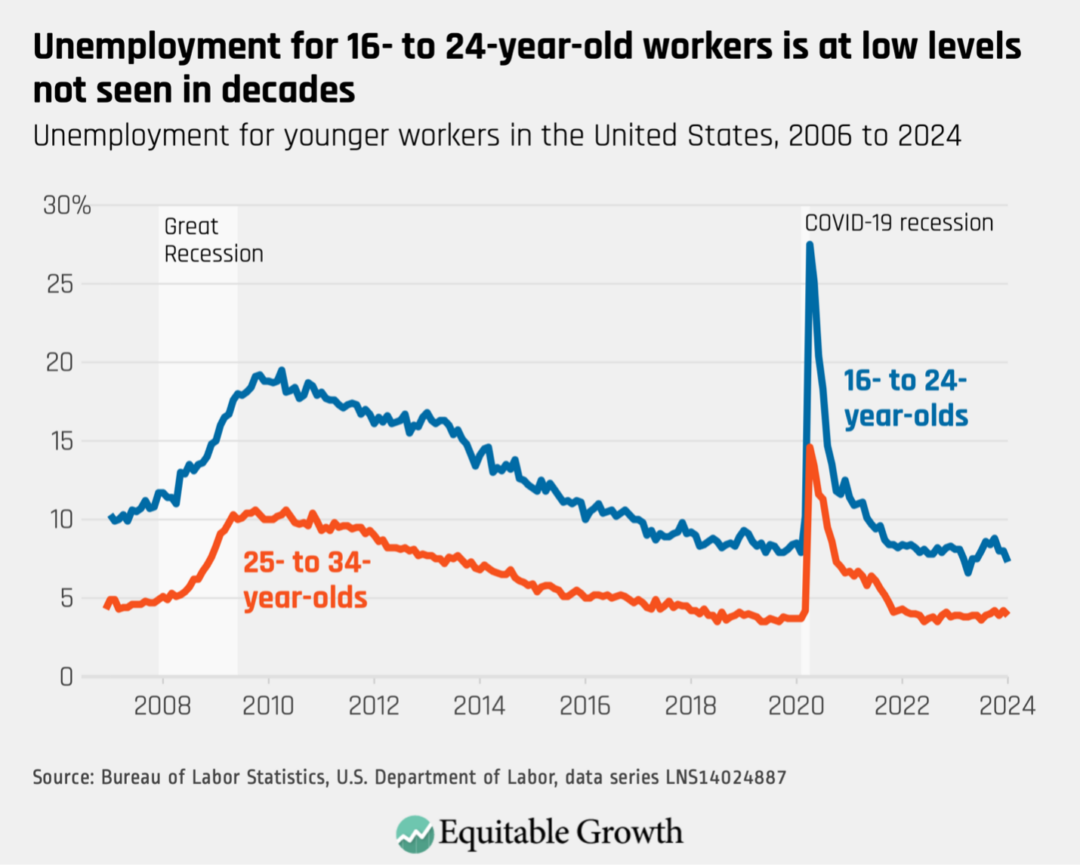

Scarring can be particularly harmful for young workers who are looking for employment for the first time. Research shows that these workers face long-lasting negative impacts from graduating into a poor labor market. Even 10 years later, these workers have lower wages, higher chances of unemployment, and worse health outcomes than their peers. So, it’s especially encouraging that young U.S. workers have fared well in the post-pandemic economic recovery: Unemployment for 16- to 24-year-olds is at its lowest level in decades. (See Figure 3.)

Figure 3

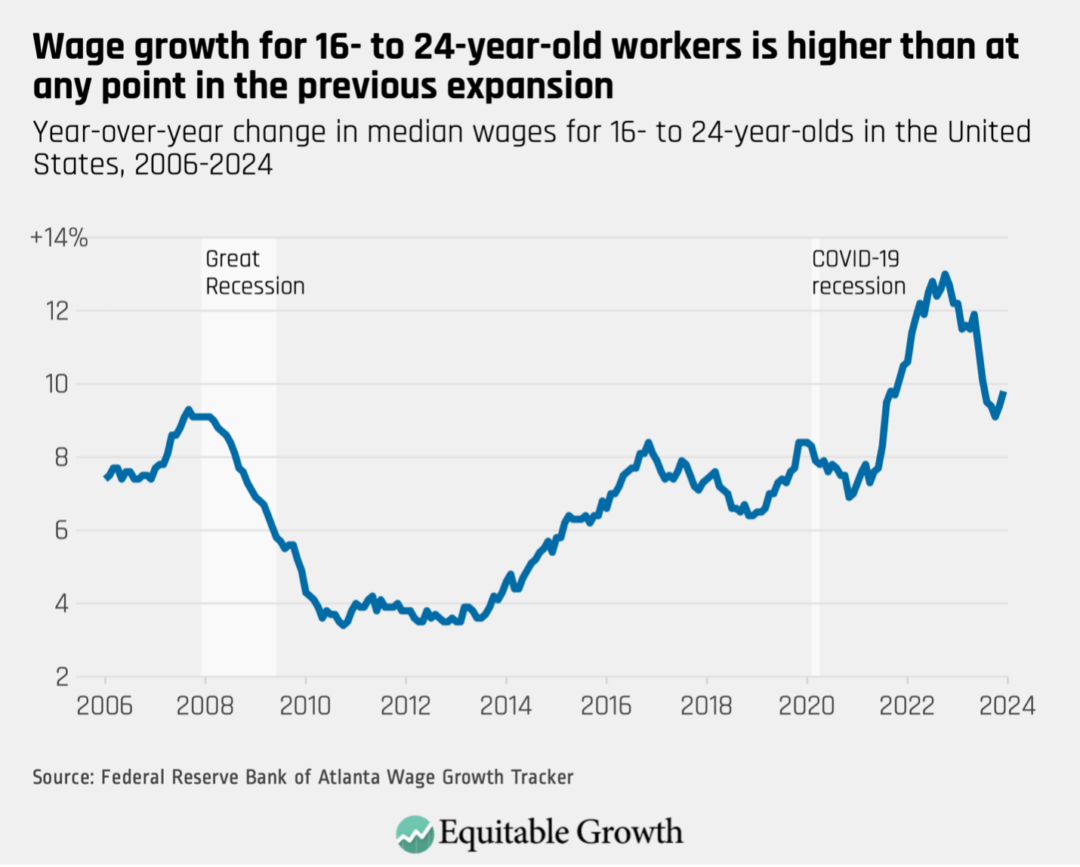

Moreover, the Atlanta Federal Reserve finds that these same workers saw significant wage increases after the pandemic. Strong wage growth for these workers suggests they have avoided the labor market scarring that usually impacts young workers after a recession. (See Figure 4.)

Figure 4

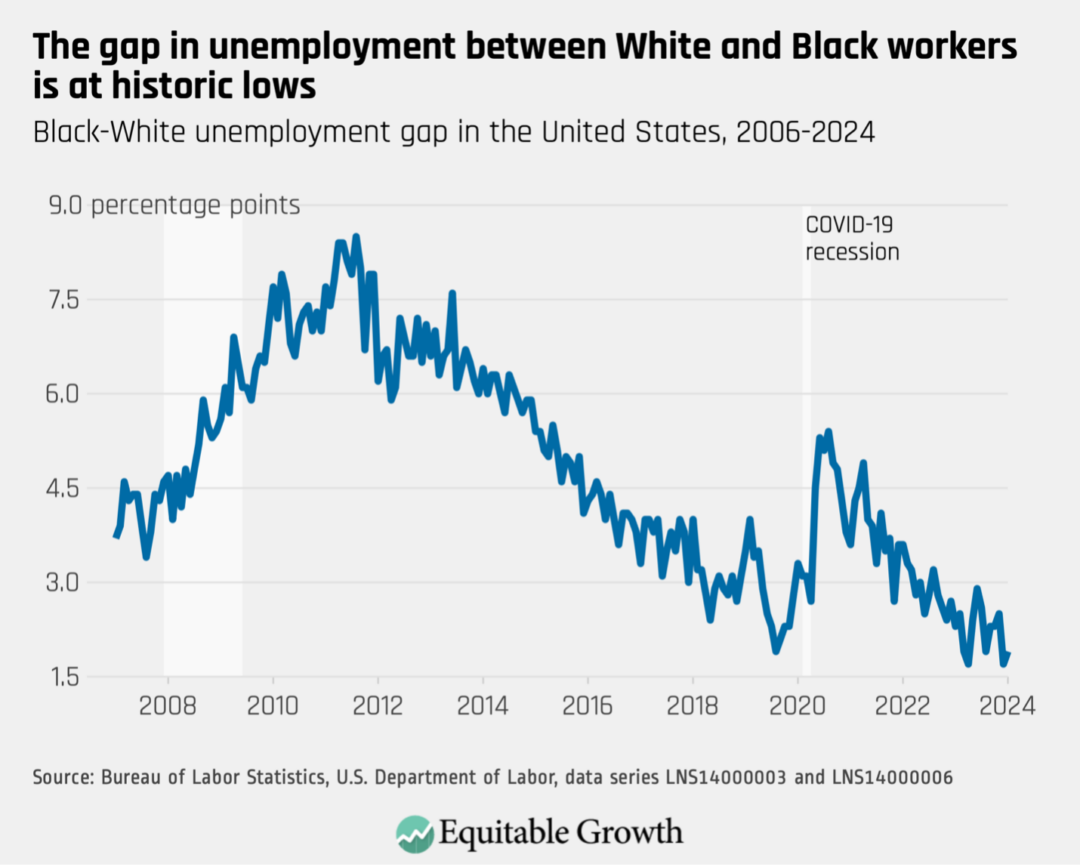

These wage gains are primarily attributable to a tight U.S. labor market that has pulled more workers into the labor market. Prime-age women’s labor force participation rates are at historic highs, for example. Additionally, the gap in unemployment between White and Black workers is at its lowest point since both rates have been measured. (See Figure 5.)

Figure 5

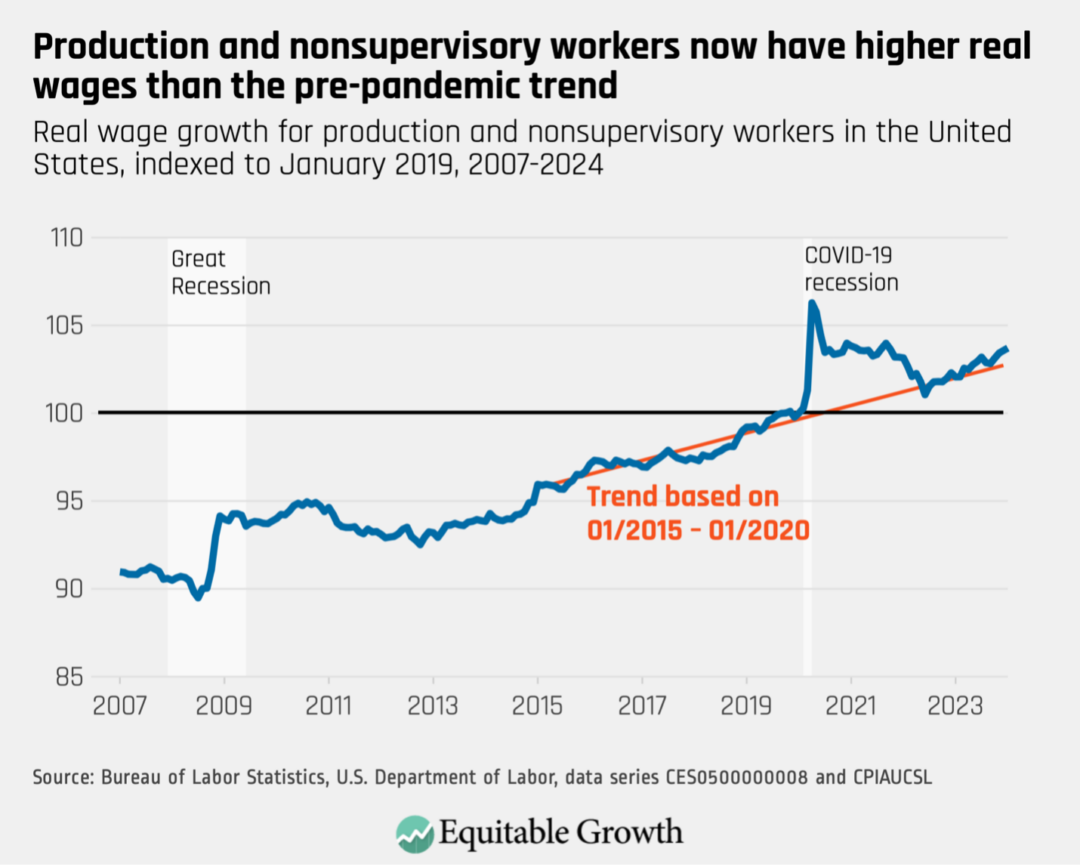

Much of this success can be attributed to the strength of consumption in the U.S. economy. Thanks in large part to aggressive fiscal policy during the pandemic, Americans emerged from lockdown with money to spend—and they are spending it. Consumption should remain strong as wage growth is now outpacing inflation for most workers. (See Figure 6.)

Figure 6

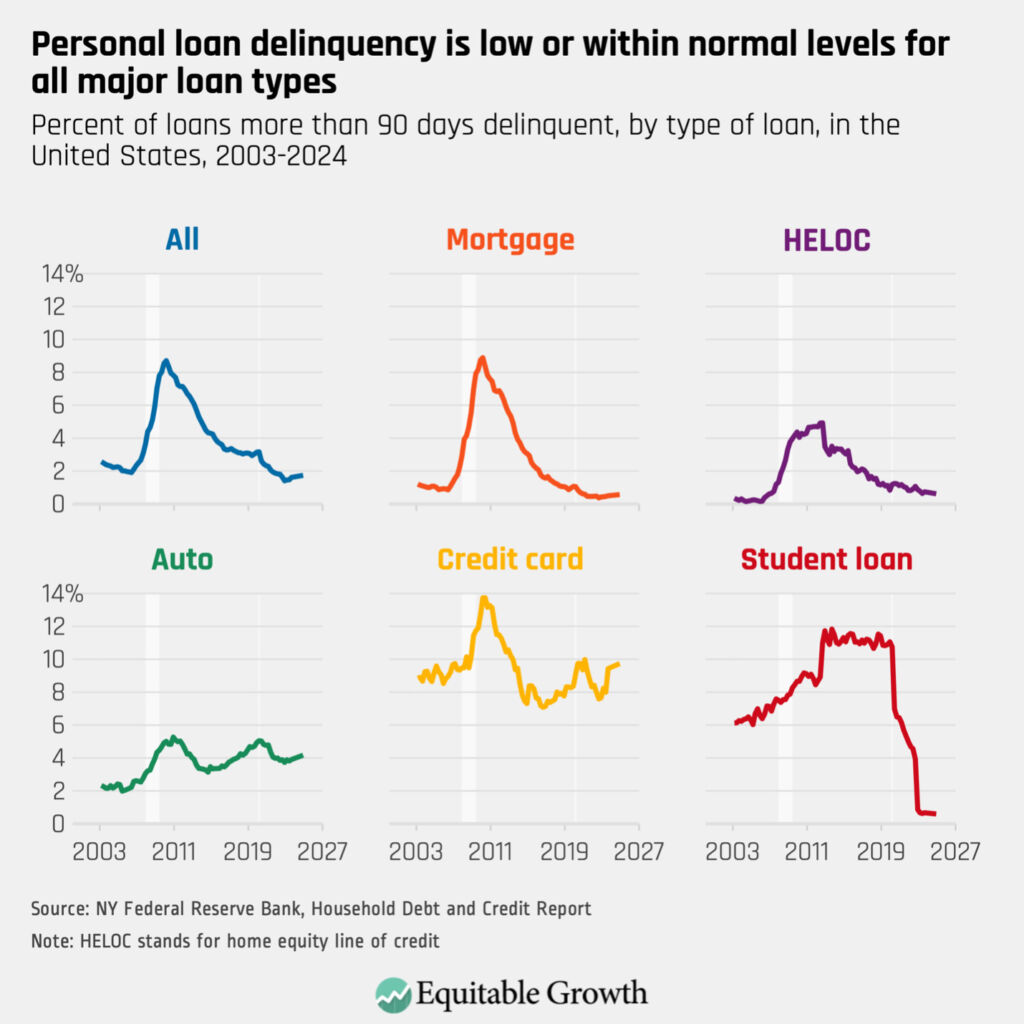

According to the New York Federal Reserve, consumer debt also remains low by historical standards. Although credit card delinquency has crept up lately, it is within normal levels historically, and delinquencies for other types of debt are at extremely low levels. (See Figure 7.)

Figure 7

Taken together, the aggregate data paints the picture of a strong economy, with relatively few threats on the horizon. After months of erroneous recession speculation over the past couple of years, the indicators clearly show that the state of the U.S. economy is strong.