A primer on monopsony power: Its causes, consequences, and implications for U.S. workers and economic growth

At its most basic, monopsony refers to a market where there is a single buyer of a good or service. Economist Joan Robinson first introduced the term in the early 1930s and used it to describe how imperfect competition in the market for labor can shift the bargaining power away from workers and toward employers—a dynamic that drags down wages and suppresses employment, just as a monopoly for a seller raises prices and lowers the amount sold. Unlike the perfectly competitive model taught in introductory economics classes, Robinson’s monopsony model captures how outsized employer power can give firms the ability to underpay workers, exacerbate income inequality, and hold back economic growth.

As interest in the relationship between employers’ labor market power and economic inequality has grown in recent decades, there is a growing boom in academic research about monopsony. Scholars studying how labor markets work under imperfect competition have found empirical evidence that challenges Econ 101 assumptions about the relationship between minimum wage increases and employment levels. And as new methods and data sources allow researchers to get a better understanding of employer concentration, a number of economists are proposing novel ways in which antitrust law can be leveraged to promote competition in labor markets.

This primer describes how monopsony offers an alternative model to the perfectly competitive model of the labor market, discusses some of the recent research studying monopsony in the U.S. economy, and tracks how employers’ ability to set wages exacerbates inequality. It then describes how discrimination, longstanding social norms, and demographic characteristics make some groups of workers especially vulnerable to wage suppression. It concludes with a series of public policy measures that, in promoting competition and boosting workers’ bargaining bower, would help mitigate employers’ ability to set wages, address inequities in U.S. labor market outcomes, and support broadly shared economic growth.

Monopsony offers an alternative framework through which to understand the labor market

According to the hypothetical perfectly competitive model of the labor market referenced in introductory economics textbooks, a business that cuts wages will eventually lose all of its workforce. The reason is that under perfect competition, workers have complete freedom to move from job to job in search of higher wages, and when the market is in equilibrium, they are able to find an employment opportunity that pays a wage equal to the value of what they produce, or equal to what economists call the marginal product of labor.

Put another way, the marginal product of labor is the change in output a firm will get by hiring one additional worker. In the actual labor market, however, workers’ decisions to leave or stay in their jobs are not as sensitive to changes in wages. Research shows that there are a number of factors that can constrain someone’s ability or desire to switch jobs. Employer concentration, the time and effort it takes to find another job, and individual preferences or needs unrelated to pay, such as looking for part-time employment due to care responsibilities, are some of those factors. Other factors include fears of losing employer-provided benefits, noncompete contracts, economic downturns, and discrimination.

All of these barriers can dampen competition in the labor market and may keep workers from moving on to other employers, even if their current pay is not commensurate with their productivity. And by giving employers an upper hand when determining compensation, monopsony not only dampens wage growth but also drags down employment, since the pay for existing employees is not enough to attract other workers.

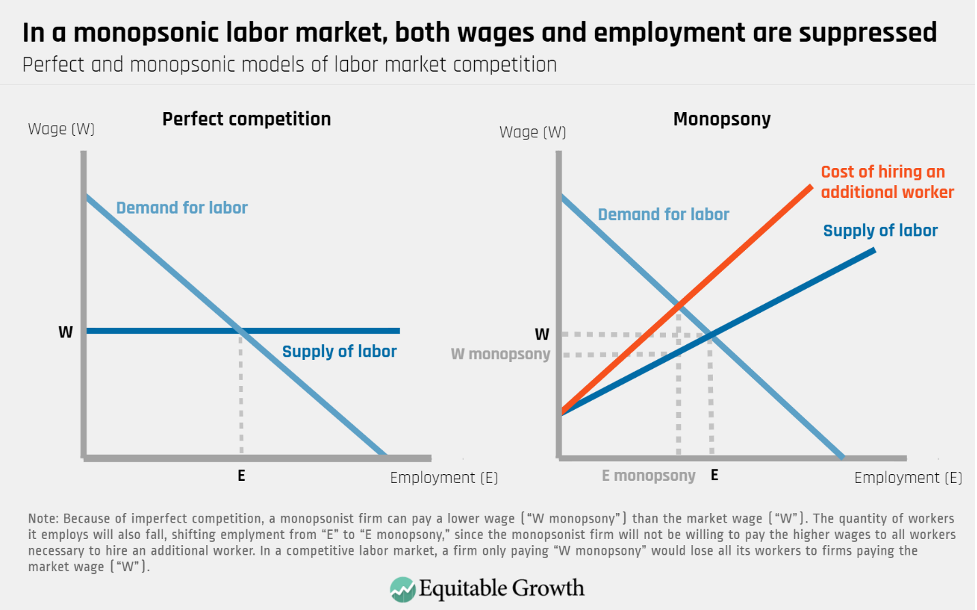

The perfectly competitive and monopsonistic models of the labor market

Let’s first take a deeper look at the perfectly competitive model of the labor market. A firm operating in this hypothetical labor market is a price-taker, meaning that it has no option but to pay the market wage—the wage that is determined by the forces of labor demand and labor supply. In economic parlance, this model of perfect competition posits that individual firms face a so-called horizontal labor supply curve, meaning that they can hire all the workers they want as long as they pay a competitive wage, or the “market wage rate.”

In this perfectly competitive model, then, a firm will decide to hire workers up to the point where the marginal revenue product of labor, or the change in revenue the firm will get by hiring one additional worker, intersects with the market wage. So, theoretically, firms operating in a perfectly competitive labor market will be able to hire all the workers they want as long as they pay the market wage. If firms pay less than the market wage or cut wages, then all of their workers will choose to go to other firms that offer higher market wages.

If a labor market is functioning in a more monopsonistic way, however, firms will be price-setters rather than price-takers. The idea is that unlike a firm operating in the perfectly competitive labor market, a monopsonist firm that faces no competition when hiring workers faces an upward-sloping, instead of a horizontal, labor supply curve. As such, if the monopsonist slashes its wages, then it will lose some, but not all, of its workforce. But while these firms will be able to hire workers even if they do not pay competitive wages, they will have to increase pay for all workers every time they want to attract an additional worker. As a result, monopsonist firms will hire fewer workers at lower wages. (See Figure 1.)

Figure 1

Of course, labor markets rarely have a single firm competing for workers. But the monopsonic model nonetheless offers important insights into the relationship between imperfect competition, wages, and employment.

Further, recent research has focused on what scholars call modern or dynamic monopsony—a framework in which a single firm does not have to be the only employer in a given labor market to be able to exercise monopsony power as long as the dynamics of the labor market reflect significant frictions in switching jobs that lend wage-setting power to employers. Indeed, a large and growing body of empirical research is finding evidence that U.S. employers often have the power to set wages.

What recent research says about the presence of monopsony power in the U.S. labor market

As interest in the causes and consequences of imperfect competition grow and new empirical methods and data become more available, there has been an explosion of research about and around monopsony. To study employers’ wage-setting power, economists and other social scientists can measure how likely workers are to quit in response to a decrease in wages, capture the degree of employer concentration in any given labor market or industry, or study the barriers that limit workers’ ability to move from job to job.

In addition, researchers can examine how discrimination, longstanding social norms, and demographic characteristics make some groups of workers especially vulnerable to wage suppression because of these dynamic factors. Next, we review recent studies in each of four buckets of research.

Markdowns and workers’ sensitivity to wage changes

A common way to measure employers’ monopsony power is through what economists call elasticity of labor supply to the firm, a concept that captures how sensitive workers are to wage changes. In the hypothetical perfectly competitive labor market, the elasticity of labor supply facing the firm is infinite, meaning that a 1 percent reduction in pay would be enough for a business to lose all of its workers, at least in the long run.

Research shows, however, that workers are much less sensitive to changes in pay than the perfectly competitive model would predict, allowing firms to pay wages that are not proportionate to workers’ productivity. In the monopsony literature, calculating the elasticity of labor supply to the firm allows economists to estimate the potential wage markdown, or the gap between the value workers generate for the firm and their actual wages.

There are a number of studies that show the existence of markdowns in labor markets. Recent research on the U.S. manufacturing industry, for example, finds that manufacturing workers employed at an average plant earn only $0.65 for every $1 of value they create, suggesting that the majority of manufacturing plants in the country operate with some degree of monopsony power.

Other studies show that lack of access to transportation infrastructure and employer concentration are associated with wage markdowns. And in a meta-analysis of 53 empirical studies with more than 1,000 estimates of labor supply elasticity, Anna Sokolova and Todd Sorensen at the University of Nevada, Reno find that, depending on the method used, employers have the power to mark down wages between 7 percent and 58 percent.

Employer concentration

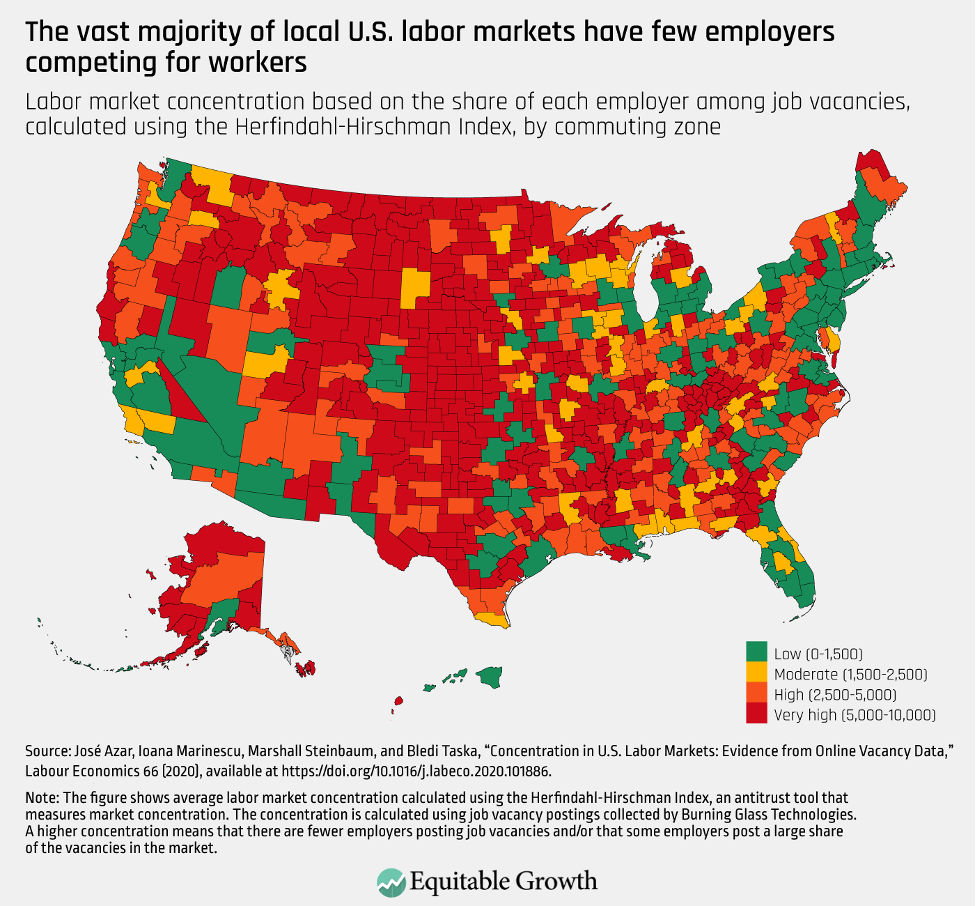

Another approach to study monopsony is to measure labor market concentration, a phenomenon in which only a few employers are competing to hire workers. To study this phenomenon, one team of economists used online job vacancy data to analyze the degree of employer concentration across occupations and commuting zones in the United States. The authors show that about 16 percent of workers in the country are employed in highly concentrated labor markets—labor markets in which few firms are recruiting, and workers are less likely to receive an employment offer.

Consistent with previous evidence, the authors also find that wages tend to be lower in labor markets with fewer recruiting employers. And employer concentration is especially prevalent in less-densely populated labor markets, a dynamic that might help explain why wages are lower in rural areas than in urban areas. (See Figure 2.)

Figure 2

There is also evidence that some labor markets and occupations have substantial employer concentration, thereby reducing wages. Take healthcare services, for instance. In one study of the labor market for nurses, researchers find that the supply of labor to hospitals is fairly inelastic, giving large healthcare employers, such as the U.S. Department of Veterans Affairs, the power to influence pay across the entire sector.

There is also evidence that the entrance of large, dominant employers to local labor markets, particularly those in rural communities, can have wide-ranging effects on the outcomes of workers in those labor markets. A study by Justin Wiltshire of the Institute for Research on Labor and Employment at the University of California, Berkeley finds, for example, that the entrance of Walmart Supercenters in local labor markets leads to overall reductions in both wages and employment in the following 5 years. Another paper finds that workers with guest worker visas are employed in more concentrated labor markets than U.S. workers in general.

Job mobility

Scholars interested in monopsony power also study the barriers that make it difficult for workers to move on to other employers. For instance, contracts, credentials, and certain occupations can keep workers locked in their jobs or places of residence, giving employers the ability to exercise monopsony power. Noncompete agreements—contracts that prohibit workers from joining or creating a competing business—have been shown to depress wages, stop workers from moving on to a better job, and hurt entrepreneurship. And a number of studies show that because they have very specific skills and have made important investments in trainings and licenses, healthcare workers often have low occupational mobility.

Indeed, researchers find that the negative relationship between employer concentration and wages is also shaped by occupational mobility, since some workers may be able to switch occupations out of concentrated industries more easily than others. In a recent paper, Gregor Schubert at the University of California, Los Angeles, Anna Stansbury at the Massachusetts Institute of Technology, and Bledi Taska at the employment data firm Lightcast (formerly Emsi Burning Glass) examine the extent to which workers’ pay reacts to changes in employer concentration within their industry of employment, as well as to their outside job options. Using econometric methods that allow the three researchers to examine variations in local employer concentration that are not the result of local economic conditions—therefore reducing the likelihood that their results are driven by anything other than the degree of competition for workers—the co-authors find that for more than 10 percent of the U.S. workforce, pay is suppressed by 2 percent or more because of employer concentration.

In addition, slack economic conditions can exacerbate employers’ market power, in part because downturns reduce workers’ alternative job opportunities. Research by Gordon Dahl at the University of California, San Diego and Matthew Knepper at the University of Georgia finds, for example, that higher rates of unemployment are likely associated with greater underreporting of sexual harassment at work—evidence that employers are more likely to exploit workers when those workers have fewer outside options and the prospect of losing a job is more costly.

Similarly, research by Janice Fine, Jenn Round, and Hana Shepherd of Rutgers University and Daniel Galvin of Northwestern University finds that during the Great Recession of 2007–2009, higher joblessness hurt low-wage workers’ labor market power. Specifically, the team of researchers shows that there was an important rise in minimum wage violations during that recession, disproportionately hurting women, non-U.S. citizens, and Black and Latino workers.

Discrimination, longstanding social norms, and demographic characteristics can make some workers especially vulnerable to employers’ monopsony power

Characteristics such as race, ethnicity, gender, level of formal education, and geographic location can all play a role in the ability of workers to move from job to job, rendering some groups of workers especially vulnerable to employers’ wage-setting power. For instance, Kate Bahn at the Washington Center for Equitable Growth and Mark Stelzner at Connecticut College, put forth a new theoretical model that shows how greater care responsibilities and lower levels of household wealth disproportionately expose Black and Latina women to wage suppression. The reason, Bahn and Stelzner find, is that care obligations and lack of access to resources constrain workers’ employment options and job search process. And because employers are often aware of these disparities, they can exploit the constraints faced by Black and Latina women workers in the form of lower wages.

Indeed, there are a number of ways in which disparities in wealth and care responsibilities can affect workers’ job-search processes and employment prospects. A worker caring for an elderly parent, for instance, will be less likely to move to an employment opportunity in another state. And a worker without a financial cushion will be much less able to take the time they need to find a job that is a good match for their interests and skills—a type of pressure that disproportionately affects workers of color. According to a 2019 survey by the U.S. Federal Reserve, White families’ median wealth ($188,200) is more than 7 times greater than Black families’ median wealth ($24,100) and more than 5 times greater than Latino families’ median wealth ($36,00).

Other studies show that monopsonistic forces affect mothers and fathers in different ways, helping explain why having children widens the wage gap between men and women. And persistent features of the U.S. labor market, such as hiring discrimination against Black job-seekers, help explain why workers of historically marginalized groups face greater costs when a worker separates from a job.

Public policies that boost competition and workers’ bargaining power can counter employers’ monopsony power

As the mirror to the term “monopoly,” which describes a market where there is just one buyer, monopsony refers to a market where there is just one seller. And like monopolies, monopsonies create a number of economic inefficiencies that hurt workers and hold back growth.

Effective public policy and strong labor market institutions, however, can temper employers’ wage-setting power. For example, a paper by Marcel Steffen Eckhardt and Michael Neugart of Technical University of Darmstadt finds that competition policy, such as antitrust regulation, and boosting worker power, including institutional support for collective action, reinforce each other, leading to a greater overall improvement in the functioning of the labor market than the sum of either policy area alone.

Let’s briefly examine some of these policies to deal with monopsony power.

Competition and antitrust policy

One important way to push back against employers’ monopsony power is through competition and antitrust policy. Suresh Naidu at Columbia University, Eric Posner at the University of Chicago, and E. Glen Weyl at Yale University propose, for instance, that current antitrust policy largely fails to evaluate and address how employer concentration affects workers and labor markets. To mitigate employers’ monopsony power, antitrust regulation could therefore be updated to consider possible harms to labor market competition when evaluating the effects of mergers and acquisitions.

Another way to boost competition in the market for labor is to ban noncompete agreements, especially for low-wage workers. Currently, almost 1 in 5 U.S. workers are bound by noncompetes, and while they are more prevalent in higher-paying jobs, about 13 percent of workers earning less than $40,000 per year are currently subject to one. Banning noncompetes for low-wage workers would therefore eliminate one important barrier that constrains job mobility by keeping workers from moving on to better employment opportunities.

Promote worker voice and bargaining power

The second public policy area involves measures that boost workers’ bargaining power. In 2021, more than 1 million workers in the United States were paid the federal minimum wage or less. After more than a decade of remaining frozen at $7.25 an hour, increasing the federal minimum wage would limit employers’ ability to pay workers a wage that was well below the value they create. In labor markets where employers have monopsony power, a higher minimum wage would not only lead to an earnings increase for the lowest-paid workers and a decline in economic inequality, but also would likely boost employment.

Further, in a national labor market characterized by prevalent monopsony, research suggests that the federal minimum wage is a useful tool for mitigating regional wage inequality and improving overall labor market outcomes.

Other public policies that would boost workers’ bargaining power include investments in a more robust income-support system and better enforcement of labor protections. Research by Ammar Farooq at Uber Technologies Inc. and Adriana Kugler and Umberto Muratori at Georgetown University shows, for instance, that access to adequate Unemployment Insurance benefits gives workers time to find a job that is a good match for their skills, leading to better-functioning labor markets. In the case of the UI system, necessary reforms include increasing benefit amounts, broadening eligibility requirements so that more workers can access them, and investing in the systems and offices charged with disbursing benefits.

Discrimination and Monopsony Power

July 13, 2020

Antitrust Remedies for Labor Market Power

September 25, 2018

Perhaps most importantly, it is important to make it easier for workers to form and join a union, as well as support effective collective bargaining so that workers can negotiate for better pay. In 2021, only about 10 percent of U.S. wage-and-salary workers were members of a union, down from about 30 percent between the mid-1940s and mid-1960s. While unions were an important equalizing force during the decades when they represented a large share of the country’s workforce, judicial and business hostility toward organized labor limits unions’ ability to deliver better working conditions for workers.

Policymakers can boost the power of organized labor by expanding the right to organize to self-employed workers and independent contractors, strengthening the right to strike, and holding employers accountable for unfair and illegal practices against organizing efforts. Future improvements to worker power could also include bold proposals to introduce sectoral bargaining—where workers across an entire sector of the economy bargain together through a union—to the United States.

Conclusion

Workers in the United States have experienced decades of wage suppression and not sharing the gains of economic growth. Monopsony suggests that these outcomes are the result of broad and common market failures, holding back both wages and employment and resulting in deadweight loss to the entire U.S. economy. Increasing worker power and enhancing competition work together to ensure the economy functions both efficiently and fairly for workers and for employers.