The most exposed workers in the coronavirus recession are also key consumers: Making sure they get help is key to fighting the recession

Overview

The United States is currently facing the fastest economic downturn in its history, which, without strong action, could also become one of the most severe that it has ever seen. In response, U.S. policymakers are currently distributing $2.2 trillion in new stimulus funds, as well as discussing the potential for more spending. The question of how to target that spending is crucial to its effectiveness. My working paper, “The Matching Multiplier and the Amplification of Recessions,” demonstrates that over the past several decades, the workers with labor market earnings that are hardest hit in recessions are precisely those who have the highest marginal propensity to consume—those whose consumption is most sensitive to fluctuations in their income. These findings suggest that those workers with a high marginal propensity to consume should be the key target for stimulus money.

Download FileThe most exposed workers in the coronavirus recession are also key consumers: Making sure they get help is key to fighting the recession

In this issue brief, I first present the key findings in my working paper and then apply my framework in a preliminary analysis of the current coronavirus recession. Briefly, my working paper finds that young and low-income workers both have higher marginal propensities to consume and are most exposed to aggregate fluctuations. When recessions hit, firms lay off young and low-income workers first, and this unequal incidence deepens recessions as these workers cut their consumption dramatically, leading to lower demand and more layoffs.

I then provide some additional discussion of this mechanism in the context of the current coronavirus recession. Preliminary evidence suggests that not only are these main overall effects still important today, but also that the occupations and industries that are most exposed to the initial shock of the coronavirus pandemic are the very industries and occupations that are even more likely to have workers with high marginal propensities to consume. This pattern indicates that understanding the incidence of the shock could be unusually important at the current moment.

I close with a look at the policy responses that U.S. policymakers should be focused on, among them making sure stimulus funds get to these workers as swiftly and sustainably as possible over the next days, weeks, and months. In this way, the shock delivered to the U.S. economy by COVID-19, the disease spread by the novel coronavirus, will be less severe and the economic recovery closer at hand.

The unequal exposure of workers to business cycles

At the core of both traditional and modern Keynesian models of the macroeconomy is the potential amplification of initial shocks coming through a powerful consumption multiplier. The consumption multiplier captures a simple and intuitive feedback loop: When there is a shock that decreases aggregate demand in the economy, some of that translates into lower incomes for workers, which leads to depressed demand, which again feeds back into incomes, ad infinitum. Through this feedback mechanism, the initial demand shock is amplified, and the size of each of these feedback loops is determined by the aggregate marginal propensity to consume, or MPC, which measures how much consumption falls for each unit of lost income.

The size of the aggregate marginal propensity to consume is therefore an important object for U.S. policymakers to understand, as it determines the potential strength of this feedback loop. In my working paper, I show that the unequal incidence of business-cycle shocks in the labor market substantially increases the aggregate MPC and thus the strength of this amplification channel. In general, when recessions hit, it is the workers whose spending is most sensitive to their own income, such as people without savings, who are most likely to lose their jobs or otherwise have their earnings cut. Economies where this inequality of response to recessions is stronger are themselves much more affected by initial shocks: The inequality matters not only for the workers who are directly affected, but also for all workers, as the effects ripple through the economy via this consumption multiplier channel.

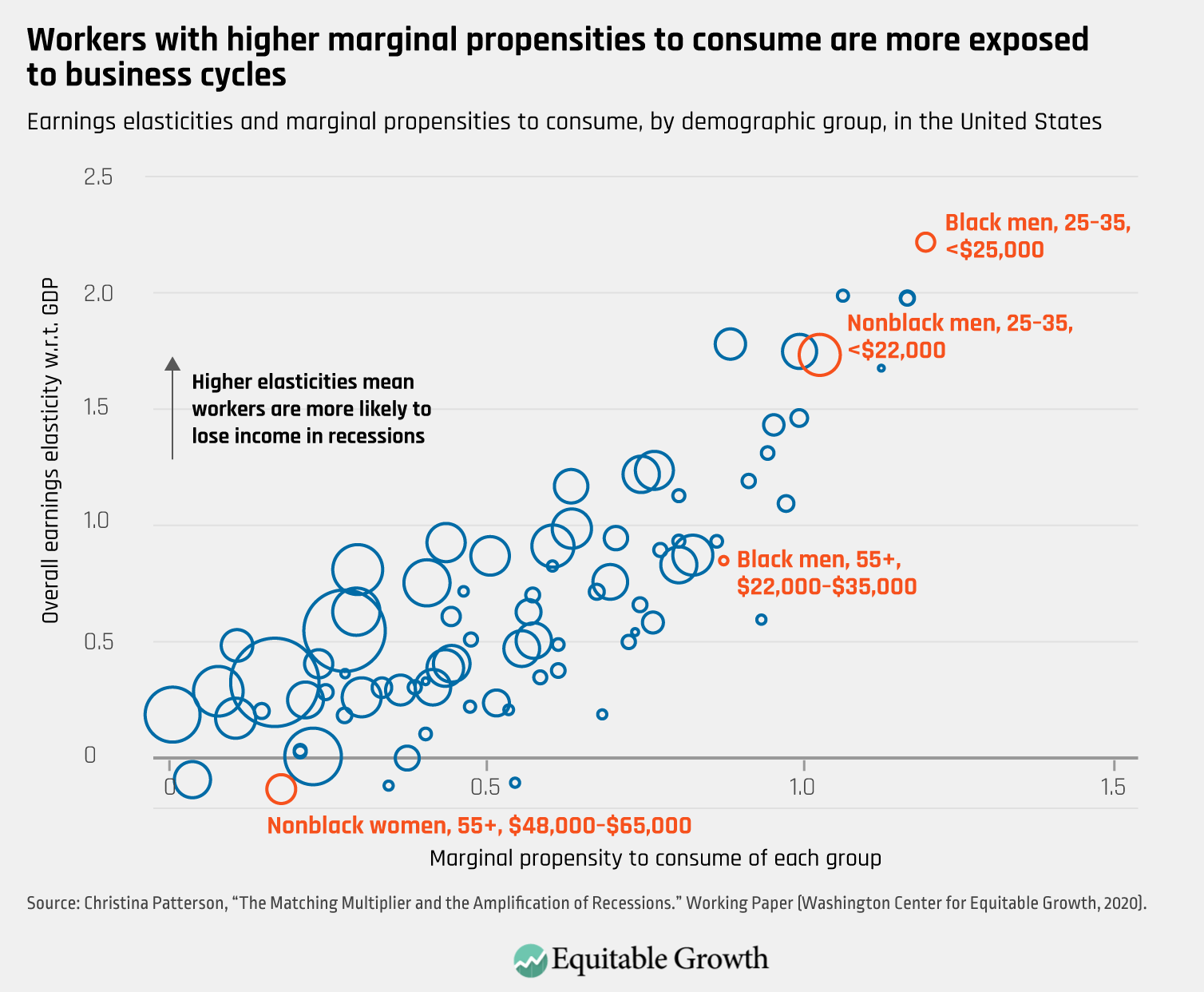

The correlation between a worker’s marginal propensity to consume and the exposure of that worker’s earnings to recessions is a challenging moment to measure as it requires high-quality data on both consumption and income. I overcome this by proceeding in two steps. First, I measure the MPCs for different demographic groups by looking at how much their consumption falls per dollar lost when they become unemployed. I find that, on average, household consumption drops by 50 cents for every dollar of labor income that is lost when someone in the household becomes unemployed, though there is substantial variation across demographic groups. (See Figure 1.)

Figure 1

In Figure 1, you can see some of the variation across demographic categories (demonstrated by the span of the x-axis). In general, these differences match what we might expect: Groups that are less likely to have a buffer of savings respond much more to losing income. Younger, low-income, and African American workers, for example, respond more than older, higher-income, nonblack workers, who may have had more time to save for rainy days or may have easier access to a loan that can tide them over.

Moreover, it is precisely this overlapping demographic group of younger, low-income workers who also have labor incomes that are very exposed to recessions. In my paper, I show that, historically, this difference is not driven primarily by the industries in which they work, but rather appears to happen within individual firms. In other words, it is not primarily the case that younger, lower-income workers tend to cluster in certain exposed sectors, but rather that when a recession arrives, firms cut hours, wages, and employment of their employees with higher marginal propensities to consume before those with lower MPCs.

This means the lower-income receptionist is laid off before the higher-income scientist. Moreover, it is perhaps the younger receptionist who just started at the firm who is laid off before the more senior receptionist at the firm. This young receptionist may have had less time to build savings, and therefore, when she loses her job, she has to alter her consumption more dramatically to get by.

On the flip side, this measured correlation between marginal propensities to consume and income sensitivity to aggregate economic conditions also implies that the incomes of the high-MPC demographic groups grow more during recoveries. Indeed, in the midst of strong Gross Domestic Product growth through 2019, lower-income workers were finally experiencing strong growth in both wages and employment.

Over the past two decades, the estimated magnitude of this correlation between marginal propensities to consume and income exposure to business cycles is large enough to increase the aggregate response of consumption to income by 30 percent. In my paper, I also show that when looking separately at individual local labor markets, in places where this correlation is stronger—such as places where the earnings of higher-MPC workers are even more responsive to business cycles than the nation as a whole—the response of the local economy is more drastic. This finding provides additional empirical support for the relationship I find overall.

These results mean that U.S. policymakers should be concerned about the unequal incidence of recessions not only out of concerns about equity but also because this “inequality of incidence” affects the economy for all of us. The U.S. labor market is structured such that high-MPC workers are more likely to lose their jobs in recessions, and this makes the entire economy more susceptible to aggregate demand shocks. Policies aimed at equalizing the incidence of the shock will mitigate the amplification that occurs through this channel.

The COVID-19 shock to the U.S. economy

What does this mean for the current shock delivered to U.S. economy by COVID-19? Detailed U.S. labor market data will not be available for some time, but we can look at initial data to understand the degree to which the shock of the coronavirus pandemic has disproportionately hit the labor earnings of workers with higher marginal propensities to consume. Ultimately, as the health shock delivered by COVID-19 becomes an economywide demand shock, it will likely affect all workers. But the initial incidence of the coronavirus recession can affect that process by strengthening or weakening the first round of the Keynesian feedback loop. Preliminary evidence suggests that policymakers should expect this channel to be particularly large.

Even though it is still early to know for sure which workers are most exposed to this COVID-19 shock, we can make an educated guess using some existing data. I classify the exposure of workers based on the combination of their occupation and their industry. Workers in industries that are inherently social will be more likely to have been laid off in response to the public health shock and the stay-at-home orders that followed. I use early data on weekly Unemployment Insurance claims by industry to identify these industries.

Specifically, I calculate the percent increases in initial claims in each industry between the week ending March 14 and the week ending March 21. The data is not yet available for all states, so I focus on data from Michigan, which has provided detailed data, under the assumption that the industrial distribution within Michigan is representative of the nation. The executive order in Michigan closing bars and other public spaces was signed on March 16, and therefore the initial claims from the week of March 16 to March 21 will capture the immediate effects of this on the labor market.

The industries that are initially most exposed to the COVID-19 shock in Michigan are those with the largest increase in Unemployment Insurance claims, such as food services, hotels and accommodations, and general services. Moreover, within industries, workers in occupations that are easy to do from home are less likely to have lost their jobs in the state than those in occupations that are less flexible along this dimension.

The American Community Survey collects information on how individuals get to work, and following other recent work, I measure flexible occupations as those with at least 5 percent of workers working at home from 2010–2019. The flexible occupations by this measure include engineers, artists, and managerial occupations (this yields similar classifications to those described by University of Chicago Booth School of Business professors Jonathan Dingel and Brent Neiman in their paper “How Many Jobs Can Be Done at Home,” who employ an alternate approach using the task content of occupations). Of course, this is an approximation, as companies may have figured out how to make other occupations more flexible in recent weeks, but it proxies for which occupations are more or less likely to be done remotely over the coming months.

Putting it all together, the workers that are most exposed to the COVID-19 shock are probably those who are in inflexible occupations within exposed industries.

Using the methodology in my working paper, I estimate the marginal propensities to consume for the different industry and occupation bins. Specifically, I use data from 1982–2015 from the Panel Study of Income Dynamics to measure the change in consumption per dollar lost when workers lose their jobs. I measure this both on average in the population and for workers in different industry and occupation bins, as described above.

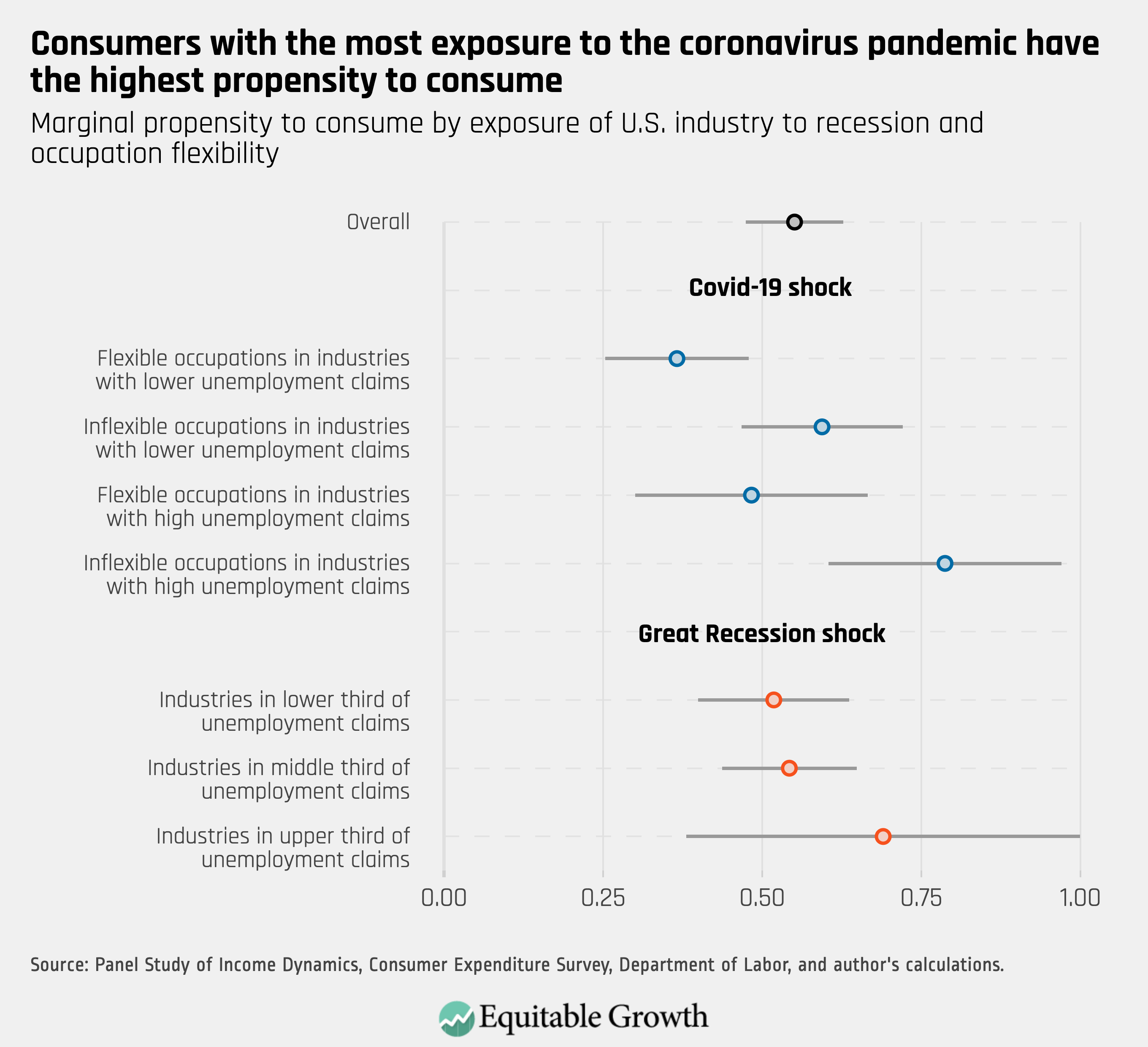

A clear picture emerges from the resulting estimates. Workers who are likely to be the most exposed to the shock—those in inflexible occupations within exposed industries—are precisely those with the highest estimated marginal propensities to consume. Workers in industries exposed most immediately to the COVID-19 shock have slightly higher MPCs than those in less-exposed industries, but workers in inflexible occupations have much higher MPCs than those in flexible occupations.

Moreover, the difference across groups is substantial. Workers in inflexible occupations and in industries that have seen the biggest increases in initial layoffs have marginal propensities to consume that are about double those of workers in flexible occupations within industries that were less directly affected. (See Figure 2.) These results echo findings in several other recent pieces on occupational exposure to the COVID-19 shock, which also find that occupations that are lower-income and require less education are much more exposed.

Figure 2

As a loose point of comparison, I implemented a similar exercise examining what happened during the Great Recession of 2007–2009, defining the initially exposed industries as those with the largest increases in Unemployment Insurance claims from September 2007 and April 2008, a window that should roughly capture the onset of the Great Recession. In that case, the most exposed industry was construction and the least exposed was education.

Given the very different nature of the 2008 shock, there were no obvious dimensions that defined which specific occupations within industries were exposed initially to the twin housing and financial crises. Therefore, I focus only on industry to define which workers were most exposed in 2008. The bottom part of Figure 2 shows the estimated MPCs for each third of that cross-industry distribution: The workers in the more exposed industries had higher MPCs on average, but the differences were much more modest. This suggests the initial shock from COVID-19 is more unequally distributed than the initial shock was in 2008.

It is important to note that the patterns in Figure 2 capture only the initial incidence of the COVID-19 shock. To the extent that this initial public health crisis sparked by the coronavirus pandemic becomes a more traditional aggregate demand shock, the general patterns that I document in my working paper are likely to persist as the consumption multiplier loop begins. As firms are forced to shed workers, they are likely to follow the patterns of past recessions and lay off their receptionists before their scientists.

Conclusion

The estimates above suggest that policymakers should be especially focused on targeting policy responses toward those who lost their labor income if they want to limit the severity of the coronavirus recession. The good news is that there are several tools at their disposal that will achieve this—and, even more encouraging, many of these policies are featured in the $2.2 trillion stimulus bill that Congress passed in late March.

The extra $600 in weekly unemployment benefits and the extension of benefits to part-time and contract workers will help all unemployed workers smooth their consumption, dampening both the level of marginal propensities to consume across the board and the dispersion in MPCs among the unemployed. Moreover, hundreds of billions of dollars targeted for firms that maintain their employee payrolls close to where they stood as of February 2020 could help firms stave off that initial wave of layoffs or encourage them to bring back employees who were either let go or furloughed.

There already are reports, however, of Unemployment Insurance systems in the 50 states, the District of Columbia, and U.S. territories being overloaded by recently laid-off workers seeking unemployment benefits. And the financial assistance to firms to keep workers employed is suffering through bottlenecks at their banks and the U.S. Small Business Administration. In order for the smoothing effects of unemployment benefits on workers’ marginal propensities to consume to be successful, we need workers to be able to access those benefits quickly and sustainably now and as the extent of the coronavirus recession becomes more clear.

Federal and state policymakers should take quick action to ensure these benefits can be rapidly distributed, for example, by following the policy recently recommended by economist Arindrajit Dube at the University of Massachusetts Amherst and Jesse Rothstein at the University of California, Berkeley in their issue brief “Pay now, Verify Later to Loosen the Unemployment Insurance Bottleneck.” Similarly, Congress and the Trump administration need to make sure the funds for businesses to maintain their payrolls are distributed quickly, and as they prepare to draft the next round of stimulus legislation, keep targeting aid toward those who both have lost the most and who are most likely to spend the dollars they receive.

—Christina Patterson is currently a postdoctoral scholar at Northwestern University. She received her Ph.D. in economics from the Massachusetts Institute of Technology in 2019 with a focus in macroeconomics and labor. In July 2020, she will begin as an assistant professor at the University of Chicago’s Booth School of Business.