Overview

In recent years, policymakers have become increasingly focused on creating a national program of paid family and medical leave. The current patchwork arrangement of federal legislation, state initiatives, and employer-provided benefits leaves many workers without coverage. The federal Family and Medical Leave Act of 1993 grants unpaid job protection but covers less than 60 percent of the workforce.1 Workers can access paid leave only if they reside in one of the nine states or the District of Columbia that have passed paid family and medical leave legislation or if their employer offers these benefits—but both options provide uneven protection.

The limitations of the current system became particularly evident during the coronavirus pandemic, when many workers struggled to balance the demands of their jobs with caregiving responsibilities and a public health crisis. In response, federal policymakers enacted emergency measures, such as the Families First Coronavirus Response Act of 2020, to require some employers to grant COVID-related paid leave. With many of these measures now expired, policymakers are debating whether the United States should adopt a comprehensive national paid family and medical leave program.2

The Biden administration recently proposed paid leave as part of its Build Back Better plan. The version of this plan that passed the U.S. House of Representatives in November 2021 would provide 4 weeks of paid leave and replace workers’ wages on a progressive scale (capped for high earners). This provision relies on general revenue, whereas most state programs and the proposed Family and Medical Insurance Leave Act—one alternative federal proposal—use a dedicated payroll tax to finance benefits.

Paid family and medical leave advocates have long argued that a national program would improve both social and economic outcomes. On the social side, they argue that time off to bond with a new child enhances the lifetime health of both infant and mother and improves gender equity in the workforce, and that a national paid leave program would reduce the current inequality of access by race and income. On the economic side, they assert that access to paid family and medical leave makes working families more financially secure; boosts employee morale and reduces turnover; encourages fertility during a time of population aging; reduces reliance on Social Security Disability Insurance; and ultimately increases national Gross Domestic Product.

But the push for a national paid family and medical leave program is not without opponents, who argue that such a program would generate significant public expense without achieving these goals.3 In addition, business groups are concerned that the policy would impose undue costs on employers.4

Understanding how a national program would affect workers, firms, and the economy overall is of paramount importance. The answer depends a lot on the specifics of the ultimate design. This report assumes that the system is financed by a payroll tax and addresses the question whether employers should be allowed to opt out of the federal program and related payroll tax if they provide workers with private paid family and medical leave benefits at least as generous as the national program. The incentive for employers to opt out arises in the context of a program financed by a payroll tax because opting out eliminates their obligation to pay the tax. Thus, if the program were instead financed by general revenues, employers would have no incentive to opt out, and the question would be largely moot. (See sidebar.)

The analysis in this report is based on the classic economic framework and involves comparing the outcomes of such a partially privatized system against a fully public program along three dimensions:

- The distribution and level of benefits

- The distribution of costs

- Employer practices, such as disability accommodations and employment discrimination

The discussion proceeds as follows. The first section defines the terminology used in this report and the types of leave programs offered. The second section outlines the current paid family and medical leave landscape, including federal legislation, state programs, and employer-provided benefits. The third section summarizes existing research on paid family and medical leave, and highlights gaps in the knowledge base that complicate analysis of a partially privatized program.

The fourth section outlines a conceptual framework for evaluating how allowing employers to opt out of a public paid family and medical leave program would affect the generosity of benefits, the distribution of the costs, and employer practices. Some predictions of the framework—particularly regarding family leave—are subject to significant uncertainty without further research to identify why current provision of employer-provided paid family and medical leave benefits is low. In these cases, the conceptual framework demonstrates how additional research could improve the analysis going forward. The fifth section describes potential sources of state policy variation and data that future researchers could use to advance the conversation.

The last section concludes with two key points. First, the desirability of allowing an employer to opt out under a program financed by a payroll tax ultimately depends on policymakers’ preferences for redistribution. Financing benefits with a payroll tax distributes the costs broadly, with low-use workers subsidizing the cost of benefits for high-use workers, while allowing employers to offer private plans means that workers will bear the full cost of their own benefits through lower wages or reduced employment. Second, more research is needed to understand the current low provision of family leave benefits before researchers can advance a firm theory of the economic consequences of partially privatized paid family and medical leave.

Defining paid leave

This section describes the benefits that can be provided under paid family and medical leave programs and the various types of programs.

Paid leave benefits

Paid leave programs can provide three specific benefits to a worker:

- Wage replacement. Workers receive a percentage of their wages for a specified number of weeks while they are out of the labor force.

- Job protection. Workers have the right to return to their jobs (or equivalent ones) after taking leave, up to a specified number of weeks. In most circumstances, employers cannot fire employees with job protection for taking leave, although in some instances, employees can be fired while on leave if their positions would have been eliminated regardless.

- Continued health insurance. During leave, workers retain access to any employer-provided health insurance. Employers pay their share of the premiums, and employees remain responsible for their share. If an employee does not return to work after leave, the employer may be able to reclaim the premiums paid.

We will use the term “full paid leave” to describe policies that cover all three components. The term “unpaid” leave refers to job protection and continued health insurance without wage replacement. Policies that offer wage replacement without job protection will be distinguished as “paid-but-unprotected” leave.

Types of paid leave programs

Paid leave programs can cover many distinct reasons for leave, each with their own motives and effects.5 These reasons include:

- Medical leave, also referred to as temporary disability insurance, which covers personal, short-term disabilities that have included pregnancy-related disabilities since 1978.

- Family leave, an umbrella term that includes leave to bond with a new child, as well as leave to care for a loved one with a serious medical condition.

- Bonding leave provides wage replacement for parents, regardless of gender, to bond with a new child. Childbirth and adoption are both qualifying events, and most state programs include the placement of a child in foster care. Colloquially, bonding leave is sometimes referred to as maternity or paternity leave, even though the law does not make distinctions based on gender. Leave limited to birth-related medical conditions is referred to as pregnancy-related temporary disability insurance.

- Caregiving leave offers wage replacement for an employee to care for a loved one with a short-term medical condition or serious medical condition for a limited period. It does not provide open-ended benefits to pay for long-term care for an elderly relative.

- Bereavement leave, which provides wage replacement for employees after the death of loved ones. No current public paid leave program provides bereavement leave.

- Military family leave, which offers wage replacement for an employee to take time off before a family member is deployed or to care for an injured or seriously ill servicemember or veteran.

- Safe leave, which provides wage replacement for victims of sexual assault, stalking, or domestic violence.

Comprehensive paid family and medical leave is an umbrella term that typically includes, at a minimum, medical, bonding, and caregiving leave.

The current U.S. leave landscape

Many U.S. workers can receive unpaid leave under the federal Family and Medical Leave Act and paid leave from their state if their state has a currently operating public program or employer mandate. All other benefits are provided through employers.

Federal leave policies

The Family and Medical Leave Act of 1993 offers 12 weeks of unpaid leave, covering temporary disability insurance, bonding, caregiving, and military leave. Employees have the right to return to the same or an equivalent job unless they would have been laid off if they had not taken leave. While on leave, employees also retain any employer-provided health insurance, although employers can recover their expense if an employee decides not to return to work.

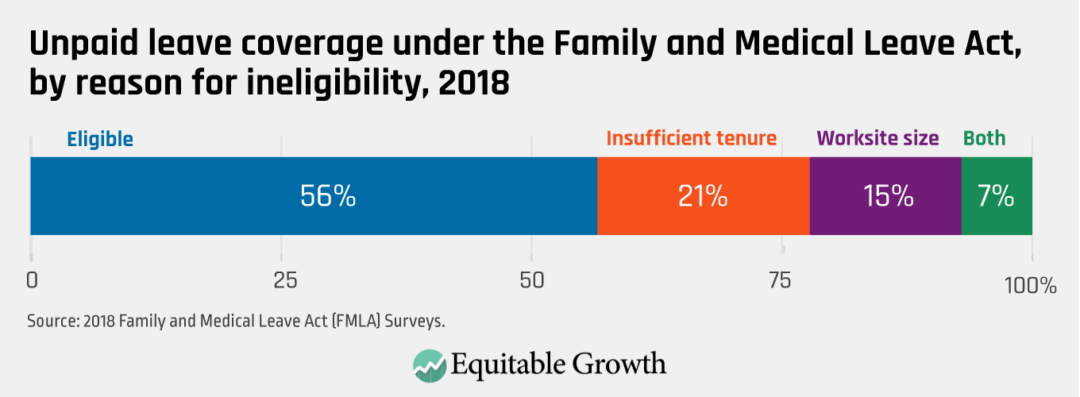

Unfortunately, the law’s strict eligibility requirements mean that many workers are not eligible. These requirements relate to size, as the law applies only to employers with 50 or more employees within a 75-mile radius; and to tenure, as employees need to work at least 1,250 hours during the year before leave and need to have worked for their employer for at least a year. Seven percent of workers are ineligible due to both restrictions, while an additional 15 percent are affected only by the size restriction and 21 percent only by the tenure restriction. (See Figure 1.)

Figure 1

Together, these provisions mean that only 56 percent of workers were covered in 2018.

In addition to the Family and Medical Leave Act, the federal government recently began offering tax credits for employers who provide paid leave. These credits were introduced as a temporary 2-year program in the Tax Cuts and Jobs Act of 2017, but Congress has extended them through 2025. Employers providing qualified paid leave receive a tax credit of 25 percent of the benefits paid. Employer-provided paid leave must offer at least 50 percent wage replacement, not counting any state-mandated benefits. Any employer claiming the credit also must provide protected leave.

State paid leave policies

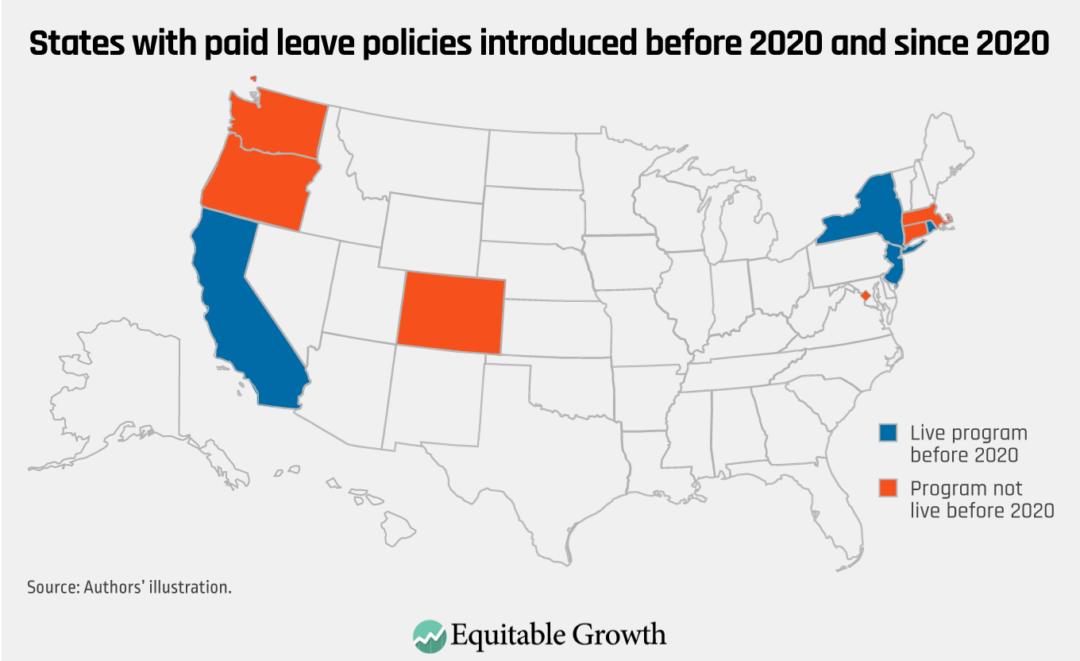

Most of the wage-replacement policies in the United States are implemented by states.6 This summary focuses on the four states that introduced their comprehensive paid leave programs before 2020: California, New Jersey, New York, and Rhode Island.7 (See Figure 2.)

Figure 2

Although several states—Colorado, Connecticut, Massachusetts, Oregon, and Washington state—and the District of Columbia have all enacted or implemented paid family leave policies in 2020 or after, meaningful data will not be available for a few years. Early data may also be affected by the unique medical and caregiving challenges posed by the coronavirus pandemic.

Temporary disability insurance

In states with comprehensive paid leave programs that offer medical, bonding, and caregiving leave, temporary disability insurance is by far the largest leave type in terms of claims and expenses. The following overview provides the highlights for the states that had programs in place before 2020.

- California. The nation’s most populous state has offered up to 52 weeks of paid medical leave (wage replacement only) since 1946 through its state disability insurance program, which is funded by a payroll tax on employees.8 Employers can opt out and offer a voluntary plan. Employees covered by a voluntary plan do not pay the payroll tax, and the employer can either deduct the costs from employees’ wages or pay the benefits themselves. The conditions for an employer to offer a voluntary plan are four-fold. The plan must offer better benefits than the state plan; the plan cannot cost the employee more than the state plan; the employer needs to post a security deposit with the state; and the employer needs written consent from a majority of their employees. Any employee has the right to individually reject the voluntary plan and return to the state plan and pay the payroll tax.

- New Jersey. This state has offered paid medical leave (wage replacement only) since 1948 through its temporary disability insurance program. The program provides up to 26 weeks of wage replacement, funded by a payroll tax split between employers and employees. Employers can opt out of the public system to offer their own plans, provided the plans offer the same or greater benefits and coverage as the state’s program. Under a private plan, neither employers nor employees pay the payroll tax. As in California, the cost to the employee cannot exceed the cost of the state program. If employees have to contribute to the plan, the employer needs written consent from a majority of their employees to opt out of the state program.

- New York. This state has offered paid medical leave (wage replacement only) since 1950. New York employers are responsible for providing the insurance, either by self-insuring or by purchasing a plan, which may include a competitive, public-option state plan. Employers may deduct the cost from employee wages up to a cap or pay for the benefits themselves.

- Rhode Island: The nation’s smallest state has offered paid medical leave (wage replacement only) since 1943 through its temporary disability insurance program, under a public system. This program provides up to 30 weeks of wage replacement, funded by a payroll tax on employees. Employers cannot opt out of the public system to offer their own plans. The state offers unpaid leave through the Rhode Island Parental and Family Medical Leave Act (passed in 1987), which provides employees access to job protection and continued health insurance for 13 weeks.9

Pregnancy-related temporary disability insurance

All temporary disability insurance programs expanded in the 1970s to cover pregnancy- and childbirth-related medical leave. The Pregnancy Discrimination Act of 1978, passed by Congress, requires pregnancy-related disabilities to be covered equal to any other disability protections for employees. In practice, plans tend to cover 6 weeks for natural childbirth and 8 weeks for cesarean sections.

- California’s state disability insurance program (in place since 1978) has offered paid, but unprotected, leave for pregnancy-related disabilities, including 6–8 weeks for recovery from childbirth; job protection during that period is provided under the state’s pregnancy disability leave.

- New Jersey’s temporary disability insurance program has long provided 6 weeks (8 weeks for C-sections) of paid, but unprotected, pregnancy-related temporary disability insurance leave.

- New York case law since 1976 has required New York employers to provide paid, but unprotected, benefits to birth mothers under the temporary disability insurance program.10

- Rhode Island’s temporary disability insurance program has provided paid, but unprotected, pregnancy-related leave, covering 6 weeks of post-birth wage replacement (8 weeks for C-sections).

State family leave

In recent decades, California, New Jersey, New York, and Rhode Island all expanded their temporary disability insurance programs to offer comprehensive paid family and medical leave, which also includes bonding and caregiving leave. More specifically:

- California expanded its paid leave offerings by providing wage replacement for caregiving for a family member with a serious medical condition or bonding with a new child through the California Paid Family Leave program, which took effect in 2004. For any program participant who also takes pregnancy-related temporary disability insurance, bonding leave follows leave taken through the state disability insurance program and is funded with the same payroll tax. Any employer offering a voluntary plan must cover paid bonding leave and caregiving leave, along with temporary disability insurance. The California Paid Family Leave program currently offers 8 weeks of additional paid, but unprotected, leave on top of the full paid leave provided through existing programs.

- New Jersey, beginning in 2009, offers paid, but unprotected, bonding and caregiving leave through its Family Leave Insurance initiative. This program is financed entirely by a payroll tax on employees, though employers may also offer private plans for family leave.

- New York, since 2018, offers full paid family leave, including wage replacement, job protection, and continued health insurance for workers to bond with a new child or provide care to a family member with a serious medical condition. Paid family leave is financed through a payroll tax on employees, which employers collect to purchase insurance.

- Rhode Island, beginning in 2014, offers paid, but unprotected, family leave to workers with new children or family members with serious medical conditions through their Temporary Caregivers Insurance program. This program is administered by the same agency, has the same eligibility requirements, and is funded through the same payroll tax as the temporary disability program. The 2014 legislation provides a maximum of 4 weeks of paid family leave.

Employer-provided leave policies

Employers are, of course, subject to any federal or state provisions concerning both unpaid and paid leave policies, assuming they do not fall under the exemptions—such as, for unpaid leave under the federal Family and Medical Leave Act, having fewer than 50 employees in a 75-mile radius. But beyond the patchwork of required coverage under federal and state laws, some employers voluntarily offer unpaid or paid leave programs.

Employers may decide to offer such programs to attract new workers or to retain their existing workers after childbirth or disability. In states with a paid leave program or mandate, employers may “top up” the benefits and offer higher wage replacement rates than the public system alone. Employers are generally free to offer any type of leave to meet any subset of employee needs. They are free, for example, to offer only unpaid leave or only paid bonding leave coverage.

The Pregnancy Discrimination Act of 1978, however, requires employers to provide pregnancy-related medical leave on the same terms and conditions as they provide leave to other workers with similar but non-pregnancy-related physical limitations. Similarly, if employers offer bonding leave to women, they must also offer it to men, per guidance from the U.S. Equal Employment Opportunity Commission under Title VII, 29 CFR Part 1604.

In terms of unpaid leave, a number of employers have established their own policies independent of the federal requirement. Specifically, the National Compensation Survey finds that 89 percent of workers had access to some form of unpaid leave in 2021 even though the federal law only covers 56 percent of workers. Access was higher than what the unpaid leave law strictly requires even for part-time employees (81 percent), for the lowest-wage occupations (78 percent), and for firms with fewer than 50 workers (82 percent).

In terms of paid leave, temporary disability insurance is the most common type offered by employers. The National Compensation Survey finds that 42 percent of private-sector workers have access to a short-term disability insurance plan, which provides some wage replacement. Most access is for full-time employees (51 percent), with little access for part-time employees (16 percent). Access to temporary disability insurance varies greatly by income. Among the top-paid occupations, 64 percent of workers have access to it, compared to only 17 percent of those in the lowest-paid occupations.

Paid family leave is more sparsely available, with 21 percent of workers having access to such leave for any condition; restricting to full-time employees, 25 percent have access. Even among the highest-paid occupations, only about a third of workers have access to paid family leave.

While formal access to employer-provided paid leave is low, employers can provide access through other paid time off. About half of employees report the ability to take paid time off for family leave.11 Employees may use paid vacation or sick days to take their leave, rather than accessing an explicit program dedicated for family leave. Paid sick leave and vacation are much more common workplace benefits, with both available to about three-quarters of the overall workforce and to about 90 percent of full-time workers.

Yet the duration of these leaves is relatively short—about 3–4 weeks combined, on average.12 Significant heterogeneity exists for the length of these other leave programs by job type and income.

Employers who voluntarily offer paid leave benefits can either self-insure or contract for services with a commercial insurance provider. While a robust national market exists for private group temporary disability insurance, very few providers currently offer family leave insurance. New York hosts the strongest market for this insurance because it mandates that employers obtain private coverage.13

Private group temporary disability insurance plans are typically experience-rated, so employers whose workforces are more likely to take leave pay higher premiums. But information on the pricing of these premiums remains closely guarded, so it is not clear whether employers in every state can access low-fee products.14 In contrast, private group family leave plans in New York are community-rated, preventing insurers from charging higher premiums based on expected cost.

Summary of the leave landscape

The current system of federal, state, and employer leave policies is extremely fragmented and piecemeal. In this environment, most workers lack paid leave coverage, and some even still lack unpaid leave access. The range and cost of paid leave coverage varies extensively depending on the worker’s characteristics; the size, location, and nature of the employer; and whether the leave is provided under federal and state policies or voluntarily offered by the employer.

The next section summarizes the existing research literature on the effects of leave policies on employers and employees.

Research on unpaid and paid leave

To date, most studies of paid family and medical leave either examine how federal and state leave policies affect workers’ wages and labor supply, or they explore how bonding leave impacts children’s health. While these studies are certainly helpful for analyzing partially privatized paid leave, understanding whether employers will opt out of a national program requires additional information that is often discussed in the context of other economic policies but has not yet been covered in the leave literature.

Hence, the goal of this section is to establish what is known by summarizing the literature on both unpaid and paid leave.15 The next section of the report will then start to build a conceptual framework for partially privatized paid family and medical leave, highlighting areas where key information is missing from the current literature.

Even within the focus on wages and labor supply, interpreting the findings from paid leave research is often difficult because federal and state policies affect behavior through many channels simultaneously. Since the ultimate outcome of these competing forces depends on the specific design of the programs and the research methodology employed, different studies of the same program can yield results that seem to conflict but are actually consistent with the same theory. Thus, this literature review begins with a brief overview of economic theory.

A quick review of the theory

The classic economic framework begins by assuming a labor market in which employers make competitive job offers, composed of wages and possibly leave benefits. Employers are theoretically indifferent between offering a compensation package with higher wages and no leave and a compensation package with lower wages and leave benefits, provided the costs will be the same.

Specifically, employers are willing to offer leave if they can pass on the full cost to the employee.16 For example, Gruber and Krueger (1991) and Fishback and Kantor (1995) studied another mandated benefit, workers’ compensation insurance, and found that employers shift the costs of insurance onto employees through lower wages. Gruber (1994) studied the effects of a mandate that health insurance cover childbirth, finding that women of childbearing age took a wage cut, relative to men and older women.

Similarly, obese workers have higher healthcare costs. Bhattacharya and Bundorf (2009) and Bailey (2013) find that these costs show up in lower wages, relative to nonobese workers.17 And Bailey (2014) shows that mandates for health insurance to cover prostate cancer screenings reduced wages for men over age 50.

In the classic framework, mandated leave benefits affect labor supply through both the benefit itself and the wage effects outlined above. Although employers pass the cost of the benefit mandate onto workers, how workers respond depends on their valuation of the new benefit and their propensity to leave the workforce due to a modest shift in compensation.

A large empirical literature suggests that prime-age workers are very attached to the labor force, so relatively modest changes to the wage-benefits package will not change their employment status.18 But specific groups of workers, such as very young workers, older workers, and, historically, women workers are often less attached to the labor force.19 If some of these workers prefer the old compensation package, they may respond by decreasing their labor supply.

In addition to this effect from the classic framework, leave policies can affect labor supply through three other channels, depending on whether the policy contains job protection, wage replacement, or a payroll tax. These channels can affect labor supply before and after a qualifying event separately. Specifically, leave policies can change employment either before the leave is taken, which is the case for the classic effect, or afterward, when the leave benefit affects how workers return to work after leave.

Job protection is predicted to increase labor supply after leave is taken, as it allows workers to return to their previous jobs. Returning to their pre-leave jobs removes the costs of searching for a new job, making it easier for workers to reenter the labor force. Additionally, workers returning to their pre-leave employers retain some employer-specific experience. Between the lower costs of returning and higher job quality, workers returning from protected leave are predicted to be less likely to exit the labor force after taking leave.

In contrast, wage replacement is predicted to decrease labor supply after a qualifying event. First, in theory, wage replacement incentivizes eligible workers to take more and longer leaves by paying them to stay home—although, in fact, these leaves tend to be brief, and the total impact on overall employment is small. Second, wage replacement may reduce employment after leave for workers not covered by job protection, who may have to quit to take the benefit if their employers do not voluntarily grant them the time away from work.

Public wage replacement programs can also affect labor supply when financed through a payroll tax on all workers, as done in some state paid leave programs. This tax amounts to an income transfer from those unlikely to use the benefits to those likely to take leave. In the context of paid bonding leave, for example, financing benefits with a general payroll tax means that parents do not pay the full cost of their expected use because they receive a subsidy from nonparents.20

By giving parents a subsidized benefit for working, this financing mechanism is predicted to increase their labor supply prior to becoming parents.21 This benefit transfer is not unique to paid leave, of course, and is present in all types of insurance, such as medical insurance where frequent users of the medical system have their care subsidized by low-use individuals in the same insurance pool.

We will distinguish between these four labor-supply channels when interpreting the results from the existing literature.

Evidence from the federal unpaid Family and Medical Leave Act

The classic theory outlined above yields a set of predictions about the wage and employment effects of unpaid leave under the federal Family and Medical Leave Act. By mandating that workers at large firms receive unpaid job protection after temporary disability and childbirth, and for bonding and caregiving purposes, the law is predicted to increase employment after leave-taking and slightly decrease the wages of workers who are likely to use the benefit.

Employment

Evidence on the employment of young women suggests a slight increase due to unpaid leave under the Family and Medical Leave Act. Thomas (2020) studies the employment effects using the Panel Study of Income Dynamics, which provides panel data on a person’s employment status before and after the enactment of the Family and Medical Leave Act. This study finds that the law increased the employment of young women.22

Wages

Research on the effects of the Family and Medical Leave Act on the wages of young women has not found any impact. Waldfogel (1999) and Baum (2003) compare the labor force outcomes for women of childbearing age between states with and without prior unpaid leave mandates; the federal law would only have had an impact in states without preexisting mandates. Men are also used as a control group to address state-specific trends. Waldfogel (1999) uses data from the Current Population Survey, while Baum (2003) uses data from the National Longitudinal Survey of Youth, which only focuses on a single cohort.

The lack of statistically significant findings on wages is actually not unexpected since the costs of complying with the unpaid leave law are likely quite small each year. First, short, unpaid leaves have low costs to employers.23 Second, only a fraction of women have children in a given year. Finally, the federal leave law only introduced unpaid leave to a fraction of the population.24 Overall, then, a back-of-the-envelope estimate for the fall in wages would be, at most, 1 percent, and existing studies lack statistical power to detect such a small effect.

A recent study by Thomas (2020), however, finds that employers were less likely to train and promote women under age 40 after the enactment of the Family Medical and Leave Act. This result diverges from the classic theory in that firms reduce their investment in women rather than simply cutting women’s wages upfront. To explain this result, Thomas (2020) proposes an alternate theory, in which employers incur initial costs to train their workers and expect to reap a productivity return that increases with future work hours. Since women who take bonding leave may be more likely to be family-oriented and work fewer hours post-leave, employers may choose not to provide leave benefits in order to screen for women highly attached to work. When unpaid leave is mandated, employers lose information about a woman’s future work hours, and they end up discriminating against all women.25

Child outcomes

Rossin (2011) found that the federal unpaid leave law greatly decreased infant mortality. Notably, these benefits far exceeded the relatively minor cost in lower wages.26 This discrepancy—the high benefits and low costs—suggests that unpaid leave was underprovided prior to the law, and some economic factor was preventing women from selecting jobs with unpaid leave but lower wages. One possible factor is the training cost theory in Thomas (2020) detailed above.

Evidence from California’s paid family leave program of 2004

Almost all research on paid leave focuses on California due to its large population and long-running paid leave programs. Specifically, many papers study how the California Paid Family Leave and Pregnancy Disability Leave programs affect the labor supply of either new mothers or young women. To place the parental leave results in context, recall that the state’s paid leave law extended paid-but-unprotected leave by transferring resources from nonmothers to mothers through a payroll tax.27 Prior to its enactment, pregnant women in California had access to 6–8 weeks of full medical leave through the state disability insurance program, and parents at large firms also had an additional 4–6 weeks of protected-but-unpaid bonding leave through the federal Family and Medical Leave Act.

The classic economic framework makes several predictions about the effects of California’s paid leave law on women of childbearing age. Regarding employment, the prediction depends on a woman’s future fertility expectations, as well as her current employment status. The income transfer from the payroll tax should increase the labor supply of young women who anticipate having children in the near future. After childbirth, if a paid leave policy does not include job protection, employers may opt to end the employment relationship when a worker takes leave, making it more likely that the worker will leave the labor market.28 The combined effect of these mechanisms on the aggregate employment rate of young women is, therefore, an empirical question.

On the wage front, firms offering full job protection face higher indirect leave costs, which they are predicted to pass on to young women.29 Counterintuitively, firms that do not offer full job protection may actually experience a decrease in costs if new mothers are more likely to quit and firms do not prioritize their retention to begin with. So, the overall effect on the wages of young women is also theoretically unclear.

Employment

The results on pre- and post-birth employment are generally consistent with theory.30 Baum and Ruhm (2016) and Byker (2016) use data from the NLSY-97 and Survey of Income and Program Participation, respectively, to show that maternal employment increased in the year preceding childbirth.31 After childbirth, Baum and Ruhm (2016) and Byker (2016) find that the employment of new mothers declines while benefits are available, then rises again. Sarin (2017) studies whether new mothers are more likely to remain with their pre-birth employer, differentiating between women with full protected leave and those whose jobs did not offer protection. Using the linked employer-employee Longitudinal Employer-Household Dynamics dataset, she finds that the California Paid Family Leave law increased job separation among women without job protection, relative to women with protection.

Similarly, Bailey and others (2019) use Statistics of Income data from the IRS to show that providing paid-but-unprotected leave without increasing labor market attachment before birth has a slight negative effect on post-birth employment.32 Lastly, Das and Polachek (2015) use data from the Current Population Survey to explore the effect of the state’s paid leave law on the overall employment of young women and find that labor force participation increased, compared to men and older women in California.33

Wages

Research generally finds the California paid leave law had no impact on the wages of young women and new mothers in aggregate (Rossin-Slater, Ruhm, and Waldfogel, 2013; Baum and Ruhm, 2016; and Curtis, Hirsch, and Schroeder, 2016). As with the federal unpaid leave law, this lack of empirical results is not surprising, given the competing economic forces outlined earlier, as well as the relatively small cost of the benefit to firms and the imprecision of most publicly available datasets (Curtis, Hirsch, and Schroeder, 2016). But Sarin (2017) shows that the California law reduced hiring of young women at firms providing job protection, relative to those firms exempt from providing protected leave.

Financial well-being

A few studies consider how California’s paid leave law affects other measures of financial well-being. For instance, Stanczyk (2019) uses the American Community Survey and finds that the law reduced poverty and increased household income for mothers of 1-year-olds. The increase in income appears to come from higher earned income and the benefit transfer paid leave represents, rather than the leave itself.34 In other examples, Lenhart (2021) uses the Current Population Survey and finds that the California Paid Family Leave program reduced food insecurity for families with infants; and Rodgers (2020) shows that the program reduced precautionary saving among higher-income families.

Child outcomes

As with unpaid leave, studies of the California paid leave law on children offer clear evidence of an underprovision of paid leave benefits. The health benefits for children seem large and important. Lichtman-Sadot and Bell (2017) find better child health outcomes, and Pihl and Basso (2019) find lower infant hospital admissions. Further evidence suggests that these benefits come from the increased time spent with children that leave provides, rather than improved household finances.

In separate studies, Rossin-Slater, Ruhm, and Waldfogel (2013) and Baum and Ruhm (2016) find that the state’s paid leave law increased leaves, allowing mothers to spend more time providing care. Huang and Yang (2015) and Pac and others (2019) find an increase in breastfeeding; and Choudhury and Polachek (2021) find an increase in vaccination rates among infants. Similar to research on the federal unpaid leave law, this body of evidence supports the notion that some market force is preventing the adequate provision of paid bonding leave. Otherwise, parents would be willing to pay the small costs of the benefit for the positive effects on their children.

Evidence on pregnancy-related temporary disability insurance leave in other U.S. contexts

A couple of studies have examined pregnancy-related leave provided through temporary disability insurance at the state level. For example, Stearns (2015) examines the effects of expanding California’s state disability insurance to cover pregnancy-related disabilities in the 1970s and finds significant health improvements for children, including a reduction in preterm birth and low birth weight.

More recently, Campbell and others (2017) study how paid-but-unprotected medical leave offered through Rhode Island’s temporary disability insurance program affects women’s employment; the authors compare outcomes for very-low-income mothers above and below the program’s income-eligibility cutoff, finding no significant difference.

Research on related social insurance programs

Although most recent research on paid leave focuses on the impact of mandated bonding leave benefits, a few studies touch on other aspects of paid leave that are useful for our conceptual framework. Coe and Belbase (2015), for example, suggest that many workers do not value long-term disability benefits because they underestimate the likelihood of experiencing a covered medical condition.

And a large literature on workers’ compensation insurance finds that increasing the generosity of workers’ compensation benefits incentivizes injured workers to take more and longer leaves (Krueger, 1990; Butler and Worrall, 1991; Dionne and St-Michel, 1991; and Biddle and Roberts, 2003). In Texas, the only state that allows employers to opt out of the workers’ compensation program, Moranz (2010) shows that a primary driver of employer nonparticipation in the program is the desire to reduce costs by offering private benefits.

What is missing from the literature on paid family and medical leave?

Despite a very large body of academic literature on paid family medical leave, almost none of the studies discussed so far can explain why so few employers currently provide paid leave benefits. For example, given that paid bonding leave has such a positive impact on children, what prevents parents, particularly young women, from negotiating this valuable benefit as part of their compensation package?35

Thomas (2020) is one of the few studies to describe a market inefficiency—asymmetric information—that prevents women from trading wages for job protection. A labor market inefficiency could be responsible for inadequate wage replacement as well. And not enough research exists on the commercial market for paid family and medical leave insurance to rule out a product-market story. Research in various health insurance contexts, for example, shows that adverse selection—when only high-use individuals have insurance in the private market—can cause an underprovision of benefits when private insurers are unable to properly price their products.36 Yet, to our knowledge, no studies examine whether such adverse selection appears in the market for private paid family and medical leave plans.

As we will demonstrate in the next section, the root cause of this underprovision of benefits in the private insurance market affects any analysis of partially privatized paid family and medical leave.

Framework for comparing alternative financing approaches

Drawing on lessons from previous literature, this section presents a conceptual framework for evaluating how allowing employers to opt out of a public paid family and medical leave program affects the generosity of benefits, who bears the cost of the program, and employer practices. Classic economic theory predicts that employers will weigh two factors when deciding whether to opt out of a public paid family and medical leave program:

- The likelihood that their specific workforces will use the new paid leave benefits

- The cost of offering a private plan, relative to the cost of remaining in the public system

If employers can offer the same benefits as the public program at a lower cost, then the theory predicts that firms with low-use employees will exit the public system, driving up costs for everyone remaining in the system.

These higher costs, in turn, create a cycle in which more employers can reduce costs by exiting the public system, and their exit, in turn, leads to further cost increases for those remaining in the public system. This cycle of increasing program costs and decreasing participation is called unraveling.

Yet it turns out that forecasting the extent of program unraveling is quite difficult in practice. The reason is that researchers have not yet determined why so many workers currently lack public paid family and medical leave benefits, and adjusting the framework to accommodate different explanations significantly affects our predictions about the likelihood that employers will ultimately opt out of a public program.

Further, making predictions about the response of employers to a comprehensive paid leave program that would include medical, bonding, andcaregiving leave is a complex exercise. Consequently, we offer heuristic examples of how employers might respond to specific ideal types of programs. These stylized examples illustrate important variables and outcomes to consider for academics who hope to evaluate real-world paid leave programs.

The rest of this section proceeds in four stages. First, it uses the stylized example of a theoretical program that would provide temporary disability insurance only for unanticipated conditions to illustrate how the theory of mandated benefits yields a general framework for understanding employers’ decision to opt out of a public program, with consequent implications for the distribution of benefit levels and cost burden.

Then, it extends the analysis to consider the case of a paid leave program that would cover temporary disability insurance for anticipated conditions, as well as bonding leave, with a focus on access to pregnancy-related medical leave and bonding leave, which is partially covered by real-world temporary disability insurance plans but where the root cause of underprovision has not been identified. This stage of the analysis compares two possible explanations for underprovision. One is driven by asymmetric information in the labor market. The other is driven by lack of competition in the insurance market. Each of these explanations yields different predictions about the outcomes of interest.37

The third stage introduces caregiving leave. The implications of an option to privately provide caregiving leave in lieu of publicly provided benefits for program financing are even more ambiguous than the implications, previously discussed, for providing temporary disability insurance for anticipated conditions and bonding leave. The final stage ties these elements together, discussing additional complications that arise when analyzing a comprehensive public paid family and medical leave program, rather than separate benefits in isolation.

An illustration of the framework: The case of temporary disability insurance for unanticipated conditions

This illustration of the mandated benefits framework describes the underlying assumptions about workers and firms, discusses the different financing options for temporary disability insurance, and then generates four testable hypotheses.

Why think about temporary disability insurance for unanticipated conditions?

For the purpose of this analysis, we divide medical conditions serious enough to require time off from work into two types: unanticipated and anticipated. Some conditions, such as cancer diagnoses, spinal fractures, and neuromuscular degenerative diseases, come to workers as surprises. Other conditions, such as pregnancy, can sometimes be planned.

Examining leave taken for unanticipated conditions offers the cleanest illustration of some of the economic forces at play in our framework—chiefly, that employers are able to assess their employees’ risk of taking leave with a fairly high level of accuracy because they can assess the costs at an aggregate level for their workforce, while employees will generally systematically underestimate their risk of experiencing an unanticipated medical condition. This heuristic thus offers a simple starting place for considering how workers and firms would interact with a publicly provided paid leave system that allowed for employers to opt out.

Assumptions about workers and firms

This analysis assumes competitive labor markets in which employers make job offers to workers, dividing total compensation between wages and temporary disability insurance benefits. Workers face some risk of an unanticipated temporary disability that would make them unable to perform some tasks of their jobs. Wages are only paid while working, so workers want paid leave benefits to provide income when they are on leave. The value that workers place on wages versus benefits is not necessarily equal to the employers’ cost of providing them. When workers value these benefits at or above the true cost to employers, they are willing to accept jobs offering lower wages but better leave policies.

Crucially for this framework, however, workers are assumed to systematically underestimate the risk that they will experience an unanticipated disability that is covered by temporary disability insurance. In contrast, employers are better able to properly calculate risk for their employees as a group and are only willing to trade wages for benefits at the true, higher probability of usage.38 Workers view this trade-off as too expensive and prefer to take jobs with too few benefits. Workers’ misperception of disability risk leads to a status quo where workers are systematically underinsured for the risk of temporary disabilities.

Studies in public health identify the health and lifestyle factors that make workers more likely to experience an unanticipated temporary disability, such as smoking, obesity, high blood pressure, depression, and diabetes (Musich and others, 2001). In practice, these underlying health conditions tend to be concentrated among low-income workers, particularly those in the South and in rural areas.39

To our knowledge, however, little research explores whether workers with these risk factors have a better understanding of their potential need for temporary disability insurance than workers with lower-risk profiles. To match the current skewed distribution of these benefits, our framework assumes that all workers perceive their risk of using temporary disability insurance as equally low regardless of their underlying health conditions. These means we assume that low-income workers, whose employers face higher costs to provide temporary disability insurance, are more likely to be underinsured. Future research is needed on worker risk perception and how it varies across socioeconomic groups.

Program design: Financing and employer opt-out

In this framework, the goal of a government paid leave program is to correct for the inadequate employer provision of temporary disability insurance. The specific areas we examine are how the design of this program affects the generosity of benefits, who bears the costs, and employer practices. As such, we compare two potential program designs: a fully public system financed by a payroll tax and a mixed private-public system, in which the public system is financed by a payroll tax.

In the first program, all workers who claim temporary disability insurance receive partial wage replacement from the government for the duration of their leave. Employers must participate in the public program but may offer supplemental benefits to top up the wage replacement.40 Temporary disability insurance benefits in the public program are calculated as a share of past wages and are financed by a flat payroll tax on employees.41 Note that our framework assumes that the economic burden of the payroll tax would not change if the tax were instead levied on employers. This assumption is a standard one, adopted by many organizations scoring the impact of federally mandated benefit programs; it assumes that employers will fully pass the cost on to workers through reduced wages or employment.42 The level of the payroll tax is set so that the program is budget neutral.

In the second program, the public plan remains the same as in the first program, including the option for employers to top up the benefits they offer to their employees, but employers can opt out if they offer private plans with the same wage replacement rate or higher. Employers pay for private plans themselves, and their employees are exempt from the payroll tax. The payroll tax for the public system is set to be budget neutral, balancing revenues with costs for the workers remaining in the system. Note that we do not consider a mixed private-public system where the public system is financed by general revenue because the answer is clear: Employers would have no incentive to opt out, so everyone would participate in the public program, and the cost burden of the program depends on the tax-and-transfer system used to produce general revenue.

Although the two scenarios differ in terms of employer opt-out, we assume that both program designs have several key points in common. Most importantly, we assume that all workers claiming temporary disability insurancefor unanticipated conditions will maintain access to their employer-provided health insurance and have the right to return to their jobs after the leave period ends. The costs for temporarily replacing the worker and providing continued health insurance are fully paid by the employer, rather than the public program.

Lastly, we assume the existence of an insurance market that is willing to supply private temporary disability insuranceplans for unanticipated conditions to employers that opt out of the public system but choose not to self-insure. We assume that commercial private plans are experience-rated—although premiums may not be actuarially fair due to administrative costs or profit margins—that all private plans cover the same unanticipated disabilities as the public program, and that the process of filing a claim is the same, as are denial rates.43

Since this set of assumptions may be particularly simplistic, the last prediction of the framework considers how employer behavior might change if they are able to affect these costs through workplace accommodations or administrative procedures. Future research to evaluate these assumptions, such as the difference in denial rates or the claims process, would provide valuable insight into employers’ and workers’ response to these programs.

Predictions from the analytical framework

The framework yields a series of predictions about the relative impacts of the alternative financing mechanisms.

- Prediction 1: The propensity of employers to offer private plans depends on the costs of opting out. At the extreme, if premiums for private plans are as actuarially fair as the public system’s payroll tax, then all employers will opt out of the public system.

- The public system’s financing mechanism transfers wealth from workers who are unlikely to claim temporary disability insurance to those who are likely to claim it. That is, low-risk workers will pay more than they receive in benefits, while high-risk workers will pay less than they receive. Overall, low-risk workers subsidize the benefits of high-risk workers, as with other types of private and social insurance.

- Employers that hire disproportionately low-risk workers have an incentive to opt out of the public program and offer their own plan because the cost of a private plan is lower than the payroll tax. Workers will agree to this arrangement because they only care about their after-tax wages and wage-replacement rates, not whether their plan is publicly or privately administered. In the long run, employers compete to hire (now relatively inexpensive) low-risk workers, who provide the same firm-specific human capital and productivity as high-risk workers—to the point where compensation equals the workers’ productivity to the firm.

- The public program will unravel as firms with low-risk workers leave the system.44 As employers with the healthiest workers opt out, the payroll tax for the public program must be increased to cover the higher costs of the higher-risk employees. The least-risky remaining workers now pay more in taxes than they receive in benefits, subsidizing the highest-risk workers. More employers can save money by opting out, and the cycle repeats.

- A public option will only remain to the extent that some employers face administrative costs to opt out that make the private option no longer more affordable than the public payroll tax. In practice, these costs are very context-dependent and could arise organically or by design. For example, while large employers that opt out can self-insure, small employers may have to purchase actuarially unfair insurance plans in a commercial market that varies from state to state. Alternately, the government could design the opt-out process to be costly for all employers by imposing fees, burdensome reporting requirements, or lengthy approval procedures for private plans.

- Prediction 2: Employers that currently provide more generous benefits than the public mandate will continue to do so regardless of program design.

- Relative to the status quo, any mandate on employers to provide temporary disability insurance for unanticipated conditions will compress the national distribution of wage-replacement rates. But the question here is how allowing employers to opt out affects this distribution, relative to a counterfactual program where employers are not permitted to opt out.

- To answer this question, first consider how employers would set benefits in a program that allows for them to opt out. Employers that already offer temporary disability insurance benefits for unanticipated conditions above the government mandate will continue to offer their previous wage-benefits compensation package, either by opting out and maintaining their previous private plan or by remaining in the program and topping up the mandated benefit level with additional, more generous private benefits (with the cost of the additional employer-provided benefits for unanticipated conditions reflecting the disability risk of workers in that firm). Those that offered temporary disability insurance below the mandate adjust their benefits to align with the new mandate.

- In a fully public program, all firms must comply with the mandated benefit level, and employees pay the accompanying payroll tax. But, as before, employers can still top up the public program with additional private benefits that are experience-rated. Employers that previously offered temporary disability insurance benefits above the mandate will use this top-up to maintain their existing benefits package.45

- Prediction 3: A fully public program that provides temporary disability insurance for unanticipated conditions, without an employer opt-out provision, transfers compensation from low-risk workers to high-risk workers. Allowing employers to offer private plans undoes this transfer to the extent that employers opt out.

- This discussion considers how allowing employers to opt out affects total compensation (defined as the cost of compensation to employers), as well as take-home compensation (defined as the pay and the expected value of public temporary disability insurance benefits). Throughout, we maintain the assumption that most prime-age workers do not adjust their labor force participation in response to modest changes in take-home compensation.

- As before, it is helpful to first focus on the extreme example of a fully unraveled program, where all employers opt out of the public option. In this scenario, employers simply offer their status-quo level of total compensation. Workers whose benefits were previously below the mandated level of benefits see the structure of their compensation package shift from wages to benefits.46

- In a fully public system, workers experience a change in take-home compensation because they now pay a payroll tax that is not always equal to the expected value of their benefits. Specifically, the payroll tax is actuarially unfavorable for low-risk workers and actuarially favorable for high-risk workers. As a result, low-risk workers experience a decrease in take-home compensation, whereas high-risk workers enjoy a commensurate increase. In practice, given the negative correlation between temporary disability risk and earnings, the payroll tax is predicted to transfer wealth from high earners to low earners.

- Hence, allowing employers to opt out of the public program undoes this transfer to the extent that employers choose to offer private plans.

- Prediction 4: Total costs—both public and private—are lower in a temporary disability insuranceprogram with an opt-out provision than in a fully public system.

- When the employer is liable for paid leave, workplace accommodations may be cheaper than paying benefits. Thus, experience-rated private plans give employers an incentive to accommodate employees with disabilities from unanticipated conditions. While employees who take temporary disability insurance may be unable to fully perform their jobs, temporarily disabled workers can still be very productive. Employers can modify job tasks to fit within employees’ abilities, keeping them at work rather than on leave.

- In contrast, in a public system that is financed through a payroll tax and is not experience-rated, employers have no incentives to help workers return to their jobs.47 In this scenario, the costs of accommodation raise the total cost to employers above the workers’ productivity, and employers prefer to keep the workers away until they can fully perform their original job. Overall, costs are lower when opting out is allowed, as the workforce is more accommodating to workers with disabilities and less leave is required.

- Allowing private plans, however, also could enable some employers to shirk the mandate by denying temporary disability insurance claims that would have been covered under the public program or by making it administratively difficult for workers to submit claims in the first place. The government might prevent such an outcome by requiring private plans to submit detailed information on administrative procedures and denial rates. This requirement could raise the administrative costs of opting out and result in more employers selecting to remain in the public system.

Extending the framework to temporary disability insurance for anticipated conditions and bonding leave

The example of temporary disability insurance for unanticipated conditions illustrates the economic forces at play in an analysis of mandated benefits. Yet the discussion ignores the other types of leave covered by many paid leave plans: temporary disability insurance for anticipated conditions, such as planned pregnancies and surgeries, and bonding leave.48

To add these benefits into the framework, we must first consider whether the assumptions about workers and firms still hold. In particular, the assumption that workers who anticipate a need for leave undervalue paid leave no longer seems reasonable. For example, a worker with an underlying health condition that necessitates a planned surgery would highly value wage replacement during leave for this planned procedure. Similarly, women who plan to become pregnant would value paid leave. Without the undervaluing assumption, what explains the current low provision of paid bonding leave benefits?49

No research to date identifies a possible answer explicitly for paid bonding leave. And unfortunately, the range of hypothetical possibilities yields different predictions when applied to the framework of mandated benefits. To give a concrete example of this ambiguity, consider two alternative explanations for the current low provision of benefits.

The first, adapted from Thomas (2020), posits that low-cost private insurance is widely available through experience-rated commercial temporary disability insurance plans, but employers avoid offering wage-replacement benefits in order to attract workers who are highly attached to their jobs and avoid hiring workers who are more family-oriented—in effect, a screening device. That is, employers incur an indirect productivity cost when they provide wage replacement beyond the direct cost of the benefit.50

The second explanation assumes that employers have no preference for work-oriented employees but do not provide bonding leave benefits unless they can self-insure because the commercial plans available charge premiums that are more expensive than workers’ valuation of the benefit, indicating a weak private market. This scenario could arise if a state has only a few insurance carriers, which could allow the carriers to extract monopoly rents.

The question is how these two scenarios differ in terms of opt-out behavior, the distribution of benefit levels, and who bears the cost of benefits. The general conditions for opt-out remain the same under either scenario: Employers opt out of the public program if they can deliver the same level of benefits at lower cost. In the screening scenario, the private market provides low-cost alternatives to the public option, which means firms with a high share of childless employees may decide to leave the public system, beginning the unraveling process.

Conversely, in the weak private market scenario, the public program provides the low-cost alternative and will attract employers that are unable to self-insure. In both cases, employers that previously offered these benefits above the public mandate will continue to do so.51

Because women remain more likely to take bonding leave and pregnancy-related medical leave than their male counterparts, women will bear the burden of funding their benefits in the screening scenario—both because the public system is more likely to unravel and because employers will respond to lack of information by reducing training and promotions for work-oriented women. Indeed, this second effect will take place regardless of whether the public system allows employers to opt out.

Further ambiguity around caregiving leave

Incorporating paid caregiving leave into a comprehensive analysis of paid leave further complicates the framework. The first complication is that, as in the case of bonding leave, caregiving leave is underprovided. As discussed above, the lack of a reason for underprovision leads to ambiguity, where different hypothetical reasons yield contrasting predictions.

The second complication is that, unlike bonding leave, paid caregiving leave is infrequently used when it is provided. In California and New Jersey, where detailed data are publicly available, requests for caregiving leave made up only 4 percent to 5 percent of all claims. Interestingly, caregiving leave comprises nearly 1 in 4 instances of leave taken by workers eligible for unpaid leave under the federal Family and Medical Leave Act, indicating that demand exists for this type of leave, despite the low levels of take-up of paid caregiving leave.

It is unclear why workers infrequently use paid caregiving leave when they have access. Perhaps they do not value this type of paid leave, fear discrimination from employers if they take paid leave, or simply do not know about the availability of this benefit.52

Further considerations for a comprehensive paid leave framework

As outlined above, the theory of mandated benefits provides a general set of principles to predict how employers will behave under a government-provided paid family and medical leave program that allows for private plans. Employers are predicted to opt out of the public system and offer private plans if they can provide the same level of benefits at a lower cost. To judge expected costs, employers would consider how likely their workers are to use the benefits, as well as the availability of low-cost commercial insurance plans and any administrative hurdles set by the government. The rate at which employers with low-use workforces opt out of the public program determines whether high-use workers bear the costs of their own benefits or whether their benefits are partially subsidized by low-use workers.

Central to our framework is the assumption that employers can accurately assess their workforces’ risk of taking leave. Under a comprehensive paid leave system that covers medical, bonding, and caregiving leave, it becomes more difficult to assess which employees may be at high risk of leave-taking. For example, a group of young, healthy, married or co-habitating men are less likely to take medical leave than older, single female employees in poor health, but the men are more likely to use bonding leave. When all leave types are bundled into one program, employers may find it more challenging to construct a low-risk workforce.

A key consideration not yet discussed is whether a public paid family and medical leave program permits employers to offer private plans for certain types of benefits, while remaining in the public system for others. For example, employers in New Jersey can take a piecemeal approach, offering a private plan for temporary disability insurance covering pregnancy-related disabilities but remaining in the state program for bonding and caregiving leave benefits. In California, however, employers face an all-or-nothing decision since private voluntary plans must cover all elements of the state’s paid family and medical leave program.

Employers that can compartmentalize their decision will consider the efficiency gains of opting out of each component of paid family and medical leave and remain in the public program for only their high-use types of leave. In contrast, employers that face an all-or-nothing decision will consider the overall expected use of their workforce and the availability of low-cost private insurance covering all elements of paid family and medical leave. Whether this program design is likely to unravel depends on the characteristics of workers who use different types of paid leave. If workers with high expected use of temporary disability insurance have low expected use of caregiving leave, for example, then the public program is less likely to unravel, relative to a program that allows employers to opt out for each type of leave.

Shifting the focus from employers to insurers, the response to mandated benefits assumes a static private insurance market. In practice, the private sector is likely to adapt to a national paid family and medical leave program. Two broad points are relevant. First, prior studies suggest that a national program could crowd out private insurance provision even if employers are allowed to opt out.53 The extent of this displacement is not obvious in advance since the program sets a benefit mandate that could increase employer demand while also establishing a public option to compete with commercial insurance.

Second, as discussed in the context of bonding and caregiving leave, the policy choice to community-rate private insurance premiums could interact with the design of the public program to create situations in which only high-use employers seek commercial insurance, leading to adverse selection in the private market. Future research on partially privatized paid family and medical leave programs should carefully consider how insurers, as well as employers, might respond to the design of a national program.

Finally, while economic theory predicts the unraveling of a payroll-tax-financed system, we see no evidence of unraveling occurring in any of the states that offer comprehensive paid family and medical leave funded by a state payroll tax. In New Jersey, for example, private temporary disability insurance plans covered nearly 72 percent of workers in 1952 but only around 20 percent of workers over the past decade—despite New Jersey’s more lenient and flexible opt-out provisions (Williamson, 2017). The source of this disparity between theory and empirical evidence is a valuable area of focus for future research.

Therefore, researchers need more information about the structure of labor markets and insurance markets before they can move from general principles to concrete predictions about the effects of a national paid family and medical leave program funded by payroll taxes. The next section considers sources of data and policy variation that researchers might use to advance the conversation.

Potential research methodologies and data sources to advance the framework

The goal of this section is to identify sources of policy variation and data sources that could be used to test the general predictions of our conceptual framework, as well as fill in the knowledge gaps that hinder a full analysis. Recall that the general framework of mandated benefits draws conclusions based on three key insights:

- Holding the structure of private insurance markets constant, employers whose workers have low expected benefit use are more likely to offer private plans.

- Holding workforce characteristics constant, employers are more likely to opt out when they can access low-cost private insurance products.

- Governments can dissuade employers from offering private plans by setting arduous approval procedures or reporting requirements.

Additionally, advancing a full analysis of partially privatized paid family and medical leave programs requires a better understanding of the broad structure of labor and insurance markets. Important questions to resolve include:

- Do labor market forces drive the current low provision of bonding and caregiving leave?

- How is leave risk distributed across employers?

- How do private insurance markets adapt to public paid family and medical leave programs?

The remainder of this section considers to what extent existing state-level paid family and medical leave programs could be used as case studies to answer these questions, and then turns to potential sources of data.

The opportunities and limitations of state-level paid family and medical leave programs as policy laboratories

Although nine states and Washington, DC have enacted paid family and medical leave policies, only four states had done so before the coronavirus pandemic profoundly disrupted public health, work, and caregiving. Because of the confounding effects of the pandemic, researchers may not obtain meaningful insights from recently adopted programs for several years. Thus, this discussion focuses on the four states that had established comprehensive paid family and medical leave policies before 2020: California, New Jersey, New York, and Rhode Island.

These state policies span the design spectrum, from a fully private benefit mandate in New York, to partially privatized public systems in California and New Jersey, to a fully public social insurance program with no employer opt-out provisions in Rhode Island. Consequently, researchers who would like a direct look at employer opt-out behavior will focus on California and New Jersey, while those conducting broader analyses of employer hiring practices, private insurance markets, and worker risk profiles may benefit from looking at all of these states.

Direct analysis of employer opt-out behavior

The primary hypothesis of our conceptual framework is that employers whose workers have low expected use of the benefits will opt out of the public program and offer private plans. To test this hypothesis, researchers could compare the workforce characteristics of employers with private plans in California and New Jersey to those that participate in the public option.

Researchers who take this approach should be mindful of subtle differences in program designs that vary across the two states and will affect outcomes. For example, California requires employers to opt out of all elements of paid family and medical leave, whereas New Jersey allows partial opting out. Similarly, California community-rates its paid leave program (as we assumed in our conceptual framework), whereas New Jersey experience-rates its temporary disability insurance program but community-rates its family leave program.

But most importantly, California sets stricter administrative hurdles to opting out than New Jersey. And California explicitly reserves the right to deny private plans that could prompt the unraveling of the public system.54

In practice, these program design choices may make it difficult for researchers to draw firm conclusions. In California particularly, the paid leave program effectively operates like a fully public social insurance system with no employer opt-out. And the experience-rating of New Jersey’s temporary disability insurance program implies that employer opt-out may be driven by factors other than expected use, such as the ability to access additional services through private insurers or the level of administrative fees.

What market forces drive current low provision of family leave?

A major hurdle in applying the standard theory of mandated benefits to family leave is the lack of knowledge about the economic forces driving current low provision of benefits. The conceptual framework section of this report introduced two possible, but certainly not exhaustive, explanations in the case of bonding leave: employer screening for workers with high returns to training and high costs of insurance in private markets.

As summarized earlier, a large and ever-growing literature studies the impact of federal and state paid leave policies on women’s labor supply and—more recently—on employers’ hiring practices. This literature should eventually provide clarity on the bonding leave front, at least as it pertains to women workers.

Research to date, however, has paid much less attention to bonding leave taken by men and caregiving leave generally. Here, a two-pronged approach might prove fruitful. First, researchers could aim to establish the cause of the underprovision of these types of family leave. While this report has discussed these two forms of leave together, they are fundamentally different, and research should focus on each individually. Second, researchers could conduct surveys in the four states with established paid leave programs to determine whether low take-up of benefits is simply due to lack of awareness or whether workers cite other reasons.

How is leave risk correlated with worker characteristics?

The likelihood that a partially privatized paid family and medical leave program would unravel depends on the distribution of leave risk across employers. Our conceptual framework assumes that workers with certain demographic characteristics are more likely to use certain types of leave—namely, that lower-wage workers in blue-collar industries and occupations are more likely to suffer unanticipated health shocks, while women workers disproportionately use bonding and caregiving leave.

Yet the extent to which leave risk is concentrated within certain workforces, as opposed to spread evenly across employers, remains an empirical question. Future research could shed light on this issue by examining claiming patterns in existing state paid family and medical leave programs. Of particular interest is the cross-correlation in claiming across different types of leave, such as whether workers who claim temporary disability leave are more or less likely to claim family leave.

How do private insurance markets adapt to public paid family and medical leave programs?