Main Street’s workers, families, and small businesses are now suffering as Wall Street prospers from policies to fight the coronavirus recession

Overview

In San Antonio, 10,000 cars lined up to get bags of groceries from a local food bank, waiting hours in the heat for help.1 In New Orleans, advocates chained themselves together outside of the city courthouse to prevent landlords from finalizing evictions.2 In New York City, more than one-third of small businesses may be closed forever.3 And across the United States, more than 190,000 lives have been lost to COVID-19, the disease caused by the novel coronavirus, as of early September.4

But while these economic and health crises unfold in cities and towns across the country, a slice of the U.S. economy continues to thrive, insulated from upheaval, or even benefitting from it. The S&P 500—an index of 500 major publicly traded companies in the United States and a benchmark for gauging the health of the U.S. corporate sector—is up more than 5 percent in 2020, as of September 9. The index has not only fully recovered to its pre-pandemic level but, in fact, has hovered around the all-time high.5

Leading the way is Apple Inc., which saw its market capitalization double in just 2 years and was the first company in U.S. history to be valued at $2 trillion.6 Bond issuances by U.S. companies—the way most medium- to large-sized firms fund themselves, by issuing debt—have also soared to an all-time high in the second quarter of 2020.7 This occurred after the U.S. bond market hit a prior high of debt-raising in the previous quarter.8 Companies issuing both the most credit-worthy investment-grade bonds and those issuing less credit-worthy “high yield” or “junk” grade bonds have been able to raise money fairly cheaply to get through the cash crunch caused by declining revenue during the coronavirus pandemic and ensuing recession.9

How did the fates of working people—facing death, hunger, displacement, and joblessness—and small businesses facing permanent closure become so disconnected from the fates of large corporations? Why isn’t the abundance channeled via U.S. financial markets to those at the top of the wealth and income ladders in the United States translating to security for most individuals and families? The answer is evident most immediately in the policy choices made during the coronavirus recession but also in policies enacted in the decades before the U.S. economy hit this particular shock.

This issue brief details what’s happening today on Main Street among our nation’s workers, their families, and our small businesses. It then explains why much of Wall Street remains insulated from the economic suffering happening across the Main Streets of our nation, and how policy decisions made over the past 40 years have produced these outcomes by design. It concludes with some key lessons about why policymakers not acting aggressively and consistently during and after the Great Recession of 2007–2009 harmed Main Street in many prolonged ways—lessons that, in 2020, seemed to have been learned, based on policymakers’ initial actions at the onset of the coronavirus recession but which increasingly fade as the fates of Wall Street and Main Street diverge.

To avoid another prolonged recession and tepid economic recovery, policymakers need to realize that Main Street needs to come first. Those policy tools are available and tested. They need to be deployed.

Individuals, families, and small businesses are on the edge

Individuals, families, and small businesses are on the edge of a cratering economy. The unemployment rate was 8.4 percent, as of August 2020, higher than at many points during the Great Recession of 2007–2009.10 While overall unemployment numbers have improved from their peak earlier this year, there’s been a surge in the number of permanent job losses, as temporary layoffs transition to lasting cuts.11 Food insecurity is rising, especially in households with children.12 Thirty million to 40 million people may be at risk of looming evictions, marking the most severe housing crisis in modern U.S. history.13 Small businesses everywhere are shuttering, and many of them may be closed for good.14 Public health data indicate that growing numbers of people are experiencing mental health challenges such as depression, anxiety, substance abuse, and suicidal ideation.15 And all of these trends, like COVID-19 itself, disproportionately harm people of color, especially Black, Indigenous, and Latinx individuals and families.

The good news is that this suffering is not inevitable. Policymakers have the tools to support individuals and families and to prevent a wider macroeconomic downturn if they choose to do so. In fact, actions taken by lawmakers in the spring and early summer as the pandemic spread across the country reduced the harm faced by most workers and their families and at least some small business owners. But that protection began to wane beginning at the end of July as various coronavirus aid programs expired. The renewed harm now facing many workers, their families, and small businesses will become more and more permanent if policymakers don’t act again soon.

Researchers at the Center on Poverty and Social Policy at Columbia University find that the Coronavirus Aid, Relief, and Economic Security, or CARES, Act, kept 12 million people out of poverty.16 Other research from former Equitable Growth Steering Committee member and Harvard University researcher Raj Chetty, leading the Opportunity Insights team, produced research showing that the “recovery rebates” (also known as direct payments) provided to individuals and families alongside enhanced Unemployment Insurance helped households in the poorest ZIP codes maintain necessary spending.17

The same is true for housing stability. ProPublica, the investigative news organization, reviewed filings in local court records in more than a dozen states over the course of months, finding that evictions dropped substantially in properties covered by the CARES Act’s federal eviction moratorium.18 All of these findings, however, are either largely expired or greatly diminished. Most of the one-time, direct relief $1,200 checks were spent many months ago, enhanced unemployment benefits ran out at the end of July 2020, and significant uncertainty surrounds the continuation of a federal eviction moratorium.19

Then, there are small businesses, which sustain half of private-sector jobs in the country. The Washington Center for Equitable Growth previously documented both the successes and challenges of earlier federal policy interventions, namely the $670 billion Paycheck Protection Program.20 While that program proved to be an effective lifeline for some firms in need of a boost to get through the worst of the mandatory, pandemic-induded lockdowns, it was less successful in helping the hardest-hit firms in the areas with the most cases of the coronavirus and the most concentrated caseloads of COVID-19.21

Challenges with the Paycheck Protection Program largely centered around issues with its program design, namely the rules around eligible uses of funds, conditions for loan forgiveness, and the intermediation of funding to these businesses through financial institutions.22 Equitable Growth documented how policymakers might fix those flaws, but the future of the Paycheck Protection Program is uncertain. As of August 8, 2020, the ability of the program to accept new applications expired, with more than $130 billion unspent and not available to eligible businesses.23

In summary, data show that we can prevent suffering when we give individuals, families, and small businesses the direct support they need to survive the coronavirus recession. Policymakers provided substantial relief in the CARES Act, but that help ran out. Yet what persists in its absence is the rescue money available for financial markets, as well as pre-existing advantages in our economy for certain large firms. Because our financial infrastructure is designed to quickly stabilize the corporate sector—even without further action from Congress—what’s happening on Wall Street looks a lot different from what’s happening for many workers.

Much of Wall Street is winning

When we say Wall Street is thriving, it’s important to identify precisely which slice of U.S. businesses is doing well in this moment. A good way to judge medium- to large-sized corporations’ health is through two measures. The first is to look at how their stocks are trading. The second is to see whether corporations have been able to borrow money and at what rate of interest. Corporations also raise money by taking out loans from banks or nonbank financial firms, with small businesses relying more on that type of funding. This issue brief will delve into those credit markets, but only minimally.24

Broadly, the two major U.S. stock markets, the New York Stock Exchange and NASDAQ, are performing extraordinarily well because a handful of powerful technology companies are profiting handsomely due to the nature of the coronavirus recession, which plays to their strengths, and because of historically lax antitrust enforcement that enables them to further boost their profits at the expense of other firms, workers, and consumers. Meanwhile, the U.S. bond market is performing well more broadly for all firms. This is due, in large part, to rescue programs designed by the Federal Reserve under authority provided in the CARES Act.

So, let’s turn to each of these Wall Street financial markets in turn.

The U.S. stock market

Stocks represent equity, or an ownership interest, in a company. Fundamentally, stock prices are determined by investors’ confidence in the future earnings of a firm (calculated by combining the risk-free rate earned on holding government debt, plus the risk premium associated with owning the stock). Stocks are also a relatively risky form of investment, as stockholders are the first to bear losses and the last in line to get paid if a company fails. In good times, stockholders are compensated by dividends issued by the company or through appreciation of the stock price, which is realized if the investor sells shares of stock.

So, how have the stock markets been performing during the coronavirus recession? While the S&P 500 index, which measures the 500 largest companies on both U.S. stock markets, is up more than 5 percent in 2020 as of September 9, those gains have been driven by only a handful of companies that control a significant share of all stocks traded on the markets.25

Those top companies are concentrated in the technology sector. Consider the roughly $27 trillion in total market capitalization of all companies in the S&P 500.26 Of the value of all outstanding shares:

- Apple Inc. boasts a $2 trillion market value.27

- Amazon.com Inc. and Microsoft Corp. each represent around $1.7 trillion in value.28

- Alphabet Inc., the parent company of Google, represents just more than $1 trillion in value.29

- Facebook Inc. represents more than $800 billion in value.30

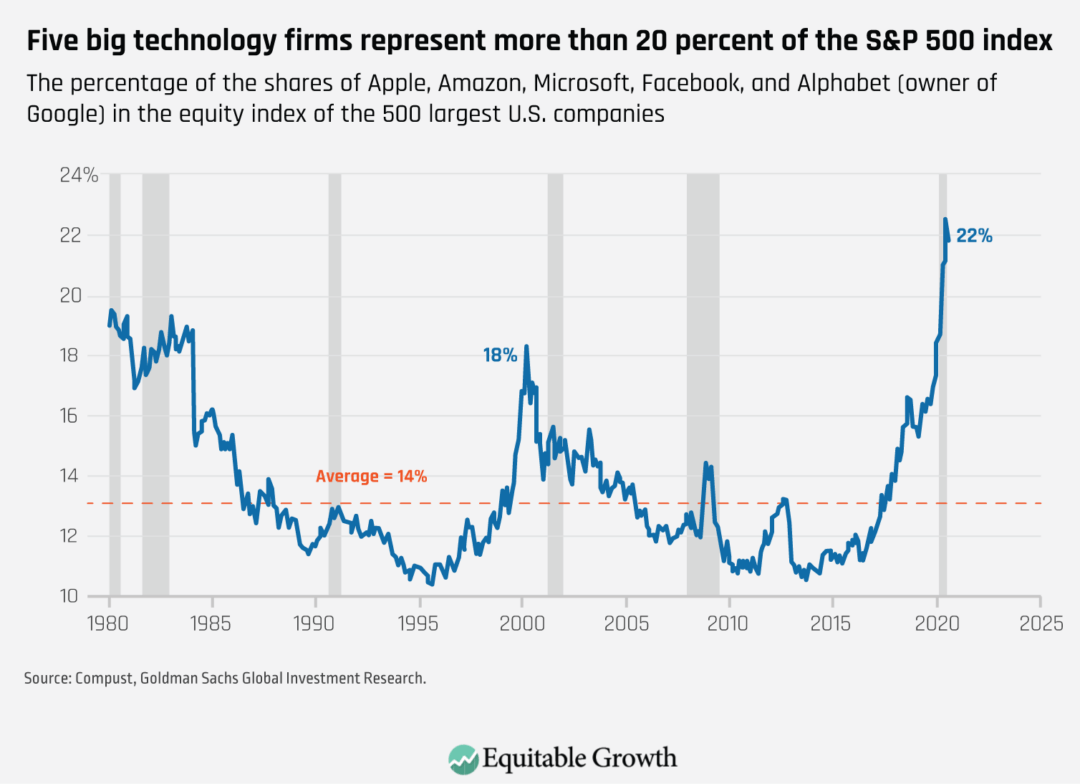

In total, the market capitalization of these five giants is more than one-fifth the value of the total market capitalization of the 500 largest firms trading on U.S. equity markets. (See Figure 1.)

Figure 1

More broadly, total market capitalization for all publicly traded firms is concentrated in the S&P 500, with those 500 companies representing more than 75 percent of the value of all equities traded on U.S. stock exchanges.31 This level of concentration in market capitalization among a small number of companies is at historically above-average levels and is at the highest level it has been in about 40 years.32 The previous time it even approached this level was during the dot-com boom more than two decades ago, though even then, the top five stocks only represented around 16 percent of the S&P 500’s total value.33

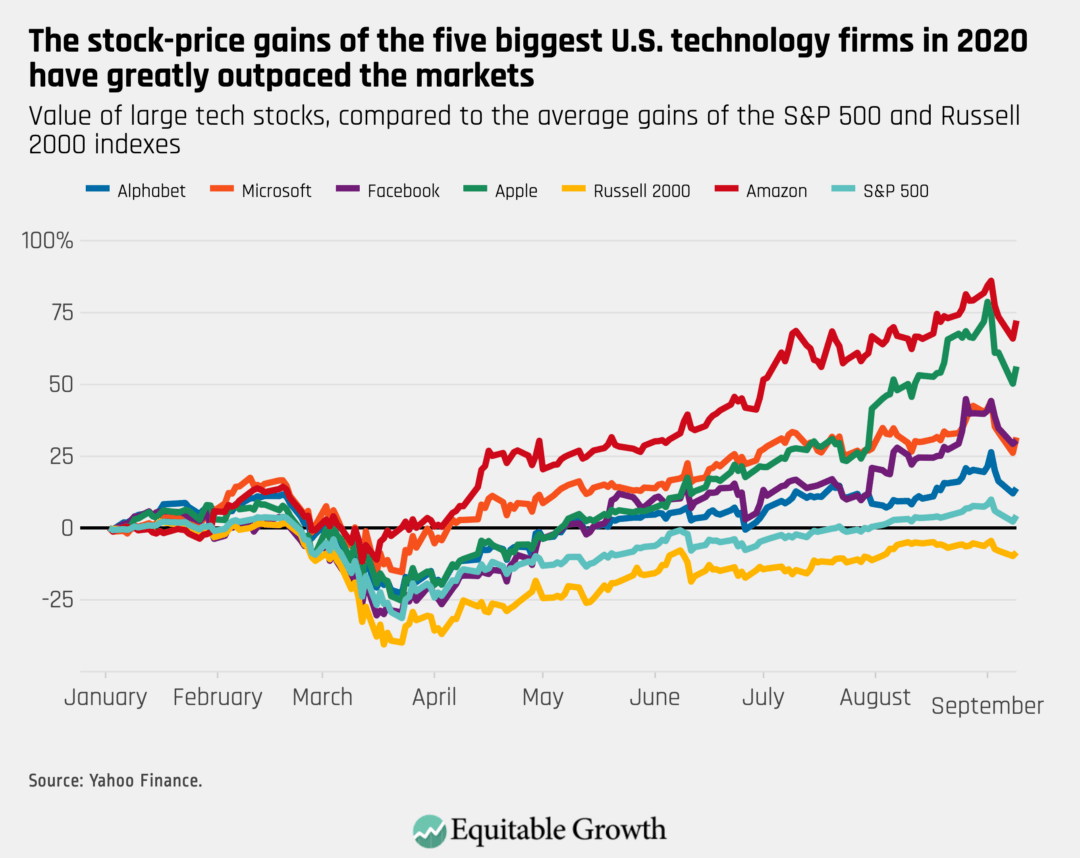

These technology companies’ stock-price gains in 2020—particularly since the coronavirus and its recession hit—are outsized, too. The stocks of these five firms are registering astronomical returns while the median stock in the S&P 500 index declined by 4 percent as of August 28.34 Technology companies dominate the stock market among large companies. And, in turn, the stock market indexes of large companies are outpacing indexes backed by the stocks of smaller firms. The Russell 2000, an index that tracks small-cap U.S. firms, is down around 8.4 percent since the start of 2020, as of September 9.35

A visualization of the returns of Amazon, Alphabet, Apple, Microsoft, and Facebook stocks, versus the returns of the overall S&P 500 and Russell 2000 indexes, is instructive. (See Figure 2.)

Figure 2

If stock prices reflect investors’ belief in the future health of a company, then technology firms are right to inspire significant confidence during the coronavirus recession. With many people trapped at home, reluctant to go outside, and increasingly working from their houses if they are able to do so, the business models of technology companies are uniquely suited for this moment.

Take the changing nature of shopping. A survey by consulting firm McKinsey taken between July 30, 2020 and August 2, 2020 finds that consumers’ use of online channels for purchases surged during the pandemic, with 59 percent growth in online grocery purchases, 45 percent growth in online over-the-counter medicine purchases, and 18 percent growth in online consumer electronics purchases, to name just three examples.36 McKinsey finds that across purchase categories, there has been a 15 percent to 45 percent growth in online sales, with similar levels of growth in the percentage of consumers who plan to make all purchases online.37 Across channels, new modes of product delivery, such as curbside pickup and home delivery, rose sharply.38

This trend benefitted Amazon the most. The company registered 40 percent growth in earnings in the second quarter of 2020, compared to a year earlier.39 In fact, the company’s second quarter earnings this year “managed to blow away elevated [investor] expectations,” according to the stock market website The Motley Fool.40 And Amazon continues to expand in ways that draw sharp contrast with the decline in brick-and-mortar retail sales and the companies engaged in traditional retail sales. News articles recently reported that Amazon is looking to convert vacant mall department stores into distribution centers, with Amazon’s growing reach coming alongside the recent bankruptcies of retailers, including J.C. Penney Company, Inc., Sears Holdings, Marcus Corp (the parent company of Neiman Marcus), J.Crew Group, Inc., and Ann Taylor’s parent company, Ascena Retail Group.41

The surge in working from home, rather than the office, has also benefited technology companies, which provide services such as cloud computing needed for telework. A survey of more than 300 chief financial officers and finance leaders by research firm Gartner Inc. finds that nearly three-quarters of companies plan to shift at least 5 percent of their previously on-site workforce to remote work permanently.42 Another study by consulting company Global Workplace Analytic estimates that when the pandemic is over, 30 percent of the entire workforce will work from home at least a couple times a week.43 In contrast, before the pandemic, U.S. Census Bureau data released in 2018 found that 5.3 percent of workers typically worked at home.44

But it’s not just COVID-19 causing technology companies’ dominance. A second factor to consider is how U.S. competition policy favors Big Tech. As the Washington Center for Equitable Growth’s Director of Competition Policy Michael Kades noted in a recent post, weak antitrust laws and conservative courts using unsound economic theories continually expose U.S. markets to corporate abuses of market power, which boost large corporations’ profits and dominance at the expense of competitors, workers, and consumers.45

In a recent hearing of the U.S. House Committee on the Judiciary featuring the chief executive officers of Amazon, Apple, Google, and Facebook, Kades notes how policymakers focused on the ways in which these technology companies have suppressed competition through harmful exclusionary conduct.46 Those practices, according to Kades, “allow dominant companies to stifle actual and potential rivals, preventing competition on the merits and allowing incumbents to obtain or exploit market power.”47

Kades notes that in the hearing, policymakers cited several examples of these practices, including:

- Facebook cutting off online entertainment community Vine’s access to Facebook because it was a potential competitor

- Amazon pricing its proprietary products and services below cost to drive out competitors

- Apple discriminating against apps that compete with Apple products

- Google preferencing its own content over that of its competitors48

Kades notes that new legislation is needed to give enforcement agencies and the courts the ability to shift the balance in U.S. antitrust law.49

The U.S. bond market

In addition to funding themselves with shares, firms also fund themselves with bonds, or securities issued by a firm paying a pre-established rate of return, either fixed or variable, for a set period of time. Bondholders’ investments are usually backed by collateral owned by the firm, and bondholders receive priority compared to stockholders if a company fails and its assets are liquidated.

Like stocks, bonds are widely traded among investors and can be grouped into indexes composed of a variety of bonds that can also be traded. Unlike stocks, bond returns do not change based on swings in the value of the firm. Note that companies can also fund themselves with other types of debt such as loans from banks or nonbank financial firms, including private equity companies, which this issue brief will touch on briefly later.

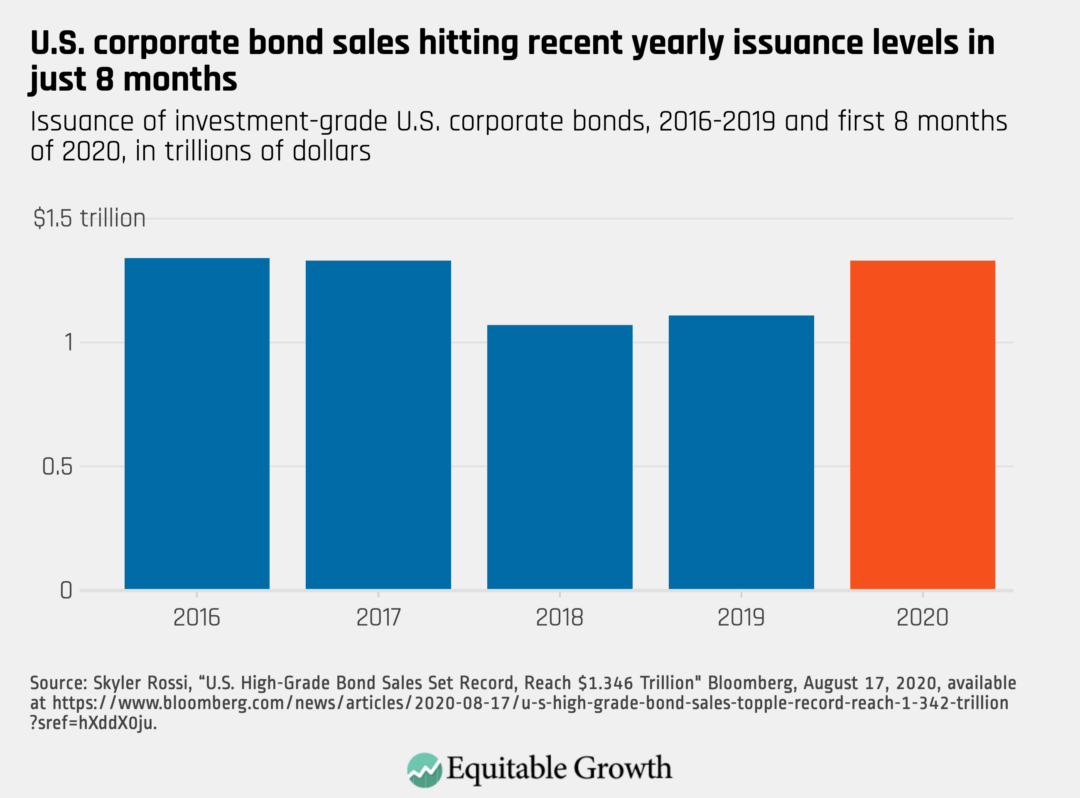

The bond market, unlike the stock markets, is performing solidly for all types of companies, even during the coronavirus recession.50 All told, companies, as of mid-August, have issued $1.9 trillion in bonds in 2020—a record amount, with healthy issuance for both investment-grade and speculative-grade companies.51 Companies have needed to raise additional money to help cover revenue shortfalls caused by a dip in demand during the pandemic. Other companies are issuing new debt because of the historically low cost of financing, driven by Federal Reserve interventions in the market, described later in this issue brief.

Among investment-grade companies, bond issuance totaled $1.3 trillion, hitting a yearly record just 8 months into the year 2020.52 Big companies such as Alphabet and Apple borrowed billions of dollars in recent weeks to lock in the low cost of debt financing.53 Indeed, mid-August 2020 was a record week for investment-grade bond issuances. (See Figure 3.)

Figure 3

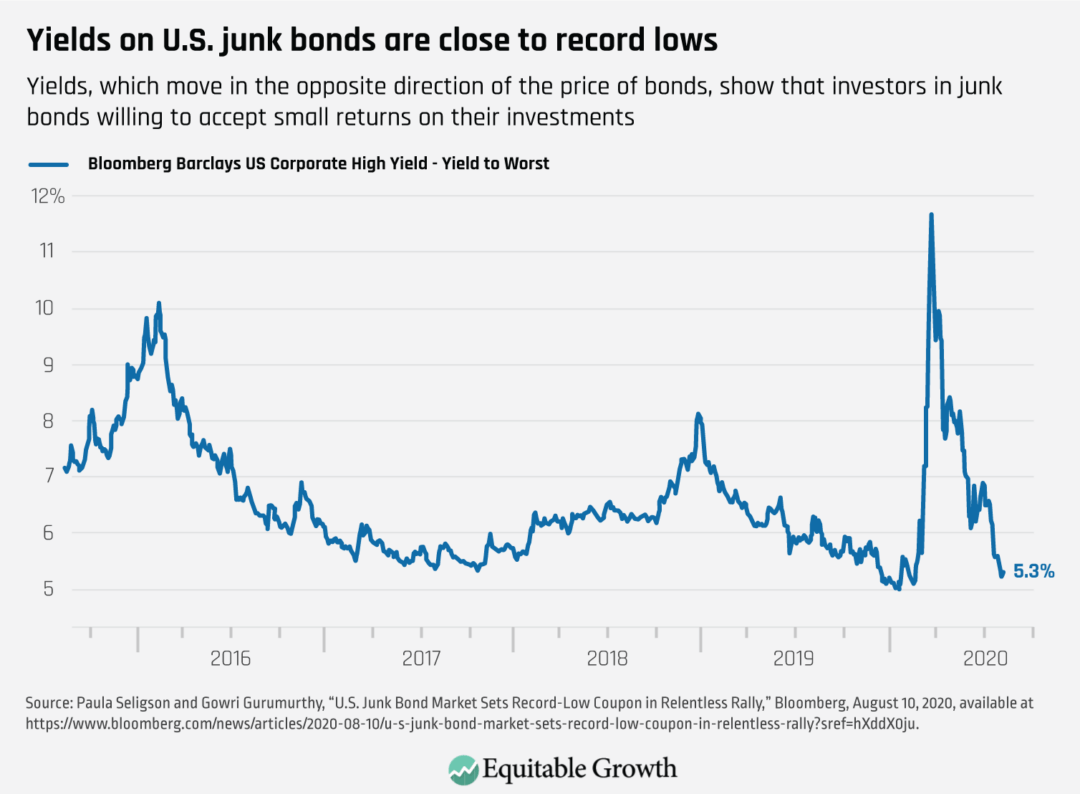

Riskier firms have been able to issue bonds as well. Issuance by high-yield companies set a record in the second quarter of 202054 and topped a new record for the “typically slow August,” breaking records not seen since 2012.55 Firms adversely affected by the pandemic—among them aerospace manufacturer Boeing Inc. and Carnival Corp., the cruise line—were able to issue debt to fund themselves when previously, both firms had sought higher-cost loans from nonbank financial firms such as hedge funds.56 In total, yields on high-yield companies’ bonds are at record lows after briefly spiking in March 2020, meaning investors are requiring historically small levels of returns in exchange for purchasing company debt.57 (See Figure 4.)

Figure 4

How did the bond market become so robust for the full spectrum of firms issuing debt? This story is about interventions by the Federal Reserve.

The U.S. bond market seized up in March, when the coronavirus recession began and as a growing consensus developed in U.S. financial markets that the United States would experience a prolonged recession due to the ongoing and failed public health response to the coronavirus pandemic.58 But the Federal Reserve’s mere announcement at the end of that month—saying the central bank would undertake a number of accommodative measures to boost the economy, including buying bonds and exchange traded funds, or ETFs, backed by bonds using funds appropriated under the CARES Act—caused markets to rebound and gain confidence.59 Indeed, Federal Reserve Chair Jerome Powell noted at the end of March that the central bank is “not going to run out of ammunition,” and financial markets responded with confidence.60

Specifically, the central bank set up two facilities, announced in March but operationalized starting in May, for the purpose of supporting corporate credit markets. The first facility, the Primary Market Corporate Credit Facility, which is operational but has not yet made any purchases, is designed to purchase debt directly from the issuing companies.61 The second facility allows the Fed to purchase both individual bonds and ETFs backed by corporate bonds on the secondary market via the Secondary Market Corporate Credit Facility.62 In total, both programs have the authority to purchase up to $750 billion in assets.63 The Fed, using its lender-of-last-resort authority to leverage money appropriated by Congress, which stands in a first-loss position relative to the central bank, has $75 billion in congressional appropriations to withstand any losses on its balance sheets.64

As of August 10, 2020, the Secondary Market Corporate Credit Facility has just more than $12 billion worth of holdings, around $8.7 billion of which is in the form of ETFs and $3.5 billion of which is in the form of individual bonds purchased on the secondary market.65 The purchases by the Fed include bonds, or ETFs backed by bonds, issued by firms that were rated as investment grade on March 22, 2020, whether they have kept that rating or have been subject to certain downgrades since that date (companies in the latter category are known as “fallen angels”).66

Among individual bond purchases, the Fed’s activity has been concentrated among blue chip companies, or large, well-established firms with household names.67 Individual bond purchases have comprised all of the Fed’s activity since the end of July.68 Generally, the Fed’s purchase activity has slowed in recent months compared to early on in the pandemic response, but it still remains active.69

The Fed helped companies that are riskier bets too, through the purchase of ETFs, which began in May 2020 but has generally slowed in the months since.70 Early purchases of ETFs by the Fed coincided with private buyers flooding the market, with the Fed’s purchases making investors feel more comfortable with the risks associated with companies with riskier profiles and higher debt.71 Though the Fed owned only 3 percent of total assets in the ETFs in which it purchased shares at the end of June, the Fed accounted for more than half of new cash inflows into some ETFs, giving it an outsized ownership share of some funds and putting pressure upward on prices and driving down yields.72

Notably, the Fed and other banking regulators sounded the alarm on high-yield corporate debt just before the pandemic.73 But today, 54 percent of the Fed’s corporate debt portfolio is composed of bonds on the cusp of junk bond territory,74 easing investors’ comfort and causing them to expand purchases notwithstanding increasing default rates and ratings downgrades.75

The size of the Fed’s total bond market interventions, at $12 billion,76 is relatively small (by way of comparison, Alphabet alone issued $10 billion in debt earlier this month).77 Still, the effects of the Fed’s actions on financial markets are profound. Fed reassurances to the bond market demonstrate that it will do whatever is necessary to stabilize corporate credit markets, and the $750 billion pledge of available funding for the Primary Market Corporate Credit Facility, alongside continuing purchases by its SMCCF window, gives confidence that the Fed has deep pockets to execute on its promises.

Observers differ on their perception of the wisdom of the Fed’s actions, with some calling it “decisive action” to “[avert] a worst-case scenario”78 and others saying the Fed is “addicted to propping up markets even without a need.”79 But all agree that the bond market was buoyed by Federal Reserve interventions.

Why isn’t the boom on Wall Street trickling down?

The stock market and the bond market are humming along amid the unprecedented coronavirus recession. But one central question that flows from these trends is to what extent the boom in stocks and bonds is helping people on Main Street by:

- Preventing layoffs

- Boosting individuals’ investment incomes

- Producing knock-on effects for small businesses

- Helping state and local governments cope with declining revenues

The short answer is that it is too soon to tell, but let’s examine each of these questions individually. The details may well indicate the emergence of trends in the coming weeks and months akin to what happened during and after the Great Recession of 2007–2009, which produced prolonged suffering for Main Street.

U.S. financial market gains are not preventing many layoffs

The stock market boom doesn’t mean much for most workers’ jobs. First, only around 17 percent of workers are employed at an S&P 500 firm.80 In contrast, nearly half the U.S. workforce is employed by small businesses.81 The vast majority of small businesses don’t issue stock.

For those who are employed at companies that issue shares, stock prices could be correlated with job growth—investors may feel confident in a company when they see it innovating or investing in workers to grow the business. But sometimes, investors actually penalize companies for investing in workers. American Airlines Group, for example, was downgraded by analysts when it gave raises to pilots and flight attendants.82 And Chipotle Mexican Grill, Inc. experienced a 3 percent decline in its stock price when analysts determined it couldn’t trim its workforce costs.83

Importantly, the companies whose stocks are surging the most during the coronavirus recession don’t employ that many people. Big technology companies, while large employers in an absolute sense, don’t have that many workers compared to their share of the stock markets’ total value. While they represent around a fourth of the total market capitalization of S&P 500 firms, they represent only 5 percent of the index’s total workforce. As a recent Bloomberg news report notes, 20 years ago, companies with the same market share employed 10 percent of the S&P 500’s total workforce.84 These companies are also more likely to use gig workers or independent contractors, who don’t have the security of permanent employees.85 Good examples are Amazon using independent contractors to do “last mile” deliveries with their own cars,86 or Google and Facebook using independent contractors to screen their platform for inappropriate content that violates the company’s guidelines.87

In fact, research suggests that companies with a higher level of “intangible assets” (such as intellectual property and brand recognition) per employee are far outpacing stock gains compared to companies with fewer intangible assets per employee.88 Part of this is driven by the unique nature of the coronavirus recession and the surge in the value of technology intermediation. But again, it’s also an outgrowth of antitrust policies that allowed prolific mergers and acquisitions in the technology sector.

The Fed’s support for bond markets could hypothetically support workers at companies that need to issue debt. After all, if a company can’t raise money, they can’t meet payroll. It is hard to causally determine whether any Fed actions are responsible for any positive indicators in labor markets, but, as economist William Spriggs of the AFL-CIO notes, one counterfactual (the Fed not acting at all) is unlikely to have produced better results for workers. Spriggs notes, “so you want [the Fed] to let all the companies go bankrupt? And then which jobs do you think will be left?”

In short, boosting teetering companies, while imperfect, may be better than the alternative.89

However, it is important to note that the Fed didn’t face a binary choice to do everything for corporate credit markets without precondition or do nothing at all. In fact, the CARES Act did include discretionary authority for the Fed to require corporations receiving rescue aid to retain jobs, maintain collective bargaining agreements, prohibit dividends and stock buybacks, and limit executive compensation,90 yet the Fed used several legal maneuvers to sidestep those conditions on aid.91 Two examples of how the Fed’s financial market activities are decoupled from worker protections can be instructive. For example, the Fed purchased corporate debt issued by ExxonMobil Corp.92 Meanwhile, the company is separately preparing for job cuts and ending their employer match for their remaining employees’ 401(k) retirement plans.93 The Fed also bought the corporate debt of Tyson Foods, Inc.,94 while the company has allowed a massive outbreak of COVID-19 in its meatpacking facilities.95

Finally, some contend that the Fed’s bond market actions are just delaying the devil coming due for many teetering firms and therefore won’t have a long-term positive effect on jobs. Indeed, the Federal Reserve Bank of New York recently noted a growth in firms whose expense payments exceed their cash flow.96 These firms are colloquially known as zombie companies.97 The New York Fed’s research finds that around 25 percent of all public firms (except agriculture) had expense payments that exceeded cash flow, along with more than a third of companies in the entertainment/hospitality/food, mining/oil, and retail industries.98 The Fed’s bond purchases could serve to prop up companies that otherwise would have stumbled or failed, including those that were precarious long before the pandemic, such as many oil and gas firms.99

Investment income doesn’t matter much for most Americans

The Fed’s actions also are unlikely to boost returns for most low- to moderate-income people in the United States. While about half of Americans own some amount of stock (either directly or through investment vehicles such as 401(k) plans), the value of all stock ownership is concentrated, with the top 1 percent of households by wealth owning more than half the value of all outstanding shares.100

As for corporate bonds, individual ownership, especially among moderate-income households, is extremely limited in the United States. Low- and moderate-income people do have exposure to the bond market through insurance companies, mutual funds, or pension funds that own such bonds.101

Small businesses continue to struggle

The Fed’s actions also are unlikely to do much for small businesses, aside from potential salutary macroeconomic effects of its actions for the U.S. economy generally. Small businesses typically don’t issue stocks or bonds, so they’re not helped by the Fed’s interventions in those markets. Low interest rates, under typical economic conditions, should enable some small firms to borrow more cheaply from commercial bank lenders. But, as described more below, bank lending is retrenching as financial institutions become more risk-averse during the pandemic.

The Fed did create a separate program to facilitate direct lending to mid-sized businesses, known as the Main Street Lending Facility.102 The program was designed to encourage financial institutions to lend to mid-sized companies with up to 15,000 employees and $5 billion in revenue by having the Federal Reserve purchase 85 percent to 95 percent of those underlying loans.103 Despite a $600 billion available pot of funding, the Fed has only committed or settled $252 million across 32 loans, with another 55 loans worth $604 million under review.104

This Fed program is floundering due to the complex rules of the Fed’s Main Street Lending Facility, alongside the already substantial debt load among mid-sized businesses and the reliance of the Fed program on the participation of private-sector lenders.105 Indeed, the sluggish start of the Main Street Lending Facility mirrors a general downturn in available credit for small- and mid-sized companies that rely on bank and nonbank loans for funding, despite low interest rates.

As noted in a recent Bloomberg article, “banks are tightening conditions on loans to smaller firms at a pace not seen since the financial crisis, while many direct lenders that have traditionally focused on the middle market are pulling back or turning to bigger deals instead.”106 This is despite claims from some that recent relaxation of post-Great Recession banking regulations would increase the provision of credit for nonfinancial businesses.107 Nonbank lenders are likewise tightening lending as they address increasing defaults and are targeting bigger deals.108

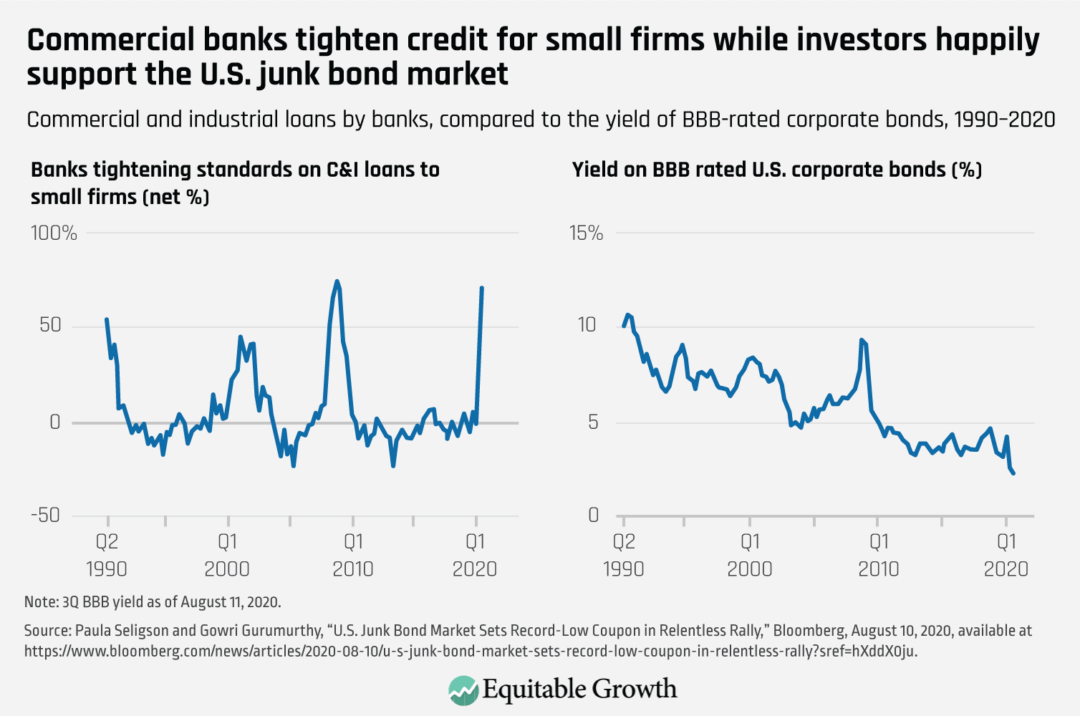

In short, the coronavirus recession and the policy response has produced a lopsided trend in corporate credit markets—with small firms that rely on lending increasingly finding it difficult to get credit while high-yield firms with access to bond markets enjoying falling yields.109 (See Figure 5.)

Figure 5

State and local government financing is dire

How are the Federal Reserve’s bond market interventions affecting the health of state and local government finances and, therefore, the workers of these public-sector employers? The Fed, in April, established a Municipal Lending Facility to buy up to $500 billion in bonds issued by certain qualifying counties and cities so that they could use the proceeds to pay for necessary expenses related to, or declines in revenue because of, COVID-19.110 But only two bonds have been purchased by the Fed so far. One was issued by the state of Illinois, for $1.2 billion.111 The other was issued by the state of New York Metropolitan Transit Authority, for $451 million.112

The discrepancy between the Fed’s municipal and corporate bond buying program rules is instructive. The Fed imposes more stringent requirements on municipal borrowers than on corporate ones. A municipality rated A3 by a credit rating agency (a medium-grade rating that signifies the weakest borrowers within the cohort of strong borrowers) could borrow for a maximum of 3 years at around a 2.2 percent interest rate, while a similarly situated bond issued by an A3-rated corporation would pay just 1 percent.113

What’s more, municipalities can borrow for a maximum of 3 years, but corporations will be able to borrow for 4 years to 5 years—giving them more time to repay debts.114 Companies that issue bonds directly to the Fed via the Primary Market Corporate Credit Facility can have repayment timelines of up to 4 years, while the Fed’s program to buy bonds in the secondary market through its Secondary Market Corporate Credit Facility is allowing maturities of up to 5 years.115

Similar to the situation with corporate bonds, municipal bonds were stressed at the onset of COVID-19, and then, the market stabilized upon the Fed announcing its interventions, which included both the creation of the state and local bond purchase facility and other actions.116 But the Fed’s terms for municipal bond purchases are generally more punitive than those for corporations, meaning that the program may only be attractive for lower-rated municipalities that would otherwise have trouble borrowing at low cost in the market. Tellingly, only two municipal bond issuers have found the Fed’s terms attractive, with issuances totaling $1.65 billion, compared to more than $12 billion in Fed-supported corporate bond issuances, which support a range of investment-grade and high-yield firms.

Given the large declines in state and local revenues, combined with a lack of emergency federal support for state and local government bearing the increased costs of fighting the pandemic, public-sector job losses and services cuts are all but certain to continue because most states cannot run budget deficits. States and localities have already cut about 6 percent of their workforces as of mid-August 2020, and most estimates anticipate further job cuts absent a stabilization of the pandemic, added support from Congress, or a loosening of borrowing terms by the Federal Reserve.117

Conclusion

The coronavirus economic crisis need not produce deep and sustained harm for individuals and families in the United States if policymakers learn the lessons of the past. During the Great Recession, Congress failed to provide support commensurate with the scale of the crisis, and we saw the consequences.118 Wall Street was quickly stabilized and returned to profitability, with the fourth quarter of 2009 being the last quarter in which the banking sector posted losses.119

But individuals, families, and small businesses did not fare as well. It took until 2017 for median household income to get back to pre-crisis levels.120 The Great Recession saw more than a third of workers unemployed for 27 weeks or more.121 These sustained periods of joblessness led to poorer health, shorter life expectancies, and worse academic performance for children.122 The eviction crisis during and after the Great Recession produced heightened levels of stress, health crises, addiction, child abuse, and myriad other negative family outcomes.123

The apex of the previous global financial crisis, 2009, marked the year when business deaths most strongly outpaced business births, and for 3 months that year, new business creation reached its lowest point since the U.S. Bureau of Labor Statistics began collecting the information.124 And, perhaps most troublingly, one study from the U.S. Centers for Disease Control and Prevention found that suicides doubled in the years just before and after the Great Recession, spurred by severe housing stress, including evictions and foreclosures.125

Today, Wall Street is recovering even faster than during and after the Great Recession. Meanwhile, the coronavirus recession may be on track to deliver even worse economic conditions for workers, their families, and small businesses. Absent further action from policymakers, our nation may replicate the alarming consequences of the Great Recession. And this is not even taking into account the human tragedies brought on by the coronavirus pandemic and COVID-19 deaths and lingering sicknesses.

Policymakers have the evidence and tools to ensure a strong recovery. Direct financial aid to individuals and families works. Programs such as extended Unemployment Insurance, increased food benefits through the Supplemental Nutirition Assistance Program, and aid to states for Medicaid should be scaled up commensurate with economic indicators—and not scaled down until indicators show it’s safe to do so. Congress also needs to provide more financial aid to state and local governments.

Then, there are the reforms needed to ensure continuing financial aid to Wall Street is accompanied by concomitant obligations to help workers and their families, and support credit to small businesses. Policymakers should design more resilient “plumbing” to make rescues of families and small businesses as frictionless as Federal Reserve financial market interventions.126

Beyond the immediate response to the pandemic, the Washington Center for Equitable Growth provides a roadmap for the structural solutions needed to rebalance the economy over the long term, including restoring antitrust enforcement, boosting wages, and empowering workers.127 The United States walked into the coronavirus pandemic with severe underlying fragilities. To ensure a sustainable recovery will require bold action now, as well as addressing these weaknesses with structural policy changes.

—Amanda Fischer is the Policy Director at the Washington Center for Equitable Growth.

End Notes

1. Sam Van Pykeren, “Food Bank Lines Across America,” Mother Jones, April 13, 2020, available at https://www.motherjones.com/food/2020/04/these-photos-show-the-staggering-food-bank-lines-across-america/.

2. Chris Granger, “Photos: Renters Block New Orleans Courthouse to Protest Rising Evictions During Coronavirus,” The Times-Picayune, July 30, 2020, available at https://www.nola.com/multimedia/photos/collection_20c3ed8c-d288-11ea-85cf-2b21a79e5ab9.html#3.

3. Matthew Haag, “One-Third of New York’s Small Businesses May Be Gone Forever,” TheNew York Times, August 5, 2020, available at https://www.nytimes.com/2020/08/03/nyregion/nyc-small-businesses-closing-coronavirus.html.

4. “United States COVID-19 Cases and Deaths by State,” available at https://covid.cdc.gov/covid-data-tracker/?CDC_AA_refVal=https%3A%2F%2Fwww.cdc.gov%2Fcoronavirus%2F2019-ncov%2Fcases-updates%2Fcases-in-us.html#cases (last accessed September 14, 2020).

5. “S&P 500 Index,” as of September 2, 2020, available at https://www.marketwatch.com/investing/index/spx.

6. Jessica Bursztynsky, “Apple Becomes First U.S. Company to Reach $2 Trillion Market Cap,” CNBC, August 19, 2020, available at https://www.cnbc.com/2020/08/19/apple-reaches-2-trillion-market-cap.html#:~:text=Apple%20hit%20a%20market%20cap%20of%20%242%20trillion%20Wednesday%2C%20doubling,barrier%20just%20before%2011%20a.m.

7. Nick W. Kraemer and others, “Credit Trends: Global Financing Conditions: Bond Issuance Is Expected to Finish 2020 Up 6% After A Strong Second Quarter,” S&P Global Market Intelligence, July 27, 2020, available at https://www.spglobal.com/ratings/en/research/articles/200727-credit-trends-global-financing-conditions-bond-issuance-is-expected-to-finish-2020-up-6-after-a-strong-sec-11584612.

8. Ibid.

9. Ibid.

10. U.S. Bureau of Labor Statistics, “The Employment Situation – August 2020,” Press release, September 4, 2020, available at https://www.bls.gov/news.release/pdf/empsit.pdf.

11. Brian Chappatta, “Permanent Job Losses Pose Trouble for Economic Recovery,” Bloomberg, September 4, 2020, available at https://finance.yahoo.com/news/permanent-job-losses-pose-trouble-150223643.html.

12. Ben Eisen, “How’s the Coronavirus Economy? Great or Awful, Depending on Whom You Ask,” The Wall Street Journal, September 2, 2020, available at https://www.wsj.com/articles/hows-the-coronavirus-economy-great-or-awful-depending-on-whom-you-ask-11599039003.

13. Emily Benfer and others, “The COVID-19 Eviction Crisis: An Estimated 30-40 Million People in America Are At Risk” (Washington: The Aspen Institute, 2020), available at https://www.aspeninstitute.org/blog-posts/the-covid-19-eviction-crisis-an-estimated-30-40-million-people-in-america-are-at-risk/.

14. Ann Saphir, “U.S. Small Businesses Face Mass Closures Without More Pandemic Aid,” Reuters, July 29, 2020, available at https://www.reuters.com/article/us-health-coronavirus-usa-smallbiz-insig/u-s-small-businesses-face-mass-closures-without-more-pandemic-aid-idUSKCN24U1MM.

15. Mark E. Czeisler, “Mental Health, Substance Use, and Suicidal Ideation During the COVID-19 Pandemic – United States, June 24-30, 2020” (Washington: U.S. Centers for Disease Control and Prevention, 2020), available at https://www.cdc.gov/mmwr/volumes/69/wr/mm6932a1.htm#suggestedcitation.

16. Zachary Parolin, Megan A. Curran, and Christopher Wimer, “The CARES Act and Poverty in the COVID-19 Crisis” (New York: Center on Poverty and Social Policy at Columbia University Poverty & Social Policy Brief, 2020), available at https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/5eefa3463153d0544b7f08b4/1592763209062/Forecasting-Poverty-Estimates-COVID19-CARES-Act-CPSP-2020.pdf.

17. Raj Chetty and others, “How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data” (Cambridge, MA: Opportunity Insights, 2020), available at https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf.

18. Jeff Ernsthausen and Ellis Simani, “The Eviction Ban Worked, But It’s Almost Over. Some Landlords Are Getting Ready,” ProPublica, July 24, 2020, available at https://www.propublica.org/article/the-eviction-ban-worked-but-its-almost-over-some-landlords-are-getting-ready.

19. Michael Garvey and Claudia Sahm, “Get More Money Immediately to U.S. Families and Help Them Out of the Coronavirus Recession” (Washington: Washington Center for Equitable Growth, 2020), available at https://equitablegrowth.org/get-more-money-immediately-to-u-s-families-and-help-them-out-of-the-coronavirus-recession/.

20. Amanda Fischer, “Did the Paycheck Protection Program Work for Small Businesses Across the United States?” (Washington: Washington Center for Equitable Growth, 2020), available at https://equitablegrowth.org/did-the-paycheck-protection-program-work-for-small-businesses-across-the-united-states/.

21. Ibid.

22. Ibid.

23. Jeanne Sahadi, “Many Small Business Owners Worry a Second Shutdown Would be Devastating,” CNN Business, July 4, 2020, available at https://www.cnn.com/2020/06/30/success/small-business-ppp-loan-coronavirus-shutdown-what-now/index.html.

24. Federal Deposit Insurance Corporation, “Leveraged Lending and Corporate Borrowing: Increased Reliance on Capital Markets, with Important Bank Links” (2019), available at https://www.fdic.gov/bank/analytical/quarterly/2019-vol13-4/fdic-v13n4-3q2019-article2.pdf. Specifically, according to the report, from 1990 to 2017, debt securities increased their share of corporate borrowing from 48 percent to around 69 percent, with the remaining borrowing taking the form of bank and nonbank loans. Corporate borrowers account for a much smaller share than smaller, noncorporate businesses such as sole proprietorships and partnerships that rely more heavily on banks to fund themselves because they do not issue stocks or bonds.

25. “S&P 500 Index,” as of September 2, 2020.

26. “S&P 500 Market Cap: 27.05 USD for Jul 2020,” available at https://ycharts.com/indicators/sp_500_market_cap.

27. “Apple Market Cap: 2.225T USD for Sept 2020,” available at https://ycharts.com/companies/AAPL/market_cap.

28. “Amazon Market Cap: 1.756T USD for Sept 2020,” available at https://ycharts.com/companies/AMZN/market_cap; “Microsoft Market Cap: 1.735T for Sept 2020,” available at https://ycharts.com/companies/MSFT/market_cap.

29. “Alphabet Market Cap: 1.143T for Sept 2020,” available at https://ycharts.com/companies/GOOG/market_cap.

30. “Facebook Market Cap: 843.71B for Sept 2020,” available at https://ycharts.com/companies/FB/market_cap.

31. “Total Value of of U.S. Stock Market, June 30, 2020,” available at https://siblisresearch.com/data/us-stock-market-value/#:~:text=The%20total%20market%20capitalization%20of,about%20OTC%20markets%20from%20here.) (last accessed September 14, 2020). Total market capitalization of all U.S. companies is $35 trillion, $27 trillion of which is represented in the S&P 500.

32. Ben Marks and Brett Angel, “The S&P 500 Has Never Been More Top Heavy,” Minneapolis Star Tribune, August 15, 2020, available at https://www.startribune.com/the-s-p-500-has-never-been-more-top-heavy/572106152/.

33. Ibid.

34. Lawrence Delevingne, “U.S. Big Tech Dominates Stock Market After Monster Rally, Leaving Investors on Edge,” Reuters, August 28, 2020, available at https://www.reuters.com/article/us-usa-markets-faangs-analysis/u-s-big-tech-dominates-stock-market-after-monster-rally-leaving-investors-on-edge-idUSKBN25O0FV.

35. “Russell 2000 index year-to-date returns,” as of September 3, 2020, available at https://www.marketwatch.com/investing/index/rut (last accessed September 14, 2020).

36. McKinsey & Company, “Survey: U.S. Consumer Sentiment During the Coronavirus Crisis” (2020), available https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-us-consumer-sentiment-during-the-coronavirus-crisis.

37. Ibid.

38. Ibid.

39. Jeffrey Dastin and Akanksha Rana, “Amazon Posts Biggest Profit Ever At Height of Pandemic in U.S.,” Reuters, July 30, 2020, available at https://www.reuters.com/article/us-amazon-com-results/amazon-posts-biggest-profit-ever-at-height-of-pandemic-in-u-s-idUSKCN24V3HL.

40. Daniel Sparks, “Is Amazon Stock a Buy Right Now?” Motley Fool, August 11, 2020, available at https://www.fool.com/investing/2020/08/11/is-amazon-stock-a-buy-right-now.aspx.

41. Esther Fung and Sebastian Herrera, “Amazon and Mall Operator Look at Turning Sears, J.C. Penney Stores Into Fulfillment Centers,” The Wall Street Journal, August 9, 2020, available at https://www.wsj.com/articles/amazon-and-giant-mall-operator-look-at-turning-sears-j-c-penney-stores-into-fulfillment-centers-11596992863.

42. Gartner Inc., “Gartner CFO Survey Reveals 74 Percent Intend to Shift Some Employees to Remote Work Permanently,” Press release, April 3, 2020, available at https://www.gartner.com/en/newsroom/press-releases/2020-04-03-gartner-cfo-surey-reveals-74-percent-of-organizations-to-shift-some-employees-to-remote-work-permanently2.

43. Rani Molla, “Office Work Will Never Be the Same,” Vox, May 21, 2020, available at https://www.vox.com/recode/2020/5/21/21234242/coronavirus-covid-19-remote-work-from-home-office-reopening.

44. U.S. Census Bureau, “Selected Economic Characteristics: American Community Survey” (2018), available at https://data.census.gov/cedsci/table?q=commute&tid=ACSDP1Y2018.DP03&hidePreview=false.

45. Michael Kades, “Hearing with Tech CEOs Sets Stage for New Legislation to Tackle Anticompetitive Conduct By Dominant Firms in U.S. Economy” (Washington: Washington Center for Equitable Growth, 2020), available at https://equitablegrowth.org/hearing-with-tech-ceos-sets-stage-for-new-legislation-to-tackle-anticompetitive-conduct-by-dominant-firms-in-the-u-s-economy/.

46. Ibid.

47. Ibid.

48. Ibid.

49. Ibid.

50. Kraemer and others, “Credit Trends: Global Financing Conditions: Bond Issuance Is Expected to Finish 2020 Up 6% After A Strong Second Quarter.”

51. Sally Bakewell, “Much of America Is Shut Out of the Greatest Borrowing Binge Ever,” Bloomberg, August 13, 2020, available at https://www.bloomberg.com/news/articles/2020-08-13/a-2-trillion-credit-boom-leaves-america-s-smaller-firms-behind?sref=hXddX0ju.

52. Skyler Rossi, “U.S. High-Grade Bond Sales Set Record, Reach $1.346 Trillion,” Bloomberg, August 17, 2020, available at https://www.bloomberg.com/news/articles/2020-08-17/u-s-high-grade-bond-sales-topple-record-reach-1-342-trillion?sref=hXddX0ju.

53. Alexandra Scaggs, “Apple Is Paying 2.6 Percent to Borrow for 40 Years in a Record Week for Bonds,” Barron’s, August 14, 2020, available at https://www.barrons.com/articles/apple-is-the-latest-to-tap-bond-markets-in-a-record-setting-week-51597344992; Kate Duguid, “Google Owner Alphabet Issues Record $10 Billion Bond at Lowest-Ever Prices,” Reuters, August 3, 2020, available at https://www.reuters.com/article/us-alphabet-bonds/google-owner-alphabet-issues-record-10-billion-bond-at-lowest-ever-price-idUSKCN24Z2PC#:~:text=Google%20owner%20Alphabet%20issues%20record%20%2410%20billion%20bond%20at%20lowest%2Dever%20price,-Kate%20Duguid&text=NEW%20YORK%20(Reuters)%20%2D%20Alphabet,lowest%2Dever%20cost%20of%20financing.

54. Kraemer and others, “Credit Trends: Global Financing Conditions: Bond Issuance Is Expected to Finish 2020 Up 6% After A Strong Second Quarter.”

55. Cezary Podkul, “Fed Stimulus Is Resuscitating the High-Yield Bond Market,” The Wall Street Journal, August 14, 2020, available at https://www.wsj.com/articles/fed-stimulus-is-resuscitating-the-high-yield-bond-market-11597438798.

56. Steven Pearlstein, “The Fed is Addicted to Propping Up the Markets, Even Without a Need,” The Washington Post, June 17, 2020, available at https://www.washingtonpost.com/business/2020/06/17/fed-is-addicted-propping-up-market-whether-it-needs-help-or-not/.

57. Paula Seligson and Gowri Gurumurthy, “U.S. Junk Bond Market Sets Record-Low Coupon in Relentless Rally,” Bloomberg, August 10, 2020, available at https://www.bloomberg.com/news/articles/2020-08-10/u-s-junk-bond-market-sets-record-low-coupon-in-relentless-rally?sref=hXddX0ju.

58. Kraemer and others, “Credit Trends: Global Financing Conditions: Bond Issuance Is Expected to Finish 2020 Up 6% After A Strong Second Quarter.”

59. Ibid.

60. Jeff Cox, “Powell on Whether the Fed Has Enough Firepower: ‘We’re Not Going to Run Out of Ammunition,’” CNBC, March 26, 2020, available at https://www.cnbc.com/2020/03/26/fed-chair-jerome-powell-on-when-to-restart-the-economy-we-would-tend-to-listen-to-the-experts.html.

61. Board of Governors of the Federal Reserve System, “Primary Market Corporate Credit Facility” (2020), available at https://www.federalreserve.gov/monetarypolicy/pmccf.htm.

62. Board of Governors of the Federal Reserve System, “Secondary Market Corporate Credit Facility” (2020), available at https://www.federalreserve.gov/monetarypolicy/smccf.htm.

63. Ibid.

64. Ibid.

65. Board of Governors of the Federal Reserve System, “Periodic Report: Update on Outstanding Lending Facilities Authorized by the Board under Section 13(3) of the Federal Reserve Act, August 8, 2020” (2020), available at https://www.federalreserve.gov/publications/files/nonlf-noelf-pdcf-mmlf-cpff-pmccf-smccf-talf-mlf-ppplf-msnelf-mself-msplf-8-10-20.pdf#page=4.

66. Board of Governors of the Federal Reserve System, “Secondary Market Corporate Credit Facility.”

67. Jeff Cox, “The Fed Bought More Blue-Chip and Junk Bonds, and Has Started Making Main Street Loans,” CNBC, August 10, 2020, available at https://www.cnbc.com/2020/08/10/the-fed-bought-more-blue-chip-and-junk-bonds-and-has-started-making-main-street-loans.html#:~:text=The%20Federal%20Reserve%20in%20July,casino%20in%20the%20Pocono%20Mountains.

68. Ibid.

69. Joy Wiltermuth, “Fed Slows Corporate Debt Purchases to a Trickle,” MarketWatch, August 10, 2020, available at https://www.marketwatch.com/story/fed-slows-corporate-debt-purchases-to-trickle-11597104973.

70. Ibid.

71. Bloomberg News, “Fed Purchases Reshape Market for Bond ETFs,” June 16, 2020, available at https://www.investmentnews.com/fed-purchases-reshape-market-bond-etfs-194149.

72. David Dierking, “Fed Purchases Account for More than 50 Percent of New Cash in Some Bond ETFs,” The Street, July 10, 2020, available at https://www.thestreet.com/etffocus/dividend-ideas/fed-bond-purchases-in-corporate-bond-etfs.

73. David J. Lynch, “Corporate Debt Nears a Record $10 Trillion and Borrowing Binge Poses New Risks,” The Washington Post, November 19, 2019, available at https://www.washingtonpost.com/business/economy/corporate-debt-nears-a-record-10-trillion-and-borrowing-binge-poses-new-risks/2019/11/29/1f86ba3e-114b-11ea-bf62-eadd5d11f559_story.html; David J. Lynch, “With Fed’s Encouragement, Corporations Accelerate Debt Binge in Hopes of Riding Out Pandemic,” The Washington Post, May 13, 2020, available at https://www.washingtonpost.com/business/2020/05/13/with-feds-encouragement-corporations-accelerate-debt-binge-hopes-riding-out-pandemic/.

74. Wiltermuth, “Fed Slows Corporate Debt Purchases to a Trickle.”

75. Matt Wirz, “Fed Backstop Fueled Corporate Bond Surge,” The Wall Street Journal, June 30, 2020, available at https://www.wsj.com/articles/fed-backstop-fueled-corporate-bond-surge-11593515309.

76. Board of Governors of the Federal Reserve System, “Periodic Report: Update on Outstanding Lending Facilities Authorized by the Board under Section 13(3) of the Federal Reserve Act, August 8, 2020.”

77. Duguid, “Google Owner Alphabet Issues Record $10 Billion Bond at Lowest-Ever Prices.”

78. Jacob Manoukian, “COVID-19 Almost Broke the Bond Market. Then the Fed Stepped In.” JPMorgan Economy & Markets, March 30, 2020, available at https://privatebank.jpmorgan.com/gl/en/insights/investing/covid-19-almost-broke-the-bond-market-then-the-fed-stepped-in.

79. Pearlstein, “The Fed is Addicted to Propping Up the Markets, Even Without a Need.”

80. Bob Bryan, “America’s Smaller Businesses Are Huge,” Business Insider, June 8, 2015, available at https://www.businessinsider.com/sp-500-employment-vs-smaller-businesses-2015-6.

81. U.S. Small Business Administration Office of Advocacy, “2018 Small Business Profile” (2018), available at https://www.sba.gov/sites/default/files/advocacy/2018-Small-Business-Profiles-US.pdf.

82. Associated Press, “American Airlines Announces Pay Raises, and Investors Balk,” April 27, 2017, available at https://www.latimes.com/business/la-fi-american-airlines-raises-20170427-story.html.

83. Thomas Franck, “Chipotle Downgraded by Bank of America on Concerns that Labor is Still Too Expensive,” CNBC, October 18, 2017, available at https://www.cnbc.com/2017/10/18/chipotle-downgraded-employee-pay.html.

84. Sarah Ponczek, “Stock Market Warns Workers That They’re the Problem for Business,” Bloomberg, August 25, 2020, available at https://www.bloomberg.com/news/articles/2020-08-25/stock-market-warns-workers-that-they-re-the-problem-for-business?sref=hXddX0ju.

85. Avery Hartmans, “‘This is Why People Are So Angry’: Tech Giants Like Google, Facebook, and Uber Built Their Empires on the Backs of Contractors. A Pandemic is Showing Just How Horrifically That Model Failed American Workers,” Business Insider, April 2, 2020, available at https://www.businessinsider.com/how-tech-relies-on-contractors-temps-gig-workers-employees-2020-1.

86. Alana Semuels, “I Delivered Packages for Amazon and It Was a Nightmare,” The Atlantic, June 25, 2019, available at https://www.theatlantic.com/technology/archive/2018/06/amazon-flex-workers/563444/.

87. Ibid; Casey Newton, “The Trama Floor: The Secret Lives of Facebook Moderators in America,” The Verge, February 25, 2019, available at https://www.theverge.com/2019/2/25/18229714/cognizant-facebook-content-moderator-interviews-trauma-working-conditions-arizona.

88. Ponczek, “Stock Market Warns Workers That They’re the Problem for Business.”

89. Victoria Guida and Kellie Mejdrich, “‘The Balloon Might Pop’: Fed’s Corporate Intervention Spurs Anxiety,” Politico, July 16, 2020, available at https://www.politico.com/news/2020/07/16/fed-corporate-intervention-worry-365047.

90. Coronavirus Aid, Relief, and Economic Security Act, Public Law 116-136, Section 4003, 116th Cong., 2d sess. (2020), p. 190, available at https://www.congress.gov/116/bills/hr748/BILLS-116hr748enr.pdf.

91. Brian Chappatta, “Fed Seems to Skirt the Law to Buy Corporate Bonds,” Bloomberg, June 18, 2020, available at https://www.bloomberg.com/opinion/articles/2020-06-18/fed-seems-to-skirt-the-law-to-buy-corporate-bonds?sref=hXddX0ju; Jeff Stein, “The U.S. Plans to Lend $500 Billion to Large Companies. It Won’t Require Them to Preserve Jobs or Limit Executive Pay,” The Washington Post, April 28, 2020, available at https://www.washingtonpost.com/business/2020/04/28/federal-reserve-bond-corporations/.

92. Christopher Rugaber, “The Fed Reveals Which Companies Make Its Corporate-Bonds Shopping List,” Fortune, June 29, 2020, available at https://fortune.com/2020/06/29/fed-buying-corporate-bonds-apple-walmart-exxonmobil/.

93. Jennifer Hiller, Ron Bousso, and Dmitry Zhdannikoy, “Exxon Prepares Spending, Job Cuts in Last Ditch Move to Save Dividend,” Reuters, July 30, 2020, available at https://www.reuters.com/article/us-exxon-mobil-cuts-exclusive/exclusive-exxon-prepares-spending-job-cuts-in-last-ditch-move-to-save-dividend-idUSKCN24V2RP.

94. Federal Reserve Bank of New York, “Composition of the SMCCF Broad Market Index” (2020), available at https://www.newyorkfed.org/markets/secondary-market-corporate-credit-facility/secondary-market-corporate-credit-facility-broad-market-index.

95. Ryan McCrimmon, “Fed to Buy Bonds from Food, Ag Firms,” Politico, June 29, 2020, available at https://www.politico.com/newsletters/morning-agriculture/2020/06/29/fed-to-buy-bonds-from-food-ag-firms-788854.

96. Anna Kovner, Stephan Luck, and Sungmin An, “Implications of the COVID-19 Disruption for Corporate Leverages” (New York: Federal Reserve Bank of New York, 2020), available at https://libertystreeteconomics.newyorkfed.org/2020/08/implications-of-the-covid-19-disruption-for-corporate-leverage.html.

97. David J. Lynch, “Here’s One More Economic Problem the Government’s Response to the Virus Has Unleashed: Zombie Firms,” The Washington Post, June 23, 2020, available at https://www.washingtonpost.com/business/2020/06/23/economy-debt-coronavirus-zombie-firms/.

98. Kovner, Luck, and An, “Implications of the COVID-19 Disruption for Corporate Leverages.”

99. Gregg Gelzinis, Michael Madowitz, and Divya Vijay, “The Fed’s Oil and Gas Bailout Is A Mistake” (Washington: Center for American Progress, 2020), available at https://www.americanprogress.org/issues/economy/reports/2020/07/31/488320/feds-oil-gas-bailout-mistake/.

100. Heidi Chung, “The Richest 1 Percent Own 50 Percent of Stocks Held by American Households,” Yahoo Finance, January 17, 2019, available at https://finance.yahoo.com/news/the-richest-1-own-50-of-stocks-held-by-american-households-150758595.html.

101. Sunny Oh, “The Number of Americans That Directly Own Bonds Fell to One Percent in 2016,” MarketWatch, October 25, 2017, available at https://www.marketwatch.com/story/the-number-of-americans-that-directly-own-bonds-fell-even-further-in-2016-2017-10-25.

102. Board of Governors of the Federal Reserve System, “Main Street Lending Program” (2020), available at https://www.federalreserve.gov/monetarypolicy/mainstreetlending.htm.

103. Ibid.

104. David Brooke, “Restrictions Keep Lenders, Borrowers From Main Street Lending Program,” Reuters, September 1, 2020, available at https://www.reuters.com/article/us-federal-reserve-coronavirus/restrictions-keep-lenders-borrowers-from-main-street-lending-program-idUSKBN25S6A3.

105. Ibid.

106. Bakewell, “Much of America Is Shut Out of the Greatest Borrowing Binge Ever.”

107. Jeanna Smialek, “Meet the Man Loosening Bank Regulation, One Detail At a Time,” The New York Times, November 29, 2019, available at https://www.nytimes.com/2019/11/29/business/economy/bank-regulations-fed.html.

108. Rachel McGovern and Kelsey Butler, “Billion Dollar Deals See Private Credit Step Out of the Shadows,” Bloomberg, July 28, 2020, available at https://www.bloomberg.com/news/articles/2020-07-28/billion-dollar-deals-see-private-credit-step-out-of-the-shadows?sref=hXddX0ju.

109. Bakewell, “Much of America Is Shut Out of the Greatest Borrowing Binge Ever.”

110. Board of Governors of the Federal Reserve System, “Municipal Liquidity Facility” (2020), available at https://www.federalreserve.gov/monetarypolicy/muni.htm.

111. Shruti Singh and Amanda Albright, “Illinois Becomes First to Tap Fed Loans After Yields Surge,” Bloomberg, June 2, 2020, available at https://www.bloomberg.com/news/articles/2020-06-02/illinois-becomes-first-to-tap-fed-loans-after-bond-yields-surge?sref=hXddX0ju.

112. Brian Chappatta, “New York’s MTA Is Saved Less by Fed and More By Kroll,” Bloomberg, August 19, 2020, available at https://www.bloomberg.com/opinion/articles/2020-09-03/coronavirus-iceland-gives-us-some-good-covid-19?sref=hXddX0ju.

113. Borrowing rates pulled from a Bloomberg terminal on September 2, 2020, available at https://twitter.com/StevenKelly49/status/1301222576337891329/photo/1, compared to the terms of the Board of Governors of the Federal Reserve System, “Municipal Liquidity Facility.”

114. Board of Governors of the Federal Reserve System, “Primary Market Corporate Credit Facility”; Board of Governors of the Federal Reserve System, “Secondary Market Corporate Credit Facility.”

115. Ibid.

116. Carla Fried, “Bonds Started to Falter. Then, the Fed Came to the Rescue,” The New York Times, April 16, 2020, available at https://www.nytimes.com/2020/04/16/business/bonds-fed-rescue-investors.html.

117. Jeanna Smialek, Alan Rappeport, and Emily Cochrane, “State and Local Budget Pain Looms Over Economy’s Future,” The New York Times, August 14, 2020, available at https://www.nytimes.com/2020/08/14/business/economy/state-local-budget-pain.html.

118. Christina D. Romer, “The Fiscal Stimulus, Flawed But Valuable,” The New York Times, October 20, 2012, available at https://www.nytimes.com/2012/10/21/business/how-the-fiscal-stimulus-helped-and-could-have-done-more.html.

119. Ryan Tracy and Telis Demos, “U.S. Banks Reported Record First-Quarter Profit,” The Wall Street Journal, May 22, 2018, available at https://www.wsj.com/articles/u-s-banks-report-record-first-quarter-profit-1526999856.

120. Binyamin Appelbaum and Robert Pear, “U.S. Household Income Rises to Pre-Recession Levels, Prompting Cheers,” The New York Times, September 12, 2018, available at https://www.nytimes.com/2018/09/12/us/politics/median-us-household-income-increased-in-2017.html.

121. U.S. Bureau of Labor Statistics, “TED: The Economics Daily. Unemployment in October 2009” (2009), available at https://www.bls.gov/opub/ted/2009/ted_20091110.htm?view_full.

122. Austin Nichols, Josh Mitchell, and Stephan Lindner, “Consequences of Long-Term Unemployment” (Washington: Urban Institute, 2013), available at https://www.urban.org/sites/default/files/publication/23921/412887-Consequences-of-Long-Term-Unemployment.PDF.

123. Thomas G. Kingsley, Robin Smith, and David Price, “The Impacts of Foreclosures on Families and Communities” (Washington: Urban Institute, 2009), available at https://www.urban.org/sites/default/files/publication/30426/411909-The-Impacts-of-Foreclosures-on-Families-and-Communities.PDF.

124. U.S. Bureau of Labor Statistics, “The Recession of 2007-2009” (2012), available at https://www.bls.gov/spotlight/2012/recession/.

125. Katherine A. Fowler and others, “Increases in Suicides Associated with Home Eviction and Foreclosure During the U.S. Housing Crisis: Findings from 16 National Violent Death Reporting System States, 2005-2010,” American Journal of Public Health (2015), available at https://ajph.aphapublications.org/doi/abs/10.2105/AJPH.2014.301945.

126. Amanda Fischer and Alix Gould-Werth, “Broken Plumbing: How Systems for Delivering Economic Relief in Response to the Coronavirus Recession Failed the U.S. Economy” (Washington: Washington Center for Equitable Growth, 2020), available at https://equitablegrowth.org/broken-plumbing-how-systems-for-delivering-economic-relief-in-response-to-the-coronavirus-recession-failed-the-u-s-economy/.

127. Heather Boushey and Somin Park, “The Coronavirus Recession and Economic Inequality: A Roadmap to Recovery and Long-Term Structural Change” (Washington: Washington Center for Equitable Growth, 2020), available at https://equitablegrowth.org/the-coronavirus-recession-and-economic-inequality-a-roadmap-to-recovery-and-long-term-structural-change/.