Fighting the next recession in the United States with law and regulation, not just fiscal and monetary policies

This essay is part of Vision 2020: Evidence for a stronger economy, a compilation of 21 essays presenting innovative, evidence-based, and concrete ideas to shape the 2020 policy debate. The authors in the new book include preeminent economists, political scientists, and sociologists who use cutting-edge research methods to answer some of the thorniest economic questions facing policymakers today.

To read more about the Vision 2020 book and download the full collection of essays, click here.

Overview

Is the United States ready for the next recession? According to many experts, the answer is no.1 Our nation’s primary recession-fighting tools—monetary stimulus by the Federal Reserve and fiscal stimulus by Congress—appear hamstrung. New policy options are desperately needed. In this essay, I outline what I call countercyclical regulatory policy as a new macroeconomic policy option. Like monetary and fiscal policy, regulatory policy affects total spending in the U.S. economy. Regulatory actions that encourage banks to lend, firms to invest, and consumers to spend can increase demand and reduce unemployment when the next recession hits—even if (as is likely) monetary and fiscal stimulus falter.

In the next recession, the Fed will be constrained in its ability to reduce interest rates to stimulate investment and consumption spending and lower unemployment. Today’s historically low rates leave the Fed little space to stimulate the economy by lowering interest rates before they hit their effective lower bound around zero. Interest rates cannot go deeply into negative territory because savers will hoard cash or prepay taxes rather than accept a negative return.2

When monetary policy is constrained during a recession, the textbook macroeconomic policy response is fiscal stimulus.3 Increases in government spending and decreases in taxes raise total spending—also known as aggregate demand—to offset the weakness in spending causing the recession. Yet partisan gridlock and fears about excessive deficits during the most recent economic downturn, the Great Recession of 2007–2009, caused the size of fiscal stimulus passed by Congress in 2009 to fall well short of what was needed to effectively relieve unemployment.4 Because partisan gridlock is, if anything, worse than a decade ago and public debt as a percentage of Gross Domestic Product has increased since 2009, we cannot depend on fiscal stimulus during the next recession.

As I explain in my latest book, Law and Macroeconomics: Legal Remedies to Recessions,5 law and regulation offer a wide variety of stimulus options in recessions across many parts of the U.S. economy. Many federal regulatory program affect the business cycle. Regulatory options are not subject to the constraints of monetary and fiscal policy. If regulators and administrators systematically favor policies promoting spending and employment in recessions, then they could collectively have an important stimulating effect on the U.S. economy. At the very least, these proposed countercyclical regulatory policy options could avoid the unintentionally pro-cyclical effects of many current laws and regulations.

What is countercyclical regulatory policy?

Countercyclical regulatory policy directs regulators to apply a rule that promotes spending during recessions and a different and more restrictive rule during periods of robust economic growth. In financial regulation, conventional wisdom favors countercyclical regulatory policy. The Basel III accords—a set of international standards of bank regulation—highlight the value of “countercyclical capital buffers,” which apply a relatively strict regulatory regime to financial institutions in good times and a more lenient one during recessions.6

Unfortunately, U.S. financial regulators have been reluctant to implement countercyclical rules in practice.7 With countercyclical monetary and fiscal policy constrained, the next administration should appoint financial regulators more willing to implement countercyclical financial regulation as a means of avoiding lending bubbles during the next boom and stimulating the economy in the next recession.

The logic of countercyclical regulation does not apply to financial regulation alone. It should apply to every regulatory regime that affects aggregate demand and unemployment, among them energy, housing, and utility regulation.

Using permits and mandates as countercyclical regulatory policy tools

Many investment projects require approval from federal regulators. The federal Bureau of Ocean Energy Management, for example, reviews applications for the construction of offshore wind turbines.8 Federal regulations grant this agency within the U.S. Department of the Interior considerable discretion over applications, authorizing rejection of projects that cause “undue harm” to other interests.9

Outside of recessions, decisions made by the Bureau of Ocean Energy Management have relatively little effect on unemployment. If unemployment is already low, then the approval of a new wind turbine project is unlikely to significantly reduce unemployment or increase investment. Instead, project approval shifts workers and capital from other uses to offshore wind turbine construction. During recessions, however, many workers are unemployed and capital lies dormant. If the agency approves an outstanding offshore turbine application during a recession that it might not have approved otherwise, then investment spending increases and unemployment decreases. Regulatory policy can stimulate the economy.

Of course, the business cycle should not be the sole determinant of regulatory decisions during recessions. The Bureau of Ocean Energy Management must still determine whether the project causes “undue harm” to other interests. Because of the stimulus value of a new investment project during a recession, however, some projects should be approved that might be rejected at other times. The economic value of the project to the economy as a whole changes with the business cycle. As a result, the determination of what is “undue harm” should change as well.

Because federal regulators are generally reviewing many billions of dollars of investment proposals at any given time, systematic countercyclical regulatory policy, in financial regulation and outside of it, offers the prospect of significant stimulus during a recession. Yet countercyclical regulatory policy does not always entail deregulation during recessions.10 In some cases, new mandates can increase spending and reduce unemployment.

Consider Section 8 housing vouchers, which provide rental assistance to low-income families. The U.S. Department of Housing and Urban Development, which oversees the program, determines a housing property’s compliance with “housing quality standards” and thus eligibility for Section 8 vouchers.11 If HUD imposed a more robust energy efficiency requirement to its housing quality standards during the next recession, then the new mandate would likely increase property investment in millions of units.

Utility regulation as a countercyclical regulatory policy tool

While countercyclical regulatory policy could deliver meaningful stimulus during a recession, the first policy task is simply to avoid making business cycles worse. Too many legal and regulatory regimes are implicitly pro-cyclical, exacerbating recessions without intending to do so. The regulation of utilities, implemented jointly by federal and state regulators, provides an example of regulation that unintentionally affects private-sector spending pro-cyclically. Ending this pro-cyclical bias and moving to a neutral or even countercyclical stance should enable tens of billions of dollars of stimulus during the next recession—without increasing the national debt.

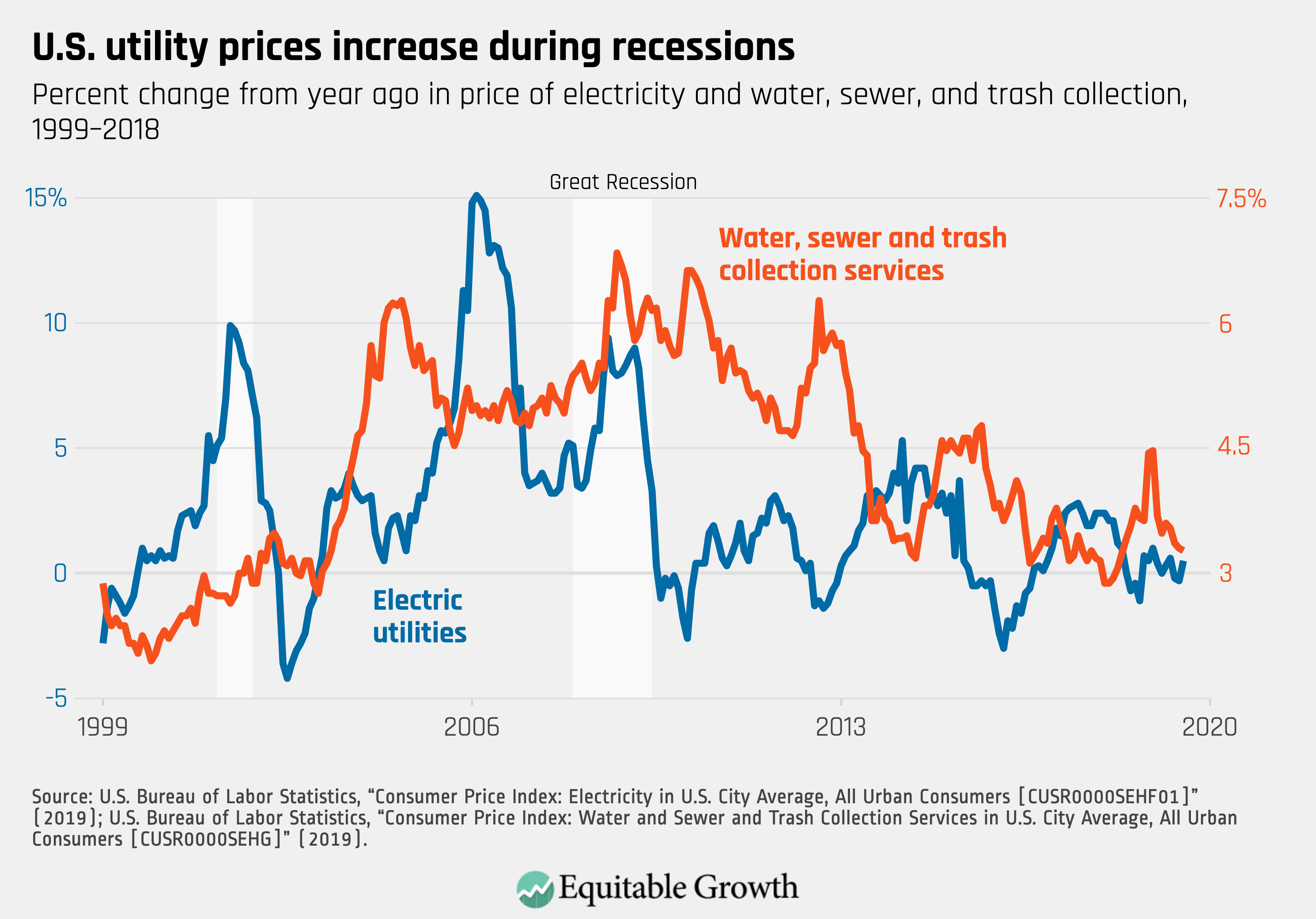

At present, utility regulators generally approve proposed utility prices consistent with returns of 8 percent to 10 percent on invested capital per year.12 When profits fall below this baseline, regulators often permit price increases.13 In recessions, demand for utilities goes down. Utility profits follow, falling below the profit baseline used by the regulators. In response, utilities request rate increases from their regulators. The regulators oblige. Retail prices in electricity (the largest rate-regulated sector) have increased substantially amid the past two recessions. Prices in the regulated water and trash-collection sectors, set by a combination of regulation and direct government provision, also experienced their highest price increases of the past 20 years during late 2008 and 2009.14 (See Figure 1.)

Figure 1

The pro-cyclical pattern of utility prices approved by regulators exacerbates recessions. A utility rate increase resembles a tax increase, decreasing discretionary income and spending by consumers when unemployment is high. While the rate increase supports utility profits and thus benefits utility shareholders, comparatively wealthy shareholders have a much lower propensity to consume out of an additional dollar than the typical utility consumer. Higher utility prices in recessions therefore decrease spending and raise unemployment.

A better regulatory framework from a macroeconomic perspective would hold utility prices down and keep returns below 5 percent during recessions, raising consumer discretionary incomes and spending. To ensure regulated utilities earn an average return of 8 percent to 10 percent over the business cycle, regulators should allow utility returns to rise above 10 percent during booms.15 This kind of countercyclical utility regulation would shift recession risk from utility consumers to utility investors, who are better equipped to manage the risk. The existing regulatory framework, by contrast, imposes the risk of recession on utility consumers, forcing consumers to reduce their spending during a recession to stabilize utility profits.

Although state public utility commissions directly regulate electricity and other utility prices, the Federal Energy Regulatory Commission enjoys considerable supervisory authority over the process for electricity. FERC “regulates the transmission and wholesale sales of electricity in interstate commerce” and “reviews certain mergers and acquisitions and corporate transactions by electricity companies.”16 If one factor in the commission’s review of electricity mergers were the merging companies’ demonstrated ability to tolerate temporarily lower profits in recessions, then utility regulation could cease exacerbating recessions. An even more ambitious regulatory reform that used lower utility prices as a stimulus during recessions would have even greater countercyclical effects.

Government insurance rates as countercyclical regulatory policy tools

Utility regulation is not the only area of regulation that produces pro-cyclical prices. Government insurance programs often yield the same result. Government insurance programs maintain reserve funds to ensure that future claims will be paid. In recessions, these reserve funds shrink as claims against the funds exceed insurance premiums. In response, the administrators of these funds raise rates. As a result, government insurance fund charges are highest during recessions, reducing discretionary income and spending at precisely the worst time.

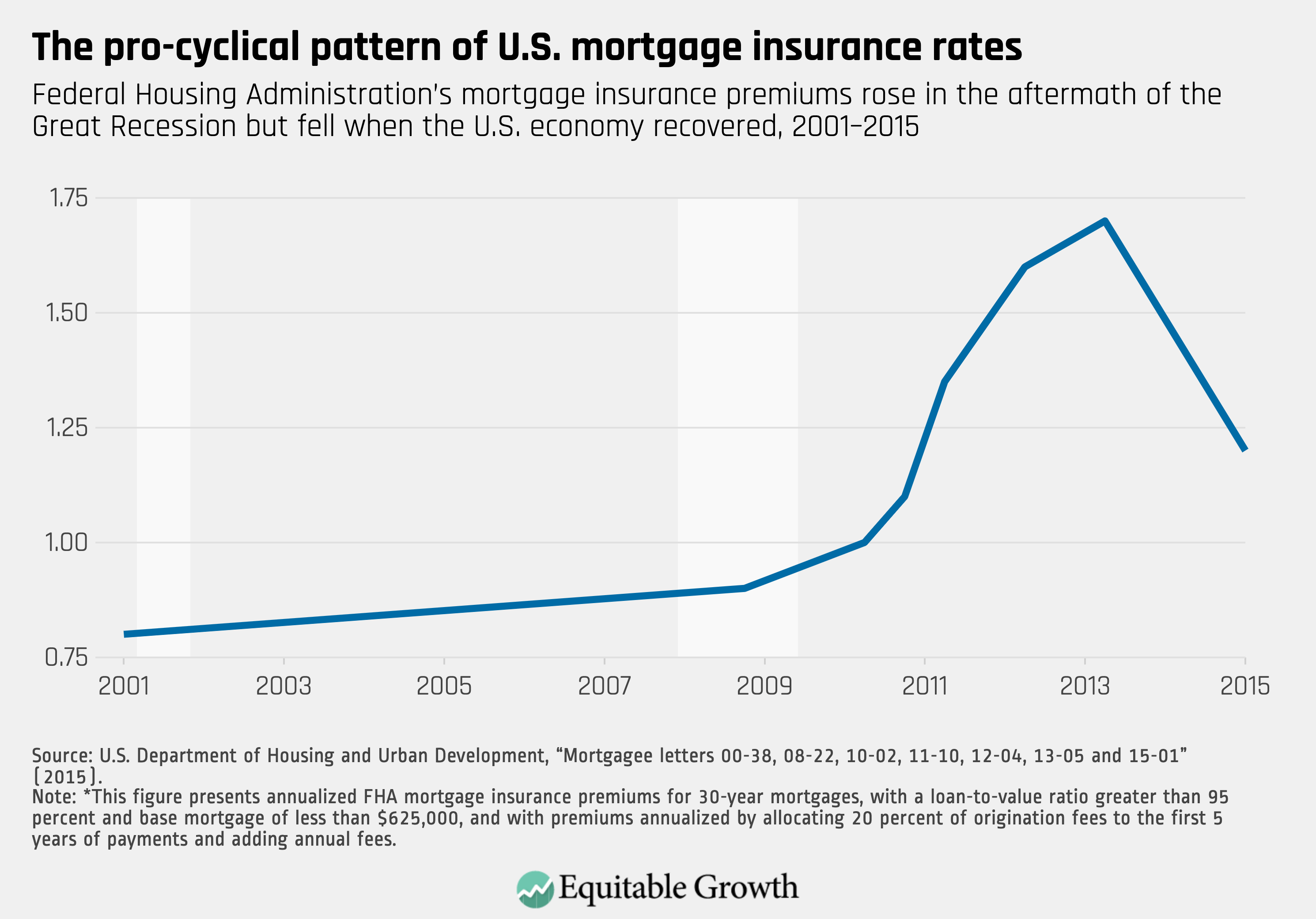

One case in point is the Federal Housing Administration’s mortgage insurance program. During the Great Recession, unexpectedly high mortgage defaults depleted the FHA’s insurance reserves. In response, the FHA raised mortgage insurance rates considerably from 2009 to 2013—when the U.S. housing market was at its weakest. Once the housing market recovered, the FHA dropped mortgage insurance rates to historical norms. (See Figure 2.)

Figure 2

This increase in mortgage insurance rates from 2009–2012 lowered borrowers’ discretionary incomes, reducing their spending at the worst possible time. Even worse, higher insurance rates discouraged borrowers from refinancing mortgages to take advantage of lower interest rates during the Great Recession and the extremely slow recovery that followed.

Instead of pro-cyclical insurance rates, the Federal Housing Agency and other government insurance programs that show similar patterns, such as unemployment insurance and deposit insurance rates set by the Federal Deposit Insurance Corporation, should strive for business cycle neutral premiums. During ordinary times, insurance premiums that exceed claims buoy insurance reserves. Program administrators and regulators need to resist the temptation to lower rates during these times. The reserves are needed for the next recession. When the next recession strikes and claims against government insurance funds rise, then program administrators should allow the insurance reserve funds to be depleted without raising rates. Keeping insurance rates low in the next recession increases discretionary incomes for the consumers of government insurance programs, raising spending and lowering unemployment.

Download FileFighting the next recession in the United States with law and regulation, not just fiscal and monetary policies

Coordinating countercyclical regulatory policy within overall macroeconomic policy

Predicting how a regulatory regime affects the business cycle demands expertise. So does determining when the economy needs stimulus. Every regulator and administrator acting across many different sectors of the U.S. economy cannot be expected to have that needed expertise. As a result, effective countercyclical regulatory policy requires a coordinating office staffed by a mix of experts in macroeconomics and regulation. A White House office, the Office of Management and Budget’s Office of Information and Regulatory Affairs, and one White House council, the National Economic Council, could be where that expertise could reside.

The Office of Information and Regulatory Affairs currently coordinates and supervises the implementation of microeconomic tools such as cost-benefit analysis in federal regulation. The National Economic Council currently provides overall macroeconomic policy advice to the president. A new office to coordinate countercyclical regulatory policy could be located within or alongside either of these offices. The next administration could create this office either by modifying the Executive Order creating the National Economic Council17 or by modifying the Executive Order instructing the Office of Information and Regulatory Affairs to focus on cost-benefit analysis.18 The countercyclical regulatory policy office would have two roles.

First, this new office would work with other agencies to determine how each regulatory regime affects the business cycle. This process would identify programs that offer the potential for meaningful stimulus during a recession if applied in an appropriate countercyclical fashion. It would also identify regimes that were unintentionally pro-cyclical and ripe for reform.

Second, the new office, working in conjunction with macroeconomic experts throughout government, would evaluate macroeconomic conditions and the ability of discretionary fiscal and monetary policies to respond to the business cycle, and instruct regulators to implement pre-identified countercyclical regulatory programs accordingly. By creating an office to coordinate the making of macroeconomic policy across the federal government’s many agencies, the next administration would build countercyclical policy into the regulatory framework, rather than making macroeconomic policy on an ad hoc basis.

The wide variety of policy proposals described here, ranging from bank capital requirements to utility regulation, demonstrates countercyclical regulatory policy’s potential. Every federal regulatory program affects the business cycle. The proposals here are merely representative examples. Countercyclical regulatory policy offers an infinite variety of macroeconomic policy options that are not subject to the constraints of monetary and fiscal policy. By paying attention to these effects and managing them, policymakers can stimulate the economy in the next recession.

—Yair Listokin is the Shibley Family Fund Professor of Law at Yale Law School.

End Notes

1. In a recent interview, for example, Mark Zandi, chief economist at Moody’s Analytics asserted that “The U.S. economy has some very particular tools to deal with recessions, but … the usual monetary and fiscal medicine may not be as effective this time around.” See Cardiff Garcia and Danielle Kurtzleben, “Are We Ready For A Recession?,” NPR, January 9, 2019, available at https://www.npr.org/sections/money/2019/01/09/683696538/are-we-ready-for-a-recession.

2. For a discussion of the constraints imposed on monetary policy by the effective lower bound on interest rates, see Ben S. Bernanke, “How Big a Problem Is the Zero Lower Bound on Interest Rates?” (Washington: The Brookings Institution, 2017), available at https://www.brookings.edu/blog/ben-bernanke/2017/04/12/how-big-a-problem-is-the-zero-lower-bound-on-interest-rates/.

3. Indeed, much of Law and Macroeconomics: Legal Remedies to Recessions is devoted to unconventional fiscal stimulus options. For a list of creative fiscal stimulus options, see Heather Boushey, Ryan Nunn, and Jay Shambaugh, eds., Recession Ready: Fiscal Policies to Stabilize the American Economy (Washington: The Hamilton Project and Washington Center for Equitable Growth, 2019), available at https://www.hamiltonproject.org/papers/recession_ready_fiscal_policies_to_stabilize_the_american_economy.

4. Eileen Appelbaum, “Panelists: Stimulus was Too Small, More Action Needed to Jumpstart Economy” (Washington: Center for Economic and Policy Research, 2010), available at https://www.cepr.net/panelists-stimulus-was-too-small-more-action-needed-to-jumpstart-economy/a>.

5. Yair Listokin, Law and Macroeconomics: Legal Remedies to Recessions (Cambridge, MA: Harvard University Press, 2019).

6. The Basel III accords envision regulators raising bank capital requirements “when authorities judge credit growth is resulting in an unacceptable build up of systematic risk.” See Basel Committee on Banking Supervision Reforms – Basel III, “Summary Table,” (n.d.), available at https://www.bis.org/bcbs/basel3/b3summarytable.pdf.

7. For example, then-Fed Governor Daniel Tarullo, a leader of the Fed’s financial regulatory efforts, asserted in 2014 that “time-varying measures will play a more limited role” in the Fed’s financial regulatory regime than many other considerations. See Daniel K. Tarullo, “Macroprudential Regulation,” speech given at the Yale Law School Conference on Challenges in Global Financial Services, New Haven, CT, September 20, 2013, available at https://www.federalreserve.gov/newsevents/speech/tarullo20130920a.htm.

8. “Renewable Energy Program,” available at https://www.boem.gov/Renewable-Energy/ (last accessed October 1, 2019).

9. See, for example, 30 C.F.R. § 585.105(a), instructing the Bureau to reject applications that cause “undue harm or damage to natural resources,” granting the Bureau discretion in determining the meaning of “undue harm.” See “What Are My Responsibilities Under This Part?,” Code of Federal Regulations, title 30 (Government Printing Office, 2018), available at https://www.govinfo.gov/content/pkg/CFR-2018-title30-vol2/pdf/CFR-2018-title30-vol2-sec585-105.pdf.

10. If regulation were equivalent to a Pigouvian tax, then deregulation should be the norm in recessions just as Pigovian taxes should be lowered in recessions and raised in booms. See Garth Heutel, “How Should Environmental Policy Respond to Business Cycles? Optimal Policy under Persistent Productivity Shocks,” Review of Economic Dynamics, Elsevier for the Society for Economic Dynamics 15 (2) (2012): pp. 244–264. Spending mandates, however, resemble a joint tax and spending program. If some of the money that is spent complying with the mandate would otherwise have been saved, then the mandate increases spending and potentially lowers unemployment.

11. See 24 CFR § 982.401—“Housing Quality Standards.”

12. Seth Blumsack, “The Mechanics of Rate of Return Regulation,” Energy Markets, Policy, and Regulation, n.d., available at https://www.e-education.psu.edu/eme801/node/531.

13. Shlomit Azgad-Tromer and Eric L. Talley, “The Utility of Finance” (New York: The Center for Law and Economic Studies, 2017), available at http://dx.doi.org/10.2139/ssrn.2994314.

14. Retail natural gas prices also spiked during the Great Recession. Because natural gas prices are largely determined by the price of their primary input (natural gas), they are not emphasized here. Natural gas prices also influence the price of electricity, but the relationship is much more attenuated.

15. To compensate utility investors for bearing recession risk, average profits in the industry would have to rise slightly.

16. “What FERC Does,” available at https://www.ferc.gov/about/ferc-does.asp (last accessed October 1, 2019).

17. Executive Order 12835, Code of Federal Regulations (1993).

18. Executive Order 12866, Code of Federal Regulations (1993).