Brad DeLong: Worthy reads on equitable growth, July 4–11, 2019

Worthy reads from Equitable Growth:

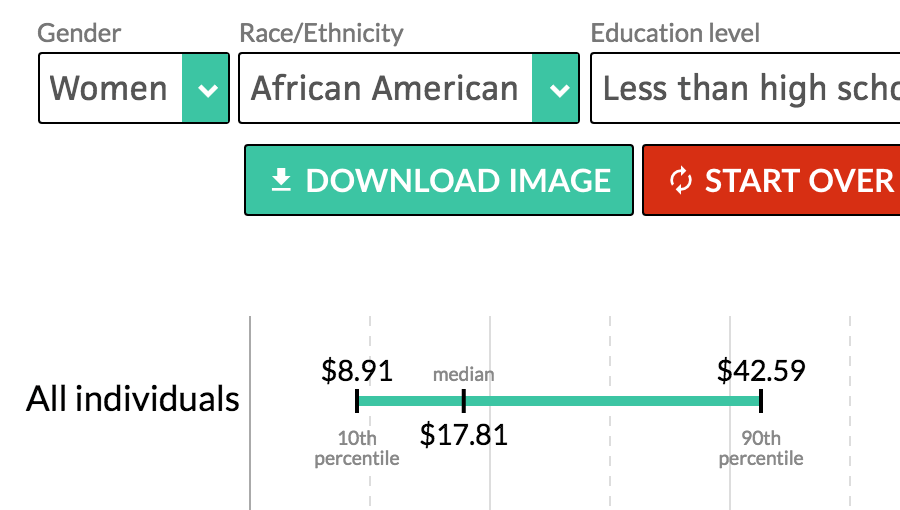

- Equitable Growth earlier this week convened an event, “Racial and Gender Wage Gaps: Overcoming Structural Barriers to Shared Growth,” that was very much worth attending. In case you missed it, you can find some highlights here. The event featured “a conversation on wage gaps for women and people of color, and what we can do about it. Wage stagnation and falling economic mobility are endemic economic problems in the United States. Their effects fall most severely on communities of color and women, who also face large wage gaps compared with white men. Key to solving wage stagnation and overall income inequality is a recognition that deeply ingrained structural forces keep many Americans from sharing in economic prosperity. This event will feature research and discussion from policy experts on the wage gaps in U.S. society.”

- Equitable Growth Executive Director Heather Boushey had a “fun chat” on Monday with David Beckworth about their work together on a new book, Recession Ready: Fiscal Policies to Stabilize the American Economy.

- Boushey also appeared in this piece by PBS Newshour, “Amid Long Economic Expansion, Why so Many Americans Are Still Struggling,” in which she explained: “We need to understand and do more to address the ways that inequality obstructs, subverts, and distorts the processes that lead to growth …. Reams of … evidence … that investments in early childhood are some of the most important … We’re not making the investments that our economic competitors are in early childhood … We’re not making those investments because we haven’t created the tax revenue to do that.”

- It was the philosopher Santayana who wrote that those who do not remember history are condemned to repeat it. Unfortunately, the rest of us are condemned to repeat it alongside them. Thus, it is very, very important that we stamp out those who do not remember history. How? By educating them. The piece of history we need to remember as we approach the next recession, whenever it starts, is that there never was any evidence that austerity is good or necessary during the bust. Read my “Risks of Debt: The Real Flaw in Reinhart-Rogoff,” in which I write: “Economists … don’t watch just quantities … but prices. And the prices of government debt are the rate of inflation, the nominal interest rate, and the level of the stock market as people trade bonds for commodities, bonds for cash, and bonds for stocks. And all three of these prices are flashing green: saying that markets would prefer and it would be better for the economy if government debt were growing at a faster pace than under current forecasts … The principal mistake Reinhart and Rogoff committed in their analysis and paper—indeed, the only significant mistake in the paper itself—was their use of the word ‘threshold.’”

Worthy reads not from Equitable Growth:

- Central banks may remain independent if they manage economies in a way that produces a modicum of stability and prosperity. If they fail to do so—if their management produces instability and poverty—I can guarantee you that they will not remain independent. Read Barry Eichengreen, “Unconventional Thinking about Unconventional Monetary Policies,” in which he writes: “Defenders of central-bank independence argue that quantitative easing should have been avoided last time and is best avoided in the future because it opens the door to political interference with the conduct of monetary policy. But political interference is even likelier if central banks shun QE in the next recession.”

- From the past, and worth highlighting. Why? Because when the next recession comes, the usual suspects will, once again, start claiming that they should not do anything to shorten or cushion it. And the usual suspects will, once again, be wrong. Read Paul Krugman’s 2008 piece, “Hangover Theorists,” in which he writes: “Somehow I missed this: via Steve Levitt, John Cochrane explaining that recessions are ‘good’ for you … The basic idea is that a recession, even a depression, is somehow a necessary thing, part of the process of ‘adapting the structure of production.’ We have to get those people who were pounding nails in Nevada into other places and occupations, which is why unemployment has to be high in the housing bubble states for a while. The trouble … is twofold: 1. It doesn’t explain why there isn’t mass unemployment when bubbles are growing as well as shrinking—why didn’t we need high unemployment elsewhere to get those people into the nail-pounding-in-Nevada business? 2. It doesn’t explain why recessions reduce unemployment across the board, not just in industries that were bloated by a bubble … The current slump is affecting some non-housing-bubble states as or more severely as the epicenters of the bubble … Unemployment is up everywhere. And while the centers of the bubble, Florida and California, are high in the rankings, so are Georgia, Alabama, and the Carolinas. So the liquidationists are still with us. According to Brad DeLong, ‘Milton Friedman would recall that at the Chicago where he went to graduate school such dangerous nonsense was not taught…’ But now, apparently, it is.”

- Why does our economic system work as well as it does, and why is it as intelligent as it is? This is a deep question in need of much more thought. Michael Jordan thinks it noteworthy that the human brain is not the only system that looks capable of “intelligent behavior.” I wonder if the things that have made our economy appear intelligent in the past may disappear in the future. Read Jordan’s “Dr. AI or: How I Learned to Stop Worrying and Love Economics,” in which he writes: “I view the scientific study of the brain as one of the grandest challenges that science has ever undertaken, and the accompanying engineering discipline of ‘human-imitative AI’ as equally grand and worthy … [But] what else is intelligent on Earth? Perhaps the Martians will notice that in any given city on Earth, most every restaurant has at hand every ingredient it needs for every dish that it offers, day in and day out. They may also realize that, as in the case of neurons and brains, the essential ingredients underlying this capability are local decisions being made by small entities that each possess only a small sliver of the information being processed by the overall system … This system is intelligent by any reasonable definition—it is adaptive (it works rain or shine), it is robust, it works at small scale and large scale, and it has been working for thousands of years … The Martians may be happy to conceive of this system as an ‘entity’—just as much as a collection of neurons is an ‘entity.’ Am I arguing that we should simply bring in microeconomics in place of computer science? And praise markets as the way forward for AI? No, I am instead arguing that we should bring microeconomics in as a first-class citizen into the blend of computer science and statistics that is currently being called ‘AI.’ This blend was hinted at in my discussion piece; let me now elaborate.”