New research shows that differences in state Unemployment Insurance rules cause inequity and inefficiency

The Unemployment Insurance system in the United States aims to provide temporary and partial wage replacement for workers who become unemployed through no fault of their own. In helping unemployed workers maintain a basic level of consumption—buying food, shelter, and other necessities—this joint federal-state insurance system is an important tool for protecting economic security and stabilizing the macroeconomy during downturns in the U.S. economy.

The role of unemployment insurance is particularly crucial for Black workers, who are more vulnerable when they lose their jobs given the large and enduring racial disparities in the United States. For instance, Black workers face discrimination in hiring and hold less in savings to help see them through periods of unemployment. Yet, in practice, the way unemployment insurance rules are designed might end up limiting access for Black unemployed workers, and mitigating how well the system can achieve its policy objectives of aiding suddenly unemployed workers and stabilizing the macroeconomy.

A key concern dating back to the founding of the unemployment insurance system is its decentralized structure, which leaves considerable autonomy in setting rules on eligibility criteria and benefit amounts to each state, as well as the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. This means that unemployed workers with the same work history, such as the same earnings before job losses, and the same reasons for separation from their last employers, can receive less unemployment insurance in some states than in others. Our recent research, available as a working paper, finds that these differences in state rules contribute to racial inequities in the amount of Unemployment Insurance accessible to Black claimants, and sacrifice the overall efficiency of the UI program.

Our research exploits administrative data from the federal audit program of the U.S. Department of Labor, the Benefits Accuracy Measurement. This data allows us to construct a representative sample of claimants since 2002, in all U.S. states and territories (except for the U.S. Virgin Islands), which includes claimants’ demographic information, work history, and the amount of Unemployment Insurance they received, if any.

Importantly, this dataset contains information on all individuals who filed a claim, whether they received or were denied Unemployment Insurance. This dataset is unique: it contains more reliable information about work histories and unemployment insurance than in survey data, and it covers individuals across virtually all U.S. states and territories, unlike in standard administrative data.

We document a large racial gap in the outcome of unemployment insurance claims. Sixty-one percent of Black claimants and 76 percent of White claimants were deemed eligible for unemployment insurance payments. Therefore, when accounting for eligibility denials, the Unemployment Insurance system replaced, on average, just 29 percent of Black claimants’ wages compared to 36 percent for White claimants. This amounts to a racial 18.3 percent gap in the replacement rate.

We analyze the factors that contribute to this racial gap. First, Black claimants have less favorable work histories when they lose their jobs. For instance, they have generally received lower earnings in the preceding quarters. Second, states with a larger share of Black workers have more stringent rules overall. It implies that even if Black and White claimants had exactly the same work histories on average, Black claimants would still receive a lower replacement rate, only because they are exposed to these more stringent state rules.

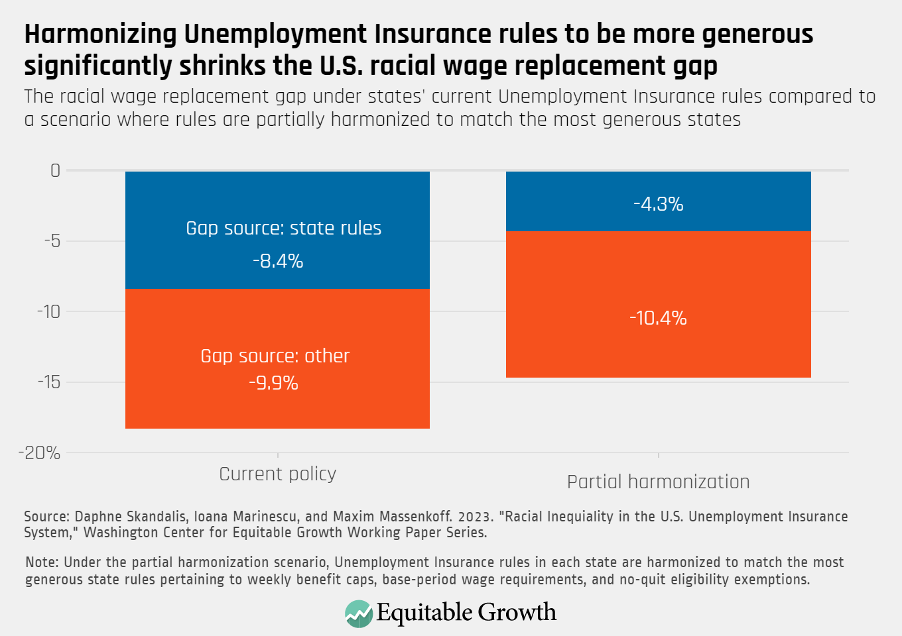

How much do differences in state rules alone contribute to the racial gap in replacement rate? After accounting for claimants’ work histories, we estimate that the differences in state rules (considering all dimensions of rules) cause Black claimants to have an 8.4 percent lower wage replacement rate than White claimants. Therefore, state rules differences are responsible for almost half of the total racial 18.3 percent gap. (See Figure 1.)

Figure 1

Importantly, these differences have nothing to do with potential racial differences in pursuing UI claims. Even if all unemployed workers claimed Unemployment Insurance, state rule differences would impose a similar penalty on Black claimants.

We then focus on three specific types of UI rules that are particularly salient: the minimum earnings required for eligibility, the possibility to be eligible after quitting one’s last job with a good reason, and the cap on the maximum weekly benefits amount. Based on our estimations, only harmonizing these three rules to the level in the most favorable state would shrink the overall racial gap—as well as the portion of the gap caused by state rules—by about 4 percentage points, as shown in Figure 1.

After showing that differences in unemployment insurance rules across states generate racial inequality, a key question is whether they represent an efficient response to differences in local economic conditions. In that case, these differences across states could help the unemployment insurance system reach its policy objectives, despite creating racial inequality.

To answer this question, we consider what would happen if all states and territories marginally increased the levels of their Unemployment Insurance. We compute for each state both the social costs and the social value that this would generate. We take into account all the relevant local economic factors, such as the average drop in income that people experience after losing their jobs, the average rate of unemployment, and the typical response to increases in UI benefits. We find that the social costs of expanding Unemployment Insurance would be lower in states with a larger fraction of Black claimants while the social value would be larger.

Our results demonstrate that increasing the amount of Unemployment Insurance would be especially beneficial on net in states with a larger fraction of Black claimants. The current situation where states with a higher share of Black claimants have less favorable UI rules is, therefore, inefficient in addition to inequitable.

Altogether, our findings show that the large disparities that exist in state UI rules generate racial inequality in the access to unemployment insurance, as well as inefficiency. Having more harmonized rules across states, for instance by setting higher minimal standards at the federal level, could both reduce racial inequality and increase the efficiency of the Unemployment Insurance system. More generally, our findings show that ostensibly race-neutral policy designs can disadvantage racial minorities. Identifying and addressing racial gaps in policies is critical for tackling racial inequality.

— Daphné Skandalis is an economist at the University of Copenhagen. Ioana Marinescu is an economist at the University of Pennsylvania, and Maxim Massenkoff is an economist at the Naval Postgraduate School.