Weekend reading: “Who gets the wage growth” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Research indicates that there is a strong relationship between intergenerational mobility and economic inequality, as Liz Hipple and Elisabeth Jacobs reports. They reviewed the vast body of research regarding the factors and metrics that influence the relationship between mobility and inequality. Based off of research conducted by former Steering Committee member Raj Chetty, they explain how mobility varies drastically throughout the country and that growing inequality was one of the main contributing factors. They emphasize the importance of the difference between relative and absolute mobility because, while relative mobility has been relatively stable, absolute mobility has been steadily declining since the 1940s.

The U.S. Bureau of Labor Statistics on Friday released new data on the U.S. labor market during the month of September. Kate Bahn and I put together five graphs highlighting important trends in the data. We found that while wages have been growing, they still remain lower than what would be expected in a tight labor market.

Brad DeLong compiles his most recent worthy reads on equitable growth both from Equitable Growth and outside press and academics.

Last week, Equitable Growth hosted the 2nd Grantee Conference, where we brought together grantees, academics, policymakers, and the press to discuss the growing body of research around the issues contributing to growing economic inequality. I recapped the events that took place over the course of the conference, including our Research on Tap event where panelists discussed the relationship among mobility, race, and place, and our Wealth Panel, where we explained how wealth has been increasingly concentrated among the top 1 percent, which contributes to greater wealth volatility and lack of wealth buffers for middle- and low-income households.

Corey Husak discussed a recently published working paper by Equitable Growth Grantees Peter Ganong and Pascal Noel, who studied the Home Affordable Modification Program (HAMP), that supported 1.7 million homeowners who struggled with mortgage payments. He details the results of their study, which indicated that HAMP lowered borrower’s monthly payments until they reached 31 percent of the borrower’s monthly income. Had HAMP allocated the money towards principle forgiveness instead, it would have been more successful at keeping households solvent.

Links from around the web

Earlier this week, Jeff Bezos, the CEO of Amazon and the world’s richest man, announced that on November 1st, all starting wages for U.S. employees would increase to $15 per hour. This wage increase, fueled by Senator Bernie Sander’s Stop BEZOS Acts, which would tax Amazon for the public safety-net benefits their employees rely on as a result of low wages, comes at a time of massive public outcry over the harsh working conditions that Amazon fulfillment employees must face in order to earn barely-livable wages. The Economist’s Idrees Kahloon explains how economists blamed employers control over the labor market, such as instituting no-poach clauses, for poor wage growth at a time of low unemployment rates. He discussed growing monopsony power with Equitable Growth’s Kate Bahn, who noted that “monopsony exercises a downward pressure on wages that exacerbates income inequality.” [economist]

While Amazon’s actions of increasing their starting salary to $15 per hour are a step forward in granting workers the ability to afford the increasing cost of living in the United States, more still needs to be done in order protect workers as employers continue to expand their monopsony power over the labor market. Janet Nguyen at Marketplace discussed with Kate Bahn about the various employment sectors in which companies have gained control over the labor market, including K-12 school districts, companies that bind employees to “no-poach” contracts, and tech and retail corporations. Bahn explained how economists are seeing trends in these sectors where employees are able to take advantage of geographic limitations in order to limit competition within the labor force, trapping workers into jobs that fail to support their cost of living. [marketplace]

Rex Nutting at MarketWatch argues that GDP has been an inadequate tool to measure growth in the 20th century. He mirrors Equitable Growth’s message that GDP measures growth for the upper class and fails to take into consideration the socio-economic challenges faced by lower- and middle-class households, such as wages, job stability, or mobility. He turns to the Measuring Real Income Growth Act of 2018 proposed by Senators Schumer and Heinrich that instructs the Bureau of Labor Statistics to report on income distributions between the low, middle, and upper classes. He quotes Equitable Growth’s Executive Director, Heather Boushey, who says “‘It is not enough to know how rapidly the economy is growing … Americans want and need to know how the economy is performing for people like them.’” [marketwatch]

Equitable Growth’s former Steering Committee Member Raj Chetty released an interactive data tool that indicates how economic mobility varies by states and neighborhoods. He combined data collected by the Internal Revenue Service and the U.S. Census Bureau to understand how individuals from different socio-economic backgrounds and communities move up the ladder. He found that when a low-income person moves from one neighborhood to a relatively better neighborhood, their lifetime earnings increase by an average of $20,000. [npr]

Research conducted by the Federal Reserve Bank found that only the top 10 percent of working-age households were on average wealthier in 2016 than in 2007. The bottom 90 percent are between 17 to 35 percent poorer today than a decade ago. The reason is because low- and middle-class households don’t hold their wealth in stocks or multiple homes, they tend to hold wealth solely in their primary residence. Recovery efforts have been concentrated in improving the stock market, which benefited wealthy households who do hold large amounts of wealth in the stock market. In addition, homeownership among the middle class fell by 12 percentage points between 2007 and 2016, which can predominantly be credited to the fact that households who didn’t own homes prior to 2007 did not buy homes during this period of time. [wapo]

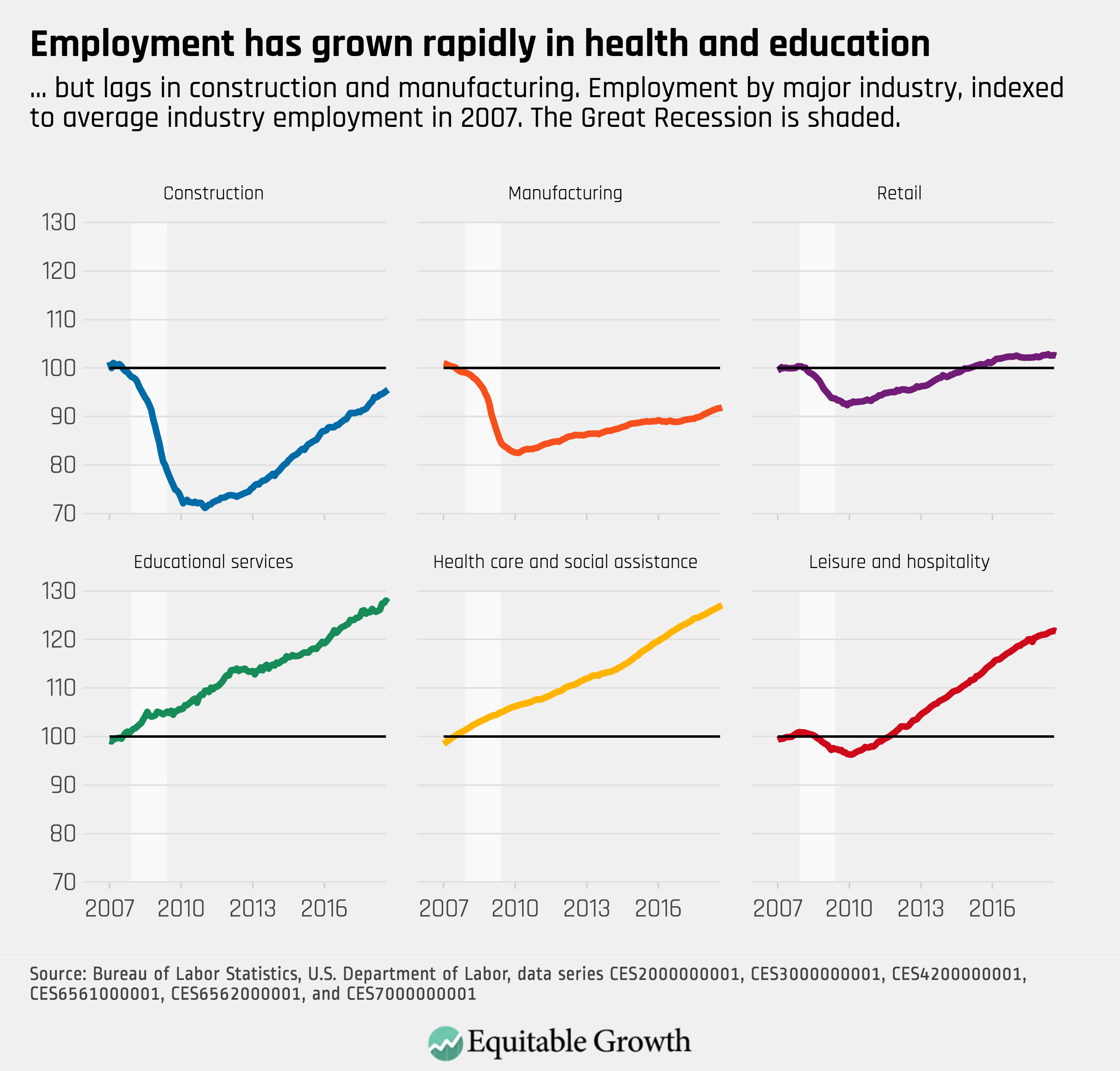

Friday Figure

Figure is from “Equitable Growth’s Jobs Day Graphs: September 2018 Report Edition”