Weekend reading: Jobs and unemployment more than a year into the coronavirus recession edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

As the U.S. economy begins to show signs of recovery from the coronavirus recession, it’s important to remember that many Americans are experiencing job displacement, where their prior positions no longer exist. This type of job loss occurs amid shifting economic and business conditions, such as business closures, corporate downsizing, or outsourcing, and is generally out of the control of individual workers. Kate Bahn and Carmen Sanchez Cumming look at the long-lasting and rippling effects of job displacement on workers and the broader economy, the especially severe labor market outcomes for those who are displaced during recessions, and the higher likelihood of being displaced for workers of color, especially Black workers. Bahn and Sanchez Cumming then present several policy ideas that would address these negative consequences for U.S. workers and job displacement, including ramping up the Short-Time Compensation and Unemployment Insurance programs, and bolstering unions and unionization efforts. Overall, they write, the critical element of these proposals is to maintain employee attachment to their jobs when possible and supplement their incomes when job loss can’t be avoided.

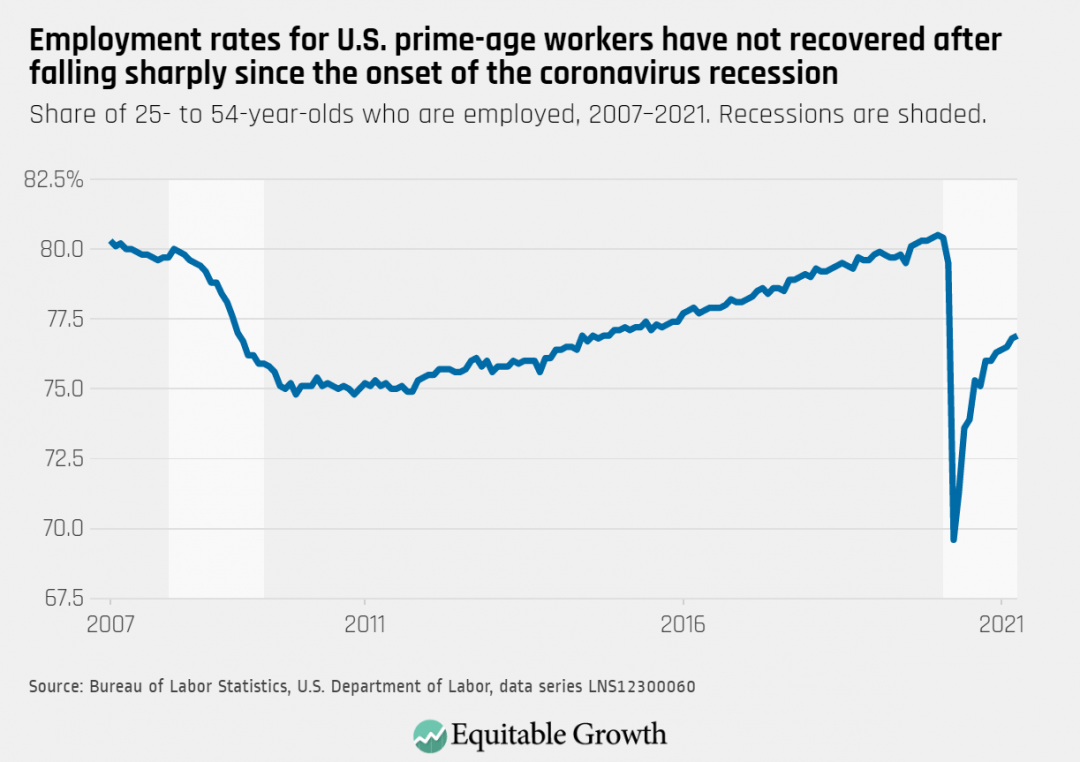

The economy continued to add new jobs in April, but much fewer than were expected. The latest Employment Situation Report from the Bureau of Labor Statistics indicates that many younger workers could face long-term harmful effects on future economic outcomes. Young workers tend to be among the most affected populations during and after recessions because early-career periods are typically characterized by strong earnings growth, which can be disrupted by slack business conditions. Bahn and Sanchez Cumming explain that the coronavirus recession has been no exception: At the height of the downturn last spring, young workers faced exceptionally high rates of joblessness. The co-authors pull together several graphics to highlight the trends in the BLS data, and also provide a more in-depth analysis of the data and its implications for the broader economy. They urge policymakers to make long-term investments in supports for workers and their families, particularly those programs that help those who are most vulnerable to economic shocks and those hardest hit by the current recession.

The Senate Judiciary Committee will soon consider a new bipartisan bill that modernizes and increases funding for antitrust enforcement. The Merger Filing Fee Modernization Act of 2021, introduced by Sens. Amy Klobuchar (D-MN) and Charles Grassley (R-IA), would boost enforcement funding and revamp the merger filing fee structure so that firms engaged in larger deals, which generally require more resources, have to pay their fair share of fees. Michael Kades examines the current funding streams and merger filing fee structures, why additional resources are needed, and how the new bill would impact antitrust enforcement. As Kades explains, the filing fee structure currently treats very differently sized mergers the same: A $1 billion deal pays the same filing fee as a $100 billion merger. Additionally, Congress has, for more than a decade, underfunded the antitrust enforcement agencies—the Federal Trade Commission and the U.S. Department of Justice’s Antitrust Division—even as their workloads have grown. Kades acknowledges that this bill will not address the serious market power problem in the U.S. economy, but he argues that it makes an important down payment on antitrust enforcement—and its bipartisan nature suggests that more comprehensive reforms may be possible.

Head over to Brad DeLong’s latest Worthy Reads column, where he provides his takes on recent must-read content from Equitable Growth and around the web.

Links from around the web

A recent report by the Federal Reserve Bank of New York finds that many small businesses that closed at the beginning of the coronavirus pandemic in 2020 may never reopen. The report finds that the restaurants, shops, and concert venues that shut their doors right when the public health crisis began are less likely to reopen than those that stayed open until July 2020. Marketplace’s Nancy Marshall-Genzer reports on the study’s findings, which argues that the longer a place remains closed, the more likely it is that customers forget they exist or move on to other businesses. These businesses also may have been ineligible for Paycheck Protection Program support—and often were owned by people of color, who not only had more difficulty accessing PPP loans but also less frequently have financial cushions to weather the recession due to longstanding systemic discrimination.

Systemic racism has entrenched a racial wealth divide in the United States so vast that even policies such as forgiving student debt and implementing baby bonds aren’t enough to close it. In a guest contribution for The New York Times, Duke University public policy professor William Darity Jr. looks at the realities of the disparities in wealth accumulation between Black and White Americans, including that the average wealth gap between Black and White households was $840,000 in 2019. Darity Jr., a member of Equitable Growth’s Research Advisory Board, urges, policymakers to consider instituting a reparations program for Black Americans whose ancestors were enslaved in the United States. This group makes up about 12 percent of the total U.S. population but own less than 2 percent of wealth in the United States, Darity Jr. continues, indicating that policies such as student loan forgiveness that have previously been proposed to close the wealth divide would help but won’t be sufficient.

It’s time to value care, writes Kristin Smith in an op-ed for the New Hampshire Union Leader. The coronavirus pandemic has laid bare the impossible choices many families face between providing care to their loved ones or earning a paycheck. Policymakers must invest in care infrastructure and family supports, argues the Dartmouth University professor, such as those proposals President Joe Biden put forth recently. These important investments would help workers who are crushed by competing demands on their time and lack of caregiving support. They also would bolster the care economy, which is the invisible engine that powers the overall U.S. economy by enabling workers to be productive, by properly paying and valuing those who perform care work. Considering the number of workers who have left the workforce due to caregiving responsibilities over the past year, Smith concludes, it is long past time to make these investments.

Friday figure

Figure is from Equitable Growth’s “Equitable Growth’s Jobs Day Graphs: April 2021 Report Edition,” by Kate Bahn and Carmen Sanchez Cumming.