Weekend reading: Addressing income inequality to spur economic growth edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

The American Rescue Plan features a variety of much-needed supports for American workers and their families to navigate the coronavirus recession and boost the economy to ensure broad-based recovery. One such support program is the expanded Child Tax Credit. Liz Hipple explains the changes made to the child allowance and how they will help more households. She then offers evidence and data from research on how other income support programs, such as the Supplemental Nutrition Assistance Program and the Earned Income Tax Credit, boost individual families’ well-being, as well as the overall economy. These income support programs work to reduce income inequality by supplementing families’ bottom lines so they can invest some of their household budget in their children’s human capital development. This not only helps families and children directly receiving these benefits, Hipple writes, but also ends up paying economywide dividends in the future as these children have greater educational achievement, are more productive and healthier workers, and earn higher wages—thus paying more in taxes. Hipple concludes by urging Congress to make these CTC extensions permanent in order to ensure both short-term and long-lasting economic boons.

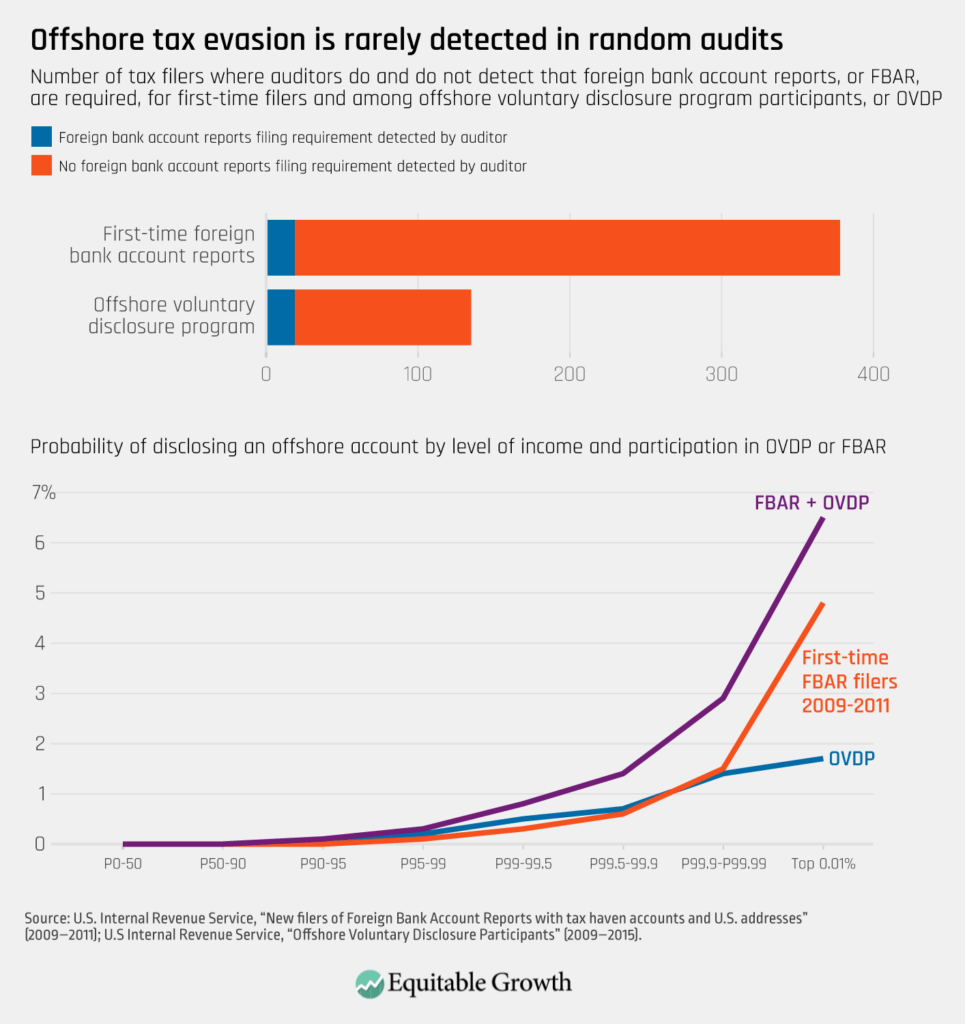

As news reports reveal the astonishing levels of wealth accumulated by billionaires during the coronavirus recession—steadily widening the income inequality that was already rampant in the U.S. economy—Daniel Reck, Max Risch, and Gabriel Zucman and their co-authors study the tax evasion tactics of the richest Americans. They find that the top 1 percent of income earners is much more sophisticated than the other 99 percent at tax evasion, and thus that conventional estimates seriously underestimate the level of tax evasion by the wealthy. Their study also reveals the main strategies the rich use to obscure and hide their income, including pass-through businesses and offshore bank accounts. The authors argue that policymakers can fight widespread tax evasion by both addressing these tactics in particular and also by increasing the funding available to the IRS to make tax enforcement more efficient and effective. These actions, the co-authors estimate, could yield $175 billion in currently uncollected taxes per year—more than enough to make permanent and expand further the child allowance extensions in the American Rescue Plan that Liz Hipple writes about.

Another way to address income inequality in the United States is to revamp pay-setting processes across the U.S. economy. In a new installment of Equitable Growth in Conversation, Kate Bahn talks to professor of sociology Jake Rosenfeld about what determines workers’ pay, how that impacts economic inequality, and policies that can support U.S. workers and decrease income disparities. They also touch upon the role of worker power and unions in the pay-setting process and how our traditional understanding of the determinants of salaries is misguided. They close their conversation with a discussion of the importance of interdisciplinary research on advancing our understanding of these dynamics and challenges.

Brad DeLong’s latest Worthy Reads column highlights recent must-read content from Equitable Growth and across the internet.

Links from around the web

Improving the U.S. child care industry is essential to the economic recovery from the coronavirus pandemic—and this is no small task as there are many issues involved. The Lily’s Anne Branigin details how high-quality child care has long been unaffordable or inaccessible to many U.S. families, while emphasizing the role of child care as a behind-the-scenes support for the whole economy, making it possible for parents to hold jobs and be productive. At the same time, child care workers are often low-wage employees who do not receive benefits such as access to health insurance or retirement plans. These dynamics only worsened amid the pandemic, Branigin continues. Many mothers and fathers (though more often mothers) were forced to leave the labor force in order to care for their children as schools and daycare centers closed or went virtual. And child care providers struggled to stay open and implement health standards—not to mention keep their workers safe. The industry received some emergency funding in the American Rescue Plan, but advocates argue it is not nearly enough to truly make headway on these challenges. Rather, they say, addressing the child care crisis ought to be treated the same way policymakers treat shoring up physical infrastructure in the United States—meaning major government investments will be necessary.

Though topline numbers clearly show how large—and growing—the disparities are between Black and White families’ wealth and income in the United States, these numbers have other, less-discussed consequences. Lynnette Khalfani-Cox writes for Vox that those Black households able to achieve a certain level of wealth face higher barriers than White households to growing that wealth. Longstanding discrimination limited Black families’ reliance on social safety net programs and access to wealth-building opportunities. And systemic inequality inhibited Black intergenerational mobility such that better-off Black families frequently relied on financial support from other family members who have not reached the same standard of living or have high levels of debt. This so-called Black tax—“the obligations of first-in-the-family college graduates, professionals, or others who ‘make it’ to assist their family members,” explains Khalfani-Cox—has implications on economic mobility and opportunity. The Black tax reduces overall wealth among Black families and their ability to save, invest, and grow their money, undoubtedly contributing to racial wealth disparities in the United States both now and in the future.

Friday figure

Figure is from Equitable Growth’s “Tax evasion at the top of the U.S. income distribution and how to fight it,” by Daniel Reck, Max Risch, and Gabriel Zucman.