The effects of the filibuster on U.S. economic policymaking and income and wealth inequality

Debate about reforming or eliminating the filibuster—the U.S. Senate rule that effectively requires 60 votes to pass most legislation—focuses mostly on voting rights and protecting democracy. But the filibuster, by making any policy change harder to enact, affects U.S. economic policymaking too, and thus contributes to the growing income and wealth divide between wealthy Americans and everyone else.

Researchers studying U.S. legislative institutions and American democracy already contribute in many useful ways to the ongoing debate over the filibuster. Princeton University historian Kevin Kruse emphasizes the deep racial history of the filibuster, while the Brookings Institution’s Sarah Binder and Stephen Smith quantify that half of all bills that failed in the Senate because of the filibuster from 1917 to 1994 were related to civil rights.

Other scholars argue that the filibuster is an unconstitutional violation of the principle of majority rule enshrined in Article 1 of the U.S. Constitution. University of Miami’s Greg Koger points out that the filibuster may have been an incentive to compromise and cooperate at one point in time but does not function that way in today’s polarized environment. In contrast, political scientist Jonathan Bernstein, who has long been a supporter of the filibuster, argues that it is not an inherently anti-majoritarian institution and is worthy of being maintained.

I want to draw attention to the underappreciated economic policymaking aspect of the filibuster and how it contributes to a highly unequal U.S. economy. To understand how the filibuster shapes the distribution of the U.S. economic pie, it is useful to start with a basic implication of the filibuster: It makes policy change harder than it would be in a purely majoritarian system. If the Senate requires a super-majority to overcome a filibuster, and a filibuster is widely applied to legislative proposals, then a smaller set of policy changes are possible with the filibuster than without it. The filibuster enhances the status quo bias in U.S. economic policymaking.

What does status quo bias have to do with the income divide between the wealthy and everyone else in the United States? The answer depends, in part, on how big that gap is to start with. And right now, it is very big. The share of national income going to the top 1 percent is currently more than 20 percent, reaching a level as high or higher than at the end of the roaring ‘20s, which was the previous high point in the measured history of U.S. wealth and income inequality.

In the contemporary context of high economic inequality, then, the filibuster, at the very least, makes government intervention to balance the scales between the rich and the rest less likely. More detailed analysis, however, suggests that the filibuster contributes not only to maintaining already-high levels of inequality, but also to a decades-long trend toward increasing inequality. The idea of “policy drift” is highly relevant, referring to a situation in which the effects of an ostensibly unchanged policy shift due to changing societal conditions. When policy drift happens, the effects of policy change even if Congress hasn’t enacted a new law. The filibuster makes policy drift more likely.

One example pertinent to economic inequality is financial deregulation. It took many decades for Congress to fully repeal the Glass-Steagall regulatory framework first enacted in the 1930s to separate commercial and investment banking. Through the middle of the 20th century, new regulatory efforts were not happening, which led to an increasingly global financial system with regulatory gaps that could be exploited by the U.S. financial sector, directly benefiting those already at the top of the economic ladder.

In short, policy was drifting, and that allowed the income gap to expand. Eventually, of course, deregulation of the financial sector moved beyond drift to legislative success in fits and starts, culminating in the late 1990s with the complete repeal of the Glass-Steagall framework, which only accelerated the upward redistributional consequences of economic policymaking.

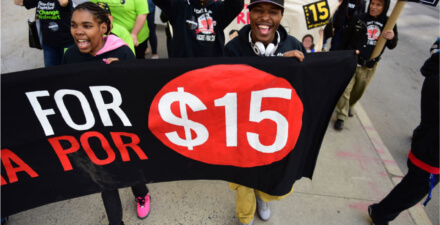

The minimum wage is perhaps an even more straightforward example of the baleful consequences of the filibuster. Because the minimum wage is not indexed to inflation, it is essentially guaranteed to erode in real value without legislative action to increase it. Given a system biased toward the status quo, minimum wage workers get an automatic pay cut each year that policy is permitted to drift. The policy does not change, but its value to minimum wage workers certainly does.

More broadly, in a recently issued report, Emily Divito at the Roosevelt Institute examined the 49 bills since 1947 related to worker power or corporate influence that fell short of the 60 votes needed for cloture but received at least 50 votes in support of cloture, a legislative motion to allow debate to proceed. She then zeroed in even further on nine bills that likely would have been enacted had the Senate approved them. Eight of these nine bills would have expanded worker rights or placed limits on corporate power, illustrating how the filibuster contributed to a policy environment that set the stage for the massive increases in inequality seen since the late 1970s.

Analysis of specific legislation that was derailed by the filibuster is certainly useful but extremely challenging. Focusing on cloture votes typically overcounts the number of active filibusters since cloture votes often appear in the record even when no filibuster is actually happening. In contrast, cloture votes underplay the effects of the filibuster because researchers cannot directly observe legislation that was never brought forward for a vote since congressional leaders knew there was no hope of reaching the 60-vote threshold for ending debate.

That’s why it’s helpful to look at broader patterns of legislative activity in addition to specific legislation. In work with a variety of co-authors, I have examined the distributional effects of factors that are best thought of as correlates of the filibuster—most notably, general partisan polarization and legislative inaction. Legislative inaction is probably the most relevant of the two since it is inaction that leads most directly to policy drift and is most clearly an indicator of adherence to the status quo.

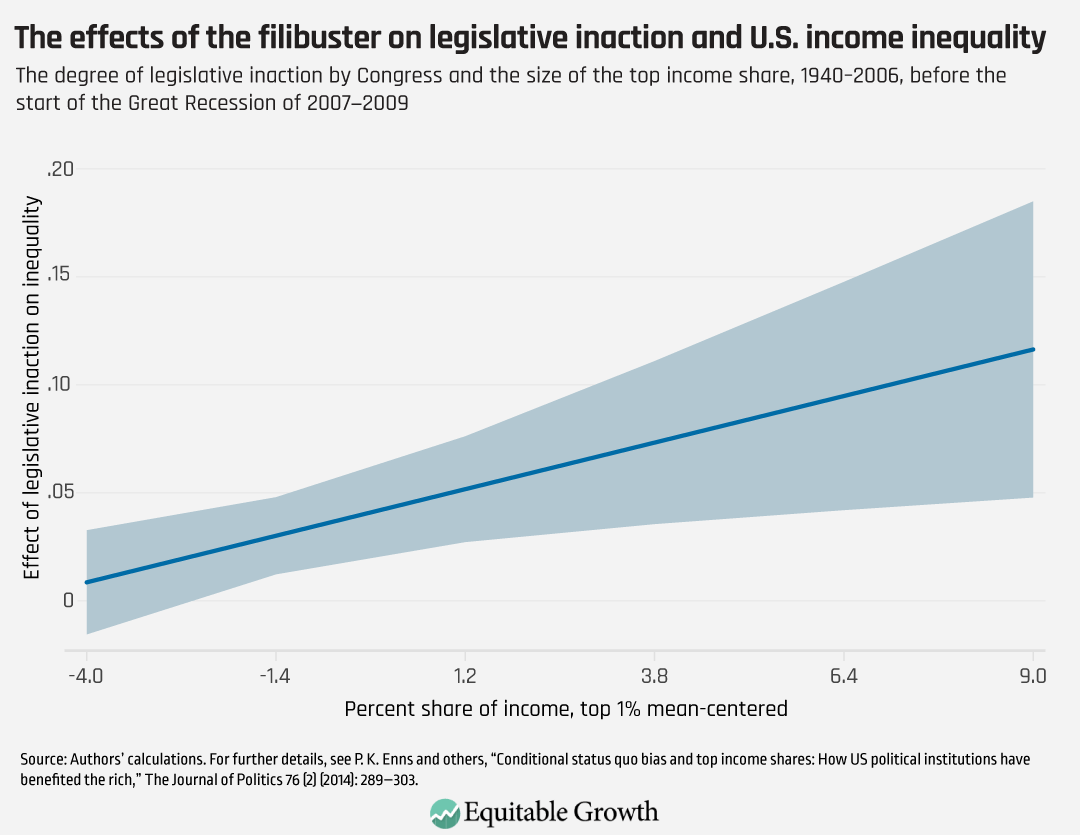

To measure legislative inaction, I tallied up the laws passed in each Congress and then used assessments of historians and policy scholars to weight the laws by importance, finally reversing the scale to capture inaction rather than accomplishment. I then used more than 60 years of data to assess the association between legislative inaction and the share of income going to the top 1 percent of income earners. I find that legislative inaction was associated with increases in income inequality, but that the effect of inaction was determined by the existing level of inequality.

The key insight is that legislative inaction only matters when preexisting income inequality is already high. So, a relatively unproductive legislative session in the early 1950s, when President Harry Truman was seeking to fully enact his Fair Deal, doesn’t have much effect given low levels of inequality during that era. But once the inequality train leaves the station, starting around 1980, periods of congressional stalemate become quite costly, greatly exacerbating income inequality by allowing it to speed up and build momentum unabated. In this way, the rise of the filibuster, which exploded in use in the 1990s, was perfectly timed—intentionally or not—to supercharge economic inequality.

Indeed, when income inequality has been low, economic policy inaction has no effect, either positive or negative, on the income divide between the wealthy and everyone else. But when income inequality is at a moderate to high level, legislative inaction is connected to further increases in inequality. (See Figure 1.)

Figure 1

Importantly, this effect occurs quite apart from any effects of general partisan polarization. In other words, while it is true that the two major U.S. political parties—and the U.S. electorate itself—have grown more diametrically opposed during the rise of inequality, that alone does not explain the policy drift we’ve experienced. Even in polarized times, unified control of national policymaking institutions is possible and even common, occurring for 4 years under President George W. Bush, the first 2 years of President Barack Obama’s presidency, the first 2 years of the Trump presidency, and today, with the Biden administration and Democrats in charge of Congress.

One major reason unified control has not led to high levels of policy action, which would help counteract the status quo bias that allows inequality to fester, is the filibuster. Though there is a connection between inaction and polarization, it’s really the inaction, rather than the partisan polarization, that matters most directly for distributional economic outcomes. This places the filibuster center stage.

Love it or hate it, the filibuster is currently part of the U.S. policymaking system. It wasn’t always this way, of course, but this Senate rule has come to play an increasingly common role in the legislative process. It gets in the way of policy action and, in doing so, contributes to what I’ve referred to elsewhere as America’s inequality trap—a situation in which our institutions help to reinforce and exacerbate the gap between the rich and the rest of us. The longer the filibuster stays in place, the longer it will take for the United States to achieve a shared prosperity marked by smaller gaps between those at the bottom, middle, and top of the American economic ladder.

—Nathan Kelly is a professor of political science at the University of Tennessee. He is the author of The Politics of Income Inequality in the United States, Hijacking the Agenda: Economic Power and Political Influence, and America’s Inequality Trap.