How market power has increased U.S. inequality

Overview

A growing body of research has found that the market power of the United States’ largest companies has grown significantly since the 1980s. Due to increased market power, firms are earning higher profits by raising prices and paying their workers less, then transferring wealth from consumers and workers to shareholders. Because shareholders, on average, are wealthier than customers and workers, this dynamic, in principle, should exacerbate inequality. Recent empirical work confirms this result.

Researchers have proposed different explanations for rising market power, such as reduced antitrust enforcement and the rise of “winner-take-most” markets. Reduced antitrust enforcement appears to be a compelling explanation, at least in part, since the U.S. government relaxed its antitrust enforcement at the same time that market power began to grow. Moreover, market power has grown more in the United States than in other countries, suggesting that U.S. policy has played a role.

This issue brief examines the latest evidence on how market power has grown, how it has increased inequality, and different explanations for growing market power.

Download FileHow market power has increased U.S. inequality

The growing evidence of greater market power

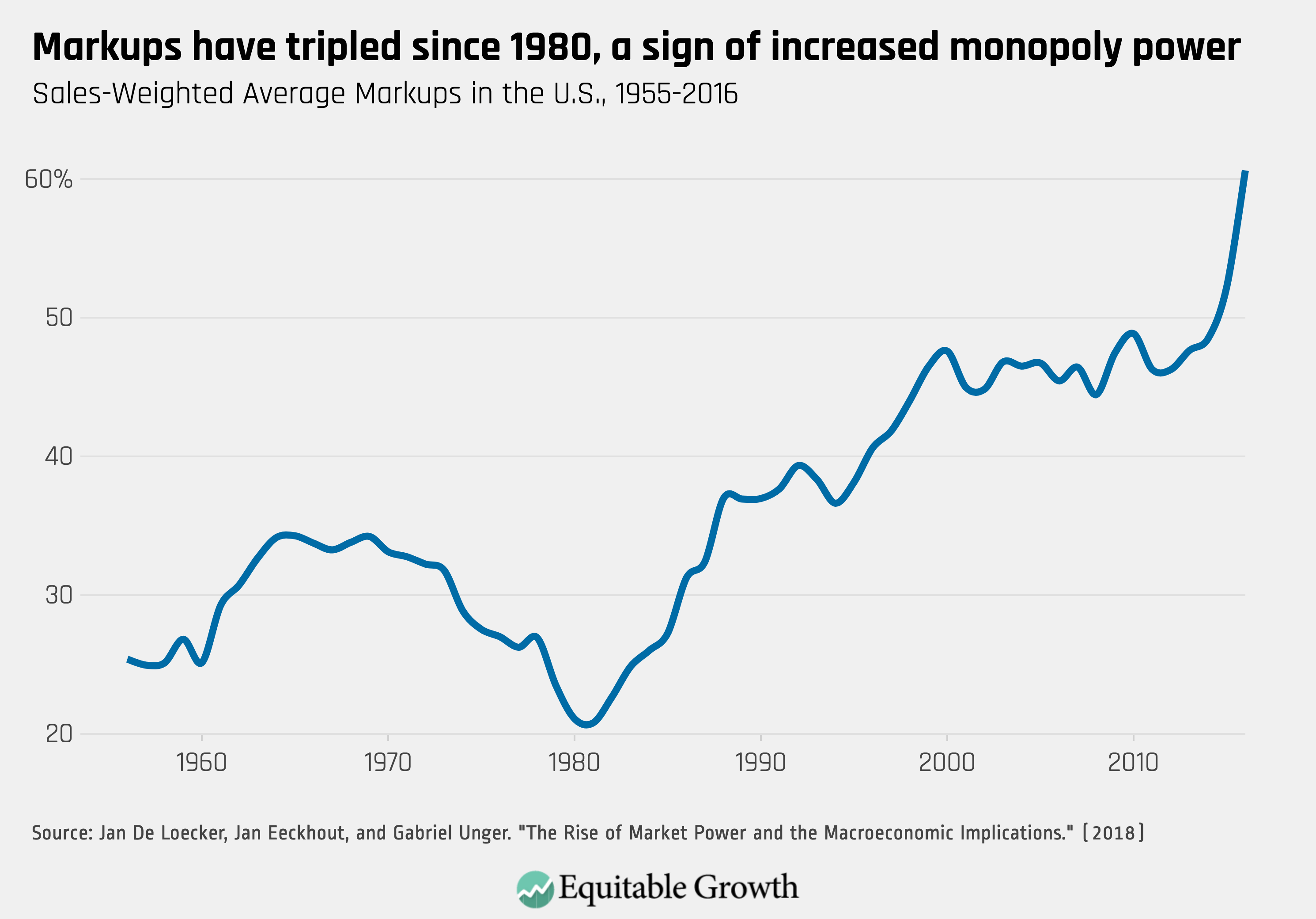

Markups and corporate profits have been on the rise since the 1980s. A markup is the difference between a product’s price and its marginal cost, or the cost of making one additional unit. High markups are a common measure of monopoly power because when a firm has less competition, it has more leverage to charge high prices. Similarly, high corporate profits are a sign of market power since they represent the rents that firms are able to capture.

While average markups in the U.S. economy were relatively stable between 1955 and 1980, they have tripled since 1980, from 21 percent above firms’ marginal costs to 61 percent above marginal costs today, according to a recent paper by Jan De Loecker of KU Leuven, Jan Eeckhout of UPF Barcelona, and Gabriel Unger of Harvard University.1 Recent papers by Robert E. Hall of Stanford University2 and James Traina of the University of Chicago3 also find that U.S. markups have risen since the 1980s, although they find more modest increases than De Loecker, Eeckhout, and Unger’s paper.

Markups are rising across the developed world. In advanced economies, markups have risen by an average of 39 percent since 1980, while rising less in developing countries, according to a recent paper by Federico Diez, Daniel Leigh, and Suchanan Tambunlertchai of the International Monetary Fund.4

Nonetheless, markups have risen more in the United States than in the rest of the world, suggesting that higher U.S. markups may be a result of U.S. policy. U.S. markups have risen more than the global average since 1980, according to a paper by KU Leuven’s Jan De Loecker and UPF Barcelona’s Jan Eeckhout.5 (See Figure 1.) A new analysis by the International Monetary Fund finds that markups have risen twice as much in the United States as in the average advanced economy since 2000.6 In the eurozone, in contrast, market power has remained stable in recent years, and markups have actually declined, according to a recent European Central Bank paper.7

Figure 1

Rising corporate profits can also be a sign of increased market power.8 In a perfectly competitive economy, profits would be competed down to zero. As a firm faces less competition, it can capture more of the surplus, increasing its profits that would otherwise go to consumers or workers. By multiple measures, corporate profits have surged since the 1980s. The before-tax profit share of Gross Domestic Product has more than doubled since 1980 to 14 percent of GDP, according to a new paper by Ufuk Akcigit of the University of Chicago and Sina T. Ates of the Federal Reserve.9 Average profits have risen from 1 percent of sales to 8 percent of sales since 1980, according to De Loecker, Eeckhout, and Unger’s paper.10 Simcha Barkai of London Business School finds that since 1984, profits have increased from 2.2 percent gross value added to 15.7 percent.11 (See box.)

The consequences of growing market power

As a matter of theory, growing market power can aggravate economic inequality because the shareholders that benefit are richer than the consumers and workers that lose out. The top 1 percent in net worth owns 50 percent of all stocks held by U.S. households, according to research by Goldman Sachs Group Inc. analyzing Federal Reserve data.22 The very richest derive the bulk of their income from investments, and market power increases the value of their portfolios. In contrast, as a group, consumers who pay higher prices or workers whose wages stagnate own less stock.

A recent paper by Joshua Gans of the University of Toronto, Andrew Leigh of the Parliament of Australia, Martin Schmalz of the University of Oxford, and Adam Triggs of Australian National University confirms that increased markups are likely to increase inequality.23 The paper finds that the top 20 percent of the U.S. income distribution owns 89 percent of all stocks, while the bottom 60 percent owns just 7 percent of stocks. In contrast, the top 20 percent spends as much as the bottom 60 percent. Thus, when markups rise, the gap between the top 20 percent and the bottom 60 percent widens. The paper finds that market power has decreased the bottom 60 percent’s share of income and increased it for the top 20 percent.

Market power has increased inequality globally by transferring wealth from consumers to shareholders. In rich countries, market power boosts the wealth of the top 10 percent and reduces the incomes of the bottom 20 percent because the rich own stakes in businesses that rise in value, while the poor get hurt by higher markups, according to a paper by Sean Ennis, Pedro Gonzaga, and Chris Pike of the Organisation for Economic Co-operation and Development.24

Rising market power entrenches inequality because the rich save and invest at higher rates, becoming larger shareholders over time. The rich can afford to save more because of their higher incomes. The wealthiest 1 percent saves 20 percent to 25 percent of their income on average, while the bottom 90 percent saves only 3 percent of their income on average, according to a paper by Emmanuel Saez and Gabriel Zucman of the University of California, Berkeley.25 As the rich build their savings, the benefits of market power compound over time, as they invest more and more in stocks that rise in value, allowing them to amass even more wealth. On the other hand, the higher prices and lower wages that result from market power make it more difficult for most people to save and build wealth.

Market power has harmed the nonrich not only as consumers, but also as workers. The share of national income going to workers has fallen significantly since the 1970s, and recent research suggests that this is due to growing market power.26 The rise of superstar firms and “winner-take-most” markets has led to a decline in the labor share of income, according to a paper by David Autor of the Massachusetts Institute of Technology, David Dorn of the University of Zurich, Lawrence Katz of Harvard University, Christina Patterson of MIT (and a visiting scholar at the Washington Center for Equitable Growth), and John Van Reenen of MIT.27 They attribute this to growing market concentration driven by greater efficiency: A small number of dominant firms are capturing a growing share of total sales, and these firms tend to pay a lower share of their income to workers. (See box above.)

Causes of increased market power and its implications

It appears that a decline in antitrust enforcement has played a role in growing market power, but researchers also have proposed additional explanations. Some economists claim that leading firms are gaining market power because they’re more efficient. Autor, Dorn, Katz, Patterson, and Van Reenen write in their paper on superstar firms that markets have become “winner-take-most” because of stronger network effects and greater competition due to globalization and new technology.28 Thus, they write, “firms with superior quality, lower costs, or greater innovation reap disproportionate rewards relative to prior eras.” Van Reenen also writes in a recent paper that leading firms are gaining market share because they are more productive, and this may be partly due to their investment in intangible capital.29

Some researchers, such as Herbert Hovenkamp of the University of Pennsylvania, suggest that leading firms may be charging higher markups to pay for technology that has high fixed costs.30 Top research and development spenders include major companies such as Amazon.com Inc. and Alphabet Inc.31

This increased investment has made it harder for other firms to catch up. A new paper by Ufuk Akcigit of the University of Chicago and Sina T. Ates of the Federal Reserve finds that reduced knowledge diffusion between firms has boosted markups and the profit share of GDP, and thus market power.32 They find evidence suggesting that increased use of patents by firms on the technological frontier may be reducing knowledge diffusion. They find that the share of patents held by the top 1 percent of firms with the most patents has risen from 35 percent in the early 1980s to nearly 50 percent today, while the share of patents held by new businesses has plunged from 7 percent to 4 percent. Moreover, top firms are solidifying their lead by buying up patents from other companies: The share of patent purchases by the top 1 percent of firms has risen from around 30 percent in the early 1980s to around 50 percent today.

There is also evidence suggesting that laxer antitrust enforcement has allowed market power to grow in the United States. The signs of increased market power—especially higher markups and higher corporate profits—date back to the early 1980s. At the same time, during Ronald Reagan’s presidency,33 the Chicago School of economics revolutionized antitrust enforcement to make it more hands-off, with the argument that most mergers were efficient.34

Experts are concerned that once companies reach a certain level of dominance, they can use their significant resources to thwart competition by buying potential competitors or through other anti-competitive measures. However, regulators have largely stayed on the sidelines as big firms have acquired or merged with their competitors. Mergers have consolidated many U.S. industries as antitrust enforcement has declined, according to an Equitable Growth report by John Kwoka of Northeastern University.35

The number of antitrust cases filed by the Justice Department under the Sherman Antitrust Act of 1890 has fallen precipitously since the 1970s, according to Justice Department data.36 For instance, the Justice Department filed only one district court monopoly lawsuit under Section 2 of the Sherman Act between 2008 and 201737—down from 62 district court monopoly lawsuits between 1970 and 1979.38

The U.S. government revamped its merger guidelines in 1982 to make them friendlier to mergers, writing: “In the overwhelming majority of cases, the Guidelines will allow firms to achieve available efficiencies through mergers without interference from the Department [of Justice].”39 Merger policy became more lenient after the adoption of the 1982 Merger Guidelines, and market concentration levels began to rise around the same time, according to a recent paper by Carl Shapiro of the University of California, Berkeley.40

Judges have increasingly sided with dominant firms. Courts have a tradition of respecting the precedents set by the highest courts, and in two major cases—Verizon v. Trinko41 and Credit Suisse v. Billing42—the Supreme Court ruled in favor of alleged monopolies, in decisions that united both liberal and conservative justices. Howard Shelanski of Georgetown University suggests in a paper that these Supreme Court decisions would have led the United States to lose its landmark anti-monopoly case against AT&T Inc., which led to the breakup of AT&T in the early 1980s, if it had happened today.43 It appears that declining antitrust enforcement and changing court attitudes toward monopolies have allowed dominant firms to grow bigger and more powerful, leading to increased market power.

Conclusion

Equitable Growth has made it a priority to investigate monopoly power and its link to economic inequality. There is growing evidence that market power has grown since the 1980s, and this has contributed to increased economic inequality by transferring wealth from consumers and workers to shareholders. Market power has raised prices and suppressed wages, while boosting corporate profits. There is also evidence that declining antitrust enforcement has played a role in increased market power. Many questions still need to be answered, and this research increases the urgency of better understanding the causes and consequences of market power.

—Bonnie Kavoussi is a policy fellow at the Washington Center for Equitable Growth.

End Notes

1. Jan De Loecker, Jan Eeckhout, and Gabriel Unger, “The Rise of Market Power and the Macroeconomic Implications.” Working Paper (2018), available at http://www.janeeckhout.com/wp-content/uploads/RMP.pdf.

2. Robert E. Hall, “Using Empirical Marginal Cost to Measure Market Power in the U.S. Economy.” Working Paper (National Bureau of Economic Research, 2018), available at https://www.nber.org/papers/w25251.

3. James Traina, “Is Aggregate Market Power Increasing? Production Trends Using Financial Statements.” Working Paper (Stigler Center for the Study of the Economy and the State, University of Chicago Booth School of Business, 2018), available at https://research.chicagobooth.edu/-/media/research/stigler/pdfs/workingpapers/17isaggregatemarketpowerincreasing.pdf.

4. Federico Diez, Daniel Leigh, and Suchanan Tambunlertchai, “Global Market Power and Its Macroeconomic Implications.” Working Paper (International Monetary Fund, 2018), available at https://www.imf.org/en/Publications/WP/Issues/2018/06/15/Global-Market-Power-and-its-Macroeconomic-Implications-45975.

5. Jan De Loecker and Jan Eeckhout, “Global Market Power.” Working Paper (National Bureau of Economic Research, 2018), available at https://www.nber.org/papers/w24768.

6. International Monetary Fund, “Chapter 2: The Rise of Corporate Market Power and Its Macroeconomic Effects.” In World Economic Outlook, April 2019: Growth Slowdown, Precarious Recovery (2019), available at https://www.imf.org/en/Publications/WEO/Issues/2019/03/28/world-economic-outlook-april-2019.

7. Maria Chiara Cavalleri and others, “Concentration, market power and dynamism in the euro area.” Working Paper (European Central Bank, 2019), available at https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2253~cf7b9d7539.en.pdf?32f5cd7aa94edc6da8e76fea748ffbc5.

8. Ufuk Akcigit and Sina T. Ates, “Ten Facts on Declining Business Dynamism and Lessons from Endogenous Growth Theory.” Working Paper (National Bureau of Economic Research, 2019), available at https://www.nber.org/papers/w25755.

9. Ibid.

10. De Loecker, Eeckhout, and Unger, “The Rise of Market Power and the Macroeconomic Implications.”

11. Simcha Barkai, “Declining Labor and Capital Shares.” Working Paper (London Business School, 2017), available at http://facultyresearch.london.edu/docs/BarkaiDecliningLaborCapital.pdf.

12. Ibid.

13. Gauti Eggertsson, Jacob A. Robbins, and Ella Getz Wold, “Kaldor and Piketty’s facts: The rise of monopoly power in the United States.” Working Paper (Washington Center for Equitable Growth, 2018), available at http://equitablegrowth.org/wp-content/uploads/2018/02/02052018-WP-kaldor-piketty-monopoly-power.pdf.

14. Elena Prager and Matt Schmitt, “Employer consolidation and wages: Evidence from hospitals.” Working Paper (Washington Center for Equitable Growth, 2019), available at https://equitablegrowth.org/working-papers/employer-consolidation-and-wages-evidence-from-hospitals/.

15. Efraim Benmelech, Nittai Bergman, and Hyunseob Kim, “Strong Employers and Weak Employees: How Does Employer Concentration Affect Wages?” Working Paper (National Bureau of Economic Research, 2018), available at https://www.nber.org/papers/w24307.

16. José Azar, Ioana Marinescu, and Marshall I. Steinbaum, “Labor Market Concentration.” Working Paper (National Bureau of Economic Research, 2019), available at https://www.nber.org/papers/w24147.

17. Jason Furman and Peter Orszag, “Slower Productivity and Higher Inequality: Are They Related?” Working Paper (Peterson Institute for International Economics, 2018), available at https://piie.com/system/files/documents/wp18-4.pdf.

18. David Autor and others, “The Fall of the Labor Share and the Rise of Superstar Firms.” Working Paper (Massachusetts Institute of Technology, 2017), available at https://economics.mit.edu/files/12979.

19. Gustavo Grullon, Yelena Larkin, and Roni Michaely, “Are U.S. Industries Becoming More Concentrated?,” Review of Finance (forthcoming), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2612047.

20. Council of Economic Advisers, “Benefits of Competition and Indicators of Market Power” (2016), available at https://obamawhitehouse.archives.gov/sites/default/files/page/files/20160414_cea_competition_issue_brief.pdf.

21. William A. Galston and Clara Hendrickson, “A policy at peace with itself: Antitrust remedies for our concentrated, uncompetitive economy” (Washington: Brookings Institution, 2018), available at https://www.brookings.edu/research/a-policy-at-peace-with-itself-antitrust-remedies-for-our-concentrated-uncompetitive-economy/.

22. Heidi Chung, “The richest 1% own 50% of stocks held by American households,” Yahoo Finance, January 17, 2019, available at https://finance.yahoo.com/news/the-richest-1-own-50-of-stocks-held-by-american-households-150758595.html; Ben Carlson, “Who Owns All the Stocks and Bonds?” A Wealth of Common Sense blog, January 27, 2019, available at https://awealthofcommonsense.com/2019/01/who-owns-all-the-stocks-bonds/.

23. Joshua Gans and others, “Inequality and Market Concentration, When Shareholding is More Skewed than Consumption.” Working Paper (National Bureau of Economic Research, 2018), available at https://www.nber.org/papers/w25395.

24. Sean Ennis, Pedro Gonzaga, and Chris Pike, “Inequality: A hidden cost of market power.” Discussion Paper (Organisation for Economic Cooperation and Development, 2017), available at https://www.oecd.org/daf/competition/Inequality-hidden-cost-market-power-2017.pdf.

25. Emmanuel Saez and Gabriel Zucman, “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data.” Working Paper (National Bureau of Economic Research, 2014), available at https://gabriel-zucman.eu/files/SaezZucman2014.pdf.

26. Federal Reserve Bank of St. Louis, “Share of Labour Compensation in GDP at Current National Prices for United States” (n.d.), Penn World Table 9.0, available at https://fred.stlouisfed.org/series/LABSHPUSA156NRUG.

27. Autor and others, “The Fall of the Labor Share and the Rise of Superstar Firms.”

28. Ibid.

29. John Van Reenen, “Increasing Differences between Firms: Market Power and the Macro-Economy.” Working Paper (Federal Reserve Bank of Kansas City, 2018), available at https://www.kansascityfed.org/~/media/files/publicat/sympos/2018/papersandhandouts/jh%20john%20van%20reenen%20version%2020.pdf.

30. Herbert J. Hovenkamp, “Is Antitrust’s Consumer Welfare Principle Imperiled?” (Philadelphia: Faculty Scholarship at Penn Law, 2019), available at https://scholarship.law.upenn.edu/cgi/viewcontent.cgi?article=2987&context=faculty_scholarship.

31. Jeff Desjardins, “Here are the countries and companies that spend the most on R&D,” Business Insider, October 16, 2017, available at https://www.businessinsider.com/countries-and-companies-that-spend-the-most-on-rd-2017-10.

32. Ufuk Akcigit and Sina T. Ates, “What Happened to U.S. Business Dynamism?” Working Paper (National Bureau of Economic Research, 2019), available at https://www.nber.org/papers/w25756.

33. Willard F. Mueller, “Antitrust in the Reagan administration,” Revue française d’études américaines (21/22) (1984): 427–434, available at https://www.jstor.org/stable/20873206?seq=1#page_scan_tab_contents.

34. Michael Kades, “Why market competition matters to equitable growth” (Washington: Washington Center for Equitable Growth, 2018), available at https://equitablegrowth.org/why-market-competition-matters-to-equitable-growth/.

35. John E. Kwoka, “U.S. antitrust and competition policy amid the new merger wave” (Washington: Washington Center for Equitable Growth, 2017), available at http://equitablegrowth.org/wp-content/uploads/2017/07/072717-kwoka-antitrust-report.pdf.

36. U.S. Department of Justice, “Workload Statistics,” available at https://www.justice.gov/atr/division-operations (last accessed April 29, 2019).

37. U.S. Department of Justice, “Antitrust Division Workload Statistics, FY 2008-2017,” available at https://www.justice.gov/atr/file/788426/download.

38. U.S. Department of Justice, “Antitrust Division Workload Statistics, FY 1970-1979” (2015), available at https://www.justice.gov/atr/antitrust-division-workload-statistics-fy-1970-1979.

39. U.S. Department of Justice, “1982 Merger Guidelines” (2015), available at https://www.justice.gov/archives/atr/1982-merger-guidelines.

40. Carl Shapiro, “Antitrust in a Time of Populism.” Working Paper (SSRN, 2017), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3058345.

41. Verizon Communications, Inc. v. Law Offices of Curtis V. Trinko, LLP, available at https://www.oyez.org/cases/2003/02-682.

42. Credit Suisse Securities (USA) v. Billing, available at https://www.oyez.org/cases/2006/05-1157.

43. Howard A. Shelanski, “The Case for Rebalancing Antitrust and Regulation,” Michigan Law Review 109 (5) (2011), available at https://repository.law.umich.edu/cgi/viewcontent.cgi?article=1160&context=mlr.