Fiscal austerity intensifies the increase in inequality after pandemics

(This column is reprinted with the permission of the authors. It was first published by voxeu.org on June 3, 2021)

In the aftermath of past pandemics, fiscal policy played an important role in reducing or amplifying income inequality. This column predicts the likely distributional effects of Covid-19 by analysing evidence from five previous outbreaks (SARS, H1N1, MERS, Ebola, and Zika). It finds that severe austerity measures were associated with inequality increases three times greater than expansive fiscal policy following a pandemic. Premature austerity is self-defeating from both a macro and an equity standpoint.

In the early months of COVID-19, there was an expectation that the pandemic might actually lessen inequality, as some low-income frontline workers received hefty pay rises (Hannon 2020). Evidence from previous centuries, such as from the 14th-century Black Death, show big increases in the labour share, as labour became more scarce relative to capital in the outbreak’s wake (Scheidel 2017, Jorda et al. 2020). As Alfani (2020) notes, however, the historical evidence is not uniform: 17th century plagues did not lead to more egalitarian outcomes, as the rich took steps to protect their wealth. Recurrent plagues in the 19th century caused by the spread of cholera had devastating effects on the poor, as they lived in unhealthy and crowded conditions. Dosi et al. (2020) conjectured that COVID-19 would amplify existing inequalities, through channels ranging from inequities in risk of infection to access to hospitalisation, ability to work remotely, and the threat of longer-term job loss.

Twenty-first century pandemics, inequality and austerity

In our recent work (Furceri et al. 2021a, 2021b), we provide evidence about the likely distributional effects of COVID-19 by analysing the impacts of five major epidemics since 2000: SARS (2003), H1N1 (2009), MERS (2012), Ebola (2014) and Zika (2016). For convenience, we refer to these major epidemics as pandemics. H1N1 (Swine Flu Influenza) was the most widespread, with over 6½ million cases across 148 countries. The other four events affected fewer countries and were largely confined to specific regions: SARS and MERS in Asia, Ebola in Africa, and Zika in the Americas.

As in Ma et al. (2020), we construct a (0,1) dummy variable – the ‘pandemic event’ – which takes the value one for countries declared by the WHO to be affected by a particular pandemic. This gives us a total of 225 pandemic events. Our results are similar if we measure the intensity of pandemics based on cases per population. We use the net Gini coefficient (Gini net of taxes and transfers) as our measure of inequality; results are similar for the market Gini.

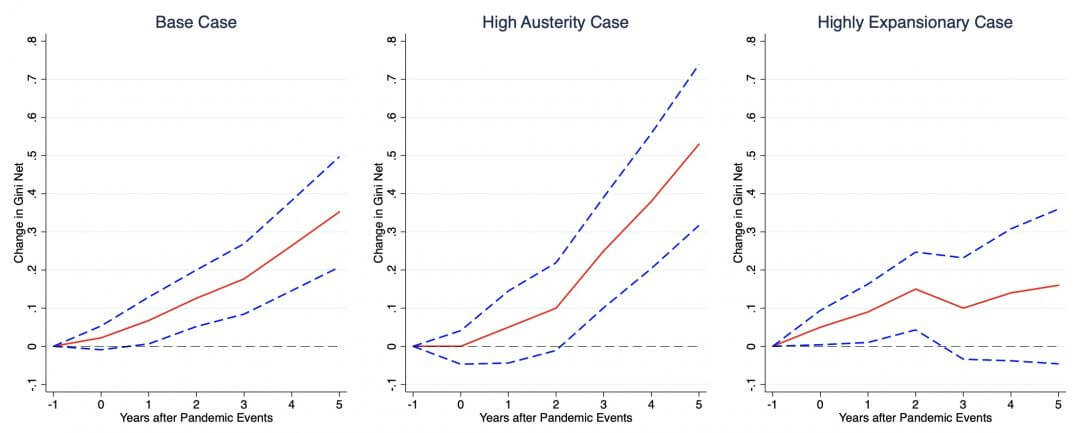

We trace the impact of pandemic events on the Gini by estimating impulse response functions directly from local projections (Jordà 2005). The left-hand panel of Figure 1 shows that the Gini measure increases by about 0.35 points after five years; the response is both statistically and economically significant given that Gini coefficients change slowly over time.

Figure 1 Fiscal policy and the impact of pandemics on inequality

The fiscal response varies considerably across pandemic events. We measure the stance of fiscal policy by shocks to the general government balance not correlated with changes in economic activity (see Fatas and Mihov 2003); results are similar using health expenditures or the extent of redistribution to reflect the fiscal stance. We exploit the variation across countries in fiscal balances after the onset of pandemics to see whether the impact on inequality is different in episodes characterised by high austerity (fiscal surpluses greater than 4% of GDP) compared with episodes of highly supportive fiscal policy (fiscal deficits greater than 4% of GDP).

The results from conditioning on the fiscal response are shown in the middle and right-hand panels of Figure 1. The key finding is that austerity intensifies the extent of the rise in inequality in the aftermath of pandemics. As shown in the middle panel, episodes of high austerity lead to an increase in the Gini by about 0.55 points, considerably larger than the average impact shown in the left-hand panel. By contrast, expansionary fiscal policy considerably dampens the rise in inequality, as shown in the right-hand panel: The increase in the Gini is under 0.2 points and is not statistically significant.

Distributional effects of COVID-19

Early evidence points to adverse distributional impacts from COVID-19 (Blundell et al. 2020, Hacioglu et al. 2020, IMF 2021) occurring through a number of channels. The poor have been more prone to getting infected – in part because they are less likely to have the option of working from home – and to die if infected due to lack of access to quality healthcare. For instance, Brown and Ravallion (2020) found that infection rates were higher in US counties with a higher share of African Americans and Hispanics. There are also indirect and longer-lasting effects from job loss and other shocks to income, particularly for workers in informal employment with limited access to health services and social protection.

However, our results suggest that a long-lasting increase in inequality need not be a foregone conclusion and is contingent on the fiscal policies adopted by governments. The COVID-19 pandemic has led to a worldwide fiscal response estimated at nearly $12 trillion, or about 12% of global GDP, though the fiscal response in low-income developing countries has been restricted by tighter financing constraints. A number of observers have cautioned against premature withdrawal of fiscal support despite the resulting build-up in debt levels (IMF 2020, Stiglitz 2020, Sandbu 2020).

While country circumstances of course differ considerably, a case can be made that there is still room for fiscal support in many economies. The likelihood that low long-term interest rates will persist can moderate debt-service burdens and allow governments to continue extending the maturity of government bonds, though caution is warranted where fiscal buffers have been eroded (Chamon and Ostry 2021). In low-income developing countries, these policy options are much less readily available, and the alleviation of financing constraints could require greater assistance from private sector creditors and additional concessional financing from the official sector.

The experience following the Global Crisis offers a cautionary tale of the dangers of premature fiscal consolidation. In 2010, buoyed by what turned out to be mistaken signs of a strong recovery, many advanced economies signalled a U-turn in their fiscal stance, a policy choice that many regard as partly responsible for the tepid recovery that followed and the consequent failure to bring about reductions in debt-to-GDP ratios (Stiglitz 2012, IEO 2014). The turn to austerity also led to cutbacks in governments’ health expenditures in the run-up to the COVID-19 pandemic (OECD 2016, Soener 2020). Instead of a premature return to austerity, countries would do better by anchoring their fiscal plans in a credible medium-term framework and orienting public expenditures over the coming years toward productive investments in digital and green infrastructure (Gaspar 2020, Estefania Flores et al. 2021). By building market confidence in fiscal sustainability and boosting growth, respectively, these two steps can bring down the debt-to-GDP ratio over time in a more durable way than sharp fiscal consolidations.

References

Alfani, G (2020), “Pandemics and inequality: A historical overview”, VoxEU.org, 15 October.

Blundell, R, M Costa Dias, R Joyce and X Xu (2020), “COVID‐19 and Inequalities”, Fiscal Studies 41(2): 291–319.

Brown, C and M Ravallion (2020), “Inequality and the coronavirus: Socioeconomic covariates of behavioral responses and viral outcomes across US counties”, NBER Working Paper 27549.

Chamon, M and J D Ostry (2021), “A Future with High Public Debt: Low-for-Long Is Not Low Forever”, IMF Blog, 20 April.

Dosi, G, L Fanti and M Virgillito (2020), “Unequal societies in usual times, unjust societies in pandemic ones”, LEM Working Paper Series, No. 2020/14, Scuola Superiore Sant’Anna, Laboratory of Economics and Management, Pisa.

Estefania Flores, J, D Furceri, S Kothari and J D Ostry (2021), “Worse Than You Think: Public Debt Forecast Errors in Advanced and Developing Economies”, CEPR Discussion Paper 16108.

Fatás, A and I Mihov (2003), “The case for restricting fiscal policy discretion”, The Quarterly Journal of Economics 118(4): 1419–1447.

Furceri, D, P Loungani, J D Ostry and P Pizzuto (2021a), “Will COVID-19 Have Long-Lasting Effects on Inequality? Evidence from Past Pandemics”, CEPR Discussion Paper 16122.

Furceri, D, P Loungani, J D Ostry and P Pizzuto (2021b), “The Rise in Inequality after Pandemics: Can Fiscal Support Play a Mitigating Role?”, IMF Working Paper 21/120.

Gaspar, V (2020), “Fiscal Policies to Contain the Damage from COVID-19”, IMF Blog, 15 April.

Hacioglu, S, D Känzig and P Surico (2020), “The distributional impact of the pandemic”, CEPR Discussion Paper 15101.

Hannon, P (2020), “How the Coronavirus Might Reduce Income Inequality”, The Wall Street Journal, 19 April.

IEO (2014), “Response to the Financial and Economic Crisis”, International Monetary Fund.

IMF (2020), Fiscal Monitor, October.

IMF (2021), Fiscal Monitor, April.

Jordà, O (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95: 161–182.

Jordà, O, S Singh and A Taylor (2020), “Pandemics: Long-Run Effects”, Covid Economics 1: 1–15.

Ma, C, J Rogers and S Zhou (2020), “Global economic and financial effects of 21st century pandemics and epidemics”, Covid Economics 5: 56–78.

Sandbu, M (2020), “There is no fiscal emergency”, Financial Times, 26 November.

Scheidel, W (2017), The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, Princeton: Princeton University Press.

Soener, M (2020), “How Austerity is Worsening Coronavirus”, Books & Ideas, College de France, 4 June.

Stiglitz, J (2012), “After Austerity”, Project Syndicate, 7 May.

Stiglitz, J (2020), “Conquering the Great Divide”, Finance & Development, Fall.

Surico, P, D Känzig and S Hacioglu (2020), “Consumption in the time of COVID-19: Evidence from UK transaction data”, CEPR Discussion Paper 14733.