A future-oriented approach to wealth offers new possibilities for wealth creation in the United States

Wealth inequality in the United States has grown significantly over the past five decades, with the overall share of wealth becoming more concentrated among the highest-income families. A lot of research in economics and other social sciences has examined the causes and consequences of this wealth inequality, but a new working paper by the sociologist Robert Manduca at the University of Michigan argues that this research is incomplete.

The working paper highlights that the existing literature on wealth inequality in the United States has been successful at connecting wealth today to events in the past, but it has not fully explored the connections between wealth in the present and events in the future. This future-oriented approach to wealth is commonly taken by accountants and asset managers in the wealth management sector of the financial services industry and also captures the importance of what Manduca identifies as “social wealth.”

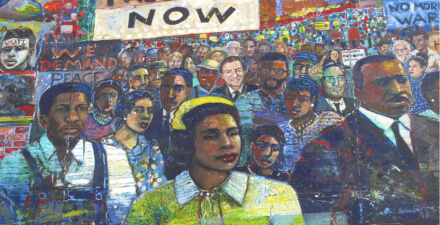

This distinction between how wealth relates to the past and the future is important. The past-oriented approach to wealth views a large fortune as something akin to a giant vault of gold coins. This image brings with it certain associations: Wealth is durable, it accumulates little by little over time, and it has an objective value. Much of the most impactful research on wealth inequality thus far documents how these specific attributes can link wealth today to events in the past—showing, for instance, how the durability of wealth allows initial income and wealth inequalities to exacerbate over time and how present disparities are directly connected to unjust and discriminatory government policies implemented by previous generations of policymakers.

Yet the financial professionals who work with wealth on a daily basis view it in a very different way. In fields such as accounting and asset management, wealth is typically understood as control over some future income stream, such as dividends from a stock or rental income from an investment property. In the wealth management sector of the financial services industry, the value of an asset reflects the amount of income it will generate going forward, discounted by uncertainty and distance into the future.

In other words, rather than a pile of gold coins, this future-oriented perspective imagines wealth as a series of bank deposits arriving each month without requiring any further work by their recipient. A wealthy person, from this perspective, is someone who has a legal right to a large stream of future payments. Indeed, as Manduca explains, “The past-oriented view might see a fortune of $10,000,000 as the end result of a multigenerational process, in which an initial endowment from generations back … grows over the years through periodic additions and compound interest. The future-oriented perspective would see the same fortune as a legal right to (roughly) $600,000 a year of income, from now until the end of time.”

This future-oriented perspective on wealth can be just as illuminating as the past-oriented one. The forward-looking view, however, has important implications that may not have been considered yet for policymaking related to wealth creation and wealth inequality. Before diving into those details, however, it’s important to first consider three of the main functions that wealth performs, especially for those individuals and families in the bottom 99 percent of the wealth distribution in the United States:

- Wealth is used as investment liquidity. Future asset growth, such as buying a home or investing in a postsecondary education, often requires putting down some money upfront.

- Wealth is used as insurance in emergencies. Such contingencies include unforeseen injuries, lost wages, or property damage. Emergencies are particularly relevant, as the Federal Reserve finds that only 64 percent of U.S. households can cover a $400 emergency expense.

- Wealth can be a long-term income replacement. This is the case with retirement income, for example, when it’s drawn from wealth-accumulating assets.

Most policy proposals focus on reducing wealth inequality and so tend to emphasize new ways of distributing ownership of traditional private assets. Proposals such as baby bonds, for instance, would distribute capital grants to individuals upon adulthood so they can make investments in housing, education, or business.

But if, instead, wealth is viewed as an entitlement to a set of future payments, then a broader set of policies should be on the table. The federal government already provides guarantees of future income payments through social insurance programs, such as Social Security and Unemployment Insurance. These programs are used by many families to meet needs they would otherwise meet through private savings.

Manduca calls these programs “social wealth” because they can be widely shared and accessed, compared to any of the particular ways in which individuals and households accumulate personal wealth. This social wealth also essentially serves as a primary form of wealth for many households because these income support payments offer families forward-looking confidence about their future assets and financial stability.

As Manduca explains, the value of social wealth is enormous. One recent study estimates the wealth equivalent of Social Security alone to be comparable to all private wealth in the country. In terms of wealth creation, then, few policies have had an impact anywhere near as large as the establishment of social insurance programs. By bolstering these programs, policymakers can create equitable and egalitarian wealth across U.S. households.

Wealth as Control of the Future

January 19, 2023

To be sure, social wealth isn’t fully interchangeable with private marketable assets. But Manduca’s new paper highlights the need for researchers and policymakers to use different definitions and perspectives of wealth that fit with the specific topics they are trying to address. The types of assets that are useful when saving to make a down payment on a house, for example, are different from the types that are useful when saving for retirement or experiencing a family emergency.

Researchers should thus be sensitive to these distinctions, and policymakers should consider the opportunities they offer. Considering the connections between wealth and the future, in addition to wealth’s connections with the past, is a good place to start.