Hospital consolidation and rising health care prices lead to job losses for U.S. workers

Overview

The majority of working-age adults in the United States have health insurance via their employers. Theory and a growing body of research suggest that when the cost of workers’ benefits go up, these cost increases are borne by workers and their employers.1 As a result, employer-sponsored insurance creates a link between what happens in the health care sector and labor market opportunities for workers outside that sector.

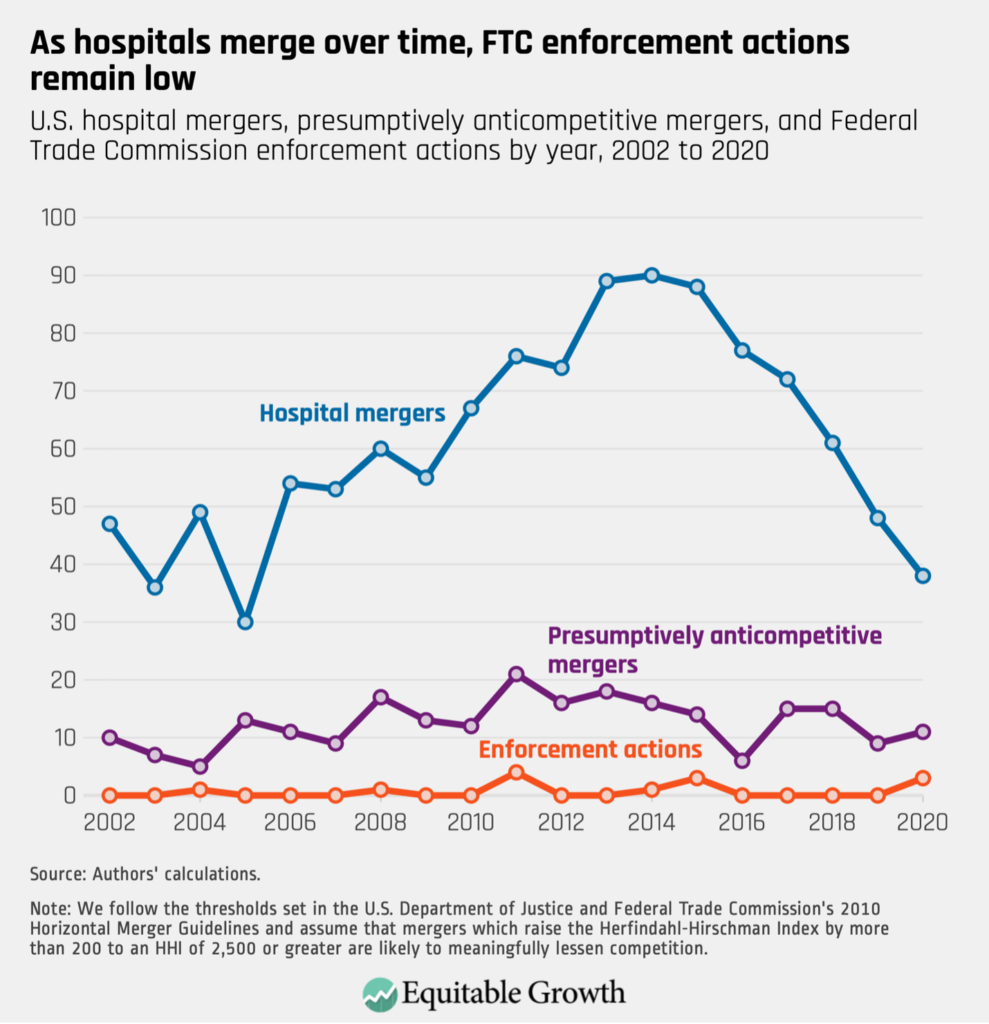

From 2000 to 2020, there were more than 1,000 hospital mergers among the approximately 5,000 hospitals in the United States. During this period, the Federal Trade Commission only took action to block 13 of those deals. Yet, in previously published work, we showed that approximately 20 percent of these hospital deals ran afoul of the U.S. Department of Justice and Federal Trade Commission’s Merger Guidelines, based on the resulting changes in the Herfindahl-Hirschman Index, a method that economists and regulators use to characterize the level of competition or concentration in a market.2 Further, we show that the average merger that ran afoul of the guidelines ultimately led to hospital price increases of 5 percent.

In newly released work, we analyze the downstream consequences of the price increases caused by hospital mergers.3 We show that a 1 percent increase in health care prices caused by a hospital merger lowers both payroll and the number of employees at firms outside the health sector by approximately 0.4 percent. At the county level, a 1 percent increase in health care prices reduces per capita labor income by 0.27 percent, increases flows into unemployment by approximately 0.1 percentage points, lowers federal income tax receipts by 0.4 percent, and increases Unemployment Insurance payments by 2.5 percent.

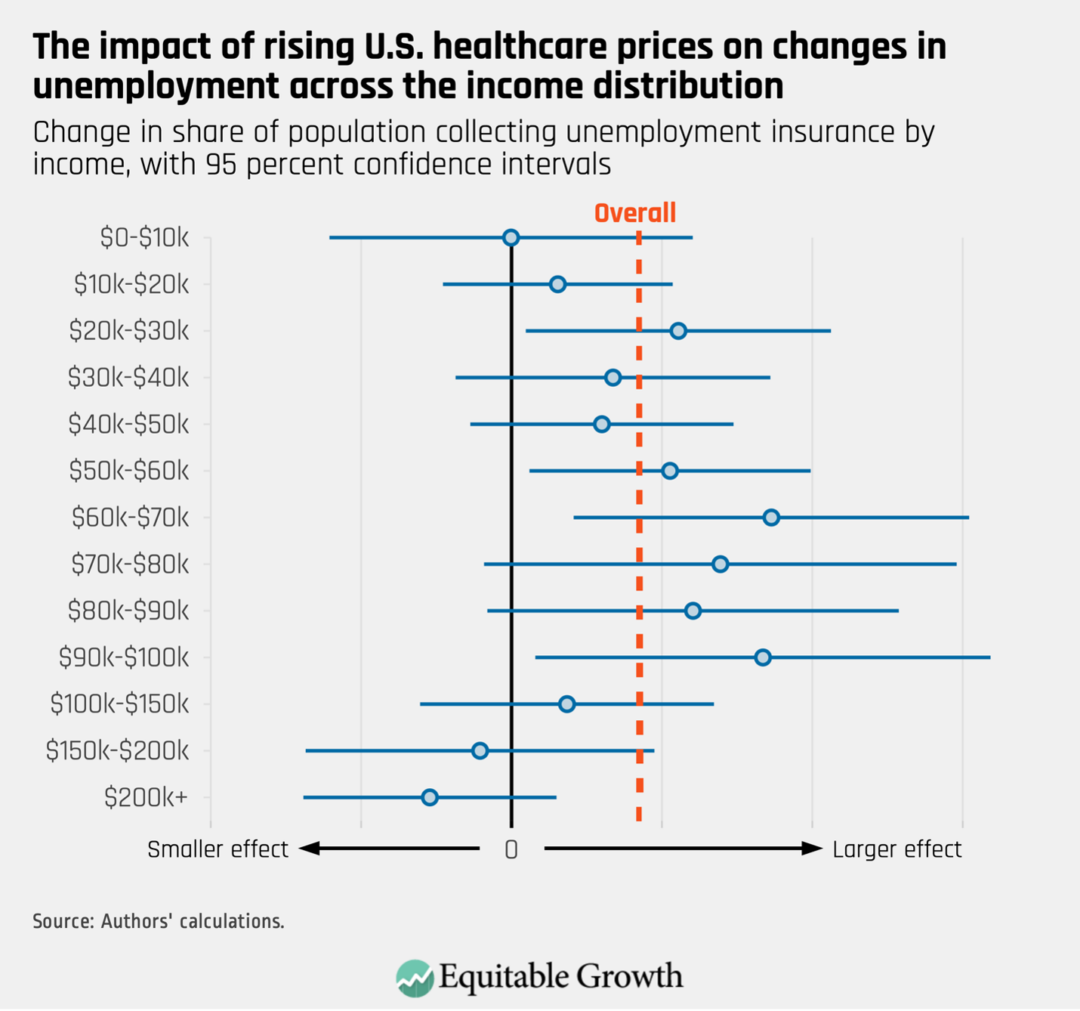

We also find that the job losses caused by rising health care prices are concentrated among low- and middle-income workers, whereas employment is virtually unchanged for U.S. workers earning more than $100,000 per year. In short, we find that hospital mergers that lead to price increases cause middle-income workers outside the health care sector to lose their jobs.

Our estimates also allow us to scale the effect of individual hospital mergers on local economies. We show, for example, that a hospital merger that raised prices by 5 percent would result in $32 million in lost wages, 203 job losses, and a $6.8 million reduction in federal tax revenue.

This issue brief explores the link between employer-sponsored health care and labor market outcomes in the United States before detailing the implications for workers, the broader U.S. economy, and competition policy.

Employer-sponsored health insurance and labor market outcomes

Over the past two decades, health care spending in the United States has surged, nearly doubling in real terms from $2.5 trillion in 2000 to $4.5 trillion in 2023.4 One of the primary drivers of the growth in health spending has been the sharp rise in the price of health care goods and services.

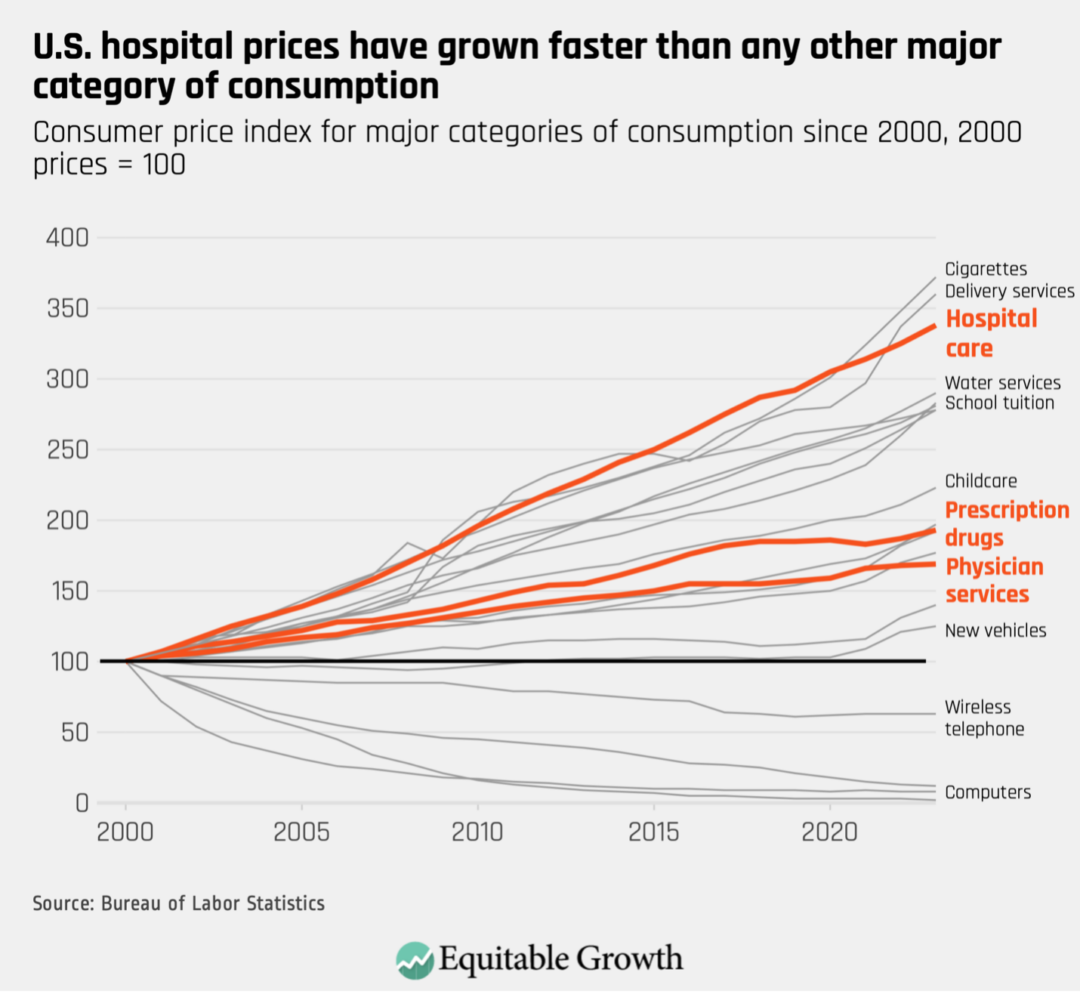

The hospital industry is a particularly stark example. Over the past two decades, hospital prices have outpaced the price growth in all other sectors of the U.S. economy.5 (See Figure 1.)

Figure 1

Across the U.S. economy, rising prices often reflect improvements in the quality of service, which benefit consumers. By contrast, many price increases in the U.S. health care sector are a result of industry tactics, such as mergers and acquisitions, surprise medical billing, upcoding, and patent hopping.6 These tactics boost revenues within the health sector without necessarily providing any additional value to customers.

So, who pays for rising health care prices in the United States?

In most markets, when sellers raise prices, these price increases are absorbed directly by customers—for hospitals, this would be their patients. Yet, because most patients in the United States have health insurance, when the price of hospital care rises by, say, 10 percent for a $20,000 hospitalization, little of this increase comes out of patients’ pockets. Instead, the bulk of that $2,000 price increase will be directly paid by patients’ insurers.

Insurers will not simply pay that $2,000, though. Insurers, like any other company, will respond to cost increases by changing the prices they charge to their customers. In the case of employer-sponsored health insurance, this means higher premiums for everyone covered by the employers’ health insurance plans.

This ability to “pass through” costs to another party means that those who ultimately pay for rising health care prices may be surprisingly far removed from the patients who receive care and the insurers who write the checks to health care providers.

The vast majority of working-age Americans receive health insurance through an employer, either via their own employer or through a spouse or family member’s employer. Employers pay steep premiums to provide this health insurance. As the prices for health care goods and services have increased, so too have insurance premiums. Over the past decade, insurance premiums grew by 47 percent, 17 percentage points faster than inflation.7 As a result, by 2023, average yearly health insurance premiums for a family of four reached $23,968—roughly the price of a new Toyota Corolla.8

At first blush, a nearly-$24,000 insurance plan might seem like a lavish benefit that employers are generously giving to their workers. Yet the prevailing view among economists is that employers often offset the cost of insurance by paying their workers less than they would in the absence of providing coverage. So, just as insurers pass on increases in health spending to their customers in the form of higher premiums, employers likely pass on the increase in premiums to their employees by lowering the wages they offer or even by reducing the number of workers they employ.

To the extent that employers pass through rising insurance premiums to their employees, then, it is U.S. workers who are paying for skyrocketing health care prices.

Examining downstream effects of hospital mergers and price increases

Our recent study examines the downstream effects of hospital mergers and rising health care prices. Our goal is to quantify who pays for increases in health care prices.

To do so, we use data on health care prices and utilization for millions of privately insured Americans from the Health Care Cost Institute, data from the U.S. Department of Labor on health insurance premiums for thousands of employers, and data from the Internal Revenue Service covering every income tax return filed in the United States. We use that data to trace out how an increase in health care prices—for example, a $2,000 increase on a $20,000 hospital bill—flows through to health spending, insurance premiums, the payroll at health care and non-health-care employers, average income per capita and unemployment in U.S. counties, and the tax revenue collected by the federal government.

To analyze the effects of rising prices, we study the consequences of hospital mergers in the United States. From 2002 to 2020, there were more than 1,000 hospital mergers among the approximately 5,000 U.S. hospitals.9 (See Figure 2.)

Figure 2

Many of these mergers substantially reduced competition. The 2010 U.S. Department of Justice and Federal Trade Commission’s Merger Guidelines state that mergers that result in an increase in the Herfindahl-Hirschman Index, or HHI, of at least 200 points and lead to a post-merger HHI of more than 2,500 should be “presumed to be likely to enhance market power” and thus are likely to result in price increases.10 In past work, we showed that approximately 20 percent of the hospital mergers from 2002 to 2020 could have been flagged as problematic according to these guidelines, and that these mergers raised prices by, on average, 5 percent.

How we study who pays for rising health care prices

To study the consequences of rising prices, we analyze employers and counties that face greater exposure to merger-driven hospital price increases. To do so, we estimate the price changes caused by every hospital merger in the United States from 2010 to 2015. We then measure the exposure of every U.S. employer with more than 50 employees to each of those mergers. A firm’s exposure to the price increases from these mergers is driven by a combination of factors: the number of mergers at hospitals where their workers get care, the degree to which a nearby merger reduces competition and raises prices, and the preferences of local workers over where they receive their care.

As we find in the data, employers and workers in counties that are more exposed to mergers face greater increases in health care prices. We then measure whether the employers and counties exposed to higher prices from 2010 to 2015 experienced reductions in payroll and employment.

Tracing how higher health care prices lead to increases in insurance premiums, lower wages, and reductions in employment

Our recent study shows that workers pay for the dysfunction in the U.S. health care industry.

We begin by showing that increases in health care spending caused by price increases are passed through on a dollar-for-dollar basis into higher insurance premiums. We then focus on how employers adjust their payroll and employment practices in response to these increases in insurance premiums. We find that a 1 percent increase in health care prices leads to a 0.4 percent decrease in employers’ total payroll.

This complete pass-through takes into account that a worker with employer-sponsored health insurance may also have a spouse and children on their insurance policy. That is, when health care prices go up, it doesn’t just increase health spending on workers employed by a firm, but it also increases the health spending on workers’ dependents, who also get their insurance coverage through the firm.

When the cost of providing health benefits goes up, firms may adjust by lowering workers’ wages or changing the number of workers they employ. Ultimately, we find that employers respond to increases in insurance premiums by reducing the number of workers they employ. We find that a 1 percent increase in health care prices caused by a hospital merger reduces employment at firms outside the health sector by approximately 0.4 percent. That is, employers are laying off workers to cover the higher costs of health care.

The unequal burden of rising health care prices

It is well-known that workers’ wages can vary markedly within a firm. Among the 1,000 largest publicly traded firms, for example, CEOs earn more than 100 times the wages of their median-wage employees.11

By contrast, while insurance premiums do vary modestly across workers within employers, they tend to vary much less than salaries.12 As a result, health insurance generally makes up a larger share of the total compensation for lower-wage workers relative to higher-wage workers.

Moreover, when health insurance premiums go up by $1,000 for all workers, this forms a larger proportional increase in the total compensation for a person in the mailroom—who earns, say, $20,000 per year—relative to a CEO, who makes $2,000,000 per year. So, while a $1,000 increase in insurance premiums could make it 5 percent more costly to retain the mailroom worker, it represents a miniscule increase in the cost of retaining a CEO.

As economists have described, rising health care spending can create more severe labor market consequences for lower-wage workers relative to higher-wage workers because health insurance premiums are fairly constant across workers.13 In a calibration exercise, Massachusetts Institute of Technology economist Amy Finkelstein and her co-authors highlight that, in the presence of employer-sponsored health insurance, rising health care costs are a leading driver of U.S. economic inequality and are leading to increases in inequality that are similar in scale to outsourcing, automation, and foreign trade.14

We show that these predictions bear out in practice. We observe that when health care prices increase, job losses are concentrated among workers earning between $20,000 and $100,000 annually. Yet we observe no decreases in employment for workers earning more than $100,000 annually. That is, when health care prices go up, the wealthiest Americans are spared from consequence, while the burden of the increase falls squarely on lower- and middle-income workers.15 (See Figure 3.)

Figure 3

Effects of rising health care prices on government spending

The harm from rising health care prices isn’t limited to job losses and income reductions for low- and middle-income workers. When workers lose their jobs, the government often steps in to provide Unemployment Insurance. As such, we find that when health care prices go up, Unemployment Insurance payments from the government also rise.

At the same time, when income goes down, so too does tax revenue. Therefore, we find that the aggregate effect of rising prices in the health care sector is an increase in government spending on Unemployment Insurance payments and a concurrent decrease in the amount of federal tax revenue that is collected from workers.

Effects on workers’ health and well-being

A growing body of research finds that job losses can have devastating health consequences. Duke University radiology professor Daniel Sullivan and economist Till von Wachter at the University of California, Los Angeles, for example, use administrative data from the 1970s and 1980s and find an increase in mortality for male workers who become unemployed.16

Likewise, Marcus Eliason at The Institute for Evaluation of Labour Market and Education Policy in Uppsala, Sweden, and Donald Storrie at the European Foundation for the Improvement of Living and Working Conditions, an agency of the European Commission, find that men face a 44 percent increase in mortality in the short term after a job loss. They also find that these increases occur concurrently with increases in hospitalization for self-harm, suicides, and drug overdoses.17

Similarly, University of Pennsylvania professor of medicine, medical ethics, and health policy Atheendar Venkataramani and colleagues find that in the wake of auto plant closures in the United States in the 2000s, there was a marked increase in opioid deaths in local counties.18 Across these studies, the authors find that approximately 1 in 300 to 1 in 600 of the individuals who lose their jobs die within a year. Consistent with this literature, we find that mortality from suicides and overdoses increases in the areas that experienced the largest increase in health care prices. In our analysis, we find that approximately 1 in 140 of the individuals who become separated from the labor market when health spending rises die from an opioid overdose or suicide within a year.

Our estimates appear higher than past estimates because we measure deaths per full separation from the labor market—individuals losing their jobs and ceasing to find new employment—whereas the past research focuses on deaths per job loss. If 1 in 3 of the individuals who lose their jobs become wholly separated from the labor market, which is largely what our results suggest, then our estimates of the effect of job losses on mortality are squarely in line with the findings of past research.

The aggregate consequences of rising health care prices

Our work highlights how a hospital merger can have severe downstream consequences for local labor markets and local economies. We find, for example, that a hospital merger that raises prices by 5 percent would lead to 203 local job losses (net of any gains in employment at the merging parties), approximately $32 million in forgone wages, a $6.8 million reduction in federal income tax revenue, and 1 to 2 additional suicide and overdose deaths. In other words, the overall economic harm from a merger that raised prices by 5 percent or more would be approximately $32 million in forgone income and approximately $9.6 million in economic harms from the deaths it would precipitate.

In past work, we noted that approximately 20 percent of hospital mergers per year over the past two decades could have been flagged by the Federal Trade Commission as likely to raise prices by lessening competition, according to federal Horizontal Merger Guidelines. Our work highlights that one year of these flagged transactions resulted in $400 million in lost wages, 2,543 job losses, $85 million in reductions in federal tax revenue, and between 12 deaths and 25 deaths annually. Collectively, this implies an economic harm from death and forgone income of approximately $500 million.

For context, the entirety of the Federal Trade Commission’s antitrust enforcement budget in 2023 was $490 million. As a result, the economic harm from a single year of mergers in the hospital industry—a sector that accounts for 6 percent of U.S. Gross Domestic Product—is approximately the size of the entire budget of the Federal Trade Commission.

Conclusion

The presence of employer-sponsored health insurance in the United States creates a link between what happens in health care markets and wages and employment at firms outside the health care sector. Our study shows that increases in health care prices are fully passed through to increases in insurance premiums and result in dollar-for-dollar decreases in firms’ payrolls. We find that firms respond to increases in health spending and insurance premiums by lowering the number of workers they employ. Notably, the job losses we observe are concentrated among workers earning less than $100,000 annually. As a result, rising health care prices in the United States are exacerbating economic inequality.

At a county level, we find that increases in health care prices lower income per capita, raise the share of individuals who receive Unemployment Insurance payments, and reduce income tax revenue collected by the federal government. That is, when health care prices go up, it results in higher federal spending and lower federal tax revenue.

Our results—that rising health care prices can lead to job losses—hold for any increase in prices in the health sector that is not driven by an increase in the quality of care that workers value. So, for instance, our results would generalize to increases in prices caused by surprise billing, upcoding, or vertical integration.

By contrast, our results may not fully generalize to the high prices of newly introduced innovative drugs. As innovative drugs are introduced, workers likely value the coverage for them, even as it increases spending. Thus, they are willing to forgo some wages to get these additional benefits.

Going forward, absent substantial changes in public policy that steer the United States away from employer-sponsored health insurance coverage, the most fruitful avenue for addressing the labor market consequences of rising health spending is to push for policies that increase productivity in the U.S. health care sector. This could include taking steps to strengthen antitrust enforcement, which could forestall anticompetitive price increases in the health sector.

Beyond strengthening antitrust enforcement, actions that reduce fraud in the health sector, address patent hopping and other price-increasing strategies in the pharmaceutical industry, and reduce surprise medical bills would all limit the types of health care price increases that workers outside the health care industry bear the burden of funding via their wages and employment.

—Zarek Brot-Goldberg is an assistant professor at the Harris School of Public Policy at the University of Chicago and a faculty research fellow at the National Bureau of Economic Research. Zack Cooper is an associate professor of public health and economics at Yale University and a faculty research fellow at the National Bureau of Economic Research. Stuart V. Craig is an assistant professor of risk and insurance at the University of Wisconsin–Madison’s School of Business. Lev Klarnet is a Ph.D. candidate in business economics at Harvard University.

Did you find this content informative and engaging?

Get updates and stay in tune with U.S. economic inequality and growth!

End Notes

1. Katherine Baicker and Amitabh Chandra, “The Labor Market Effects of Rising Health Insurance Premiums,” Journal of Labor Economics 24 (3) (2006), available at https://www.journals.uchicago.edu/doi/abs/10.1086/505049?mobileUi=0&; Jonathan Gruber, “Health Insurance and the Labor Market.” In A. J. Culyer and J. P. Newhouse, eds., Handbook of Health Economics, 1 ed., Vol. 1 (Amsterdam: Elsevier, 2000), pp. 645–706.

2. Zarek Brot-Goldberg and others, “Is There Too Little Antitrust Enforcement in the U.S. Hospital Sector?,” American Economic Review: Insights (forthcoming), available at https://www.aeaweb.org/articles?id=10.1257/aeri.20230340.

3. Zarek Brot-Goldberg and others, “Who Pays for Rising Health Care Prices? Evidence from Hospital Mergers.” Working Paper 32613 (National Bureau of Economic Research, 2024), available at https://www.nber.org/papers/w32613.

4. Matthew McGrough and Aubrey Winger, “How Has U.S. Spending on Health Care Changed Over Time?” (Peterson-Kaiser Family Foundation Health System Tracker, 2023), available at https://www.healthsystemtracker.org/chart-collection/u-s-spending-health care-changed-time/.

5. U.S. Bureau of Labor Statistics, “Consumer Price Index (CPI) Database” (n.d.), available at https://www.bls.gov/cpi/data.htm.

6. On hospital mergers, see Zack Cooper and others, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” Quarterly Journal of Economics 134 (1) (2019): 51–107; Keith Brand, Christopher Garmon, and Ted Rosenbaum, “In the Shadow of Antitrust Enforcement: Price Effects of Hospital Mergers from 2009-2016,” Journal of Law and Economics (forthcoming); Brot-Goldberg and others, “Is There Too Little Antitrust Enforcement in the US Hospital Sector?”. On hospital-physician vertical integration, see Cory Capps, David Dranove, and Christopher Ody, “The Effects of Hospital Acquisitions of Physician Practices on Prices and Spending,” Journal of Health Economics 59 (2018): 139–52; Haizhen Lin, Ian M. McCarthy, and Michael Richards, “Hospital Pricing Following Integration with Physician Practices,” Journal of Health Economics 77 (2021). On surprise billing, see Zack Cooper, Fiona Scott Morton, and Nathan Shekita, “Surprise! Out-of-Network Billing for Emergency Care in the United States,” Journal of Political Economy 128 (2020): 3226–77. On hospital upcoding, see Leemore S. Dafny, “How Do Hospitals Respond to Price Changes?,” American Economic Review 95 (5) (2005): 1525–1547. On drug copayment coupons, see Leemore Dafny, Kate Ho, and Edward Kong, “How Do Copayment Coupons Affect Branded Drug Prices and Quantities Purchased?,” American Economic Journal: Economic Policy (forthcoming).

7. Kaiser Family Foundation, “2023 Employer Health Benefits Survey” (2023), available at https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/#:~:text=The%20average%20family%20premium%20grew,outpaced%20inflation%20(47%25%20vs.; Salpy Kanimian and Vivian Ho, “Why does the cost of employer-sponsored coverage keep rising?” Health Affairs Scholar 2 (6) (2024), available at https://academic.oup.com/healthaffairsscholar/article/2/6/qxae078/7687295.

8. “Toyota 2024 Corolla,” available at https://www.toyota.com/corolla/ (last accessed January 26, 2024); Kaiser Family Foundation, “2023 Employer Health Benefits Survey.”

9. Brot-Goldberg and others, “Is There Too Little Antitrust Enforcement in the U.S. Hospital Sector?”

10. U.S. Department of Justice, “Horizontal Merger Guidelines” (2010), available at https://www.justice.gov/atr/horizontal-merger-guidelines-08192010.

11. Anders Melin, “Warren, Sanders Target Firms that Pay CEOs Way More Than Workers,” Bloomberg, available at https://www.bloomberg.com/graphics/ceo-pay-ratio/index.html.

12. Ithai Z. Lurie and Corbin L. Miller, “Employer-sponsored health insurance premiums and income in US tax data,” Journal of Public Economics 224 (2023), available at https://econpapers.repec.org/article/eeepubeco/v_3a224_3ay_3a2023_3ai_3ac_3as004727272300124x.htm.

13. Emmanuel Saez and Gabriel Zucman, The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay (New York: WW Norton & Company, 2019); Anne Case and Angus Deaton, Deaths of Despair and the Future of Capitalism (Princeton, NJ: Princeton University Press, 2020).

14. Amy Finkelstein and others, “The Health Wedge and Labor Market Inequality.” Working Paper No. 31091 (National Bureau of Economic Research, 2023), available at https://www.nber.org/system/files/working_papers/w31091/w31091.pdf.

15. We also estimate smaller effects for very low-wage workers, which largely arises because these workers are rarely offered health insurance benefits by their employers.

16. Daniel Sullivan and Till von Wachter, “Job Displacement and Mortality: An Analysis Using Administrative Data,” Quarterly Journal of Economics 124(3) (2009): 1265–1306, available at https://academic.oup.com/qje/article-abstract/124/3/1265/1905153?redirectedFrom=fulltext.

17. Marcus Eliason and Donald Storrie, “Does Job Loss Shorten Life?,” Journal of Human Resources 44(2) (2009), available at https://www.researchgate.net/publication/5094807_Does_Job_Loss_Shorten_Life.

18. Atheendar S.Venkataramani and others, “Association Between Automotive Assembly Plant Closures and Opioid Overdose Mortality in the United States: A Difference-in-Differences Analysis,” JAMA Internal Medicine 180 (2) (2020): 254–262, available at https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2757788.