Weekend reading: What to include in COVID-19 relief legislation edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

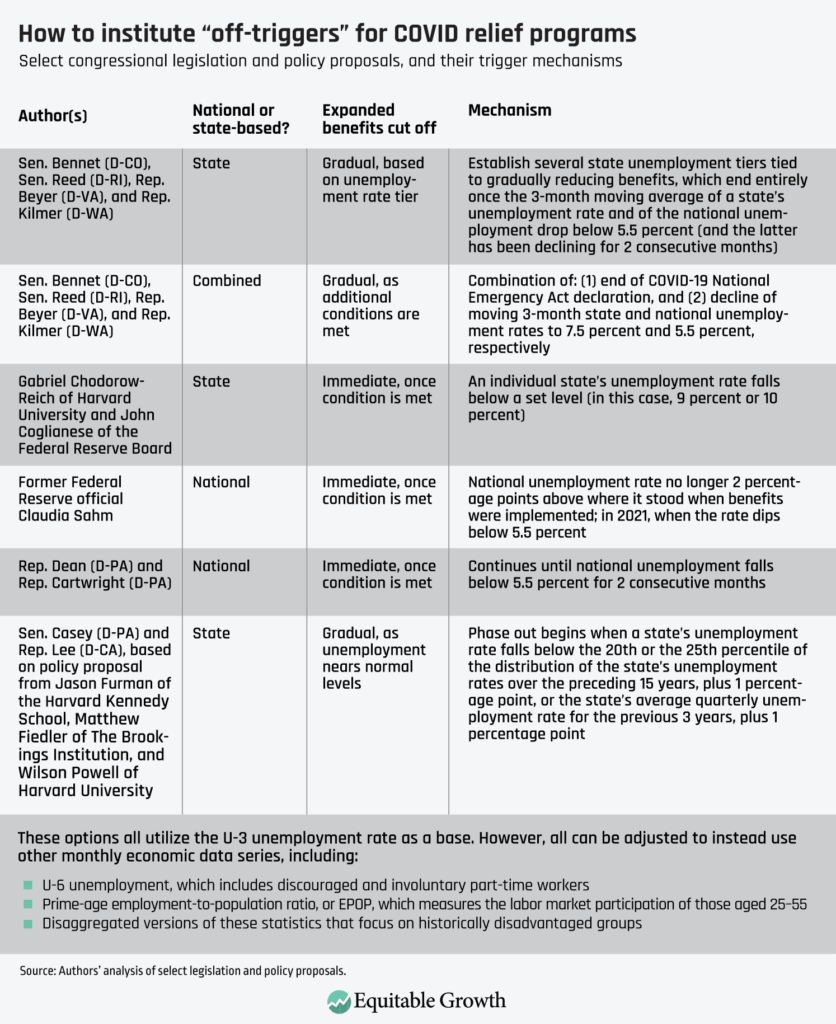

As Congress continues negotiating the details of a new COVID-19 stimulus bill, David Mitchell and Corey Husak make the case for including automatic triggers rather than arbitrary cut-off dates for relief programs. President Joe Biden’s current proposal includes the latter—random dates at which point emergency benefits such as extended Unemployment Insurance will expire—but this idea is misguided and based on the idea that legislators can somehow predict when the recession will have abated. Mitchell and Husak argue that instead, lawmakers should include automatic stabilizers—triggers that moderate the level of aid programs provide based on specific economic trends and data that indicate the state of the economy. This policy idea was included in the 2019 book of essays published by Equitable Growth and The Brookings Institution’s Hamilton Project, Recession Ready, and has gotten traction recently. Mitchell and Husak detail several options proposed for implementing these on- and off-triggers, explaining how each one is designed and how it would benefit U.S. workers and their families. They urge policymakers in Congress to adopt one of the options in the coming COVID relief bill in order to ensure that those most vulnerable in this economic downturn are supported and able to provide for their families.

Since the Clean Air Act was passed in 1970, many studies show the benefits of reducing air pollution on outcomes from health and well-being to economic productivity for parents and children alike. Studies also reveal the disproportionate exposure to poor air quality among disadvantaged communities, highlighting the linkages between environmental justice and economic inequality. A new Equitable Growth working paper by Jonathan Colmer and John Voorheis looks at the long-term effects of the Clean Air Act and finds that not only did the law affect children of mothers who benefited from cleaner air during pregnancy as a result of the new regulations, but also the grandchildren of these mothers. The co-authors in an accompanying column explain how the mechanism through which the intergenerational effects of air pollution arise, finding little evidence that the improvements in grandchild outcomes are biologically inherited, but rather are likely driven by increased parental resources and investments. Colmer and Voorheis also detail the policy implications of their research, particularly on how future cost-benefit analyses of environmental regulations can take these intergenerational transmissions into account.

Every month, the U.S. Bureau of Labor Statistics releases data on hiring, firing, and other labor market flows from the Job Openings and Labor Turnover Survey, better known as JOLTS. Earlier this week, the BLS released the latest data for December 2020. Kate Bahn and Carmen Sanchez Cumming put together four graphs highlighting the most important trends in the data.

Brad DeLong’s latest Worthy Reads column provides his takes on recent posts from Equitable Growth and around the web, covering some must-read content you may have missed.

Links from around the web

If the Great Recession of 2007–2009 taught policymakers anything, it is that stimulus legislation must be big and bold. Any coronavirus relief package must last as long as the pandemic does, writes Neel Kashkari in aWashington Post op-ed, and should be linked to the recovery of the job market. During the Great Recession, policymakers underestimated the depth of the crisis and were consistently surprised when things got worse, Kashkari explains. Today, rather than underestimating how bad the recession is, lawmakers risk underestimating how long it will last. Kashkari pushes for automatic triggers to tie fiscal support “to recovery of the job market rather than an arbitrary date.” And should the labor market actually rebound faster than what some public health experts are predicting, automatic triggers would shut off the aid gradually as things improve. Kashkari’s comparisons to the Great Recession paint a compelling picture for Congress to include automatic stabilizers in COVID relief legislation—or else, risk a repeat of the sluggish recovery and wage stagnation of the previous economic crisis.

A new project from The New York Times details the many challenges facing working parents amid the coronavirus recession and how they have been left to fend for themselves as the crisis persists. As is well-known, most household responsibilities fall on women and mothers more than other family members. In this series of articles and features, the Times looks in detail at the various ways in which mothers have been left behind, how they have been affected by the pandemic and recession, and the implications for women’s labor force participation in the future. The series also looks at the potential solutions offered by the Biden administration’s recovery plan—supports that some employers are offering to employees with children—alongside other solutions that would help working parents as they struggle to not only keep their jobs amid the recession, but also support their families and navigate the public health crisis.

The budget reconciliation process presents a prime opportunity to abolish the federal debt ceiling, argues Vox’s Dylan Matthews. The debt ceiling is essentially a hard limit on how much debt the U.S. government can take on and is typically adjusted based on tax and spending laws already passed by Congress. If Congress does not raise the debt ceiling, then the U.S. government cannot pay its legally mandated bills, and, in the worst-case scenario, the United States goes into default, triggering a global financial crisis. This arbitrary federal law has led to major and unnecessary political fights in the past, another of which would be devastating now, Matthews writes. Most wealthy countries around the world do not have legal limits on government debt and instead simply pass tax and spending legislation, issuing debt to make up any difference. Matthews lays out various ways that Democratic leadership in Congress and/or President Biden could follow in these footsteps and eliminate the debt ceiling, and focuses on why using the reconciliation process is the least politically fraught and most realistic option.

Friday figure

Figure is from Equitable Growth’s “How to replace COVID relief deadlines with automatic ‘triggers’ that meet the needs of the U.S. economy” by David Mitchell and Corey Husak.