Wage and employment implications of U.S. labor market monopsony and possible policy solutions

This essay is part of Vision 2020: Evidence for a stronger economy, a compilation of 21 essays presenting innovative, evidence-based, and concrete ideas to shape the 2020 policy debate. The authors in the new book include preeminent economists, political scientists, and sociologists who use cutting-edge research methods to answer some of the thorniest economic questions facing policymakers today.

To read more about the Vision 2020 book and download the full collection of essays, click here.

Overview

When a firm cuts wages by 5 percent, how many workers will quit in the next year? If the labor market works the same way as the market for chairs, then virtually all of the workers should leave for other firms. This is because, in a perfectly competitive market, there will always be another firm that is willing to pay the worker the value of what she produces. But ask any human resources manager or any worker, and they will tell you that it is extremely unlikely that all the workers would leave their jobs.

Recent economic research is able to quantify this: Between 10 percent and 20 percent of workers will quit. New estimates of this number—known as the elasticity of a firm’s labor supply—which rely on administrative data or innovative experiments, are arriving all the time.1

Economists have a word for this phenomenon: monopsony power. While literal monopsony power in the sense of a labor market with one employer is rare, the modern model of monopsony applies to markets where there are still many firms. The fundamental reason employers have this power is that jobs are complex transactions where the preferences of both workers and firms over job characteristics and performance are important and idiosyncratic. Because job shopping is rare and sporadic, workers don’t have many tools with which to figure out how much they will value a particular job before they take it.

A modern job in the United States is integrated in a constellation of relationships among co-workers and managers. Many workers possess skills that are specialized for particular employers and particular tasks. They also have preferences about their work environment. They may need to have a short enough commute. They may enjoy working with certain people. And they may have strong preferences about the communities in which they live.

Furthermore, searching for a job in the labor market takes time and energy. All potential job offers are not immediately observable by all workers who might accept them. Both of these facts mean that employees will only slowly respond to wage changes at their jobs. They may poke around the web for new job listings or they may ask their friends or former colleagues about possible job opportunities. None of this happens quickly, however, giving firms monopsony power over their workforces.

Monopsony power hinders wage growth for workers, which, in turn, slows consumer demand and reduces overall savings in the U.S. economy. This slows U.S. economic growth over the long term. Understanding the influence of monopsony power on the U.S. labor market is important because it helps make sense of why, from the point of view of employers, labor is often scarce. This perception often leads employers to demand policies that increase the supply of properly skilled workers, be they training programs, education, or increased migration. Some of the perceived “skills gap” may simply be because employers can’t find skilled workers at a wage they are willing to pay.

Fortunately, there are a number of policy actions that can be taken that are effectively “free lunches,” in the sense that there may be room for policymakers to increase wages without reducing employment. Other basic labor market institutions, such as unions, wage mandates, and mandated benefits may also improve workers’ welfare.

In this essay, we review the evidence for firms’ monopsony power in the U.S. labor market and explain what this means for wage growth and wage inequality. We then explain why, in a labor market where monopsony power is ubiquitous, policies that restrain firms’ wage-setting power and policies that bring workers to the bargaining table will stimulate wage growth without costing jobs. Furthermore, policies that encourage competition in the labor market—such as restricting the use of noncompete or nonsolicit agreements—are likely to help workers throughout the wage distribution.

All of these outcomes, we argue, could help ameliorate income inequality in the United States and generate more broad-based and sustained economic growth.

Economic evidence for U.S. labor market monopsony

The academic literature on monopsony—and the term itself—date back to 1933, when Joan Robinson published The Economics of Imperfect Competition.2 Mainstream mid-20th century U.S. labor economists were enthusiastic proponents of the view that laissez-faire labor markets were characterized by monopsony.3 Sometime in the late 20th century, however, this viewpoint fell out of favor, and economists started to emphasize models where wages were determined primarily by the value of an individual worker’s skill.

In recent years, research using new matched employer-employee data, which allows researchers to track workers’ careers across employers, casts doubt on the idea that workers’ wages are only determined by their individual skills. Pioneering recent research asked a simple question: Do workers’ wages depend not only on their skills but also on the identity of the firms they work at?4

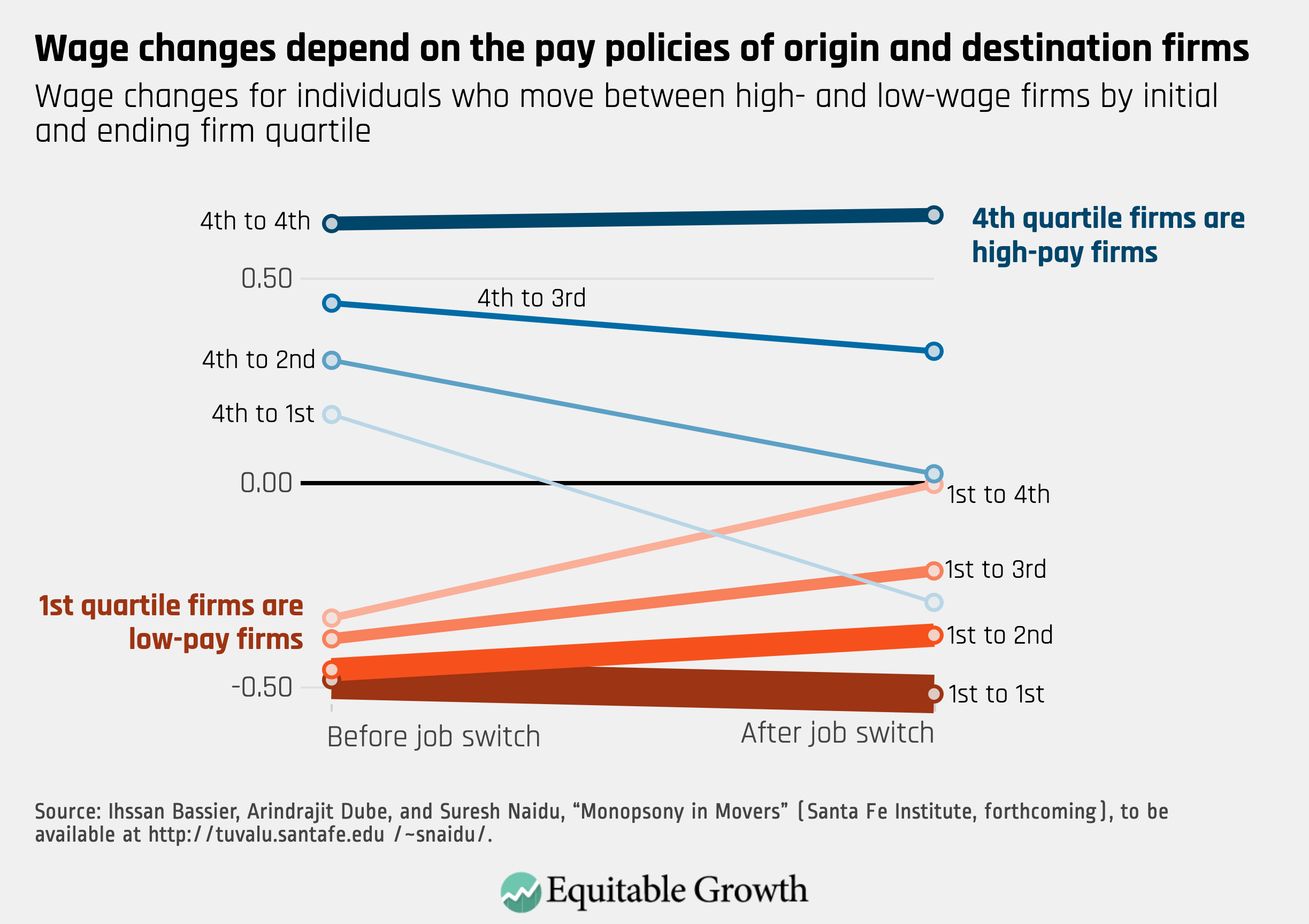

One answer comes courtesy of graphs such as the one below, produced using Oregon unemployment records. Figure 1 shows that the wage gains experienced by Oregonian workers who transition from the firms paying the lowest overall wages (by quartile) to those in the highest quartile of wage payers is strongly positive and is similar to the wage decreases experienced by their counterparts who transition the other way. Figure 1 also shows that while workers do transition to higher-wage jobs more than to lower-wage jobs (as measured by the thickness of the line), there are almost as many transitions from high-wage firms to low-wage ones. (See Figure 1.)

Figure 1

This would not be true if workers’ wages depended only on their skill levels. In that case, workers’ wages would not depend on the identity of their employers. This empirical research shows that firms played an independent and significant role in determining wages. In short, the outdated “law of one price” for an individual worker is, at best, a suggestion in the labor market.

Of course, there are a variety of reasons workers at different firms may be paid different wages. There could be differences in how productive workers are at different firms or differences in working conditions. The cleanest test for the presence of firms’ monopsony power involves experimentally manipulating wages and seeing how much turnover among employees changes. What monopsony models predict is that the separations response to randomized wages is low, as it is for new recruits. That means that only some of the workers leave, and that the firm is still able to recruit new workers, though fewer of them.

The recent availability of administrative data from firms and labor market platforms, such as Amazon Mechanical Turk and Burning Glass, have made it possible to examine contexts where wages can be experimentally manipulated in “real world” labor markets. One of these studies comes from the type of labor market that would seem to be the least likely to be plagued by monopsony power: an online labor market with thousands of workers and thousands of easy-to-find employers. Economist Arindrajit Dube at the University of Massachusetts Amherst and his co-authors conducted a series of experiments on Amazon Mechanical Turk, where they asked workers who had already completed a simple task if they would like to complete a given number of additional tasks at a specific rate.5 The take-up of this offer across workers with different, randomly assigned wage offers allowed the researchers to estimate the amount of wage-setting market power held by employers posting on the platform.

The researchers found that, even in this setting, there were sufficient frictions—economic parlance for the difficulty workers face in searching for jobs—such that a 10 percent increase in the offer increased take-up by only 1 percent, on average. This means that because workers aren’t able to easily match into the best possible job option, they end up accepting lower wage offers than would be predicted in a competitive market.

Another popular research strategy to identify firms’ monopsony power focuses on documenting the extent of concentration in the labor market and then examining the impact of this concentration on wages.6 Intuitively, more concentrated markets are those in which there are fewer employers competing for workers.7 The two federal antitrust agencies, the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice, have long used the Herfindahl-Hirschman Index, or HHI, a measure of concentration in product markets when evaluating the impacts of potential mergers. Finance professor Efraim Benmelech at the Kellogg School of Management at Northwestern University and his co-authors use administrative data from the U.S. Census Bureau to calculate the level of concentration of each labor market in the United States. The researchers find an HHI level of 2,300.8

This research shows that firms, at the very least, enjoy moderately concentrated labor markets for their employees. The main antitrust agencies in the United States classify product markets as concentrated if the HHI level is more than 1,500; the cutoff for a market to be considered highly concentrated is 2,500. By this metric, many labor markets in the United States are moderately concentrated. Researchers also uniformly find a negative correlation between concentration and wages, meaning that wages are, on average, lower in more concentrated markets.9

Mergers in more concentrated product markets typically face more government scrutiny. New research by labor market economists question whether mergers in more concentrated labor markets should also face antitrust scrutiny. While some economists have found that the average merger has no impact on wages, more careful research—such as by Elena Prager at Northwestern University and Matt Schmitt at the University of California, Los Angeles—finds that mergers greatly reduced wages for workers with healthcare industry-specific skills, who have fewer outside options than workers with more general skills.10 That is, hospital mergers reduced wages for workers in more concentrated markets.

In some cases, reducing wages may even be an explicit goal of the merging firms. Recent research conducted in Denmark finds that firms there target high-wage firms for acquisition, then, after the acquisition, they fire the managers and lower workers’ wages.11 As we discuss in the final section of this chapter, scrutinizing mergers for impacts on labor market outcomes is well within the orbit of current U.S. antitrust legal doctrine and enforcement capacity.

Implications of monopsony in the U.S. labor market for wages and wage inequality

Firms with monopsony power set pay policies, taking into account that if they want to hire more workers, they have to pay higher wages. This leads to workers earning less than they produce, as well as to higher unemployment. The unemployment created by firms’ monopsony power is not a result of market power, per se, but rather firms’ inability to perfectly pay each worker the minimum amount required to get that worker to become an employee at the firm.

Because employers cannot observe each worker’s reservation wage—the minimum the firm would have to pay to get the worker to accept the job—employers pay relatively uniform wages to their employees. So, even a small degree of monopsony power—a labor supply elasticity of around 4 (meaning 40 percent of the workers leave if the firm cuts wages by 10 percent)—would imply that workers take home only about 80 percent of what they produce, with the rest accruing as profits for their employers.

These pure monopsony profits can raise the measured capital share of income, which, in the national accounts, combines pure economic profits with the returns to productive capital, as well as the wealth-to-income ratio and the ratio of market-to-book values of firms. The increase in all these measures are part of the so-called Piketty facts, named after the Paris School of Economics professor Thomas Piketty, the author of the best-selling Capital in the 21st Century.12 These facts point to the increasing importance of wealth in the economy, and a monopsonistic lens suggests that some of this rise may be due to the erosion of policies that mitigated the use of monopsony power.

And because capital income is more concentrated than labor income, these pure monopsony profits would likely increase overall income inequality as well. Yet the inequality induced by these additional profits could be offset somewhat by some high-income workers facing potentially quite high degrees of monopsony power (think software engineers, whose high levels of pay shouldn’t obscure the fact that they work for employers who have considerable market power due to concentration and anticompetitive conduct such as no-poaching agreements).

Lowering monopsony power may, in fact, raise wages for some already high-paid occupations. In the United Arab Emirates, for example, research by one of the co-authors of this essay, Suresh Naidu, and the co-authors of that paper find that weakening monopsony power raised wages the most both at the bottom and at the top of the wage distribution.13 While the overall effect of monopsony on income inequality is an open question, there are reasons to suspect monopsony is, on net, disequalizing.

Firms’ monopsony power also can contribute to racial and gender wage gaps. In fact, the original use of monopsony, first put forward by the famous 20th century economist Joan Robinson, was to explain why equally productive workers might earn different wages. In her formulation, monopsony power might lead to a gender wage gap, as employers could use “female” as a tag for less elastic labor supply, identifying workers who are less willing (or able) to leave their current jobs for better opportunities elsewhere. They could then exploit this fact to pay these workers lower wages.

There are at least three reasons women and minorities may be less elastic and thus earn lower wages. First, as in the original Robinson formulation, women, particularly married women, may face geographic constraints on their job search that men do not face. For instance, women may need to work close to their homes if childcare is not widely accessible.

Second, the presence of discriminatory employers in the U.S. labor market can lead to a wage gap—even at the firms that do not discriminate. This is because the presence of discriminatory employers affects the wages of nondiscriminatory employers, worsening the overall labor market for some individuals more than others.

Third, some groups of workers, including women and minorities, may have less access to information about new openings than their nonminority male colleagues, making the market effectively less competitive for them.14 This may contribute to gender and racial wage gaps. A commonly cited statistic is that half of all jobs in the United States are found through informal contacts or social networks, which are themselves segregated and unequally distributed.15

Then, there’s the rising practice among companies that use or sell software, which these firms claim can accurately predict which workers are likely to leave, as well as when and at what wage. An important open question today is whether modern human resource analytics, by predicting turnover and retention and producing recommended wage policies based on the data of many firms, facilitates employer collusion on wages or wage discrimination.

If firms use these predictions to target wage increases or bonuses—and do not train their algorithms to be gender- and race-blind—then this may lead to a wage gap over time. Yet software tools that make competing offers increasingly visible to workers may prove to play some role in mitigating monopsony. The interaction of technological change and labor market monopsony is clearly an area that needs further research.

Public policy implications of monopsony in the U.S. labor market

There are several ways policymakers can address the potential negative consequences of firms’ market power on wages and employment in the U.S. labor market. First, antitrust regulation could be updated to more comprehensively and explicitly cover labor market monopsony.16 This means both considering potential labor market harms when evaluating mergers and acquisitions, and increasing the amount of funding available to the two federal antitrust agencies to investigate anticompetitive practices, including wage fixing or no-poaching agreements.17

Even in the absence of antitrust action, policies that encourage firms to compete more aggressively for workers, such as restrictions on the use of noncompete clauses or nonsolicit agreements, may be effective at helping workers throughout the wage distribution. Using data from the U.S. Census Bureau, researchers find that increased enforceability of noncompete clauses across states in the United States led to lower wage growth and decreased job-to-job mobility.18 Using discontinuities in laws at state borders, these researchers further showed that the enforceability of noncompetes had spillover effects on workers who were not directly affected. These results highlight why noncompete clauses and nonsolicit agreements reduce workers’ wages both by reducing workers’ ability to take advantage of new opportunities and by reducing their ability to renegotiate their wages on the job.

A classic intervention in the presence of monopsony power is the minimum wage. By restraining firms’ wage-setting ability at the lower end of the U.S. labor market, policymakers can increase wages for the lowest-paid workers and stimulate higher wages for those just above them on the wage ladder. What’s more, modest increases in the minimum wage can lead to gains in both wages and employment.

The reason increases in the minimum wage may increase employment is that, in the absence of a minimum wage, firms with market power have to trade off the benefit of hiring more workers against the cost of raising wages for all workers (not just the additional worker). A minimum wage removes this trade-off for many firms. Prior empirical research documents that increases in the minimum wage increased employment in the most concentrated labor markets.19 These include areas of the country where there are few firms hiring stock clerks, cashiers, or other retail sales workers. In Germany, the minimum wage has also been shown to reallocate labor from low-productivity to high-productivity employers.20

Of course, changes in the minimum wage only benefit low-wage workers. But if firms’ monopsony power is pervasive even for mid- to high-wage workers, then tools such as unions or wage boards—which can raise wages for workers further up in the wage distribution—may also have quite limited disemployment effects. A few states, including New York and New Jersey, already have wage boards, whose power could be strengthened. These institutions could be copied in other states.

Finally, in the presence of monopsony power, policies that nominally target large individual firms, including public-sector employers, may have economywide effects. A classic paper by economists Douglas Staiger at Dartmouth College, Joanne Spetz at the University of California, San Francisco, and Ciaram Phibbs at Stanford University showed that increases in wages at government-funded Veterans Administration hospitals led to wage increases at nearby hospitals due to labor market competition.21 One way to partially reconcile the interests of small businesses and workers may be to target wage increases to large employers (including the government), and rely on labor market competition to transmit those increases to smaller employers.

Download FileWage and employment implications of U.S. labor market monopsony and possible policy solutions

Conclusion

Labor market monopsony in the United States means that firms pay workers much less than the value of what their workers produce. Policymakers can hope to stimulate wage growth both by promoting competition in the labor market and by placing constraints on firms’ wage-setting capabilities. In doing so, policymakers also can help tackle rising U.S. income inequality and set the table for more sustainable, broad-based economic growth.

—Sydnee Caldwell in 2020 will be an assistant professor of business administration at the University of California, Berkeley’s Haas School of Business and an assistant professor of economics at UC Berkeley. Suresh Naidu is a professor of economics and international and public affairs at Columbia University.

End Notes

1. Anna Sokolova and Todd Sorensen, “Monopsony in Labor Markets: A Meta-Analysis.” Discussion Paper (IZA Institute of Labor Economics, 2018), available at https://www.iza.org/publications/dp/11966/monopsony-in-labor-markets-a-meta-analysis.

2. Joan Violet Robinson, The Economics of Imperfect Competition (London: Palgrave Macmillan, 1933).

3. Clark Kerr, “Labor Markets: Their Character and Consequences,” The American Economic Review 40 (2) (1950): 278–291; Martin Bronfenbrenner, “Potential Monopsony in Labor Markets,” ILR Review 9 (4) (1956): 577–588; Lloyd G. Reynolds, “The Supply of Labor to the Firm,” The Quarterly Journal of Economics 60 (3) (1946): 390–411.

4. John M. Abowd, Francis Kramarz, and David N. Margolis, “High Wage Workers and High Wage Firms,” Econometrica 67 (2) (1999): 251–333; David Card, Jörg Heining, and Patrick Kline,“Workplace Heterogeneity and the Rise of West German Wage Inequality,” The Quarterly Journal of Economics 128 (3) (2013): 967–1015.

5. Arindrajit Dube and others, “Monopsony in Online Labor Markets,” American Economic Review: Insights (forthcoming).

6. José Azar, Ioana Marinescu, and Marshall I. Steinbaum, “Labor Market Concentration.” Working Paper No. w24147 (National Bureau of Economic Research, 2017); José Azar and others, “Minimum Wage Employment Effects and Labor Market Concentration.” Working Paper No. w26101 (National Bureau of Economic Research, 2019).

7. Labor markets are typically defined by both geography (typically commuting zone) and industry or occupation.

8. Efraim Benmelech, Nittai Bergman, and Hyunseob Kim, “Strong Employers and Weak Employees: How Does Employer Concentration Affect Wages?” Working Paper No. w24307 (National Bureau of Economic Research, 2018).

9. José Azar, Steven Berry, and Ioana Elena Marinescu, “Estimating Labor Market Power” (2019).

10. Elena Prager and Matthew Schmitt, “Employer Consolidation and Wages: Evidence from Hospitals.” Working Paper (Washington Center for Equitable Growth, 2019), available at https://equitablegrowth.org/working-papers/employer-consolidation-and-wages-evidence-from-hospitals/; Christina De Pasquale, “The Effects of Hospital Consolidation on Labor Market Outcomes” (Atlanta, GA: Emory University Department of Economics, 2014).

11. Alex Xi He and Daniel le Maire, “Mergers and Managers: Manager-Specific Wage Premiums and Rent Extraction in M&As.” Working Paper (2018).

12. Gauti B. Eggertsson, Jacob A. Robbins, and Ella Getz Wold, “Kaldor and Piketty’s Facts: The Rise of Monopoly Power in the United States.” Working Paper No. w24287 (National Bureau of Economic Research, 2018), available at https://equitablegrowth.org/working-papers/kaldor-piketty-monopoly-power/

13. Suresh Naidu, Yaw Nyarko, and Shing-Yi Wang, “Monopsony power in migrant labor markets: evidence from the United Arab Emirates,” Journal of Political Economy 124 (6) (2016): 1735–1792.

14. David S. Pedulla and Devah Pager, “Race and Networks in the Job Search Process,” American Sociological Review (2017).

15. Yannis M. Ioannides and Linda Datcher Loury, “Job information networks, neighborhood effects, and inequality,” Journal of Economic Literature 42 (4) (2004): 1056–1093.

16. Suresh Naidu, Eric A. Posner, and Glen Weyl, “Antitrust remedies for labor market power,” Harvard Law Review, 132 (2018): 536; Ioana Marinescu and Herbert Hovenkamp, “Anticompetitive Mergers in Labor Markets.” Working Paper (Washington Center for Equitable Growth, 2018), available at https://equitablegrowth.org/working-papers/anticompetitive-mergers/; Ioana Marinescu and Eric A. Posner, “A Proposal to Enhance Antitrust Protection Against Labor Market Monopsony” (2018).

17. C. Scott Hemphill and Nancy L. Rose, “Mergers that Harm Sellers,” Yale Law Journal 127 (2017): 2078.

18. Matthew S. Johnson, Kurt Lavetti, and Michael Lipsitz, “The Labor Market Effects of Legal Restrictions on Worker Mobility” (2019).

19. José Azar and others, “Minimum Wage Employment Effects and Labor Market Concentration.”

20. Christian Dustmann and others, “Reallocation Effects of the Minimum Wage: Evidence from Germany.” Working Paper (2019).

21. Douglas O. Staiger, Joanne Spetz, and Ciaran S. Phibbs, “Is there Monopsony in the Labor Market? Evidence from a Natural Experiment,” Journal of Labor Economics 28 (2) (2010): 211–236.