Income support programs boost earnings for low-wage workers by reducing household poverty in the United States

The U.S. government expanded Unemployment Insurance and support for families with children amid the coronavirus pandemic to a degree unprecedented in recent history. Preliminary estimates of these expansions show their positive impacts on U.S. households. These income support programs are, among other things, reducing child poverty by almost 50 percent and ensuring parents who lose their jobs through no fault of their own can keep paying for everyday necessities such as rent and groceries.

Yet the expansion of Unemployment Insurance and the Child Tax Credit are only temporary. Congress will soon begin debating whether to make these measures permanent. As policymakers consider the implications of permanently improving our nation’s social infrastructure, they should look at the impact of income support on wages and poverty across the U.S. workforce.

My new working paper finds that broader accessibility to household income support leads to positive labor market outcomes for workers. Some think expanding income support will increase the likelihood of low-wage workers choosing unemployment over work. My research, however, finds the opposite: Low-wage workers in households falling into poverty who receive greater income support are more likely to not only remain employed, but also start earning higher wages.

Household poverty and low-wage workers’ upward mobility

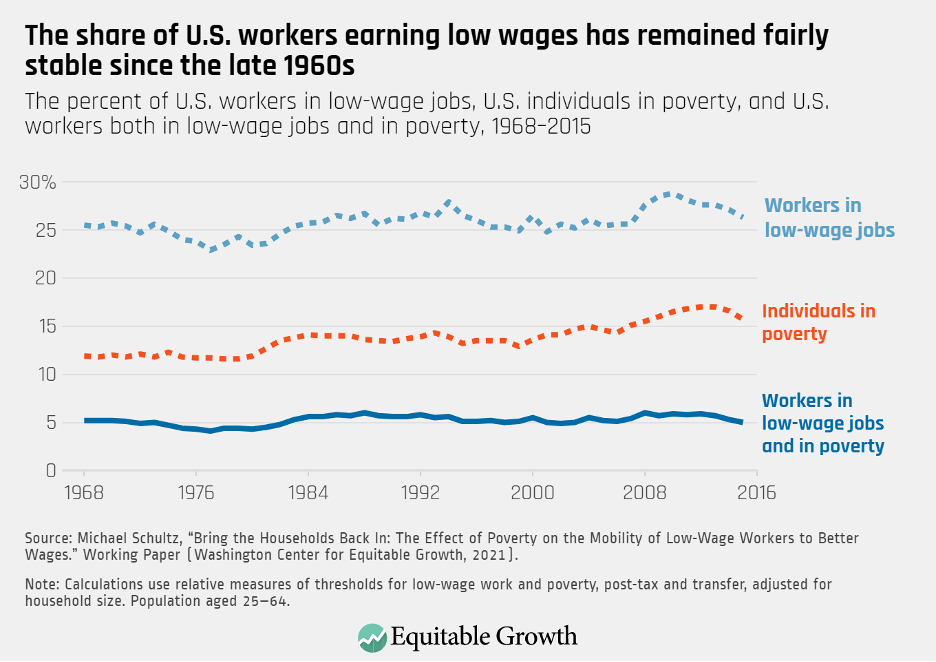

Although 80 percent of low-wage workers are not in poverty, low-wage work and poverty are often conflated. The low-wage labor market encompasses those workers earning less than $14 per day in 2021 dollars, using the international standard definition. This is currently about 25 percent of all workers in the United States and has remained a relatively stable share of the labor force for at least the past 50 years. (See Figure 1.)

Figure 1

It’s important to note that poverty is a household economic situation, not a permanent status. Most households in poverty are in poverty for only a year. Consequently, low-wage workers in poverty and not in poverty are similar in terms of education, work experience, jobs, and demographic characteristics, such as age, race, and gender. This also helps explain why, as Figure 1 shows, only about 20 percent of low-wage workers are in households in poverty in any given year, using the international standard definition of the poverty rate.1

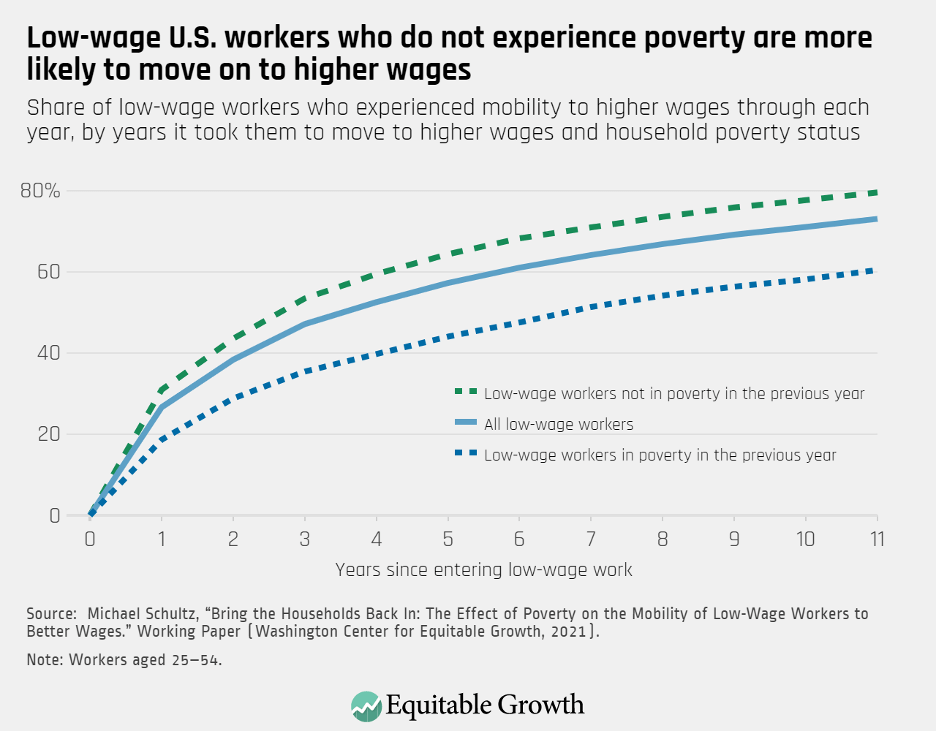

My research sheds light on the interaction between low-wage work and poverty. I estimate what economists call “individual wage mobility”—the movement of low-wage workers up and down the lower rungs of the earnings ladder—for households in and not in poverty in the previous year.

Using a nationally representative survey called the Panel Study of Income Dynamics that follows U.S. households and the individuals within them over time, I find that about 30 percent of low-wage workers who experienced poverty in the previous year move to better wages within 2 years, compared to 45 percent of low-wage workers who did not experience poverty in the previous year. (See Figure 2.)

Figure 2

Simply put, falling into poverty disrupts households. Household disruptions make it more difficult for workers to search for alternative jobs. Finding alternative jobs is one of the primary ways workers in the U.S. labor market gain a wage increase. Disrupted households must divert more resources, such as time and money, to address the disruptions, limiting the ability to search for new jobs.

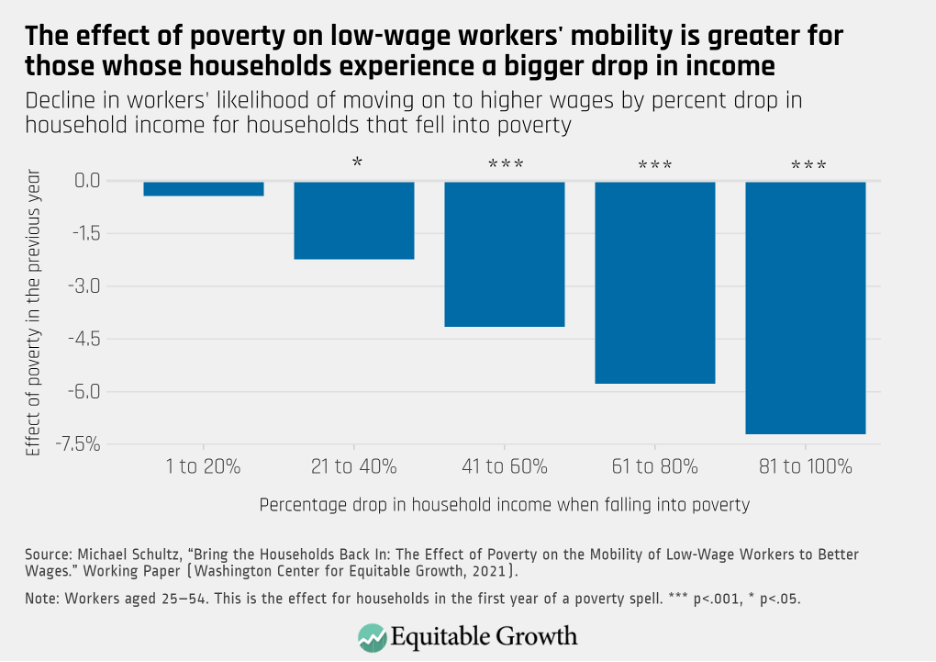

Households falling into poverty face the challenge of greater disruption with fewer resources to manage that disruption. Greater losses of household income when falling into poverty are an approximation of greater household disruption. Consistent with this explanation, I find that low-wage workers whose households lose a greater share of their household income when falling into poverty have lower rates of mobility out of low-wage work. (See Figure 3.)

Figure 3

I also find that workers in households experiencing longer poverty spells—of 3 or more years—are much less likely to move out of low-wage work than those workers in households in the first 2 years of poverty. Income support keeps households from falling deeper into poverty and helps shorten the time a household remains in poverty.

My study then estimates how other characteristics explain why workers in poverty households are less upwardly mobile. I find that human capital factors, such as education and work experience, explain just 20 percent of the difference in mobility outcomes among workers in households either experiencing or not experiencing poverty. Much more significant is a household’s resources, such as household savings and average income across the previous 3 years, which explains 60 percent of the poverty gap in mobility.

Improving U.S. social infrastructure helps workers find dignity at work

Policymakers should permanently expand social infrastructure programs, such as Unemployment Insurance and the Child Tax Credit. This can help boost workers’ wages and reduce household poverty by providing timely income support to families in need. Timeliness means the income comes to households before or as they need it, which buffers the household disruptions of falling into poverty and helps workers in these households find better jobs.

Removing the complexity and confusion surrounding the application for these programs will improve workers’ outcomes. Burdensome paperwork and reporting requirements tax the limited resources of low-income households, reducing workers’ resources to search for new jobs and move to better wages. The catastrophic failure of the joint federal and state Unemployment Insurance system to deliver timely aid in many states since the onset of the coronavirus pandemic is the exemplar of trying to target benefits gone wrong. Reform is needed.

The newly expanded Child Tax Credit presents a potential path forward in terms of the structure of our nation’s income support delivery infrastructure. CTC payments are deposited directly to families’ bank accounts every month. This allows households to use these resources to meet pressing needs and more easily resolve the disruptions associated with living on a low income and working in a precarious labor market.

Congress should consider providing a free bank account to every American. My data reveal that about 20 percent of workers starting a low-wage job in recent years do not have a checking or savings account. Among those entrants in poverty in the previous year, 40 percent are unbanked. This is consistent with national estimates of the unbanked. Programs such as the Child Tax Credit are ineffective if the benefits never reach those who need them most.

Responsive social infrastructure made up of timely income support programs can help workers avoid poverty spells and move to better-paying jobs. Higher wages help put these workers and their families on a more secure income trajectory. This strengthens the labor force and bolsters the overall economy. It also provides these workers and their families with the dignity that comes with better-wage jobs. Higher-paying employment is more stable and more likely to provide benefits such as health insurance and further training.

Easing access to income support programs and making the recent expansions permanent would have wide-ranging impacts across the U.S. economy and society. Not only would it boost wages for workers and lower the poverty rate, but it would also reduce economic inequality in the United States.

End Notes

1. Unlike the Census Bureau’s official poverty measure, the international standard definition incorporates government transfers, such as the Child Tax Credit, allowing me to capture some of the economic hardship and insecurity not revealed in other official measures.