Equitable Growth’s ‘Econ 101’ offered congressional staffers a rundown of the contours of U.S. tax policy

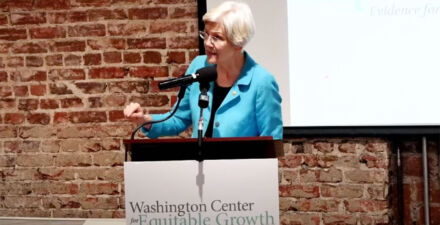

The Washington Center for Equitable Growth recently hosted a congressional briefing—part of a series we call “Econ 101”—for Hill staffers interested in learning more about the ins and outs of the U.S. tax code and various tax policy issues. Equitable Growth’s senior fellow for tax and regulatory policy, David S. Mitchell, and University of Maryland economics professor Daniel Reck led the briefing, which covered topics such as major U.S. federal taxes, individual versus business taxation, debates surrounding tax expenditures, and more.

Ahead of the expiration of many provisions in the 2017 Tax Cuts and Jobs Act in 2025, policymakers are gearing up for forthcoming tax policy debates. Understanding the U.S. tax code and being able to evaluate conflicting claims about the relationship between taxes and the economy will take on added importance next year.

Mitchell began the briefing with an overview of basic tax facts. He discussed how government revenues—funded mostly by the individual income tax and payroll taxes—currently are too low to handle federal spending demands and demographic shifts in the United States. Reck then explored payroll taxes in more detail, before Mitchell dove into individual income taxes and how they are calculated. Reck then discussed business income taxation, differentiating between the tax treatment of C corporations and pass-through businesses. Reck also discussed how the IRS taxes businesses’ international activities.

The pair then went through several major issues in tax policy. Mitchell first detailed tax expenditures, or spending through the tax code such as tax credits for higher education spending and retirement savings accounts. Reck defined both statutory incidence (which groups have a legal responsibility to remit taxes) and economic incidence (which groups bear the economic burden of a tax) and the relationship of these two incidences with the progressivity of the tax code.

Mitchell then turned to the main purpose of taxation—raising revenue for the federal government—and how to read a federal revenue table. He discussed the effects of tax cuts on the federal deficit and overall strength of the economy before turning it over to Reck to discuss behavioral impacts of tax policy.

Mitchell and Reck then took audience questions, many of which centered on the preference in the business code for private debt financing and private equity and tax treatment of pass-through businesses.

This Econ 101 was the first of a two-part series on the U.S. tax code and tax policy changes. The second, in mid-October, will focus on the most persuasive, evidence-backed arguments for how the tax code affects economic growth.

Review the presentation slides from the September 27 Econ 101 briefing to learn more.

Did you find this content informative and engaging?

Get updates and stay in tune with U.S. economic inequality and growth!