This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Over the past half-century, American women have joined the formal economy in massive numbers. This led to a lot of economic growth that we otherwise wouldn’t have experienced, but because of an outdated labor standards infrastructure it’s meant families are struggling to keep up with responsibilities outside of work.

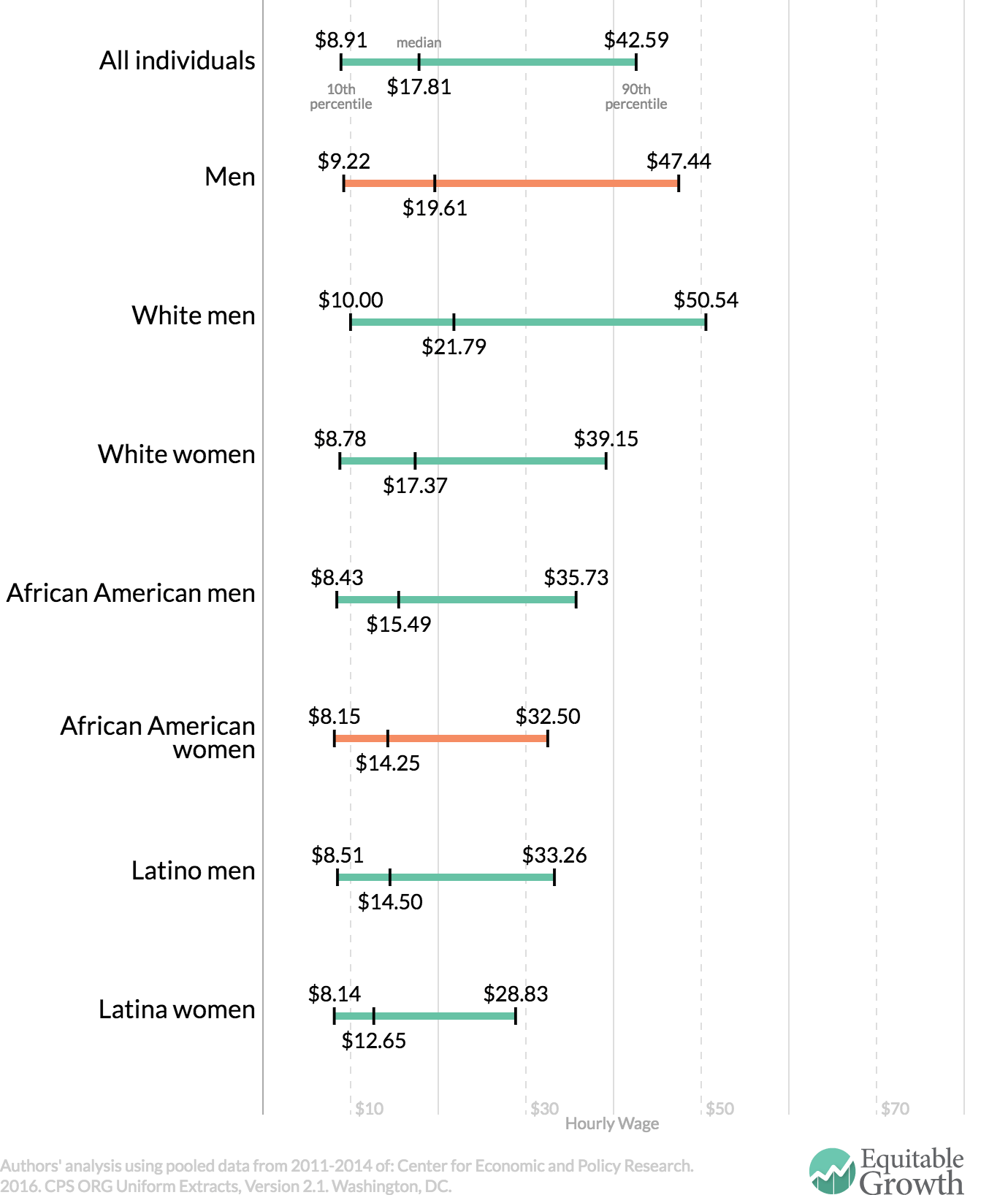

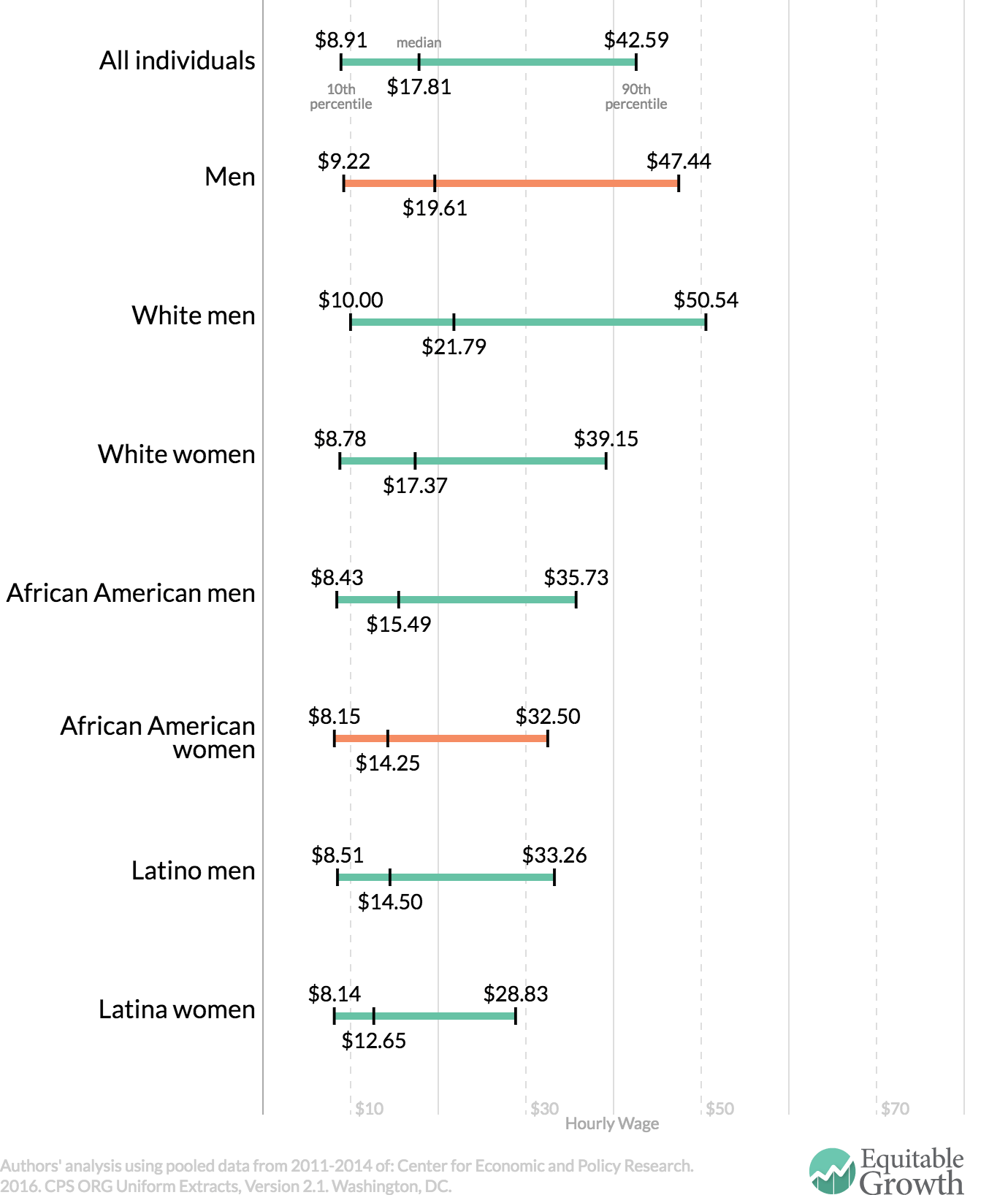

The gender wage gap remains significant, especially among minority communities. On average, men make roughly 27 percent more than African American women. Minimum wage increases, unionization, child care, and workplace flexibility policies could go a long way in ameliorating this problem.

Low interest rate environments are causing problems for pension fund managers and retirees, as meeting retirement goals requires more savings up front. “Thankfully, there is one retirement program in the country that would actually be easier to finance during an era of low-interest rates: Social Security”

We’ve known from recent economics literature that marginal propensities to consume, or how much of an additional dollar of income people are willing to spend, differs dramatically among classes of individuals. But how do MPCs change over time and throughout the business cycle?

Links from around the web

The Federal Reserve’s annual conference in Jackson Hole, Wyoming is underway and an unlikely participant is attending this year. Policymakers met with Fed Up, an activist group, to discuss lackluster wage growth and tight monetary policy’s disproportionate effect on marginalized segments of the labor force. [The New York Times]

Despite concerns such as these and despite the Fed undershooting its 2 percent inflation target 77 of 81 months since the recession ended, Chairwoman Janet Yellen “believe[s] the case for an increase in the federal funds rate has strengthened in recent months.” [Board of Governors of the Federal Reserve System]

Second quarter GDP growth was revised downward to an annualized 1.1 percent. [Bureau of Economic Analysis]

Income and wealth inequality are as bad now as they have been in nearly a hundred years, and gauging from the past there’s no indication that it couldn’t get worse. A new book by Kenneth Scheve of Stanford and David Stasavage of New York University examines the history of progressive taxation and how states have responded to rising inequality, and conclude that taxes on the rich generally do not increase as a response to inequality itself. [The Upshot]

Economics as a discipline rarely advances through periods of actual economic turmoil by locking itself away and dispassionately coming to agreement on the right set of equations and models, argues Ryan Avent. Invariably, politics matters and is just as important to the advancement of the discipline. [The Economist]

Friday figure

The gender wage gap is more severe among minority women.

Figure from “A fresh look at the wage gap on African American Women’s Equal Pay Day”