Weekend reading: The inequality and coronavirus edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

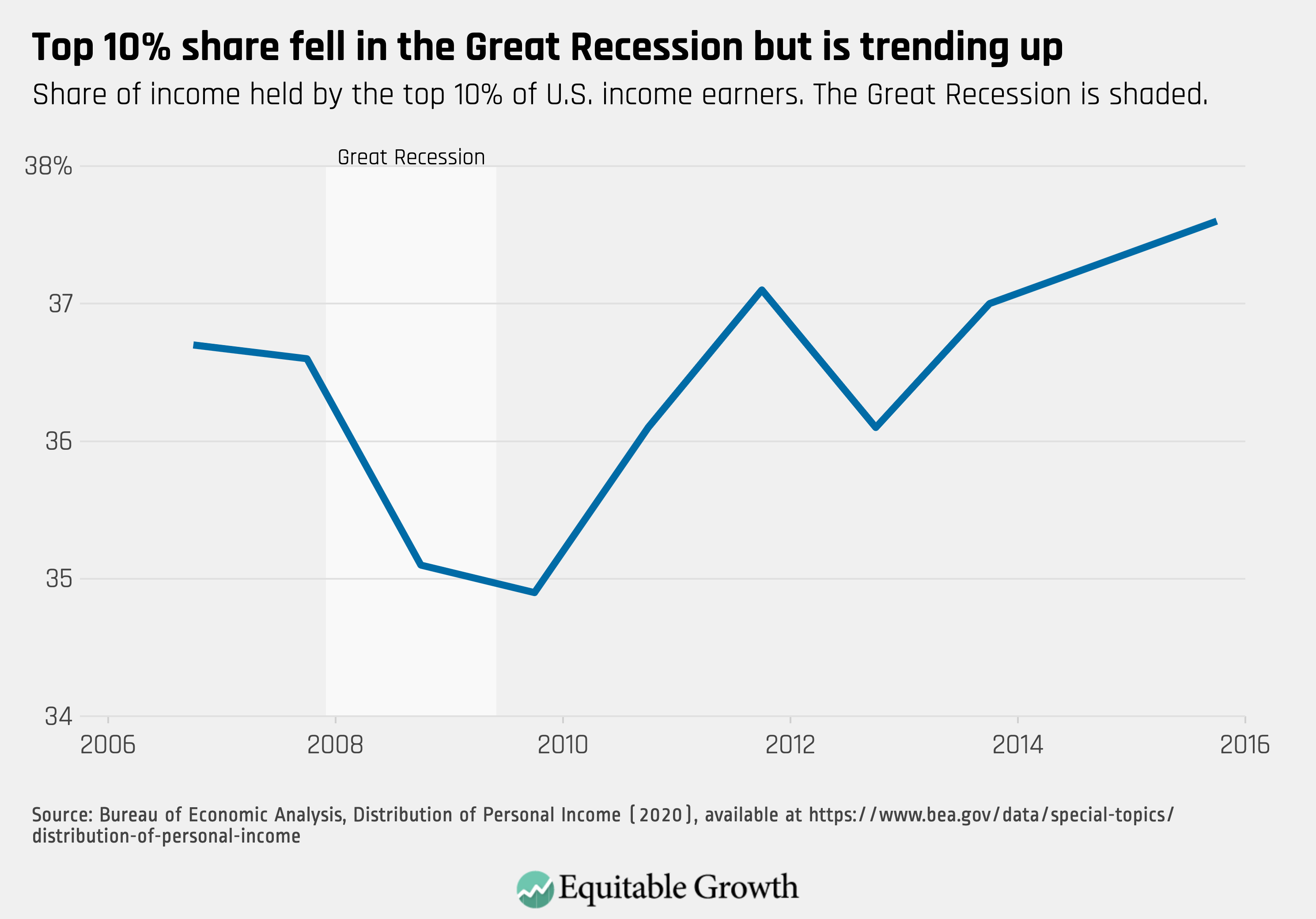

In news that may have gotten lost amid the NEW coronavirus outbreak, the U.S. Department of Commerce’s Bureau of Economic Analysis finally released income growth data from 2007 to 2016 separated by income quintile. The prototype—something Equitable Growth has long argued for as a means to show who is really profiting when the economy grows—shines a light on the vast inequality that persists in the U.S. economy, writes Austin Clemens. Additionally, in looking at how various income groups fared during and after the Great Recession of 2007–2009, the data can shed light on how an almost-inevitable coronavirus recession would impact the U.S. population. Clemens explains why the BEA focuses on personal income and shows how this dataset compares to similar data series, before concluding with some key takeaways.

In a joint letter to Congress, Heather Boushey and the heads of three other economic think tanks in Washington ask lawmakers to take action to “stanch the economic bleeding” caused by public health actions to contain the new coronavirus. They propose direct cash payments to American families, expanding Unemployment Insurance and the Supplemental Nutrition Assistance programs, protections against eviction and measures to deal with homelessness and overcrowding in shelters, student debt relief, and financial aid to states, particularly to their health programs. They also argue for so-called automatic triggers, so that the emergency measures passed into law will not be turned off until the economy recovers from the current shocks and will automatically be switched back on in the next economic crisis. Finally, the four think-tank leaders urge Congress to prioritize benefits for small and medium-sized businesses over shareholders.

Back in January, the U.S. Department of Justice’s Antitrust Division and the Federal Trade Commission released draft Vertical Merger Guidelines and requested public comment on the draft. The guidelines ignore the often-claimed and ill-supported notion that vertical mergers are inherently procompetitive, writes Jonathan Sallet, instead arguing that vertical mergers can have just as much of a dampening effect on competition as other mergers. But something called the elimination of double marginalization, or EDM, threatens to revert thinking back to the idea that vertical mergers cannot harm competition. Sallet goes through what, exactly, EDM is, why it threatens progress in this area, and why it should be treated just like any other claim of competitive benefits arising from a merger.

Links from around the web

In the face of mass layoffs in retail and hospitality industries, alongside an almost-inevitable coronavirus recession, it isn’t hard to see that COVID-19 is more than just a public health emergency—it is also an economic one, and one that will hit lower-income workers particularly hard. But are the first waves of layoffs from the service industries an indication of what’s to come for the rest of the economy and labor market? The forecast doesn’t look good, write Ben Casselman, Sapna Maheshwari, and David Yaffe-Bellany for The New York Times, arguing that with each day and each new setback, the damage looks likely to last longer and be more devastating than what anyone could have imagined. And while many companies outside of the hospitality and tourism industries have not yet announced layoffs, it is also true that many companies don’t have the financial buffer to outlast what could be a prolonged crisis. The authors say that a big sign of what is to come could be what happens to the retail industry, which is the largest private-sector employer in the country.

As cities from New York and Washington, D.C. to San Francisco shut down restaurants, bars, and cafes in order to facilitate social distancing and quarantines, service industry workers are facing hard times ahead. Many of these workers don’t have health insurance, or other sources of income, or any form of a safety net. One such worker, Anna Bradley-Smith, shared with Slate her experience before, during, and after being let go from her restaurant job, as part of a series documenting how the coronavirus is affecting people’s lives. Bradley-Smith does not qualify for government assistance or unemployment insurance because she is a foreigner on a work visa, but her friends who do qualify report experiencing difficulty accessing these supports.

The state of Minnesota declared that grocery store workers are considered emergency workers during the coronavirus outbreak, providing them with access to free childcare. Emergency workers deemed “critical” to the state’s response to the outbreak receive free childcare, and the state’s governor declared food distribution workers—including clerks, stockers, cleaning staff, and deli and produce staff—as Emergency Tier 2 workers this week. Having access to free childcare allows these already-overloaded workers to have one less thing to worry about.

Even before this recent crisis, U.S. economic data shows that the country’s economy is growing slower than in past decades, and that less growth is going to the average worker, writes Daniel Alpert for Business Insider. With U.S. Gross Domestic Product growth steady but lower than historical levels, and most of the slow growth going directly to the upper echelons of the U.S. income distribution, it becomes very clear just how unequal the economy is, even before adding in the impact of the coronavirus. Using both Gross Domestic Income and GDP, Alpert shows just how badly the average worker is faring nowadays—and highlights just how promising our GDP 2.0 work and the new BEA data releases could be in terms of ameliorating economic inequality. But, he concludes, “what is far less promising is the future for most American workers—who continue to receive a shorter end of the slowly growing stick that is the U.S. economy.” And now the U.S. economy faces a looming coronavirus recession.

Friday Figure

Figure is from Equitable Growth’s “New distributional snapshot of U.S. personal income is a landmark federal statistical product” by Austin Clemens.