Weekend reading: “This post is tax-ing” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Nick Bunker writes about a new working paper that looks at how income inequality in the United States has changed in the 21st century. The research finds that the increase in income inequality since 2000 is largely driven by higher capital income among the top .01 percent of earners.

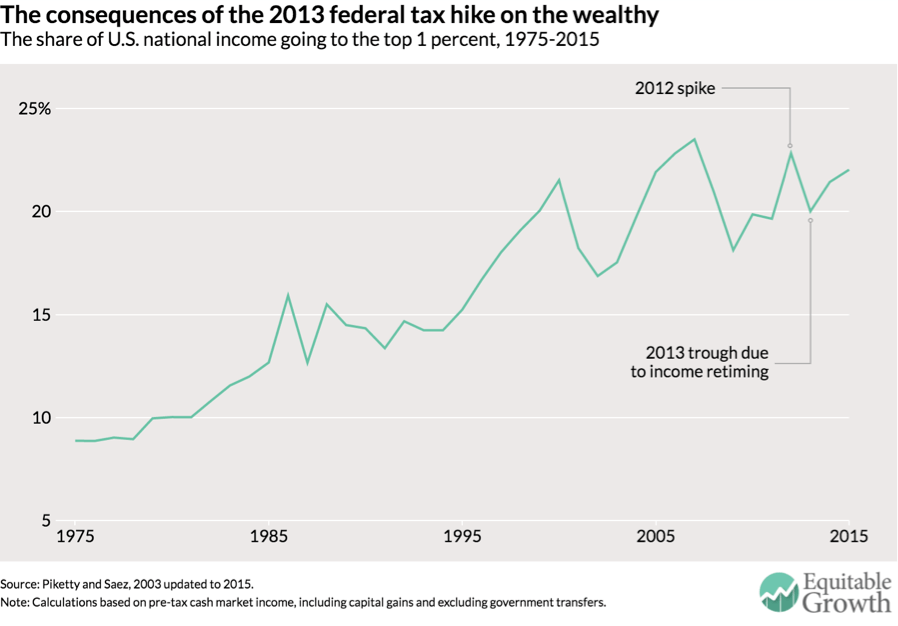

With tax day 2017 having come and gone this past week, Kavya Vaghul compiles a roundup of graphics showing interesting trends in U.S. tax policies over the years.

In the aftermath of almost a decade of unconventional monetary policy to fight the Great Recession, many political actors are contemplating new rules on monetary policy. But Nick Bunker cautions that when it comes to creating rules-based monetary policy these politicians should be aware of what aspects of monetary policy the rule is trying to govern.

Links from around the web

In the face of big job declines within some U.S. service sectors, Paul Krugman asks why the discussion on job loss focuses almost exclusively on mining and manufacturing. [nytimes]

In the past 10 years, student loan debt in the United States has grown by a whopping 170 percent, to $1.4 trillion, which is more than car loans or credit card debt. As more debt is transferred out of the private sector and into the public “in an eerie echo of the housing crisis,” Rana Foroohar says that increasing economic anxiety is well founded. [ft]

Claire Cain Miller looks about a new study that shows how investments in childcare pay off for mothers and kids alike, especially for boys, and returned $7.30 for every dollar spent. The study’s researchers (who include Nobel Laureaute James Heckman) found that children who were enrolled in a free, full-time childcare program in North Carolina earned more later in life, were healthier, and had fewer misdemeanor arrests. The mothers of these children also earned more. [the upshot]

Vanessa Williamson debunks the myth that Americans hate paying taxes. Instead, her research finds that many Americans are angered by their belief that some people aren’t paying their fair share. Williamson argues that, not only are these beliefs untrue, but as the country gears up to debate tax reform, these misperceptions can have a profound effect on our future policies. [washington post]

One sign that monopolies are a problem in the United States? The University of Chicago, where economists have argued that growing concentration is not a threat to economic growth, recently held a conference around antitrust concerns. [the economist]

Friday figure

Figure from “Taxing the rich more—evidence from the 2013 federal tax increase,” by Emmanuel Saez