Weekend reading: Tax evasion in the United States edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

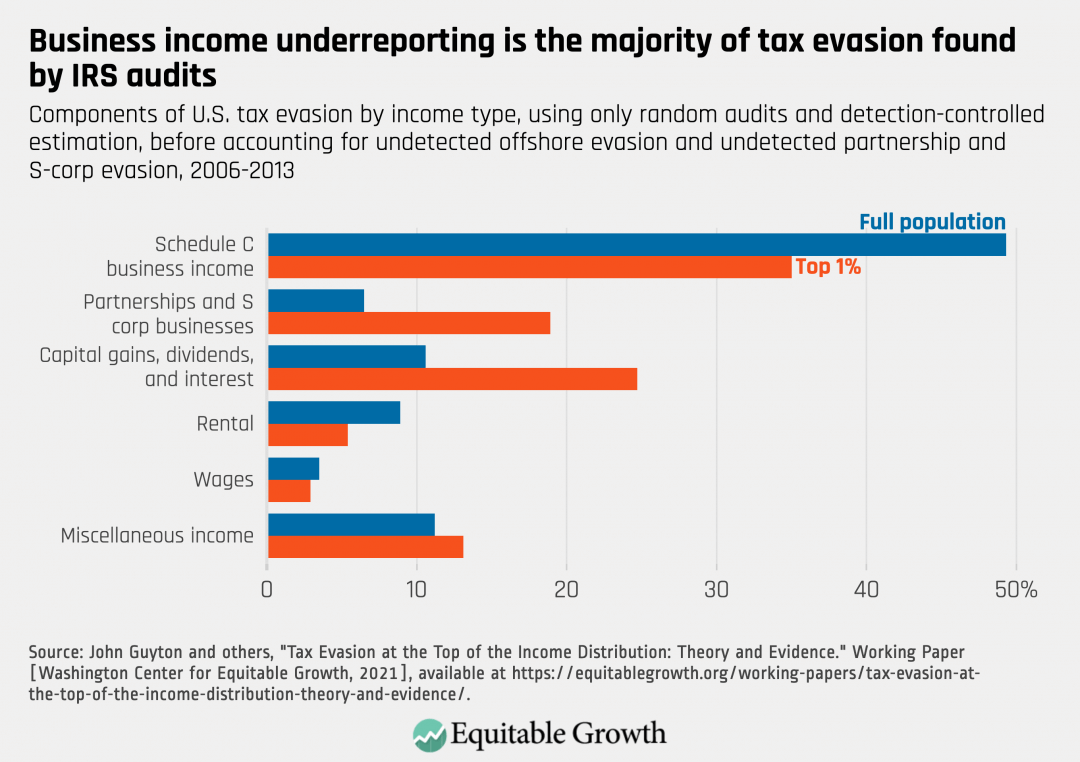

Tax Day 2021 is Monday, May 17. As many Americans prepare to file their tax returns and await their refunds, Corey Husak writes that some of the wealthiest Americans will engage in complicated tax evasion techniques to avoid paying their fair share—costing the U.S. government up to $700 billion this year, according to Treasury Secretary Janet Yellen. This tax evasion trend has gotten so severe, Husak continues, that the Biden administration is proposing several measures to crack down on it and try to close the so-called tax gap. Husak looks at the ways tax evasion contributes to U.S. economic inequality, the various extralegal methods these rich tax cheats use to evade taxation and hide their income from the IRS, and the impact of declining resources for the IRS to investigate tax evasion and enforce the tax code. Policymakers must understand these sources of tax evasion, he explains, in order to enact strategies and proposals that will close the tax gap.

If the state of the U.S. economy were to be measured solely based on stock prices and Wall Street’s performance, then it would appear to be booming. But this standard does not provide an accurate view of what’s really going on, particularly amid the K-shaped economic recovery from the coronavirus recession, in which the wealthy are becoming ever wealthier while the nonrich continue to struggle. The financial sector’s tightening grip on the economy leads to expanding inequality and wealth divides—and policy enables this trend. Amanda Fischer explores a recent hearing before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, which looked at the financialization of the U.S. economy, its effect on workers and inequality, and its contribution to racial economic disparities in the United States. She also provides some policy proposals for addressing this financialization, including investing in physical and care infrastructure, boosting worker power, strengthening financial-sector regulations, and making the tax code fairer.

Earlier this week, the U.S. Bureau of Labor Statistics released data on hiring, firing, and other labor market flows from the Job Openings and Labor Turnover Survey, better known as JOLTS, for March 2021. The report contains useful information about the state of the U.S. labor market, including the quits and job openings rates. Kate Bahn and Carmen Sanchez Cumming put together a few key graphs using data from the report, highlighting the major trends in the release.

Brad DeLong provides his takes on the latest must-read content from Equitable Growth and around the web.

Links from around the web

A number of states are planning to end the expanded Unemployment Insurance of $300 extra per week related to COVID-19 emergency benefits, arguing these benefits—a lifeline for millions of U.S. workers amid this economic crisis—discourages people from going back to work. As the U.S. economy reopens and vaccination rates jump, some sectors are still experiencing challenges to rehiring their workforce, but there is nothing in the data to suggest that expanded UI benefits are behind that trend. NBC News’ Dartunorro Clark reports on several governors’ reasoning behind the decision to end emergency UI benefits, which critics call “ill-informed and cruel.” For more details on what’s really at stake as states cancel this federally funded UI expansion, check out this factsheet by The Century Foundation’s Andrew Stettner. He details what will happen to workers in need as these programs are cut, how cuts will disproportionately impact workers of color, and why this policy choice is short-sighted. Stettner also explains the Biden administration’s alternative approach to the issue of getting workers back into jobs.

The stock market is booming, and while this is great news for anyone with investment or retirement accounts, it also signals a deeper issue within the U.S. economy. NPR’s Greg Rosalsky delves into why soaring profits and stock prices are eating into the incomes of U.S. workers and exacerbating inequality, hurting the overall economy. It’s part of why wages have stagnated, why fewer people are in the workforce, and why startups haven’t been growing as much in recent decades, he continues. Rosalsky looks at the rise of market power in the United States since the 1980s, why this rise has occurred, how it has affected the broader economy, and what policymakers can do to address it.

Friday figure

Figure is from Equitable Growth’s “The sources and size of tax evasion in the United States,” by Corey Husak.