Weekend reading: “Last minute edits” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Is there a trade-off between growth and equity? It’s hard to measure that question without determining how we measure growth in the first place. Austin Clemens and Heather Boushey look at how we could measure growth by taking equity into account.

Last month Equitable Growth co-hosted an event with the Program on Law and Government at the Washington College of Law on the untapped potential of current antitrust law. With the U.S. Department of Justice suing to block AT&T Inc.’s purchase of Time Warner Inc., the event has even more relevance. Liz Hipple summarizes some key takeaways from the conference.

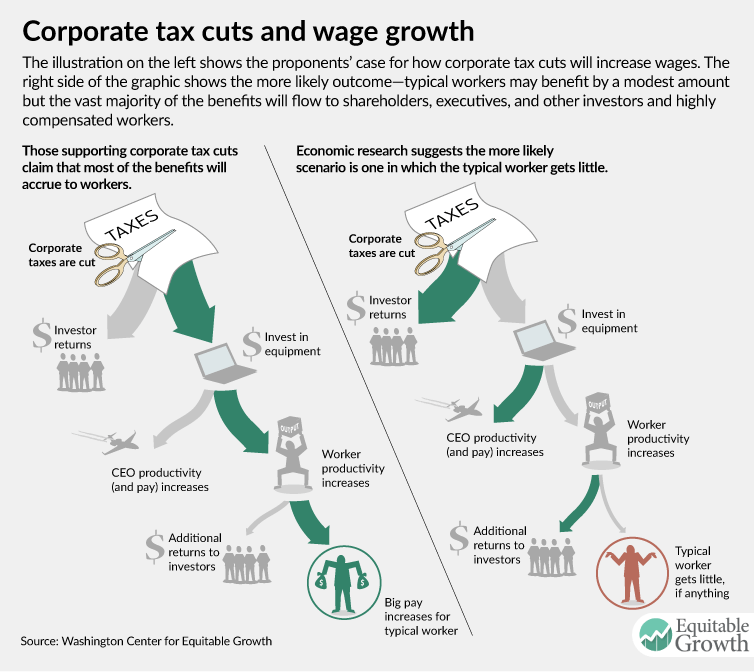

One of the key questions of the current tax policy debate—perhaps the key question—is whether a cut in the U.S. corporate income tax will lead to a significant increase in wage growth for most Americans. A new infographic from Equitable Growth shows how tenuous the connection between the tax cut and wage growth is.

According to the National Bureau of Economic Research, the Great Recession started 10 years ago this month. A decade later, perhaps it’s time to rethink whether the long-run potential of the economy isn’t affected by recessions and booms.

Links from around the web

Some statistics might give you the impression the U.S. economy is back to where it was before the Great Recession, but it doesn’t feel that way for millions of U.S. families. The ramifications of foreclosures, job loss, and deferred dreams are still being felt. Alana Semuels tells the story of one California family as just one example of this reality. [the atlantic]

Retail jobs are generally not regarded as “good” jobs. But looking at new research from the Russell Sage Foundation, Eduardo Porter concludes that “[t]here is nothing inevitable about dead-end jobs.” [nyt]

High profit margins might be a sign of market power but a company might not need to have high profits in order to draw policymakers’ attention. Alexandra Scaggs advances this argument, looking at the timely example of the AT&T Inc.’s proposed purchase of Time Warner Inc. [ft alphaville]

In the latest round of a debate about the growth impact of the tax plan making its way through Congress, Lawrence H. Summers and Jason Furman find that the evidence provided by supporters of the bill is weak. [wonkblog]

One benefit of tight labor markets is that they will help pull people back into work who might otherwise find it difficult to find a job. The labor market in New Hampshire is currently a good example. As Jennifer Levitz documents, employers and the government are working to help workers in recovery from drug addictions get jobs. [wsj]

Friday figure

Figure from “U.S. corporate tax cuts and wage growth.”