Weekend reading: “Disaggregating data” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Research released last week documents the decline in economic mobility in the United States since the 1940s. Equitable Growth released a factsheet summarizing the report here.

By one metric racial economic inequality in the United States is back at levels last experienced in the 1950s. Bridget Ansel writes on a new study looking at trends in the black-white male wage gap.

Business investment growth in the United States has been weak compared to the level of profits recorded over the past 15 years. A new study finds evidence that a lack of competition and short-termism in financial markets is to blame.

Another paper looks at how business investment is faring in the United States, this one focusing on how financing is flowing to companies based on investment opportunities. The results should make us concerned about the functioning of the stock market.

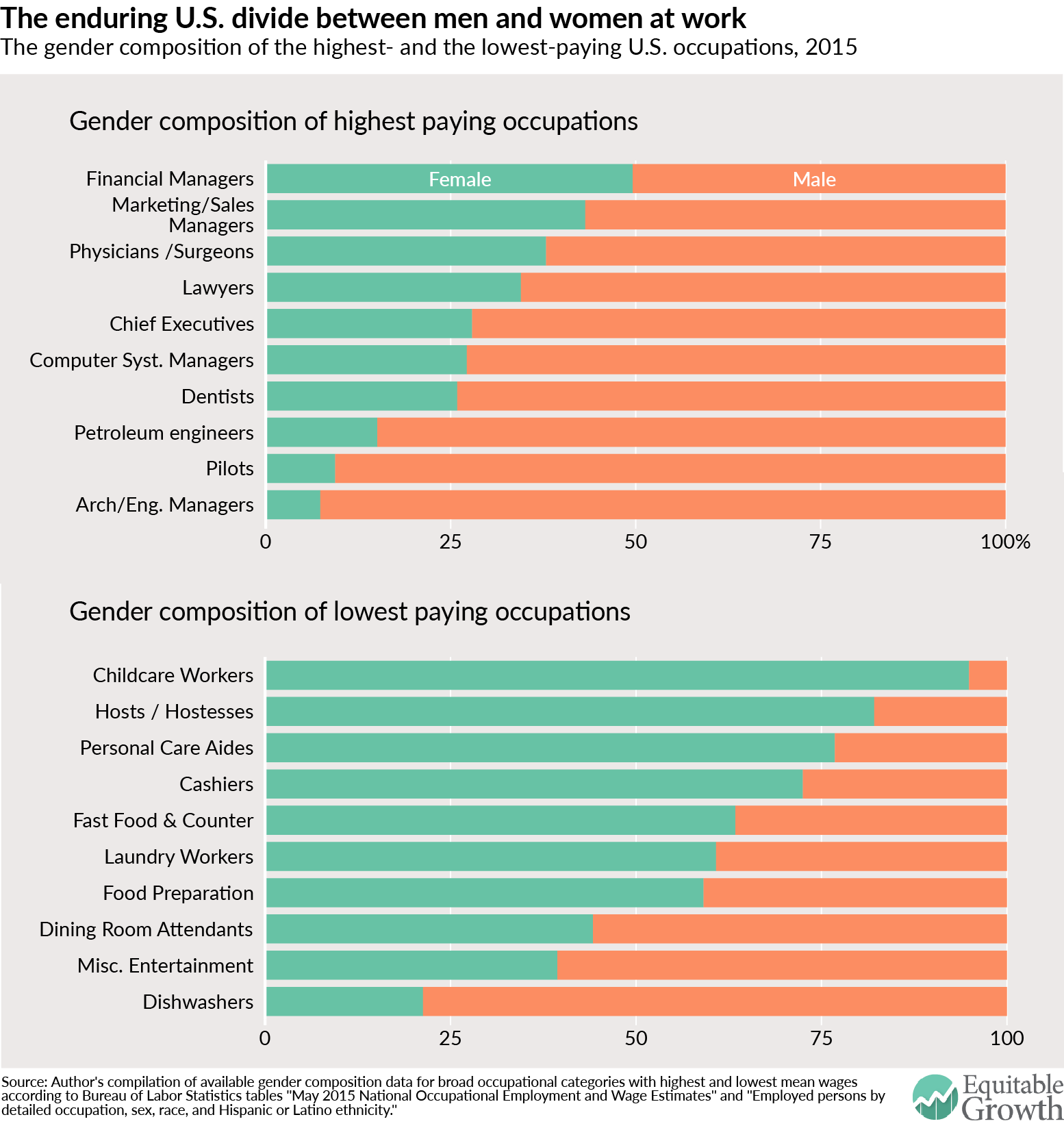

Some of the fastest growing occupations in the United States are dominated by women while men seem unwilling to enter these jobs. Bridget Ansel looks into why that seems to be the case.

The aggregation of economic data on Asian Americans and Pacific Islanders hides significant variation of socioeconomic conditions among those Americans. Kavya Vaghul and Christian Edlagan dive into the numbers to show why disaggregation matters.

Links from around the web

Can potential long-term economic growth be affected by short-run factors? J.W. Mason continues an investigation into how set potential growth rates. [the slack wire]

Speaking of the long-run effects of short-term programs, Max Ehrenfreund looks at how the creation of Medicaid helped improve the lives of poor children later in life. [wonkblog]

“If you spend more on education, will students do better?” ask Kevin Carey and Elizabeth Harris. Looking at new research on the effects of education spending pushes them to consider that the answer is yes. [the upshot]

Imagine a tax that not only would target the wealthy, but would also be efficient. This tax would help reduce wealth inequality while not harming economic growth. Adam Ozimek writes up such a tax: a tax on luxury homes. [moody’s]

The Federal Reserve raises interest rates this week for the first time this year. The expectation is that the central bank will hike several times in 2017. Ryan Avent argues the global economy will be better off if that doesn’t happen. [free exchange]

Friday figure

Figure from “Many of the fastest growing jobs in the United States are missing men” by Bridget Ansel