The coronavirus recession highlights the importance of automatic stabilizers

Overview

In February 2020, the U.S. unemployment rate was 3.5 percent. In May 2020, it stood at 13.3 percent. The unemployment rate for Black workers was a still-higher 16.8 percent. Unemployment for women exceeded that for men overall, among Black workers and among White workers. Adjusting for classification errors associated with the coronavirus pandemic would increase the overall rate by about 3 percentage points.1 Job losses were concentrated among lower-income workers and in sectors that rely on close physical proximity. In March and April, employment in the leisure and hospitality sector fell by nearly one-half; that is, there were half as many people working in that sector in May as there were just a few months before.

The emergence of the novel coronavirus that causes the COVID-19 disease led to this collapse in economic activity. This recession is unique in that it was caused by a global pandemic, but it also shares many features with the typical recession. One thing specifically: We know certain policies will support the U.S. economy while we work toward recovery. Automatic stabilizers—programs that automatically scale up in recessions and draw down during booms to stabilize the economy—play a critical role in fighting every recession.

In May 2019, Equitable Growth and the Hamilton Project published Recession Ready, which contained six proposals on automatic stabilizers. This issue brief examines the critical role that automatic stabilizers can play amid the current recession and in future downturns. The brief first explains what a recession is, what role public policy plays in fighting recessions, and then a few important ways in which this recession differs from previous recessions. Finally, the issue brief explains why Congress should expand and reform the United States’ existing automatic stabilizers.

What is a recession?

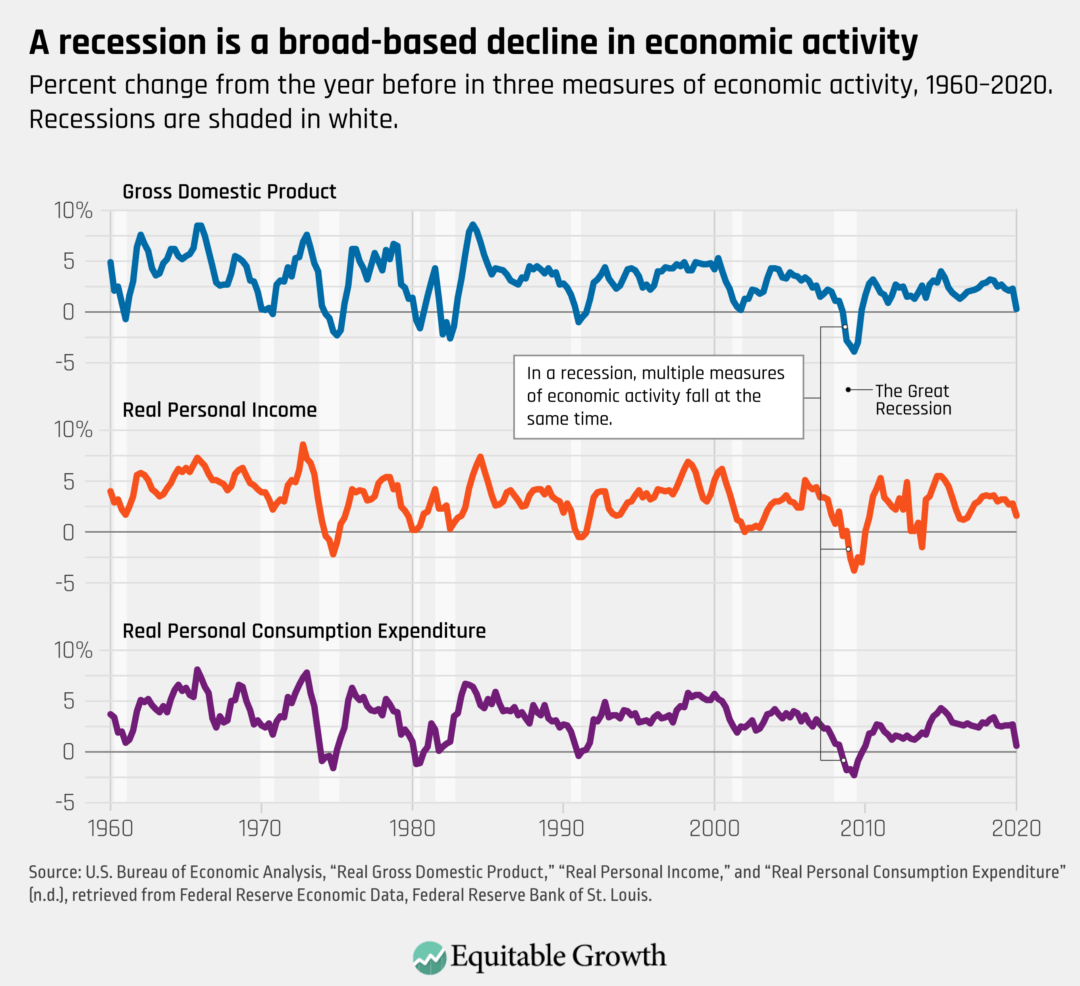

A recession is a broad-based decline in economic activity across the country. This general definition leaves substantial room for interpretation, however, and there is no hard rule for how big the drop in activity needs to be or how many different measures of economic activity need to fall. In identifying recessions, economists look for decreases in measures of activity such as production, personal income, employment, consumer spending, and retail sales, as well as increases in measures such as the unemployment rate. (See Figure 1.)

Figure 1

These measures of economic activity are better understood as different ways of looking at the same economy rather than entirely distinct measures of different things. If workers are laid off during a recession, they appear as unemployed workers when computing the unemployment rate and as a reduction in employment when computing total employment. The output they no longer produce appears as a reduction in output, and the income they no longer earn appears as a decline in personal income. The change in each statistic will differ based on exactly what it measures, but the decline in each statistic is a manifestation of the same underlying job losses.

The formal definition of a recession is the period when economic activity is decreasing. An expansion, or recovery, is when economic activity is increasing. This formal definition of a recession, however, does not capture the full extent of the economic suffering, which is generally a result of the depressed level of economic activity, not the rate of change.

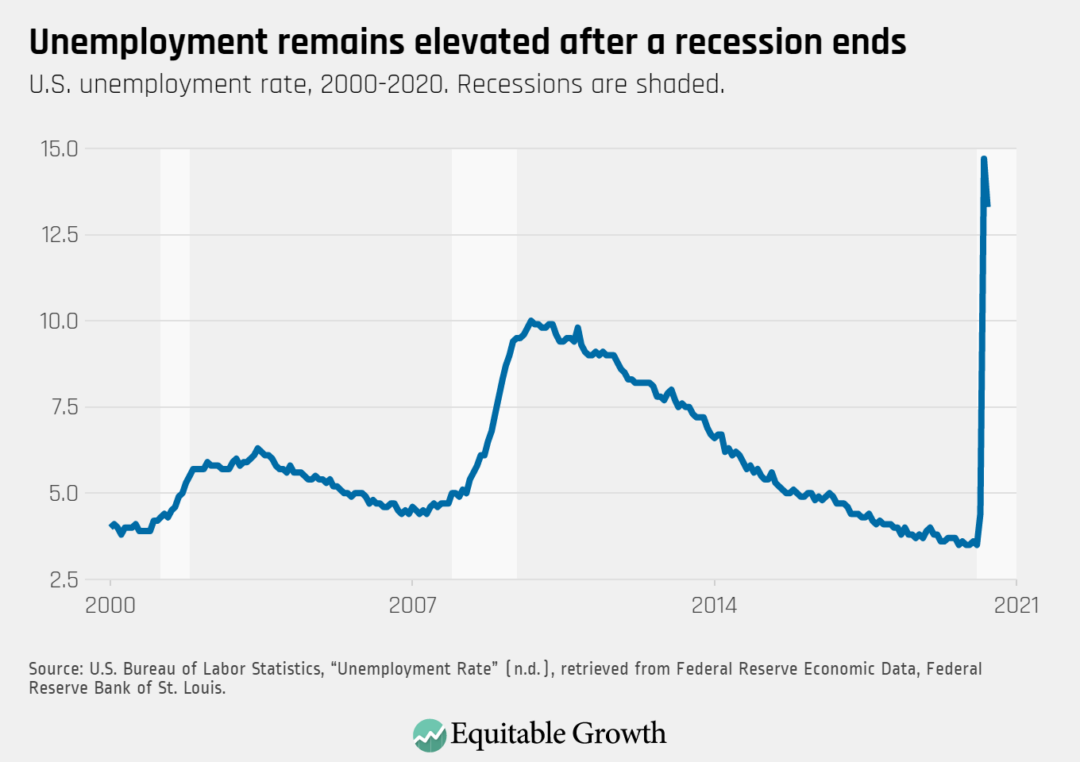

Unemployment, for example, typically remains elevated long after a recession ends. The Great Recession ended in June 2009, according to the formal definition, but unemployment peaked in October 2009 and remained higher in 2012 than it was during most of the recession. (See Figure 2.)

Figure 2

The persistence of suffering after a recession ends according to the formal definition is essential for understanding the current recession. The National Bureau of Economic Research recently announced its determination that the recession began in February 2020. The unemployment rate spiked between February and April, increasing from 3.5 percent to 14.7 percent, before falling to 13.3 percent in May. It’s possible—though certainly not guaranteed—that the decline in activity was concentrated in those 2 months. The formal recession might be both extremely short and extremely sharp.

Yet even if this turns out to be true, it will certainly be the case that the suffering will persist long after the formal recession ends. Moreover, there are important risks that this will not be the case, including if Congress allows critical relief enacted in March and April to expire over the next several months or if public health measures are unable to control the spread of COVID-19.

For this reason, the term recession is often also used to refer to the longer period of depressed activity that persists after the formal recession ends, even though the official definition of a recession is limited to the period of declining economic activity.

Defining recessions in terms of aggregate economic indicators also obscures disparate experiences for different populations. As noted above, the unemployment rate peaked in October 2009 following the end of the Great Recession several months earlier. This peak in overall unemployment coincided with the peak for White workers, but the peak for Black workers was not reached until March 2010, 6 months later. Similarly, the peak for men occurred in October 2009, but the peak for women was not reached until November 2010.

The economic pain from recessions compounds longstanding racial inequalities. Unemployment rates for Black and Latinx workers are persistently higher than unemployment rates for White workers.2 During recessions, the increases in the unemployment rate are consistently larger for Black and Latinx workers than they are for White workers. Moreover, wealth is a critical source of support for workers who lose their jobs during a recession, but Black and Latinx households have less wealth than White households.

Finally, economic activity is not an end in itself. What really matters about economic activity is the role it plays in determining families’ living standards. Put differently, the economic harm caused by a recession is not the decline in Gross Domestic Product or any of the other measures used to identify a recession. The harm is the decline in families’ living standards.

This distinction is of relatively little importance when thinking about the harm resulting from a recession absent policy action as a recession causes simultaneous declines in economic activity and living standards. But it is critical for understanding the policy response. Public policies can have different impacts on living standards and economic activity. Restrictions on business activities, for example, may reduce economic activity even as they increase living standards by reducing the spread of disease. The appropriate focus of public policy is living standards, not economic activity per se.

What is the role of public policy during a recession?

During a recession, it becomes harder for people to find (and hold onto) jobs and business opportunities. The policy response can provide direct relief, moderate the decline in economic activity, and accelerate the recovery. Policies are typically categorized as either fiscal policies or monetary policies. The fiscal policy response consists of changes in taxation and spending. The monetary policy response consists of actions taken by the Federal Reserve through and in financial markets, such as influencing interest rates and lending.

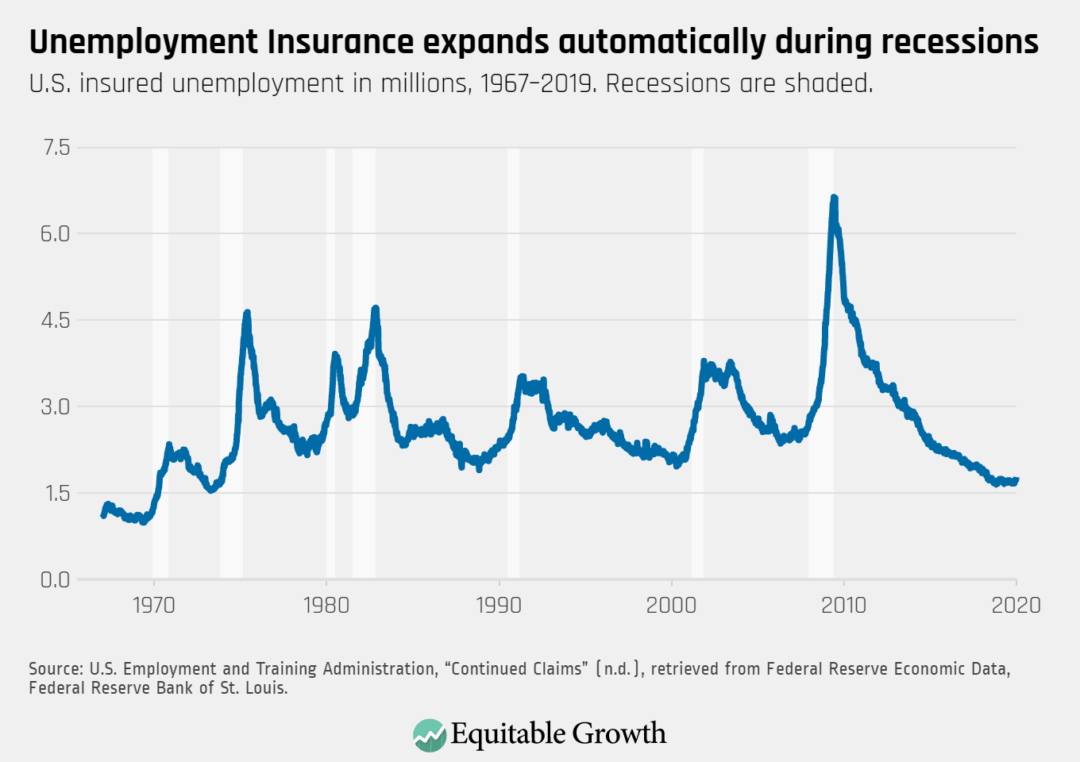

On the fiscal side, public programs provide critical relief to people hurt by a recession and shorten the recession itself. Programs that automatically scale up during recessions and scale down during expansions are known as automatic stabilizers, and many of the United States’ most well-known social insurance and safety net programs function as automatic stabilizers.

Unemployment Insurance provides cash to people who lose their jobs through no fault of their own, helping them maintain their standard of living. Even in relatively good times, some workers lose their jobs, and Unemployment Insurance serves this role. In bad times, Unemployment Insurance continues to serve this role while also short-circuiting the process by which cutbacks in spending by the newly unemployed spill over into reduced spending in other sectors, in turn causing even more job losses. Unemployment Insurance automatically scales up during recessions and down during expansions. (See Figure 3.)

Figure 3

Unemployment Insurance is perhaps the most prominent automatic stabilizer, but it is far from the only one. Medicaid provides health insurance to low-income families, automatically expanding during recessions, when incomes fall and more families become eligible. The Supplemental Nutrition Assistance Program provides assistance to low-income families in purchasing food and, like Medicaid, expands during recessions when incomes fall.

In addition to automatic stabilizers, Congress often responds to recessions by enacting additional policies specific to the recession. These new policies are known as discretionary fiscal policies, because they are enacted at the discretion of Congress. The American Recovery and Reinvestment Act of 2009 is an example of discretionary policy. The Recovery Act enhanced Unemployment Insurance, cut taxes, and provided financial support to state and local governments, including increased Medicaid payments, among other policies.

In addition to the fiscal policy response, the Federal Reserve responds to recessions using monetary and financial policy tools, which make it easier for people and businesses to borrow money. The logic is that this response will both prevent people and businesses unable to borrow funds from going bankrupt and encourage people and businesses to take on loans to support their purchases and investments, which will ramp demand back up to reverse the economic contraction.

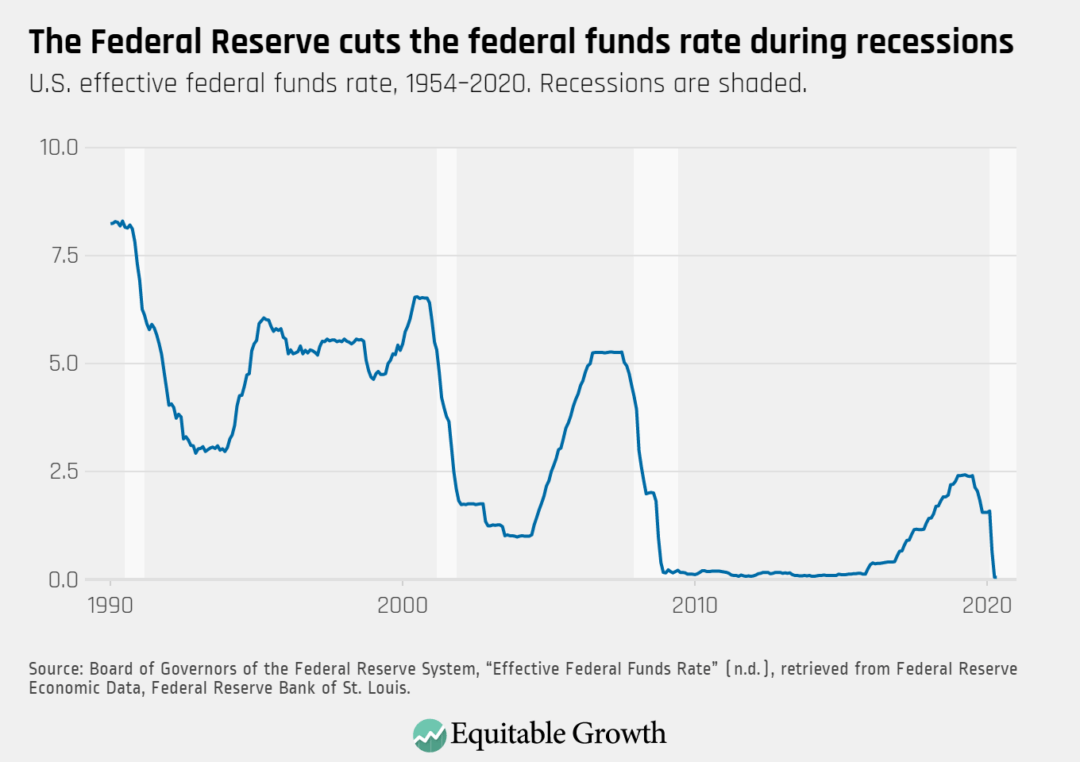

The traditional monetary policy tool is control of the federal funds rate, which is the interest rate at which banks lend money to each other overnight. In recent decades, the Federal Reserve has reduced the federal funds rate during recessions and increased it during expansions. (See Figure 4.) These changes in the federal funds rate make borrowing cheaper during recessions and more expensive during expansions.

Figure 4

In both the Great Recession and the current recession, control of the federal funds rate has been insufficient to fully address the recession. During and after the Great Recession, the Federal Reserve set the rate to nearly zero for 7 years. In part for this reason, the Federal Reserve has increasingly relied on other tools, such as lending programs and asset purchases, to stabilize the economy as well. These programs aim to ensure that the deterioration of financial market conditions does not create additional stresses for public- and private-sector employers, further exacerbating the recession.

How is this recession different?

The coronavirus recession shares many similarities with previous recessions but is also different in some key ways. First, this recession occurred with unprecedented speed due to the sudden emergence and spread of the novel coronavirus. Second, the virus has made economic activity more dangerous. Third, because the recession was caused by a virus, the decline in economic activity has occurred alongside an increase in morbidity and mortality.

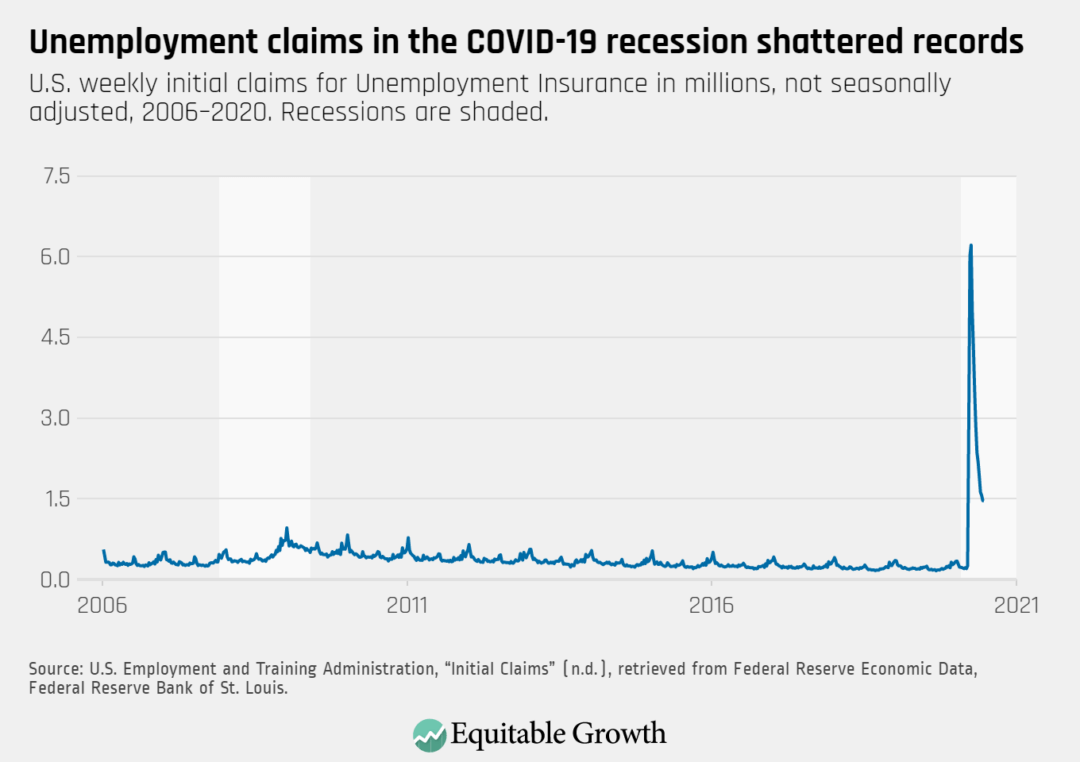

The onset of the coronavirus recession was sudden. In February 2020, U.S. unemployment was 3.5 percent. Employment stood at 152 million. In the week ending March 14, 250,000 people filed for Unemployment Insurance. Then, the recession began. The following week, 2.9 million people filed for Unemployment Insurance—by far the highest number on record and three times higher than the highest week during the Great Recession. The following week, 6 million people filed for Unemployment Insurance. And the filings have continued at a historic pace since then, with more than 40 million applications since mid-March. (See Figure 5.)

Figure 5

The rapidity of the coronavirus recession stands in sharp contrast to recessions more generally. Typically, unemployment is a lagging indicator; that is, it rises as firms lay workers off over time. For example, in December 2007, the month the Great Recession began, the unemployment rate was 5 percent. As the consequences of the financial crisis spread through the economy, it took 8 months for the unemployment rate to rise by 1 percentage point and another 4 months to rise by a second percentage point. In contrast, the unemployment rate rose 11 percentage points in 2 months in the coronavirus recession.

The speed with which the current recession began also is apparent in data on consumer spending and employment. Spending on travel, shopping, and entertainment plummeted in a matter of weeks. Overall, consumer spending fell by 19.6 percent between February 2020 and April 2020. Employment, particularly in jobs that involve close physical proximity, likewise fell sharply. About half of the jobs in leisure and hospitality were lost in March and April.

This brings us to the second distinguishing feature of this recession: The coronavirus has made economic activity more dangerous. In any other recession, being lucky enough to keep your job is almost certainly a good thing, but in the current recession, it’s more complicated. Being lucky enough to keep your job means you are much more likely to have maintained your income, but if you cannot perform your job remotely, it is also a risk factor for exposure to the coronavirus.

Existing patterns of occupational segregation in the United States play a critical role in determining who is hurt—and in what ways—by this unique feature of the coronavirus recession. Unemployment for Latinx workers, who are overrepresented in leisure and hospitality, has spiked more than for Black and White workers. Unemployment for Black workers, who had the highest pre-recession unemployment rate but are overrepresented in essential jobs, has increased dramatically but by a smaller amount.

The increased danger of economic activity changes the goals for the policy response. A typical recession does not change the cost-benefit analysis of working. In the coronavirus recession, the relative costs and benefits of work have changed for many jobs. This unique characteristic of the coronavirus recession required policymakers to act in unusual ways. Across the country, states and cities prohibit many types of economic activity to stop the spread of the coronavirus, shutting down businesses and asking—in some cases requiring—people to maintain greater physical distance from each other.

In principle, these shutdown orders could have induced the recession. Yet state closures appear to be responsible for only a modest portion of the decline in economic activity. Economic activity began to fall in early-closing states before closures began—and this gap is even more pronounced in late-closing states. In other words, people and organizations began to respond to the risks associated with the coronavirus before state orders took effect. In addition, a similar decline in economic activity is observed in states that did not issue formal stay-at-home orders. For the same reason, even as state orders have been relaxed, economic activity has remained substantially depressed.

Because the coronavirus makes economic activity more dangerous, a core focus of the policy response in this recession should be making jobs and other activities of economic life safer. Needless to say, in a typical recession, this is not a concern in the same way. By reconfiguring our economic life to improve safety, we lay the groundwork for the future economic expansion. The longer we delay addressing this task and the less we focus on it, the more severe the consequences of the coronavirus pandemic will be.

The third and final distinguishing feature of the coronavirus recession is the accompanying increase in mortality and morbidity attributable to the virus that caused the recession. More than 115,000 people have died from COVID-19 and more than 2 million people have been confirmed infected in the United States. Moreover, there remains much we don’t know about the virus and the disease it causes, including how long the effects of COVID-19 will persist in those who recover, and how severe they will be afterward.

Existing inequalities continue to shape the health consequences of the coronavirus and COVID-19. Severe outbreaks occurred and continue to occur in prisons, nursing homes and other care facilities, and at worksites such as meat-packing plants. Mortality rates for Black people and for Latinx people far exceed those for White people, especially at younger ages. These differences likely reflect, in part, the fact that many of the jobs that rely on close physical proximity and have been deemed essential are held by Black and Latinx workers, as noted above.

How have policymakers responded to the COVID-19 recession?

Because the COVID-19 recession is caused by the emergence of a new virus, the most important response to the crisis is the public health response. But the Trump administration’s response has been ineffective and poorly managed. The United States lagged on testing throughout early 2020, which contributed to the undetected spread of the novel coronavirus.

The administration also failed to facilitate a coordinated response to the crisis in terms of managing supply chains, organizing or directing production of needed supplies, or providing clear guidance to people and businesses on appropriate health and safety measures. Numerous journalists have provided detailed accounts of this ineffective executive branch response. This failure exacerbated the spread of the virus, and deepened the recession and will undermine the recovery.

For its part, Congress enacted four major bills in response to the COVID-19 crisis that President Donald Trump signed into law. First came the Coronavirus Preparedness and Response Supplemental Appropriations Act, on March 6; then, the Families First Coronavirus Response Act on March 18; then, the Coronavirus Aid, Relief, and Economic Security, or CARES, Act on March 27; and then, the Paycheck Protection Program and Health Care Enhancement Act on April 24.

The Coronavirus Preparedness and Response Supplemental Appropriations Act provided emergency appropriations to federal agencies to respond to the crisis and made changes to Medicare rules for telehealth services. The price tag was only $8 billion—by far the smallest response legislation.

The Families First Coronavirus Response Act provided a more substantial response. The legislation required public and private insurers to provide free coronavirus testing, provided increased Medicaid funding to states, created a paid leave program for employers with more than 50 and fewer than 500 employees, provided additional funding to pay for SNAP benefits, provided administrative funding for Unemployment Insurance programs, and provided supplemental appropriations for a variety of purposes. The estimated cost was $192 billion.

The major federal legislative response came with the CARES Act. It had a price tag of $1.7 trillion. (The legislation is estimated to increase the federal deficit by $1.7 trillion; it is sometimes described as a $2.2 trillion package because that is the gross amount of spending, tax cuts, and loan guarantees.) This legislation offered direct payments to most families, sharply but temporarily increased Unemployment Insurance benefits and expanded eligibility for the program, created multiple business loan programs, and cut and deferred a range of business taxes, among other provisions.

Finally, about a month later, the Paycheck Protection Program and Health Care Enhancement Act provided additional funding for the Paycheck Protection Program (one of the small business loan programs created by the CARES Act), additional funding for healthcare providers, and made additional appropriations.

The Federal Reserve also took unprecedented actions to address the economic fallout due to the coronavirus pandemic. The Fed cut the federal funds target rate by 1.5 percentage points in two steps in March. It also announced an open-ended commitment to purchase Treasury debt, government-guaranteed mortgage-backed securities, and commercial mortgage-backed securities. It also created and expanded several programs that lend to financial-sector institutions in an effort to ensure the smooth functioning of financial markets.

In addition, the Fed created new programs that lend directly to businesses, relying in part on funds appropriated by Congress in the CARES Act for this purpose, and started lending directly to state and local governments. Finally, the Fed is lending dollars to foreign central banks.

Why should Congress expand automatic stabilizers?

Nobody knows for sure how long the coronavirus recession will last or exactly how severe it will be. The uncertainty that would exist when confronting any recession is compounded by the uncertainty about the nature and consequences of the coronavirus itself, including the number of people who will die from COVID-19 now and in the future, the short- and long-term health impacts of the virus on those who recover, the pace at which treatments and vaccines will be developed, and the quality of the public health response.

As with any fiscal policy response, automatic stabilizers support household incomes and spending during recessions. Crucially, however, automatic stabilizers continue as long as they are needed without requiring further legislative action. If the recession is deeper and longer, then the response grows. If the recovery is quicker, then the response shrinks.

The coronavirus recession is the most severe economic downturn since the Great Depression. Yet key provisions of the congressional response to the pandemic are either scheduled to expire or were made available only in a fixed amount. The $600 increase in weekly Unemployment Insurance benefits expires at the end of July, for example, and state and local governments are facing a looming budget crisis but have received only a modest amount of aid.

Congress should set up a permanent set of automatic stabilizers that continue aid for as long as economic conditions warrant. In Recession Ready, Equitable Growth and the Hamilton Project published six proposals for expanding and reforming automatic stabilizers, including proposals for direct payments, countercyclical Medicaid funding for states, changes in Unemployment Insurance, and changes to the Supplemental Nutrition Assistance Program. These proposals should guide the legislative response going forward.

Conclusion

The United States is currently experiencing a severe recession attributable to the emergence of a new virus. Unemployment jumped at a record-breaking pace, and daily life swiftly changed in radical ways. Policymakers responded quickly but insufficiently. Their response headed off the worst of the recession to this point, but Congress should move immediately to extend necessary relief and make it automatic by tying it directly to economic conditions.

End Notes

1. As described in an FAQ from the Bureau of Labor Statistics, many workers who should have been classified as unemployed on temporary layoffs were instead classified as employed but not at work due to issues in data collection. The 3 percentage point adjustment cited in the text is an estimate from the Bureau of Labor Statistics of the impact of this problem.

2. For a discussion of pre-COVID trends in the Black-White unemployment gap, see Olugbenga Ajilore, “On the Persistence of the Black-White Unemployment Gap” (Washington: Center for American Progress, 2020).