Overview

The decline in antitrust enforcement in the United States has been a project of conservatives for decades. Since the 1970s, the range of conduct that would be condemned by courts as anticompetitive has decreased significantly,1 and the evidence required to prove any particular anticompetitive harm has increased appreciably, resulting in much more freedom for business to seek profit through anticompetitive means. The conservative goal of freeing business from the constraints of antitrust law was, in theory, to obtain productivity growth that would benefit consumers through lower costs and new products. That motive—even if it characterized some of these adherents of the so-called Chicago School—has been joined, or perhaps overtaken, by support from some companies and some think tanks that want to see companies earn higher profits unconstrained by the antitrust laws. Without regard for good research or scientific evidence—as the literature review below shows—today, many continue to claim a benefit for consumers from a limited enforcement agenda.

Download FileEG Antitrust Lit Review, Database

The experiment of enforcing the antitrust laws a little bit less each year has run for 40 years, and scholars are now in a position to assess the evidence. The accompanying interactive database of research papers (see below) for the first time assembles in one place the most recent economic literature bearing on antitrust enforcement in the United States. The review is restricted to work published since the year 2000 in order to limit its size and emphasize work using the most recent data-driven empirical techniques. The papers in the interactive database are organized by enforcement topic, with each of these topics addressed in a short overview of what the literature demonstrates over the past 19 years. These topics are:

- Horizontal mergers—mergers and acquisitions involving direct competitors

- Coordinated effects—the study of conditions under which competitors in an industry tacitly collude

- Vertical mergers—mergers and acquisitions where a company acquires another company to which it sells goods or services or from which it buys goods or services

- Exclusionary conduct—actions in the marketplace that deny a competitor access to either suppliers or customers

- Loyalty rebates—a type of conduct that occurs when a company gives a discount to a buyer for limiting its purchases from the company’s competitors

- Most Favored Nation clause—this clause requires a seller to give a specific buyer the best terms offered to other (often competing) buyers

- Predation—the strategy of taking losses in the short run in order to drive out a competitor and retain or gain a monopoly position, permitting prices the later exercise of market power

- Common ownership—the impact on competition when mutual funds and other types of institutional investors are the largest owners of product market competitors

- Monopsony power—the anticompetitive exercise of market power by employers (firms) in the labor market for workers

- Macroeconomics and market power—the impact of competition issues on the larger economy

The bulk of the research featured in our interactive database on these key topics in competition enforcement in the United States finds evidence of significant problems of underenforcement of antitrust law. The research that addresses economic theory qualifies or rejects assumptions long made by U.S. courts that have limited the scope of antitrust law. And the empirical work finds evidence of the exercise of undue market power in many dimensions, among them price, quality, innovation, and marketplace exclusion. Overall, the picture is one of a divergence between judicial opinions on the one hand, and the rigorous use of modern economics to advance consumer welfare on the other.

One of the most influential principles of the Chicago School is concern that overenforcement would be worse than underenforcement. Overenforcement occurs when antitrust rules and enforcement are too strict and condemn procompetitive conduct; underenforcement occurs when the antitrust rules and enforcement are too lenient and allow anticompetitive conduct to occur. According to Chicago School proponents, the harms from condemning procompetitive conduct are likely to be larger and harder to fix than harms from underenforcement, primarily because their theories hold that the market will promptly correct the latter.2 Professor Jonathan Baker provides an overarching framework that questions this judgment. And the most recent research on competitiveness in the U.S. economy identifies areas where the dangers of underenforcement are real and substantial and where evidence indicates that self-correction has not occurred—and where theory often indicates we should not expect it would.

This summary also responds directly to the call from current enforcers for new cases. In 2018, Bruce Hoffman, director of the Federal Trade Commission’s Bureau of Competition, announced at the American Bar Association Antitrust Section’s Spring Meeting, “We’re open for business, and we’re looking for cases. My phone number is pretty easy to find.”3 Similarly, the assistant attorney general in charge of antitrust enforcement at the U.S. Department of Justice, Makan Delrahim, also calls for an “evidence-based approach” that is “built on credible evidence that a practice harms competition.”4 As FTC Chairman Joseph Simons recently explained, “We ought to pursue those policy and enforcement goals that are supported by economic evidence, including especially empirical economic evidence.”5

This collection attempts to assemble the relevant literature so that the two agencies can bring meritorious cases backed by rigorous economics. By creating this review in an academic context duplication across agencies is eliminated, the coverage is comprehensive, and the results can be released publicly. Such a public database makes it both clear and common knowledge how much evidence there is on each side of important antitrust contentions.

An important point to emphasize is just how useful competition enforcement is to those interested in broader public policy issues. Many are concerned about widening income and wealth inequality in the United States and the political instability it is bringing about. Improving competition is one policy that should appeal across the ideological spectrum. While there are many possible policies that redistribute resources from rich to poor, many of these are taxes of some form that come with shadow costs, such as a disincentive to work or invest, that must be weighed against the benefits (the public goods) of redistribution. By contrast, more competition in the markets where consumers shop redistributes from corporate profits—primarily earned by the richest 10 percent through their equity holdings—to the bottom 90 percent through the lower prices they pay for goods and services. But this change has positive effects on both social welfare and marketplace incentives. Moving a market from monopoly to competitive outcomes increases consumer surplus, increases quantity consumed, reduces deadweight loss, and allocates resources across the U.S. economy more efficiently.

Firms facing more competition have incentives to innovate more vigorously. Thus, competition policy brings its traditional benefits of price, quality, and innovation to consumers and has the side effect of decreasing economic inequality. In addition, the ability of businesses to enter markets without needing to overcome barriers put up by entrenched, incumbent firms, and the ability of consumers to choose among products offered by multiple competitors increases economic freedom. Antitrust enforcement is thus one of the best choices policymakers have for increasing productivity, real income, and equality.

The state of antitrust enforcement in the United States today

The effectiveness of the U.S. antitrust laws in protecting competition depends on the three key factors. The first is jurisprudential doctrines that courts develop. The second is the prosecutorial discretion that enforcers—the Antitrust Division of the Department of Justice, the Federal Trade Commission, and state attorneys general—employ. And the third is the fiscal resources provided to the enforcers. It can be difficult to disentangle the role of these factors.

The federal government, for example, may bring fewer antitrust cases because it has changed its enforcement philosophy. Or a judicial decision may limit the reach of the antitrust laws by limiting the government’s ability to challenge certain types of cases. Similarly, a change in enforcement discretion or the courts broadening the scope of the antitrust law could lead to increased enforcement. Indirectly, judicial or evidentiary rules that increase the cost of successfully pursuing cases can reduce the number of antitrust cases (and the reverse could increase it). Increasing or decreasing appropriations for the antitrust enforcement agencies also can affect both the degree of antitrust enforcement and its impact.

Of course, the issue is not whether there are more or fewer enforcement actions or whether antitrust doctrine has become more or less strict. Rather, the question is whether the antitrust laws as interpreted, and the cases being brought, are protecting competition. Nonetheless, antitrust enforcement looks dramatically different today compared to the period prior to the late 1970s.

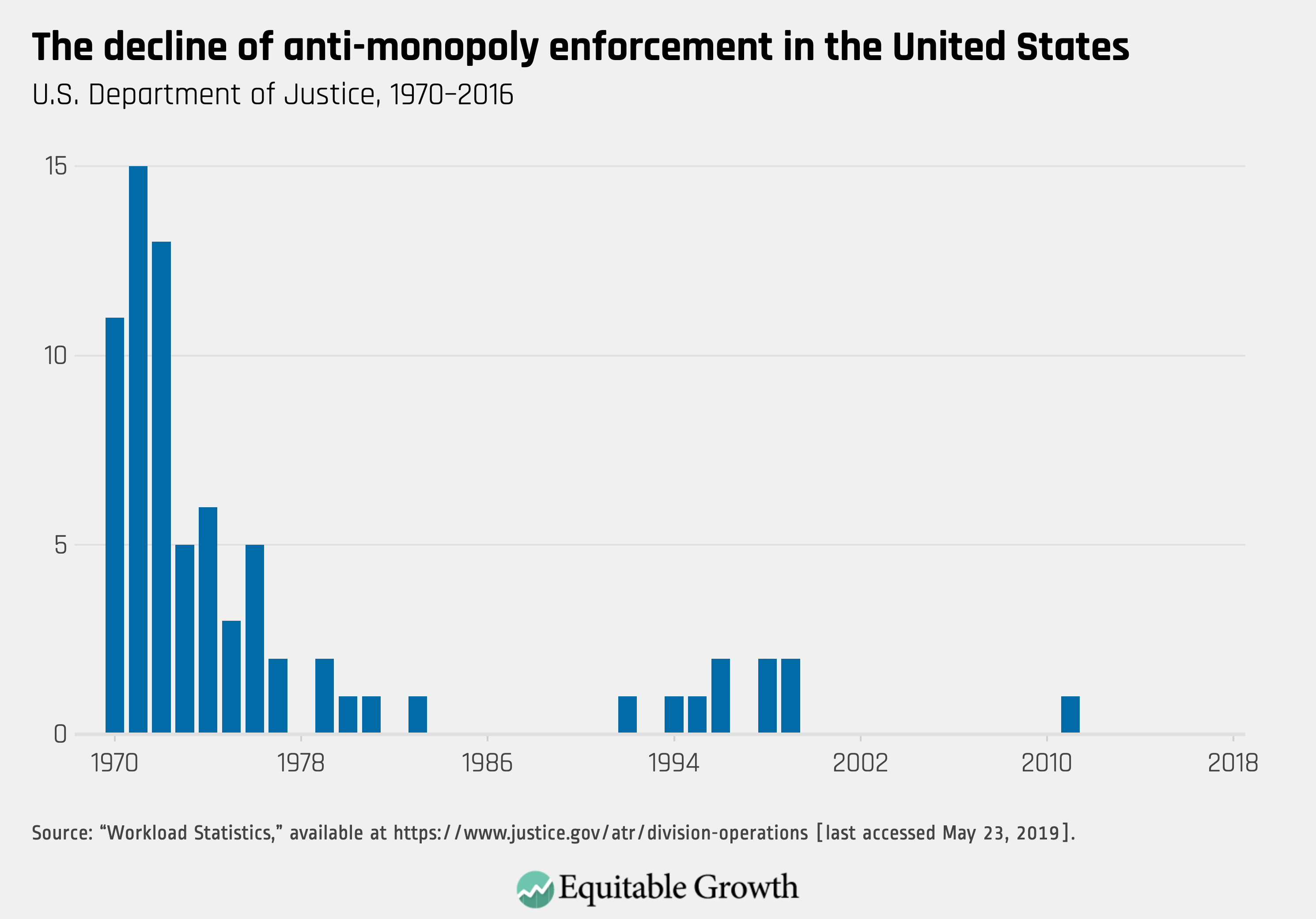

Narrowing legal doctrines have limited the scope of the antitrust laws. One does not have to believe the antitrust enforcement of the 1960s and 1970s was optimal to be concerned about the state of antitrust law today. According to its workload reports, the Antitrust Division has, for all practical purposes, stopped bringing standalone Section 2 cases—Section 2 being the section in the landmark Sherman Antitrust Act of 1890, the first federal anti-monopoly law—pursuing only one monopolization case in this century.6 (See Figure 1.)

Figure 1

Source: Department of Justice, Workload Statistics, https://www.justice.gov/atr/division-operations

The data above are only standalone Section 2 cases, which understates the division’s enforcement against exclusionary conduct, or actions in the marketplace that deny a competitor access to either suppliers or customers. Conduct that violates Section 2 of the Sherman Antitrust Act may also violate Section 1, which bars agreements in restraint of trade. For instance, exclusive contracts signed by a monopolist and another party that harm competition could be illegal under both sections. If Section 1 is the dominant theory, the division only reports it as a Section 1 case.

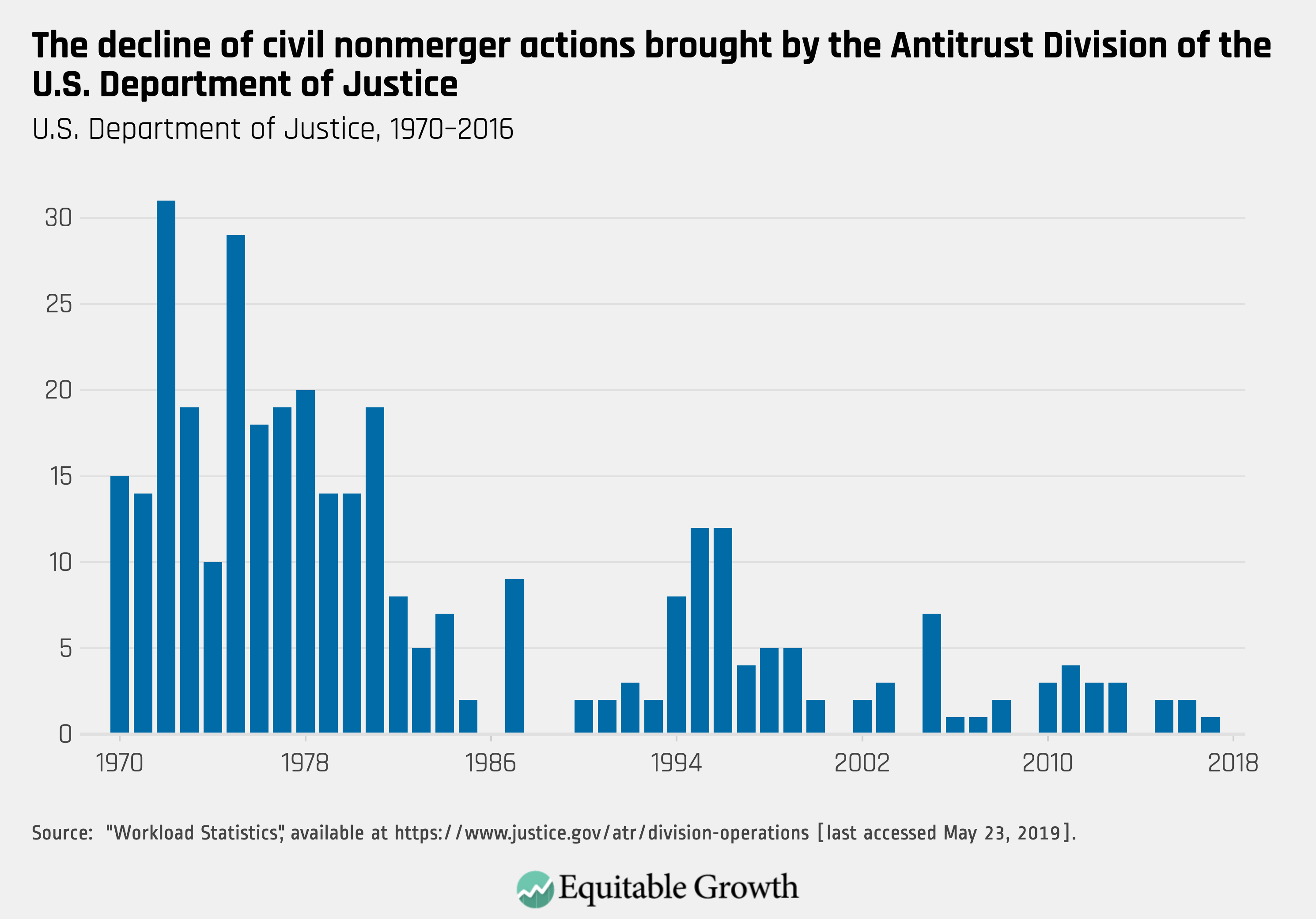

Alternatively, based on the legal standards or evidence, the division might not pursue a monopolization claim and rely solely on Section 1. In the American Express case, for example, the Antitrust Division alleged that the company’s contractual restraints with merchants prevented price competition. This is arguably an exclusion case; however, the complaint alleges only a violation of Section 1. Nevertheless, Section 1 cases, which include far more than exclusionary conduct, brought by the Antitrust Division are falling in number as well, if not as dramatically.7 (See Figure 2.) 8

Figure 2

Source: Department of Justice Workload Statistics, https://www.justice.gov/atr/division-operations

Since 2000, the Antitrust Division has brought five or more cases only once. In comparison, the division brought five or more cases in six of the 10 years comprising the 1990s.9

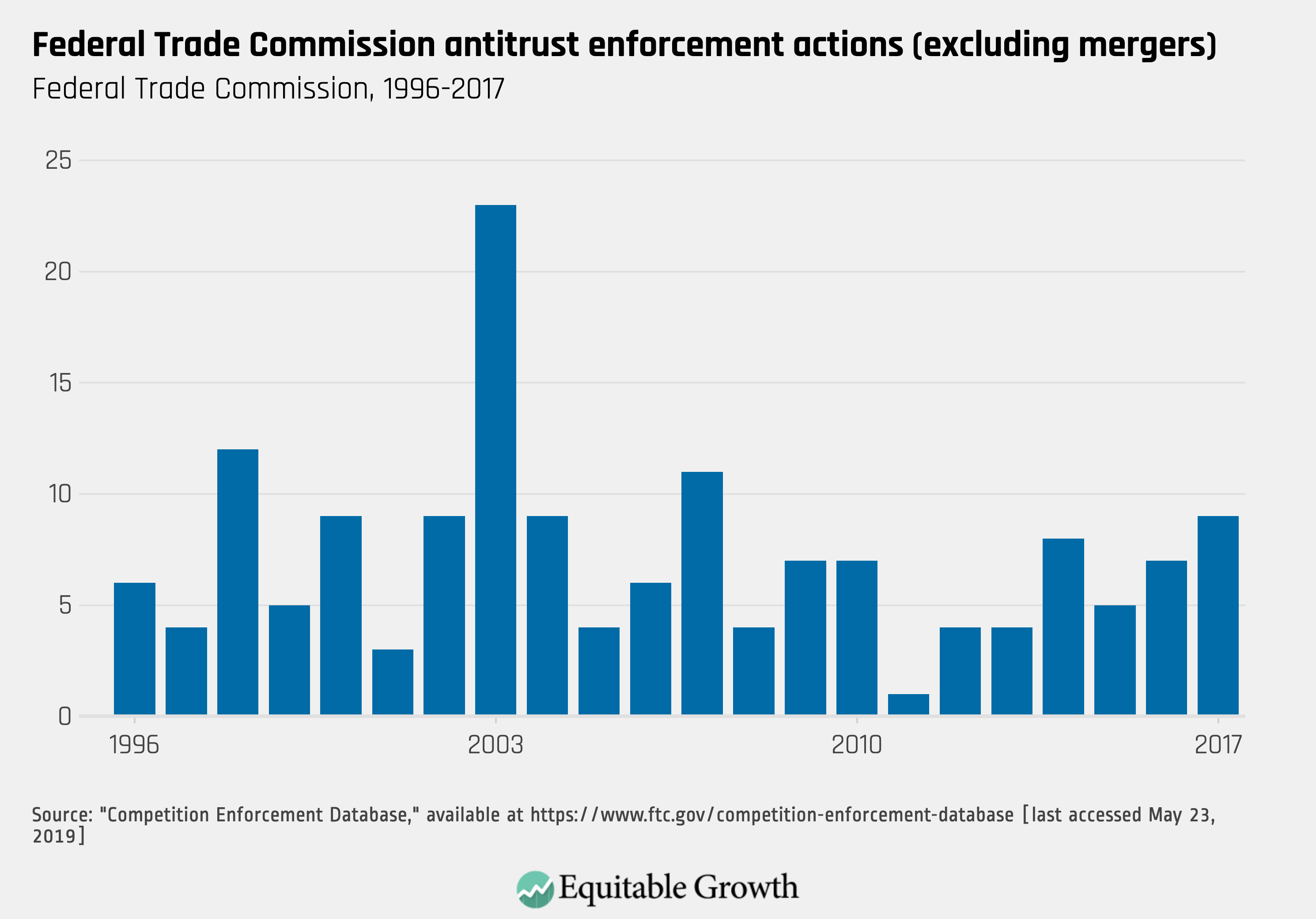

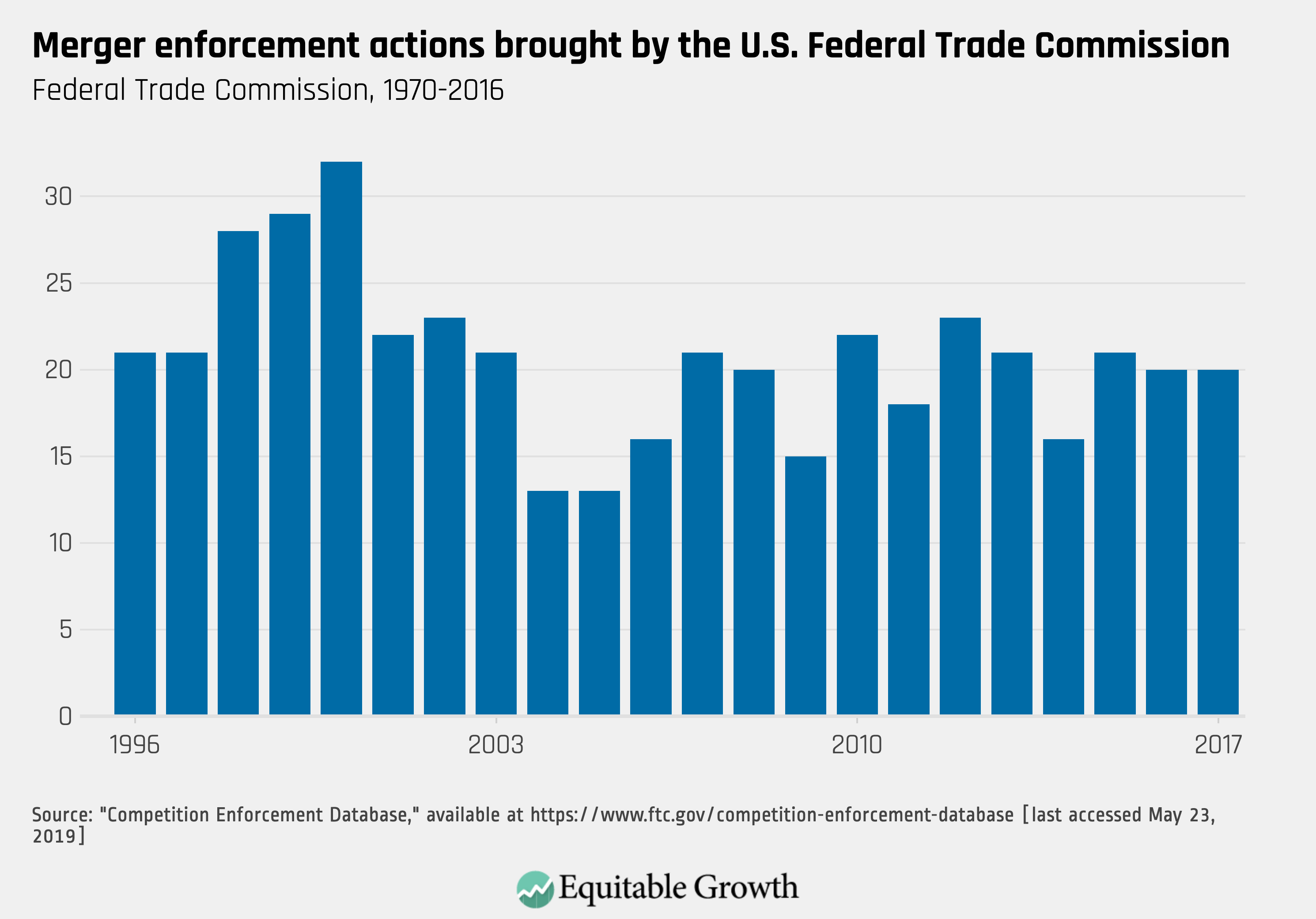

The FTC reports enforcement activity only since 1996, and it distinguishes only between merger and nonmerger cases. For that time period, there is not an obvious change in the FTC’s nonmerger enforcement. (See Figure 3.)

Figure 3

Source: “Competition Enforcement Database,” available at https://www.ftc.gov/competition-enforcement-database (last accessed May 23, 2019)

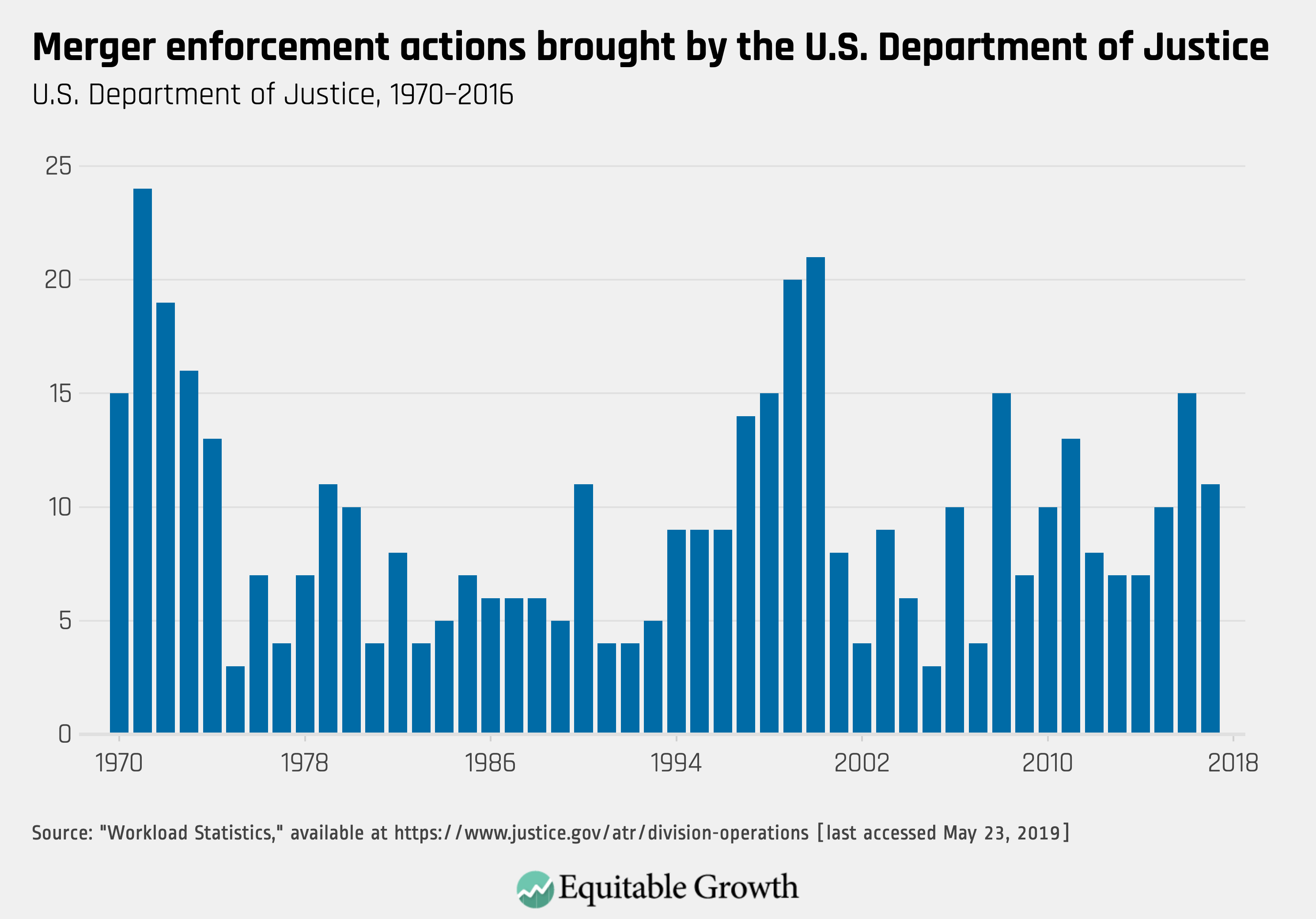

As to mergers, we do not see a trend in overall enforcement at the two antitrust enforcement agencies, despite a significant increase in economic activity over this time period.10 (See Figures 4 and 5.)

Figure 4

Source: Department of Justice Workload Statistics, https://www.justice.gov/atr/division-operations

Figure 5

Source: “Competition Enforcement Database,” available at https://www.ftc.gov/competition-enforcement-database (last accessed May 23, 2019)

A recent article by John Kwoka, the Neal F. Finnegan Distinguished Professor of economics at Northeastern University, shows that the agency challenges a narrower range of mergers than it did 20 years ago.11 Based on periodic reports issued by the FTC, Kwoka finds that in 2008–2011, the most recent year for which the data are available, the FTC challenged nearly all mergers that would result in three or fewer significant competitors, most (just less than 75 percent) that would result in four significant competitors, and none that would leave five or more competitors.

The practice looks strikingly close to conservative Chicago School jurist Robert Bork’s proposal in the 1970s that mergers resulting in four or more competitors should be presumptively lawful. 12 Current economic literature illuminates the lenient standards that have developed in antitrust law in the United States. The pages that follow break out the different types of modern research on competition and antitrust to demonstrate where the evidence stands in mostly stark contrast to conservative assumptions.

Mergers and acquisitions

Horizontal mergers

Horizontal mergers refer to acquisitions involving direct competitors. Horizontal mergers are a large and critical element of antitrust enforcement. The recent literature suggests that merger enforcement has been too lax in the 21st century. A number of empirical papers find that mergers increase prices for consumers and businesses and that mergers can stifle innovation. In just the past 10 years, the economics literature documents a striking amount of research demonstrating that market power is being created and exploited through horizontal mergers.

This literature spans a broad range of economic arenas, from healthcare to retail to intellectual property, among many others. For instance, research by professors Orely C. Ashenfelter at Princeton University, Martin C. Weinberg at The Ohio State University and Deputy Assistant Director Daniel S. Hosken at the Federal Trade Commission concludes that about half of the consummated horizontal mergers they examine lead to economically significant price increases by the newly combined firms. (See the horizontal mergers section of our interactive database for details.)

Table 1: Horizontal Mergers

Interestingly, anticompetitive effects are even prevalent in mergers too small to be reported under the Hart-Scott-Rodino Act, the statute that requires parties to report their merger or acquisition to the government before completing the transaction.

The evidence overall supports the conclusions that interpretations of U.S. antitrust laws have been too lax toward consolidation and that a significant strengthening of horizontal merger enforcement is needed. Antitrust enforcers should be more aggressive in challenging mergers. Courts should give more weight to the specific facts of how market power can be accumulated in any given case. Firms’ claims of efficiencies resulting from mergers and acquisitions should be scrutinized to ensure they are merger-specific and verifiable. And all parties should pay careful attention to the benefits of potential competition and nascent competitors. Finally, premerger notification of smaller mergers would help to prevent anticompetitive acquisitions, particularly in more rural areas where geographic competition is important.

Coordinated effects

Typically, antitrust enforcers look for two potential anticompetitive effects of mergers. As a result of eliminating competition, a merger may make it more likely that the remaining firms harm competition through coordinated interaction. With fewer competitors, firms might be more likely to engage in explicit or tacit collusion.13 In contrast, if a merger allows a firm to harm competition without regard to the market response of its rivals, it is called a unilateral effect.

The bulk of the focus in most cases is on unilateral effects; this was driven by two developments in the economics literature. Economic arguments from the 1950s and 1960s concluded that it was unlikely, even in highly concentrated markets, that firms would coordinate without an explicit agreement. Meanwhile, economists developed new models and empirical techniques to identify mergers that were likely to lead to unilateral effects, thus giving courts a sense of science and precision on that topic.

The structural, or market-share, presumption is the main tool enforcers have to capture the risk of coordinated effects. If a merger increases concentration in a highly concentrated market, the burden is on the parties to provide “evidence clearly showing the merger is not likely to have such anticompetitive effects.”14 Although the two antitrust agencies continue to rely on the structural presumption in bringing and litigating merger challenges, and courts regularly cite it, it has been weakened over the years.15 Courts have lowered the burden on defendants to rebut structural presumption.16 In 2010, the agencies raised the concentration thresholds for triggering the presumption and, incorporating the 1990 decision in United States of America v. Baker Hughes Inc., explicitly adopted a sliding scale for the structural presumption. The stronger the prima facie case, the more evidence defendants need to rebut it.17 Rare is the case where the government does not introduce substantial evidence of the actual likely effects of the transaction to bolster the presumption.

Recent academic literature, however, has establishesd that coordinated interaction is a much more pressing danger than had been thought. The field of applied game theory has advanced greatly over the past 40 years, and the models in that literature can explain a large range of behavior by rational and sophisticated actors. The collusive outcomes that can be sustained without a formal contract and recourse to courts are determined by the patience of the parties, the cost and precision of punishing a rival, and the financial reward from continuing to collude versus defecting from the coordinated efforts among a smaller set of firms, among other factors.

Indeed, recent empirical studies have confirmed the importance of coordinated effects across a number of industries such as airlines, health insurance, and beer. (See the coordinated effects section of our interactive database for details.)

Table 2: Coordinated Effects

This literature provides support for a complete rethinking of the jurisprudence on coordinated effects. Before this literature, the structural presumption stood in as a useful, if not tailored, enforcement guide. But its weakening, by both the courts and the enforcement agencies, and the lack of adoption of modern economics in the area, has left consumers with little protection from coordinated effects. Courts and agencies should update their thinking concerning the risk of coordinated effects. When there is a lack of tools to provide quantification, courts should give the presumption more weight.

Vertical mergers

Vertical mergers refer to an acquisition where a company acquires a company it sells to or buys from, such as AT&T Inc.’s 2019 acquisition of Time Warner Inc., which enabled the owner of distribution, AT&T, to acquire the content of Time Warner. Challenges to vertical mergers have become rare, reflecting the assumption that such mergers can almost never be anticompetitive. The modern literature rejects that assumption, signaling instead that vertical mergers deserve more scrutiny than they currently receive.

For decades prior to the late 1970s, antitrust doctrine took a skeptical view of vertical mergers.18 But beginning in the 1950s, academics, particularly from the University of Chicago, began questioning that view, arguing that vertical integration is always (or almost always) procompetitive.19 The Supreme Court adopted a more permissive attitude toward vertical integration in general.20 And vertical merger challenges became rare.

Although the two antitrust enforcement agencies have periodically settled allegations that a vertical merger is anticompetitive with a consent decree, the Department of Justice’s unsuccessful challenge of AT&T’s acquisition of Time Warner is the first litigated vertical merger in more than 40 years. Reflecting the lack of activity, the Department of Justice’s vertical merger guidelines were last updated in 1984, making them woefully out of date and providing minimal useful guidance to a court.

Recent economic research makes clear that a generalization that vertical mergers are either all harmless (close to the Chicago School view) or all anticompetitive (close to the 1962 Supreme Court decision in Brown Shoe Co. Inc. v. United States) is incorrect. Sophisticated analysis of vertical mergers is a new area of research in economics made possible by advances in modeling and empirical techniques.

The media industry is a popular area of study in this literature due to the availability of data, the variety of possible relationships, and policy interest. An important theme that emerges is that anticompetitive effects from vertical mergers are context-specific, rather like horizontal mergers: Some are benign and others harmful. Theory indicates that “foreclosure” (disfavoring a competing input to advantage the vertically integrated entity) will be profitable under certain circumstances. There are multiple empirical papers that find that result, indicating that it should not be assumed away by courts. (See the vertical mergers section of our interactive database for details.) There also are studies that conclude that foreclosure is not profitable in the case being analyzed, again indicating the need for attention to the facts in any given case.

Table 3: Vertical Mergers

Agencies should therefore examine vertical mergers with the same attention to efficiencies (are they merger specific, verifiable, and do not arise from anticompetitive reduction in output?) and harms to competition (would foreclosure be profitable?), the same scrutiny as is given to horizontal mergers. This literature provides guidance on the types of vertical mergers that are more likely to be problematic.

Exclusionary conduct

Exclusionary conduct can be profitable, thereby creating an incentive for an incumbent firm to use it as a strategy against potential and actual entrants. Chicago School proponents have long argued that firms could only adopt an exclusionary contract if their customers benefited from it and therefore permitted it. Further, this line of thinking assumed that oligopoly or monopoly markets are contestable—meaning that entry is costless and immediate for potential new competitors—and that there is only one so-called monopoly rent, meaning there was no reason for the incumbent firm to engage in an exclusionary strategy because it would either not be successful or not be profitable. Decades of economics literature has refuted the robustness of all of these propositions and much of that work predates the time period covered by this literature review. Academics have studied “pay for delay” extensively. Patent settlements involving a patent-holder with market power and a potential competitor can benefit by eliminating or delaying competition. The conditions for those settlements are prevalent in the pharmaceutical and biologics industries.

The exclusive dealing literature has established that exclusives need not be efficient to be profitable. In one example from our interactive database, economists John Asker at the University of California, Berkeley and Heski Bar-Issac at the University of Toronto’s Rotman School of Management develop a model identifying when a vertical restriction can co-opt a retailer to exclude a seller’s rival and harm competition. (See the exclusionary conduct section of our interactive database for details.)

Table 4: Exclusionary Conduct

Similarly, economists Ilya Segal at Stanford University and Michael Whinston at the Massachusetts Institute of Technology show that an incumbent may be able to exclude rivals profitably by exploiting buyers’ lack of coordination. They find that if a seller can discriminate among buyers, then the seller can exclude rivals in situations in which buyers can coordinate. Moreover, a seller can costlessly exclude rivals if the buyers are so numerous that the impact any one of them has on the presence or absence of the entrant is minor. In that case, the “externalities” make coordination among the buyers impossible.

Some of these strategies have been found to violate U.S. antitrust laws. Other tactics designed to prevent entry or exclude existing entrants have not yet attracted any successful enforcement. Agencies interested in protecting consumers from new violations of antitrust laws, often applied to new products, will need to devote resources to adjusting theories of harm to fit those new products or business models and, in addition, be willing to take the risk of bringing a case that is analogous to previous successful cases, rather than almost identical. Below is a summary of the research focusing on specific categories of conduct that can be exclusionary.

Most Favored Nation clauses

Most Favored Nation, or MFN, clauses also are known as Price Coherence, Price Parity, or Best Price clauses. These refer to agreements that ensure a buyer receives the best (lowest) price offered by the seller to other buyers. On the surface, such clauses may appear procompetitive because they guarantee the lowest price, but they create a horizontal link permitting one buyer to control the input cost to the disadvantage of its rivals. The economics literature long ago established that MFNs can arise “endogenously” (they are adopted by self-interested market participants) and raise prices. New research also demonstrates that MFNs can harm entrants and the entry process itself.

The MFN clause has experienced a resurgence of research interest in light of its use in many internet platforms. The European Commission, for example, opened an investigation into MFNs employed by Amazon.com Inc. that prevented sellers from selling at lower prices on another website, and the company voluntarily dropped the contract provisions in response. Amazon took similar action in the United States after Sen. Richard Blumenthal (D-CT) asked the Federal Trade Commission to investigate the practice.21

In the United States, however, MFN enforcement in the digital platform context is disjointed; it includes the eBooks case involving Apple Inc.—where the court ruled that the MFN was an effective part of the conspiracy to raise the price of eBooks—as well as the American Express case, where the 2018 Supreme Court decision in Ohio v. American Express Co. included the finding that the company’s MFN caused market efficiency because even though low-priced cards were disadvantaged, high-priced credit cards chose to enter.

There has been no case yet concerning online travel platforms in the United States, despite their use being banned in Europe due to enforcement actions. Recent literature establishes that the use of Most Favored Nation clauses, particularly by internet platforms (such as online travel agencies, rebate services, and search services generally), as a matter of theory and empirics, probably increases prices and stifles entry and innovation, particularly when the platform holds a dominant position or the entrant has a lower-cost position. In one of several research papers in the interactive database, economists Andrew Boik and Kenneth Corts at the University of Toronto examine the effects of these platform clauses on competition and entry. (See the Most Favored Nation clause section of our interactive database for details.)

Table 5: Most Favored Nation clauses

Antitrust enforcement actions that use these findings to target anticompetitive platform MFNs have the potential to increase entry and price competition, and thereby enhance productivity and consumer welfare.

Loyalty rebates

There is a growing literature focused on loyalty (or market-share) rebates. A loyalty rebate is a pricing contract that references rivals because when a customer buys a larger share of purchases from the rival, it pays more for its purchases from the dominant firm. For example, a buyer receives a higher rebate for buying 90 percent of its need from a specific company. Theory demonstrates that loyalty rebates can hamper entrants and harm competition. There is a closely related set of literature demonstrating the procompetitive uses of rebates that allow for beneficial price discrimination or analyzing settings where there is no noncontestable share and the new entrants can compete for the whole market. But because these papers analyze different models, they do not refute the basic theory of harm.

For a simple unifying theoretical framework of loyalty rebates, see the paper by Fiona Scott Morton and Zachary Abrahamson. The empirical literature is scarce, but a recent paper by economists Christopher T. Conlon at New York University and Julia Holland Mortimer at Boston College concludes that the loyalty rebates they study cause foreclosure and inefficiency. Recent theoretical work also identifies practical criteria that allow antitrust enforcers to distinguish between procompetitive and anticompetitive uses of these practices. (See the loyalty rebates section of our interactive database for details.)

Table 6: Loyalty Rebates

Because these types of contracts are commonly seen in business, there is a steady flow of antitrust cases brought by private plaintiffs in the United States.22 Yet game theory teaches that a private case of exclusionary conduct will be settled with a payment from the monopolist to the entrant, allowing monopoly profit to be preserved (as we see in the business practice of pay for delay). Such payments do not bring lower prices to consumers or protect future competitors, indicating the need for public enforcement. Agencies could should look for cases consistent with the criteria in the literature that likely lead to anticompetitive effects and use them to set precedent.

Predation

Predation refers to a company taking a loss in the short run (usually by selling below cost) to drive out competition and create a monopoly. Under current antitrust doctrine, a plaintiff must prove that the defendant priced its product below cost and that the defendant reasonably expected to recover those loses once it had eliminated competition (referred to as the recoupment requirement).

The Chicago School has had perhaps its greatest impact in the development of predation law. Its battle cry that “predation is rarely tried and even more rarely successful,” has become nearly an article of faith in antitrust law. In Matsushita Elec. Indus. Co. v. Zenith Radio Corp., the Supreme Court in 1986 adopted an assumption of the Chicago School, that effectively predation could not exist—a position that lacks empirical foundation. In Brooke Group v. Brown & Williamson Tobacco, the Supreme Court in 1993 rejected yet more economic theory by adopting the notion that an oligopoly could not tacitly collude in order to recoup its losses.

Yet just as courts were cementing these assumptions into U.S. jurisprudence, advances in game theory were establishing that the strategy of successful predation was possible in a variety of market structures and settings. Later empirical work confirmed the existence of price wars and exclusion. As the Federal Trade Commission’s Director of the Bureau of Economics Bruce Kobayashi acknowledges, within the past two decades, the relatively settled consensus in which predatory pricing was thought to be irrational has become much less settled. Kobayashi argues that despite the theoretical and empirical work establishing the viability of successful predation strategies, the current lenient legal rule may still be justified due to its administrability.

But in this century, there has been a steady flow of theory and empirical research on predation that demonstrates it is not sufficiently rare or difficult that it should be exempt from enforcement. That is likely the result of the current, or any, cost test for any product with negligible marginal costs such as airline seats or digital goods.

Despite its age and stature, much of the learning from this literature has not been adopted into U.S. jurisprudence. There is no theoretical reason, for example, why recoupment cannot be undertaken by an oligopoly. Further, as professors Hemphill and Weiser explain, whether a predatory price is above or below a entrant’s marginal cost (which, as noted, is often zero in modern markets) will likely have a minimal relationship to the harm to competition. (See the predation section of our interactive database for details.) A firm executing on a logical predatory strategy may not have either finished or earned any net profits before causing harm. Antitrust agencies determined to protect consumers and competition could bring a predation case that emphasized its reliance on correct and modern economics to make this point.

Table 7: Predation

Broader issues in modern U.S. antitrust theory and practice

This section of the paper examines the latest research on more broadly defined areas of antitrust theory and practice: common ownership of companies in concentrated markets, monopsony power exercised in U.S. labor markets, and the impact of competition on the U.S. macroeconomy. The more modern theoretical research and evidence accumulated so far this century also points to labor monopsony being a bigger problem than previously supposed, concerns about common ownership, and the possibility that market power, in general, may be contributing to economic performance overall.

Common ownership

Common ownership has arisen as a competition concern due to the dramatic growth of mutual funds over the past 40 years. Mutual funds and other larger institutional investors now comprise 70 percent of the U.S. stock market and are frequently the largest shareholder in publicly traded firms that compete in the same product markets.23 Think, for example, of The Coca-Cola Co. and PepsiCo Inc., which share three common shareholders among their top five institutional investors.24 The common shareholders in the two companies have much greater incentives to support soft competition (higher prices, less innovation) than separate owners would because the market share gained by one firm is primarily lost by the other, while a common owner wants to maximize joint profits.

The theory of how common ownership may lessen competition is well-established in the existing theory literature. A young and growing empirical literature attempts to quantify the impact of common ownership, which may vary across industries and also by the size and identity of common shareholdings. Hovenkamp and Scott Morton explain how mutual funds’ acquisition of the shares of firms that compete would violate the antitrust laws if the effect of the acquisition were to lessen competition. (See the common ownership section of our interactive database for details.)

Table 8: Common Ownership

This is an area where active enforcement could have a high payoff, given the likely size of any competition problem that were found to exist. In particular, an FTC study on common ownership using its authority under 6(b) of the Federal Trade Commission Act could be very useful to determine the relationships between asset managers, common owners, and top management, and additionally could illuminate the mechanism behind any effects.

Monopsony power in labor markets

Monopsony power in labor markets is a very old topic in the economics literature, but it was not a subject of research in the latter half of the 20th century. More recently, however, a spate of economic research on the topic is carrying the antitrust debate over monopsony power to more prominence, due to well-documented trends such as the decline in the labor share of profits in the U.S. economy and a report on the topic by the White House Council of Economic Advisers in 2016.25

New research demonstrates that monopsony power is far more prevalent than previously believed. Researchers uses techniques such as mergers to create sharp exogenous changes in monopsony power. Economists Elena Prager at Northwest University and Matt Schmitt at the University of California, Los Angeles, for example, find that hospital mergers increased labor market power and suppressed wages for healthcare workers. Similarly, University of Chicago economists Austan Goolsbee and Chad Syverson find monopsony power in markets for tenure-track faculty in higher education, but not among adjunct faculty. (See the monopsony power section of our interactive database for details.)

Table 9: Monopsony Power

A second strand of work estimates how workers respond to higher wages and finds monopsony power (Andrea Weber at Central European University, Michael R. Ransom at the Institute of Labor Economics, and David Card at the University of California, Berkeley). A third category finds evidence of labor monopsony based on wage bunching around round numbers (Arindrajit Dube at the University of Massachusetts Amherst) or the minimum wage (Natalya Shelkova at Guilford College ), which is inconsistent with the heterogeneity that should be observed in competitive markets.

Finally, further evidence of monopsony power in labor markets come from the use of noncompete clauses in employment contracts, which have become pervasive in low-skilled jobs. Princeton University economists Alan Kreuger and Oreley Ashenfelter examine the use of noncompetes that prevent employees of one retail franchise from working for other franchisees. Natararjan Balasubramanian, an economist at Syracuse University, and his co-authors find evidence that noncompete clauses harm workers through lower wages. And business professor Evan Starr at the University of Maryland examines noncompete clauses used by firms within an industry and concludes that their use as a profit-maximizing mechanism is widespread, both in high-skill/high-wage industries, as well as the low-wage/low-skill sector.

Antitrust enforcement is a potential tool to address some of these issues. New York University School of Law’s Scott Hemphill and economist Nancy Rose at the Massachusetts Institute of Technology establish that monopsony power is an anticompetitive effect that the antitrust laws can address. Economists Suresh Naidu at Columbia University, Eric Posner at the University of Chicago, and E. Glen Weyl at Yale University explain the conditions under which a merger, increasing labor market concentration, or an employment noncompete agreement can violate the antitrust laws. And Ioana Marinescu at the University of Pennsylvania School of Public Policy and Practice and Herbert Hovenkamp at the University of Pennsylvania Law School focus on why mergers that increase monopsony power can violate the antitrust laws.

The two federal antitrust agencies should consider monopsony power as a routine part of a merger review and engage in analysis of restrictions on employment mobility or other conditions that affect competition in labor markets.

Macroeconomics and antitrust law and practice

Many papers have assessed the relationship between competition and the broader economy. The earlier literature focused on whether concentration had risen, although it is widely understood that either vigorous competition could cause concentration to increase or increased concentration could reduce competition. Still, a number of papers find evidence of a market power problem in the U.S. economy, including increasing price mark-ups, falling labor and capital shares of national income, and rising corporate profits as a share of national income.

The work of professors Jan De Loecker of KU Leuven and Jan Eeckhout of the University College London is an example of this research. (See the macroeconomics section of our interactive database for details.) Similarly, other research attributes falling business investment, loss of business dynamism (new firm entry and exit), less reference to “competition” in U.S. Securities and Exchange Commission filings, and other trends to growing monopoly power.

Table 9: Macroeconomics

Although there is general agreement that mark-ups have increased, and that the labor share of national income has fallen, there is uncertainty about what share of the blame belongs to antitrust enforcement. Researchers point to other causes of increasing monopoly power, such as increases in fixed costs, globalization, the rise of superstar firms, or the increasing importance of intangible assets such as the value of a brand and intellectual property. These forces may explain the increase in measured mark-ups.

A final set of papers addresses the relationship between changes in antitrust enforcement and concentration and profits. These papers are included in the literature review both to establish the backdrop in which enforcement occurs and to illustrate the consequences of failing to enforce the antitrust laws.

There are many great papers out there, and no doubt we missed some that we should include. This is intended to be a living collection so new research is welcomed. Please email any work that you think should be included to ThurmanArnoldYale@gmail.com or mkades@equitablegrowth.org or both.

About the author

Fiona M. Scott Morton is the Theodore Nierenberg Professor of economics at the Yale University School of Management, where she has been on the faculty since 1999. Her area of academic research is industrial organization, with a focus on empirical studies of competition in areas such as pricing, entry, and product differentiation. The focus of her current research is competition in healthcare markets and antitrust (competition) economics. From 2011 to 2012, Scott Morton served as the deputy assistant attorney general for Economic Analysis (chief economist) at the Antitrust Division of the U.S. Department of Justice, where she helped enforce the nation’s antitrust laws. At Yale, she teaches courses in the area of competitive strategy and antitrust economics and also directs the school’s Healthcare Initiative. She served as associate dean from 2007 to 2010 and won the school’s teaching award in 2007 and 2016. Scott Morton has a Bachelor of Arts degree from Yale and a Ph.D. from the Massachusetts Institute of Technology, both in economics.

End Notes

1. Ohio v. Am. Express Co., 138 S. Ct. 2274 (2018); Bell At. Corp. v. Twombly, 550 U.S. 544 (2007); Verizon Communs., Inc. v. Law Offices of Curtis V. Trinko, 540 U.S. 398 (2004); Brooke Group v. Brown & Williamson Tobacco Cop., 509 U.S. 209 (1993); Howard Shelanski, “The case for Rebalancing Antitrust and Regulation,” Michigan Law Review 109 (2011).

2. Frank H. Easterbrook, “Limits of Antitrust,” Texas Law Review 63 (1) (1984), available at https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?referer=https://www.google.com/&httpsredir=1&article=2152&context=journal_articles.

3. Richard Vanderford, “With pay-for-delay litigation drying up, FTC on hunt for ‘good’ conduct cases,” MLex Market Insights FTC Watch, April 23, 2018, available at https://www.mlexwatch.com/articles/3109/with-pay-for-delay-litigation-drying-up-ftc-on-hunt-for-good-conduct-cases.

4. U.S. Department of Justice Assistant Attorney General Makan Delrahim, “Keynote Address at the University of Chicago’s Antitrust and Competition Conference,” University of Chicago 2018 Antitrust and Competition Conference, April 19, 2018, available at https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-keynote-address-university-chicagos.

5. Federal Trade Commission Chairman Joseph Simons, “Prepared Keynote Address,” American University Washington College of Law Conference on Themes of Professor Jonathan Baker’s New Book, March 8, 2019, available at https://www.ftc.gov/system/files/documents/public_statements/1515179/simons_-_jon_baker_speech_3-8-19.pdf.

6. U.S. Department of Justice, “Workload Statistics: Ten Year Workload Statistics Report” (2019), available at https://www.justice.gov/atr/file/788426/download; “Historic Workload Statistics: FY 2000–2009, FY 1990–1999, FY 1980–1989 and FY 1970–1979”, available at https://www.justice.gov/atr/division-operations (last accessed May 23, 2019)

7. U.S. Department of Justice, “U.S. and State Of Michigan v. Blue Cross Blue Shield Of Michigan” (2013), available at https://www.justice.gov/atr/case/us-and-state-michigan-v-blue-cross-blue-shield-michigan; U.S. Department of Justice, “U.S. And Plaintiff States v. American Express Co., Et Al.” (2016), available at https://www.justice.gov/atr/case/us-and-plaintiff-states-v-american-express-co-et-al.

8. Similarly, a monopolist’s acquisition of a competitor can violate both Section 2 as an act of monopolization and Section 7 of the Clayton Act as an anticompetitive merger. As discussed infra, the Antitrust Division’s merger enforcement does not show an increasing trend as the number of Section 2 cases fall.

9. U.S. Department of Justice, “Workload Statistics: Ten Year Workload Statistics Report” (2019), available at https://www.justice.gov/atr/file/788426/download; “Historic Workload Statistics: FY 2000–2009, FY 1990–1999, FY 1980–1989 and FY 1970–1979”, available at https://www.justice.gov/atr/division-operations (last accessed May 23, 2019). Only DOJ statistics are shown for two reasons. The FTC reports enforcement activity only since 1996, and it distinguishes only between merger and nonmerger cases. For that time period, there is not obvious change in the FTC’s nonmerger enforcement.

10. U.S. Department of Justice, “Historic Workload Statistics: FY 2000–2009, FY 1990–1999, FY 1980–1989 and FY 1970–1979”; “Competition Enforcement Database,” available at https://www.ftc.gov/competition-enforcement-database (last accessed May 23, 2019), Figure 4.

11. John Kwoka, “U.S. antitrust and competition policy amid the new merger wave” (Washington, D.C.: Washington Center for Equitable Growth, 2017), available at https://equitablegrowth.org/research-paper/u-s-merger-policy-amid-the-new-merger-wave/?longform=true.

12. Robert H. Bork, The Antitrust Paradox, 2nd edition (New York, NY: Free Press, 1993): p. 221.

13. U.S. Department of Justic and Federal Trade Commission. Horizontal Merger Guidelines. Washington D.C., 2010. Pg 1-4. available at https://www.justice.gov/atr/file/810276/download; Tronox Ltd et. al is an example of a challenge based on coordinated interaction. See: D. Michael Chappell, “Initial Decision,” Federal Trade Commission No. 9377 (Dec. 14, 2018), available at https://www.ftc.gov/system/files/documents/cases/docket_9377_tronox_et_al_initial_decision_redacted_public_version_0.pdf.

14. William J. Brennan, Jr. and the Supreme Court Of The United States, “U.S. Reports: U. S. v. Philadelphia Nat. Bank, 374 U.S. 321 (1963)” (Washington, D.C.: Library of Congress), available at https://www.loc.gov/item/usrep374321/.

15. Steven C. Salop, “The Evolution and Vitality of Merger Presumptions: A Decision-Theoretic Approach,” Antitrust Law Journal 80 (2) (2015), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2375354.

16. United States v. Baker Hughes, 908 F.2d 981 (DC Cir. 1990)

17. U.S. Department of Justice and the Federal Trade Commission, “Horizontal Merger Guidelines” (2010), available at https://www.justice.gov/atr/horizontal-merger-guidelines-08192010.

18. Earl Warren and the Supreme Court Of The United States, “U.S. Reports: Brown Shoe Co. v. U.S., 370 U.S. 294. (1961)” (Washington, D.C.: Library of Congress), available at https://www.loc.gov/item/usrep370294/.

19. Robert Bork, “Vertical Integration and the Sherman Act: The Legal History of an Economic Misconception,” University of Chicago Law Review 22 (1) (1954), available at https://chicagounbound.uchicago.edu/uclrev/vol22/iss1/4; Richard A. Posner, “Vertical Restraints and Antitrust Policy,” University of Chicago Law Review 72 (2005), available at https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?referer=https://www.google.com/&httpsredir=1&article=2806&context=journal_articles.

20. Lewis F. Powell, Jr. and the Supreme Court Of The United States, “U.S. Reports: Continental T. V., Inc. v. GTE Sylvania Inc., 433 U.S. 36. (1976)” (Washington, D.C.: Library of Congress), available at https://www.loc.gov/item/usrep433036/; Antonin Scalia and the Supreme Court Of The United States, “U.S. Reports: Business Electronics v. Sharp Electronics, 485 U.S. 717. (1987)” (Washington, D.C.: Library of Congress), available at https://www.loc.gov/item/usrep485717/. Leegin Creative Leather Products, Inc. v. PSKS, Inc., 551 U.S. 877 (2007), available at https://supreme.justia.com/cases/federal/us/551/877/.

21. Letter from Sen. Richard Blumenthal to FTC Chairman Joseph Simons, December 19, 2018, available at https://www.blumenthal.senate.gov/imo/media/doc/12.19.18%20-%20FTC%20-%20Price%20Parity.pdf.

22.

ZF Meritor v. Eaton Corporation (3rd Circuit decision), 696 F.3d 254 (2012) available at http://www2.ca3.uscourts.gov/opinarch/113301p.pdf; Pfizer v. J&Jv 17-CV-4180 (2017)

available at https://www.paed.uscourts.gov/documents/opinions/18D0139P.pdf.

23. Fiona Scott Morton and Herbert Hovenkamp, “Horizontal Shareholding and Antitrust Policy,” The Yale Law Journal 157 (7) (2018): 2026–2047, available at https://www.yalelawjournal.org/feature/horizontal-shareholding-and-antitrust-policy.

24. “PepsiCo, Inc. Ownership Summary,” available at https://www.nasdaq.com/symbol/pep/ownership-summary (last accessed May 23, 2019); “The Coca-Cola Company (KO),” available at https://finance.yahoo.com/quote/KO/holders/ (last accessed May 23, 2019)

25. Council of Economic Advisors, “Labor Market Monopsony: Trends, Consequences, and Policy Responses” (2016), available at https://obamawhitehouse.archives.gov/sites/default/files/page/files/20161025_monopsony_labor_mrkt_cea.pdf.