The Promise of Equitable and Pro-Growth Tax Reform

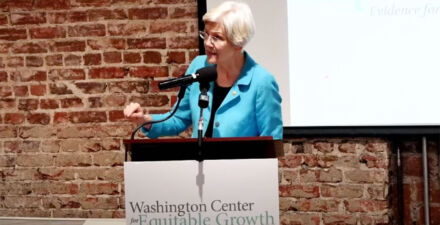

This in-person event featured Sen. Elizabeth Warren (D-MA) and other tax policy experts discussing how evidence-backed changes to the tax code can buck recent regressive trends and instead spur strong, stable, and broad-based economic growth. The debate next year on what to do with certain expiring tax provisions offers policymakers an opportunity to reimagine how taxes can both raise additional revenue for critical public investments and ensure the economy is working for all, not just the privileged few. Replacing the failed “trickle down” tax policies of the past will require both robust evidence and creative vision. Both were on full display as speakers and attendees grappled with the best individual and business tax policies for achieving equitable growth in 2026 and beyond.

Speakers:

Keynote

Senator Elizabeth Warren, D-MA

Panel

Nadiya Beckwith-Stanley, Skadden, Arps, Slate, Meagher & Flom LLP

Daniel Reck, University of Maryland

Kimberly Clausing, UCLA School of Law

Zachary Liscow, Yale Law School

Natasha Sarin, Yale Law School

Panel moderator:

Michael Linden, Washington Center for Equitable Growth

Closer:

Daniel Hornung, White House National Economic Council

Watch video of the event:

Get updates to stay in tune with U.S. economic inequality and growth and receive notice of our next event!

Related

Explore the Equitable Growth network of experts around the country and get answers to today's most pressing questions!