This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth has published this week and the second is work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

The focus on research on income inequality has mostly been on rising inequality within firms. But newly updated research shows that inequality between firms is just as important contributor to rising inequality as intra-firm inequality.

The decline of manufacturing employment in the United States has been a big contributor to the decline in prime-age male employment since 2000. Yet the decline could have been worse during the housing bubble as the construction boom employed more of these workers.

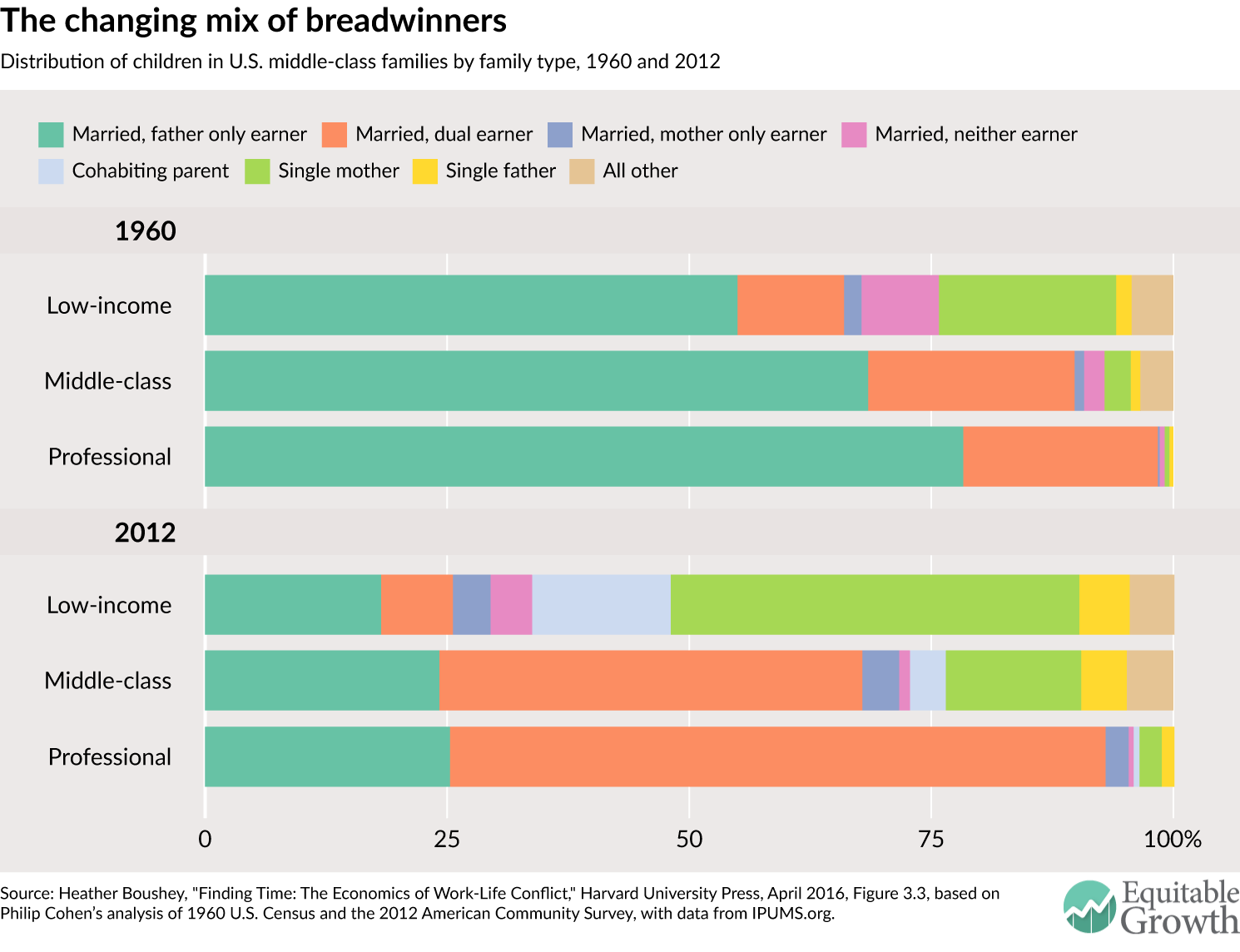

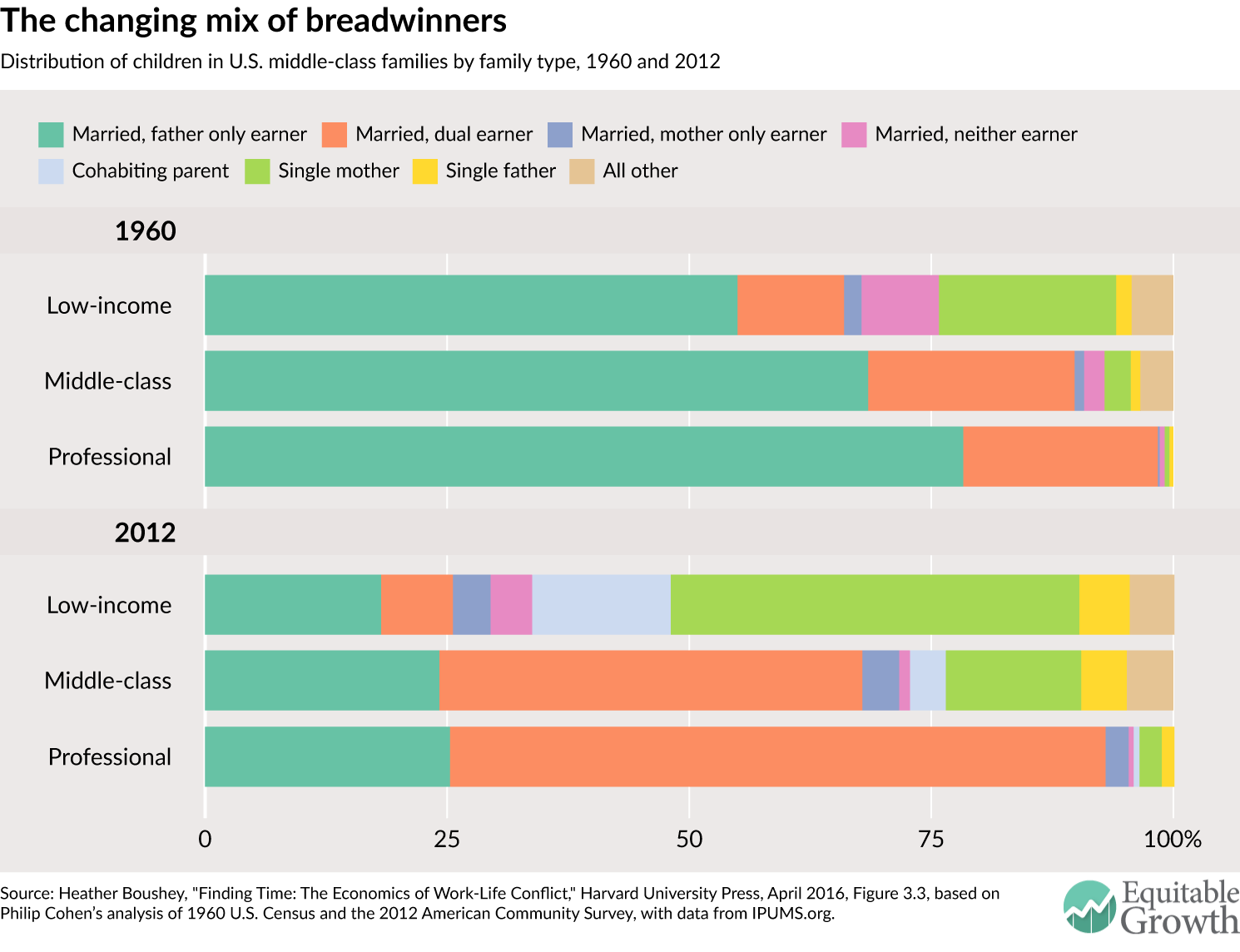

Heather Boushey and Kavya Vaghul released a new issue brief this week and their findings show that working mothers with children ages five and under are indispensable to their families’ bottom line.

Debates about wage rigidity seem like the heights of academic minutia. But the answer to whether wages are rigid or not has important implications for how we think about the labor market during economic downturns.

Emmanuel Saez updates his research on the U.S. income distribution for 2015. Income growth for the bottom 99 percent was quite strong at 3.9 percent, its fast pace in 17 years. The top 1 percent also saw fast income growth, at a 7.7 percent annual rate.

Links from around the web

“In fact, all racial groups are in below-average pre-K except whites.” Jonathan Rothwell looks at the racial disparities in access to high-quality pre-K programs. [brookings]

Recent research highlights how non-compete agreements have become overly prevalent in today’s labor market. As Steve Lohr writes, several states, including Massachusetts, are looking to rein in non-competes. [nyt]

The recent focus in Europe may be on the Brexit referendum (and soccer pitches in France), but the situation in Greece remains dire. Matthew Klein writes about the massive dissaving going on in the Greek economy. [ft alphaville]

As wealthy Americans start to move back into city centers, the changing demographics of who lives in city centers is returning to an old trend. Emily Badger reports on research showing how the rich were once the ones living at the center of cities. [wonkblog]

Economic clusters offer the promise of revitalizing regions and boosting economic growth. But can policymakers actually intentionally create them? Noah Smith looks at what we know and what we don’t know. [bloomberg view]

Friday figure

Figure from “Working mothers with infants and toddlers and the importance of family economic security” by Heather Boushey and Kavya Vaghul.