Weekend reading: Expanding Unemployment Insurance coverage benefits workers and boosts the economy edition

This is a post we publish each Friday with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is relevant and interesting articles we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

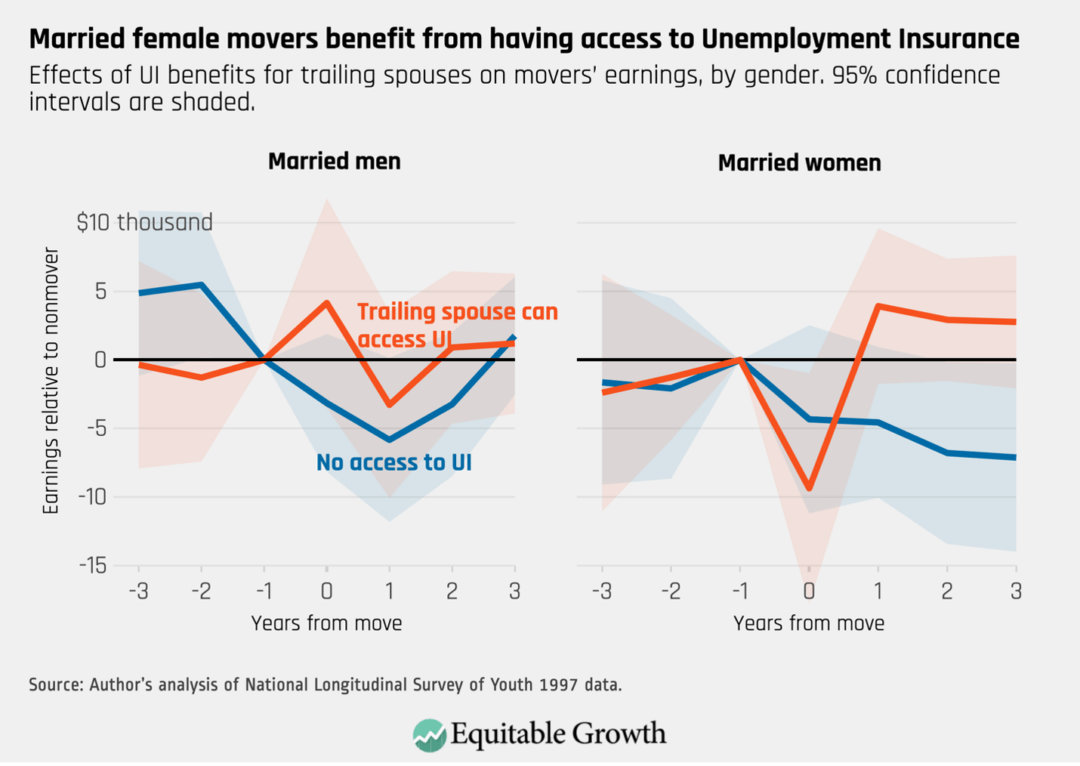

Unemployment Insurance is a vital resource for U.S. workers who lose their jobs through no fault of their own, but those who voluntarily leave their jobs typically are not eligible to receive UI benefits. This complicates job searches for married dual-earner couples. Studies show they tend to move to pursue job opportunities less often than single-earner households, partly because of the challenges involved in moving two jobs as opposed to one. When married couples do move, one spouse frequently becomes the so-called trailing spouse, leaving their job behind and usually facing earnings penalties and lower labor force participation rates as a result. A new working paper by Joanna Venator looks at the impact of Unemployment Insurance for trailing spouses—a program enacted in 23 states, as of 2017—which allows trailing spouses to apply for and receive Unemployment Insurance from the state in which the couple worked prior to moving. Venator explains in a column that her research finds access to this income support program increases the likelihood that a dual-earner household will move and improves married women’s labor market outcomes after a move, in part because women become the trailing spouse more often than men. In fact, she writes, married women who are able to claim the trailing spouses benefit receive higher annual earnings 3 years after moving of between $4,500 and $12,000, compared to similar women who are not eligible for these benefits. Venator details the policy implications in terms of the design of UI systems and policies meant to encourage moving for work opportunities.

Head over to Brad DeLong’s latest Worthy Reads column to get his takes on recent Equitable Growth content and other items from around the web.

Links from around the web

The Unemployment Insurance system in the United States dealt with unprecedented demand over the past year, starting with new benefit claims shattering records in March 2020 and continuing through this year. The U.S. Department of Labor reports the 52nd consecutive week with more than 1 million new claims filed. A Century Foundation factsheet, compiled by Andrew Stettner and Elizabeth Pancotti, distills a vast array of data on UI take-up and distribution since the onset of the pandemic, providing comparisons to data from previous downturns. One point in particular stands out: The co-authors show that 1 in 4 workers has relied at least once on UI benefits during the COVID-19 pandemic. They also highlight the various inequities, deficiencies, and delays that plague the system, particularly for workers of color, and how this affects unemployed workers and access to UI benefits amid the coronavirus recession. Stettner and Pancotti close with lessons to be learned after this trying year, including a call for implementing automatic stabilizers, expanding UI eligibility, increasing benefit levels and duration, and modernizing the current system to increase efficiency and prevent fraud.

Friday figure

Figure is from Equitable Growth’s “Moving with two careers is hard, but Unemployment Insurance for trailing spouses can help,” by Joanna Venator.