Weekend reading: “Unlocking the cable box” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth has published this week and the second is work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

Earlier this week, a group of researchers released a new report looking at the variation in the life expectancy across the United States. Their findings are an important reminder of the significance of both income and place in the United States.

After a huge increase in the duration of unemployment insurance in the wake of the Great Recession, economists wondered if such an increase boosts unemployment rates. The answer, according to one new study, is yes—but only by a very small amount.

Tax Day is just around the corner. If you’ve already filed, congratulations are in order: You’re administrative data. Unfortunately, getting access to the data you’ve created isn’t easy.

Earlier this morning, the Obama administration announced a number of steps to place a new emphasis on increasing competition in the U.S. economy. Spurring competition in today’s economy, though, will require some creative policy thinking.

Links from around the web

Black and Hispanic students are disproportionately underrepresented in “gifted” programs in public schools, despite becoming a larger and larger share of all students. Susan Dynarski reports on a new study that shows using a universal test instead of teacher recommendations can help boost the share of black and Hispanic students in these programs. [the upshot]

Before Silicon Valley became the technology center for the United States, many wondered if it would beat out the Route 128 Corridor outside Boston. Why did the valley win? Seems as though it was a lack of non-compete agreements, which Justin Fox argues could use some pruning. [bloomberg view]

One of the more intriguing ideas in recent years is that increased “common ownership” of competitors through mutual funds has reduced competition in the United States. While Steven Davidoff Solomon isn’t sure it’s causing outright collusions, we need to think about the root causes. [dealbook]

As household wealth increased in the United States during the mid-2000s, savings rates correspondingly dropped. And after wealth dropped after the housing bust, savings rates increased. But as wealth has started to increase again, savings rates haven’t declined as much as we’d expect, as Tim Taylor points out. [conversable economist]

There are a number of ways to improve the stability of a financial system. One of them is to require financial firms to be funded more via equity, which is called “holding more capital” for some strange reasons. Either way, Matt Klein makes the argument for more capital. [ft alphaville]

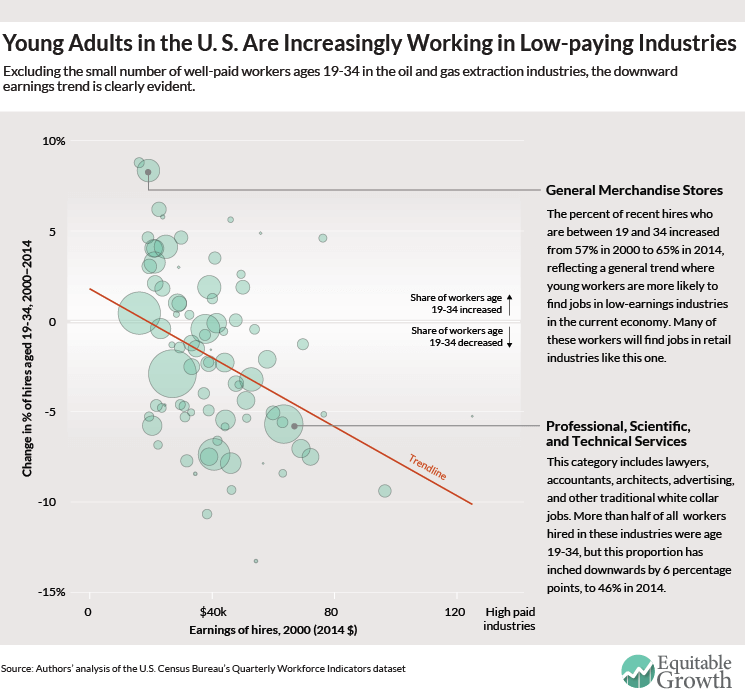

Friday figure

Figure from “What happened to the job ladder in the 21st century?” by Marshall Steinbaum and Austin Clemens