Weekend reading

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth has published this week and the second is work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

The recent pushes to increase the federal minimum wage to $12 or $15 would result in hikes at the upper bound of, or above the range of, previous increases we’ve seen in the United States. Because we can’t look at the academic research when it comes to these proposals, perhaps we should look at the historical and international comparisons.

The rate at which U.S. workers move to different states and counties has been on the decline for several decades now. This change has significant effects on how workers respond to job losses. And the evidence suggests that this decline in migration is due to changes in the labor market.

Equitable Growth launched a new series this week that looks back at the history of technological change and policy reactions to it in hopes of finding lessons for the future. Read the introduction from Jonathan Moreno.

In the first report in the series, Harvard University historian Matthew Hersch looks at the development of the aerospace industry in Southern California as a case study in equitable growth.

In the United States and other high-income countries, corporations are investing far less than they used to, resulting in increased savings by corporations. These savings and their eventual destination have potentially significant implications for economic growth and stability.

Links from around the web

Isabella Kaminska also takes a look at the decline in corporate investment in high-income countries. She focuses on the role of information technology in decreasing investment, and argues that the move toward tech firms that shoot for monopolies is “shrinking the pie.” [ft alphaville]

Japan has been dealing with the problem of deflation for more than 20 years now. The problem has yet to be solved, and alarmingly it might be spreading. Greg Ip argues that the conditions that led to deflation in Japan are appearing once again in China. [wsj]

After decades when they would have settled in the suburbs, young U.S. workers are increasingly moving to central cities. What’s causing this shift? As Lydia DePillis explains, a new working paper argues that a key driver is the desire for leisure time among more educated workers. [wonkblog]

Upon the release of new data on household debt, several researchers at the Federal Reserve Bank of New York dig into data on auto loans. Among their many insights, the staffers show that auto finance companies are the largest source of subprime auto loans, and their lending is increasing. [liberty street economics]

When it comes to retirement savings plans, defined contribution plans, such as 401(k) plans, dominate the private sector. The public sector, however, is still a bastion for traditional defined benefit pensions. Justin Fox argues that pensions can be great—they just have to be managed well. [bloomberg view]

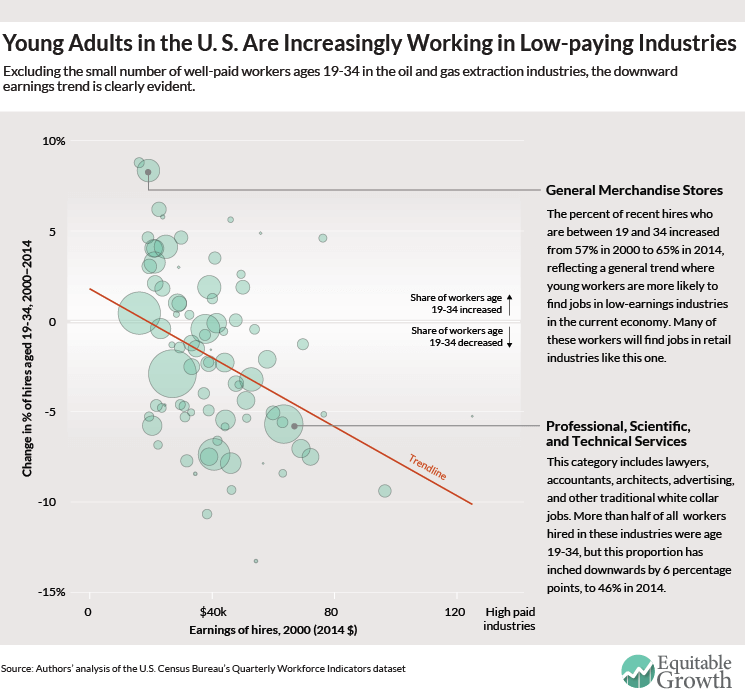

Friday figure

Figure from “What happened to the job ladder in the 21st century?” by Marshall Steinbaum and Austin Clemens