Why is the federal business-level tax rate on capital so low?

The “Unified Framework for Fixing Our Broken Tax Code” recently released by the Trump administration and congressional Republicans proposes sharp reductions in the corporate tax rate (from 35 percent to 20 percent) and in the tax rate applicable to pass-through income (from 39.6 percent to 25 percent). Proponents of large reductions in the federal statutory tax rates on business income often assert that these cuts will generate large increases in private-sector investment and economic growth. A key premise underlying these arguments is that federal business taxes—the corporate income tax paid by traditional C corporations and the individual income tax paid by owners of pass-through businesses—impose a substantial burden on new investments by businesses.

Yet due to the combination of accelerated depreciation of tangible investments, expensing of intangible investments, largely unrestricted deductibility of interest payments, and the research and development tax credit, federal business taxes impose only a low rate of tax on new investment today. In a recent issue brief, “What is the federal business-level tax on capital in the United States?,” I presented estimates of the effective tax rate on capital income attributable to business-level taxes. The effective marginal tax rate on capital income (the risk-free return attributable to new investment) is 8 percent under current law and would rise only to 13 percent if a temporary provision known as bonus depreciation expires.

Why do new investments face such a low rate of tax attributable to business-level taxes? In short, the answer is that deductions and credits serve to exempt most of the capital income attributable to new investments from taxes. Accelerated depreciation allows businesses to write off the cost of an investment faster than the equipment, structures, inventories, or intangibles in which they invest lose value, effectively understating income. Interest deductions allow firms to subtract interest payments from income, effectively exempting the return on debt-financed investments from business-level taxes. And the research and development tax credit offers a direct reduction in tax for investments in many types of intangibles.

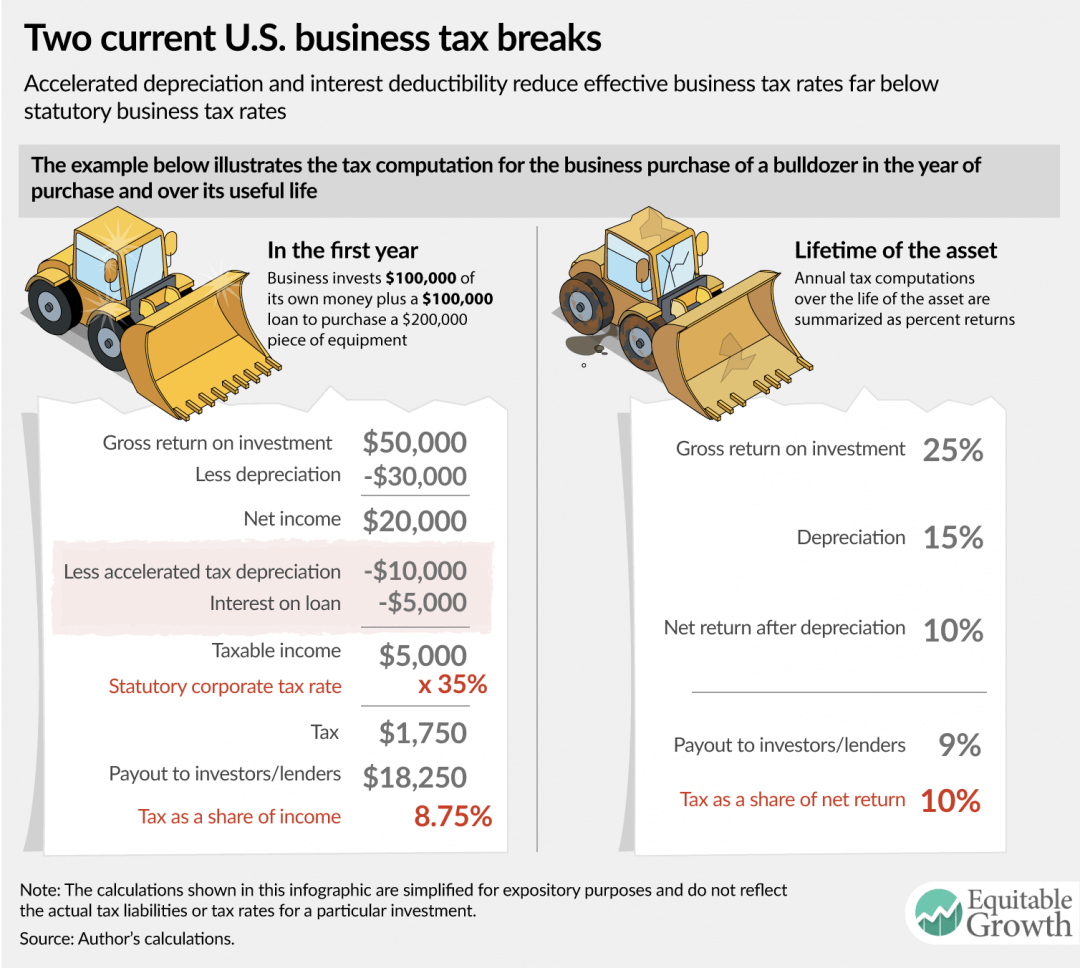

When a firm invests in a tangible asset—for example, when it buys a bulldozer—it is entitled to deduct a portion of the cost of the bulldozer each year to reflect depreciation, or the decline in the value of the bulldozer over time. Depreciation at a rate that corresponds to the true decline in value of the asset over time is referred to as economic depreciation, and depreciation at a faster pace is referred to as accelerated depreciation. Because a dollar today is worth more than a dollar tomorrow, when depreciation deductions are accelerated, it serves to reduce the total tax burden and reduce the tax rate. (See Figure 1.)

Figure 1

On average, depreciation deductions allowed by federal tax law are accelerated relative to economic depreciation. In addition, bonus depreciation—a temporary provision scheduled to expire in 2020—further accelerates depreciation deductions for certain investments. For many types of intangible assets, firms can deduct the full cost of creating them in the year in which the expense is incurred. This extreme case of accelerated depreciation is known as expensing.

In addition to deductions for accelerated depreciation, if a business finances an investment using debt, it can also deduct the interest payments from income. This serves to exempt the income on the debt-financed portion of the investment from business-level taxes. Suppose, for example, a business borrows half the money it needs to buy a bulldozer. Then it will have a stream of interest deductions that offset a portion of the net income generated by the bulldozer equal to the interest payments on that loan. Regardless of whether the interest income is taxed when it is received by the lender, the deduction will serve to ensure that much of the income resulting from this investment does not appear in the business tax base.

Federal tax law also provides a credit for research and development expenses. Similar to other tax credits, the research credit directly reduces the tax rate on the activity for which the credit is granted—in this case, investing in certain intangibles by conducting research.

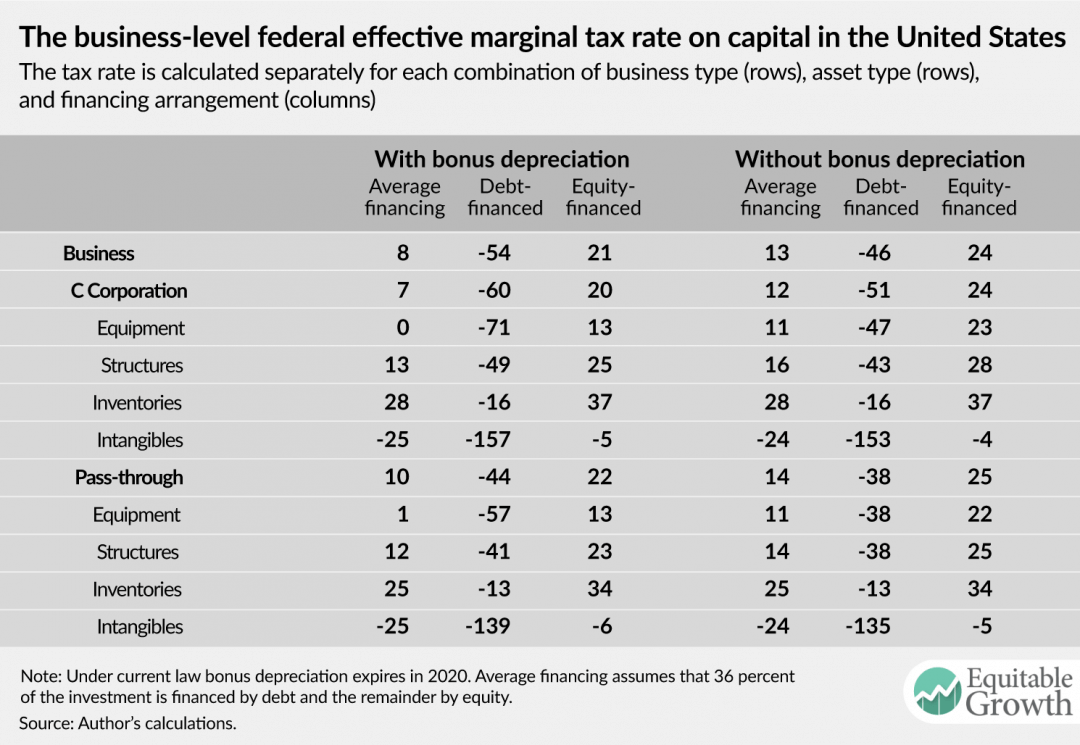

The table below presents estimates of the business-level effective marginal tax rate on capital under current law. The first three columns provide estimates assuming bonus depreciation is in effect and the second three columns provide estimates assuming bonus depreciation has expired. The average business-level effective marginal tax rate is 8 percent under current law today and 13 percent without bonus depreciation, as would be the case for current law in 2020. These rates reflect the average of a strongly negative tax rate for fully debt-financed investment (negative-54 percent) and a positive tax rate for fully equity-financed investment (21 percent). (See Table 1.)

Table 1

A better approach to business tax reform

In light of these findings, the case for reductions in the statutory business tax rate as a means of spurring additional capital investment is weak. A reduction in the business tax rate would come at a very high cost, as it would apply to the entire business tax base, including excess returns and labor income, as well as to returns on investments made in the past. (See this previous column for an extended version of this argument.) The impact on capital investment would be highly attenuated, as debt-financed investments face a negative rate at the business level, and thus a rate cut would increase the tax rate on such investments by reducing the value of the deductions they generate. Moreover, as the channel through which a reduced effective marginal tax rate can increase investment is lowering the cost of capital, deficit-financed tax cuts that increase the cost of capital can be actively counterproductive.

A better approach to reform would focus on reducing the disparities in tax rates across types of produced capital and across financing arrangements. This variation is largely driven by variation in the extent to which tax depreciation is accelerated relative to economic depreciation and variation in the use of debt finance. Well-designed reform should thus pursue a revenue-neutral or revenue-increasing reallocation of the current tax benefits for debt to equity that reduces the disparities in the tax rates on investments in different types of produced capital. Such a reallocation could also lower the tax rate on produced capital and increase the tax rate on land. These reforms would offer a more plausible path to economic growth than reductions in the statutory tax rates on business income.