Where is the U.S. labor market recovery for prime-age workers?

The weak employment and earnings growth—reported today by the U.S. Bureau of Labor Statistics—shows that the labor market is still recovering from the shocks of the Great Recession. After six full years of consecutive monthly employment growth beginning in October 2010, when the labor market stopped contracting, employment rates for prime-age workers ages 25 to 54 are still low, and wage growth is not fast enough to reverse worsening income inequality.

Nominal wages grew 2.2 percent compared to a year ago, before adjusting for inflation, and at the same rate over the past three months. Although monthly data can be noisy, the lack of clear signs that wage growth is accelerating bolsters the case for the Federal Reserve to continue to wait to raise its benchmark interest rate. An additional recent concern is that wage growth for production and nonsupervisory workers—those who generally make up the bottom 80 percent of the labor market—has begun to see slower wage growth, at a rate of 1.9 percent compared to last year.

If overall nominal wage gains do not exceed annual increases of 3.5 percent then income inequality will tend to rise. Below this rate, real (inflation-adjusted) wage growth is likely to fall behind long-run productivity growth of about 1.5 percent, assuming the Federal Reserve’s inflation target of 2.0 percent. The current slow rates of nominal wage growth help to guarantee that national income will continue to shift away from labor and toward the owners of capital.

The establishment survey data also show that the economy added 142,000 jobs in September, with gains of about 36,400 in health care industries. After revisions to prior months’ data, further reducing estimates of employment growth in August, the economy has added jobs over the past three months at a slow monthly pace of 167,000. With this job growth, the economy increased the size of the employed workforce by only 1.2 percent last month at an annual rate, and by 1.9 percent compared to a year ago. These rates of job gains compare poorly to the faster growth one would expect a vigorous recovery to deliver. Just three years after the 1990-1991 recession, for example, annual employment growth exceeded 3 percent for more than one year straight.

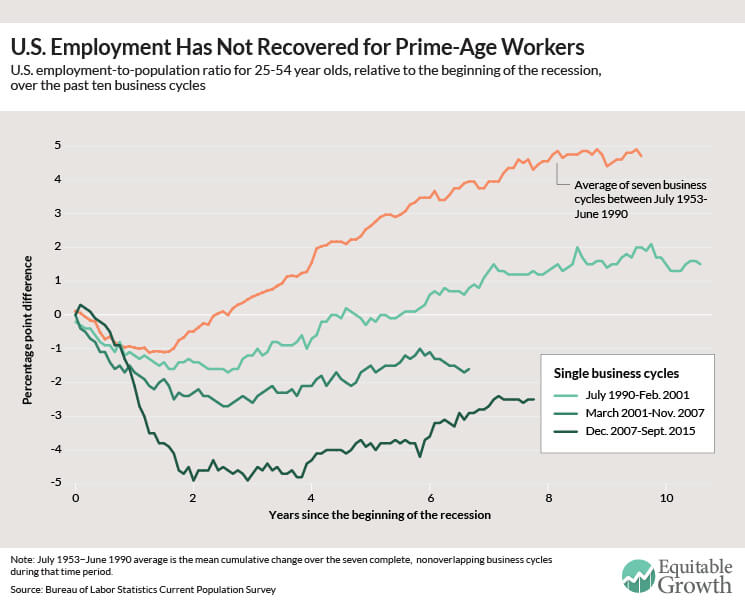

Indeed, compared to prior business cycles, the labor market recovery has been especially weak when judged by the performance of employment rates for those in their prime working years, ages 25 to 54. From 1953 to 1990, the U.S. economy experienced seven business cycles, where the employment-to-population ratio for prime-age workers fell during a recession but then recovered to the level experienced just prior to the recession in less than three years on average. (See Figure 1.)

Figure 1

After the recession beginning in 1990, the labor market for prime-age workers recovered more slowly, taking about five years to reach its prior employment rate. During the past two business cycles, the prime-age employment rate never fully recovered. The shift toward longer and incomplete labor market recoveries is inconsistent with the Federal Reserve’s mandate to promote full employment and coincides with the reluctance of using fiscal policy to reverse economic contractions.

Current employment rates for the prime working-age population are insufficient for ensuring satisfactory wage growth, even after six years of recovering from the Great Recession. Without a tight labor market, employees have lower bargaining power and employers have less incentive to raise wages in order to retain and recruit workers. Over the past 25 years, wages for production and nonsupervisory workers reliably grew at healthy rates of 3.5 to 4.5 percent only when the employed share of the prime-age population exceeded 79 percent. The current prime-age employment rate of 77.2 percent, which has stayed roughly the same over the entire course of this year, will continue to make it difficult for workers to obtain sustained, economically meaningful wage gains.