Weekend reading: “low probability event” edition

This is a weekly post we publish on Fridays with links to articles that touch on economic inequality and growth. The first section is a round-up of what Equitable Growth published this week and the second is the work we’re highlighting from elsewhere. We won’t be the first to share these articles, but we hope by taking a look back at the whole week, we can put them in context.

Equitable Growth round-up

A new paper looks at the forces that could be pushing down long-term interest rates in the United States. The economists find that aging demographics and slower productivity are behind the decline.

The U.S. Department of Labor released new data on the labor market on Tuesday, in the form of the February release of the Job Openings and Labor Turnover Survey. Check out three graphs showing important trends in the data.

President Trump’s choice to head the Department of Labor, Andrew Puzder, has written quite a bit about the low-wage labor market. T. William Lester of the University of North Carolina – Chapel Hill writes that “some of [Puzder’s] opinions and beliefs are simply at odds with the facts or at the very least ignorant of recent evidence.”

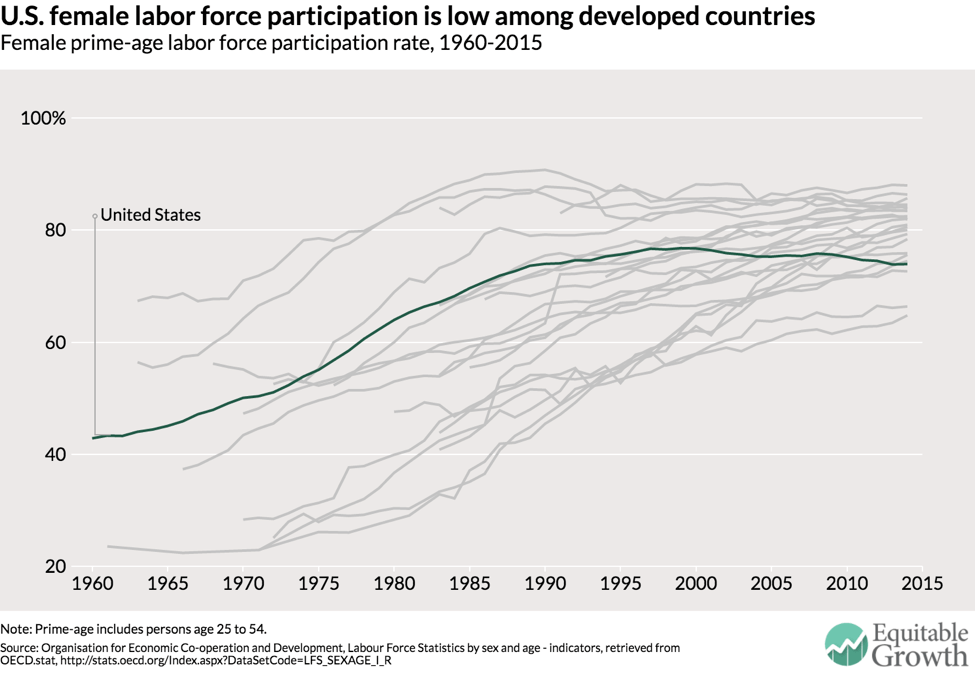

The United States ranks 21st out of the 24 OECD countries in prime-age female labor force participation. Why is this? A lack of paid family and medical leave is a strong suspect, Matt Markezich argues.

According to new projections from the Congressional Budget Office, corporate income tax revenue will continue to stagnant for years to come despite an increase in corporate profits. Kavya Vaghul looks at what’s behind this trend and the prospects for the future.

Links from around the web

When it comes to the U.S. economy, is there too little destruction or too much? Neil Irwin tries to understand whether a boost in dynamism would be a welcome trend or a worrying acceleration of current trends. [the upshot]

Unemployment may be under 5 percent, but millions of workers still struggle with persistent unemployment. Jenna Smialek and Patricia Laya tell the stories of several workers who are seemingly locked out of the labor market. [bloomberg]

Articles and discussion about joblessness in the United States often center on men. But this crisis of missing men is also a crisis of missing women as well. Sarah O’Connor highlights the declining labor force participation of U.S. women. [ft]

If you’re wondering when a strong dollar or a weak dollar is good for the economy, consider the role of the dollar as a reserve currency. Ryan Avent takes a look at how international dependence on the dollar affects the U.S. economy. [the economist]

Households were once the major source of saving in the world economy, financing the investment of corporations and governments. But over the past 30 years, the corporate sector has become a net lender. Timothy Taylor writes up a new paper explaining the increasing corporate savings rate. [conversable economist]

Friday figure

Figure from “Why the United States still needs paid family and medical leave” by Matt Markezich