Taxing the rich more—evidence from the 2013 federal tax increase

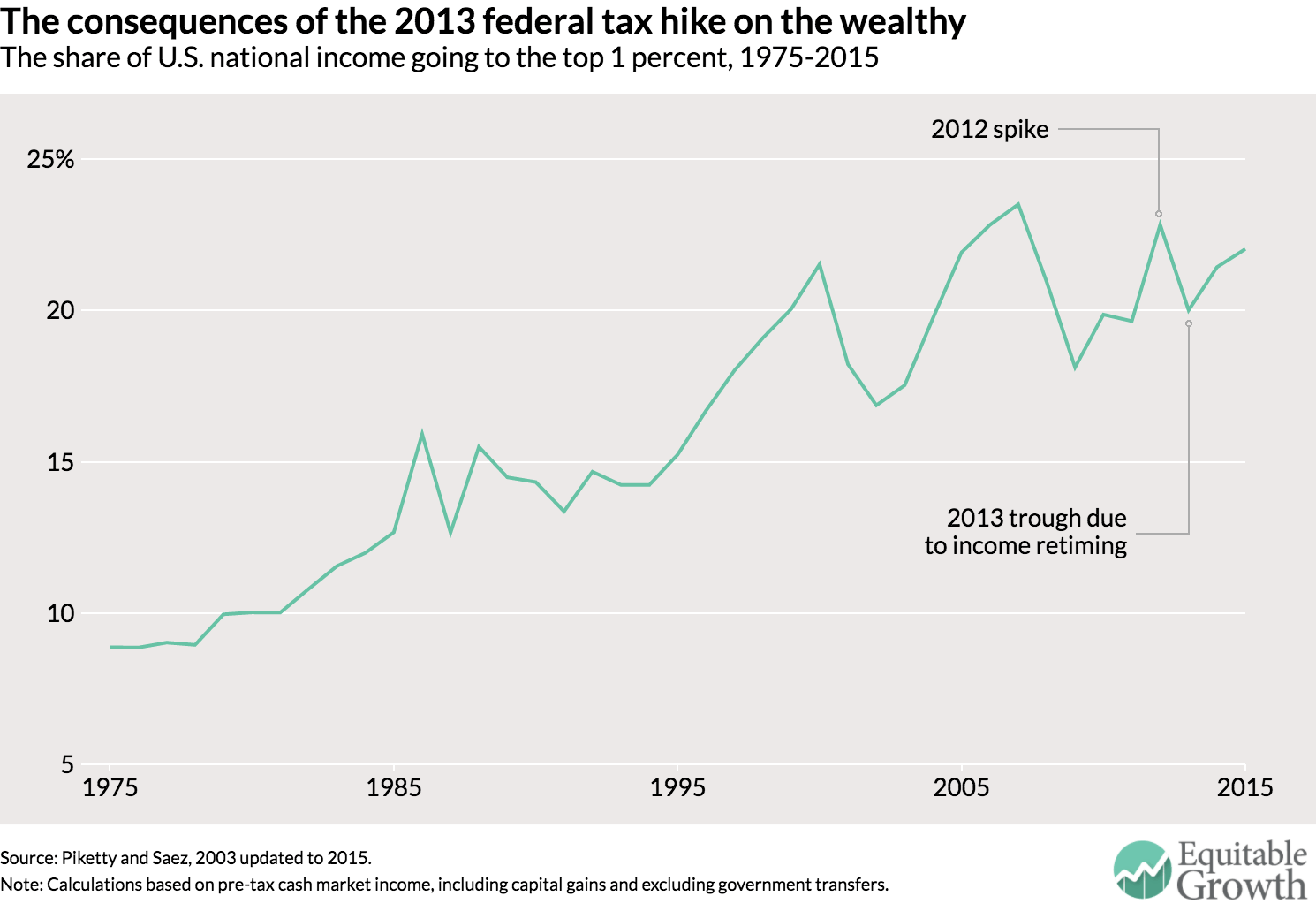

One of the most contentious aspects of the tax policy debate in the United States today is the proper level of taxation of the rich. In the current presidential election contest, Hillary Clinton proposes to increase taxes on the rich while Donald Trump proposes to cut taxes on the rich. This policy decision is particularly important because the concentration of income at the top is extremely high. The share of total pre-tax income earned by the top 1 percent of families has more than doubled from 8.9 percent in 1975 to 22 percent in 2015.

Progressive taxation historically is the most powerful tool to reduce income concentration. The classic counter argument is that higher top tax rates might discourage economic activity among the rich. In a recent paper, I analyze the effects of the 2013 federal income tax increase on the behavior of top income earners to cast light on this issue.

In 2013, a surtax on high earners was levied to help pay for the Affordable Care Act at the same time as the 2001 tax cuts for high-income earners that were signed into law by President George W. Bush expired. The 2013 tax increase on high earners was the largest since the 1950s, and larger than the previous increase of the top tax rate by the Clinton administration in 1993. The 2013 tax increase is concentrated among the top 1 percent of income earners. The Congressional Budget Office statistics show that the average federal tax rate—comprised of all federal taxes (individual, corporate, and payroll)—on the top 1 percent of income earners rose by 5 points, from 29 percent before 2013 to 34 percent in 2013.

Besides this direct increase in their tax burden, how did the 2013 tax increase affect the behavior of the rich and the pre-tax incomes they reported on their tax returns? The relevant concept for behavioral responses to taxation is the marginal tax rate, which measures how much you have to pay in taxes on an extra dollar of earnings. At a marginal tax rate of 40 percent, for example, you would have to pay $40 extra in taxes if you earn $100 or more. The 2013 tax increase raised the top marginal tax rate on capital income (including realized capital gains, dividends, and other forms of taxable capital income) by about 9 points, and on labor income (wages and salaries, and self-employment income) by about 6 points. The accompanying chart, which depicts the top 1 percent’s share of pre-tax income since 1975, answers two important tax policy questions about the effects of the 2013 tax increase on pre-tax incomes reported by the rich in the short term and the medium term. (See Figure 1.)

First, in the short-term, there is a clear surge in reported top incomes in 2012 in anticipation of the 2013 tax increase. The top 1 percent’s income share increases sharply, from 19.6 percent in 2011 to 22.8 percent in 2012—the largest year-to-year increase over the past 25 years—before falling sharply back to 20 percent in 2013. The stock market booms of the late 1990s and mid-2000s, and economic downturns of the early 2000s and late 2000s, produced large fluctuations in the top 1 percent’s share of national income. But this cannot be the explanation for the 2012-2013 pattern, as the U.S. economy was growing at a modest but regular pace between 2011 to 2015 and stock prices were increasing steadily during all of these years.

That unusual pattern in those two years is due to behavioral responses to taxation, in the form of income retiming. After President Obama was re-elected in early November 2012, it was virtually certain that top income tax rates would go up in 2013. For the rich, shifting $100 of income from 2013 to 2012 saves $9 in taxes for capital income (and $6 for labor income), which means the rich had strong incentives to accelerate their incomes into 2012 to benefit from the lower 2012 tax rates and avoid the higher 2013 tax rates.

Consistent with this explanation, further analysis shows that the spike in 2012 is due primarily to realized capital gains, which taxpayers can retime easily. But there is also retiming for other income categories, notably dividend income and to a lesser extent wages and salaries and business profits. This retiming response is large—income earners in the top 1 percent shifted about 10 percent of their income from 2013 into 2012. Lost government tax revenues, however, were modest as income shifted into 2012 still were taxed at the 2012 rates, which were about three-quarters of the 2013 tax rate. I estimate that, combining 2012 and 2013 federal individual income tax revenue, the government lost only about 20 percent of the projected revenue increase for 2013 due to these retiming responses.

What happened to top incomes in the medium-term? Figure 1 shows that the share of national income going to the top 1 percent income resumed its upward trend after 2013. By 2015, that share is back up to 22 percent. This means the 2013 tax increase depressed pre-tax top incomes only temporarily in 2013. This finding presents two important consequences. First, it means that raising taxes on the rich is an efficient way to raise additional revenue, as the rich do not respond much to the higher tax rates in the medium term. I estimate that only about 20 percent of the projected revenue increase from the 2013 tax hike is lost due to the behavioral responses over the medium term. Second, by itself, the 2013 tax increase will not be sufficient to curb the extraordinarily high level of pre-tax income concentration in the United States.

These findings echo the findings of earlier work analyzing the 1993 Clinton era tax increase, which also generated short-term retiming of top incomes into 1992 but did not prevent top income shares from surging in the mid-to-late 1990s. It is also striking that the best growth experience for the bottom 99 percent of income earners over the past 25 years took place in the mid-to-late 1990s and between 2013 and 2015—after tax increases on the rich. This suggests that taxing the rich more does not have detrimental effects on the broader economy; quite the contrary.

—Emmanuel Saez in a professor of economics at the University of California-Berkeley and a member of the Washington Center for Equitable Growth’s steering committee